Why Warren Buffett’s purchase of Barrick shares is such a big deal for gold-mining stocks

Warren Buffett has bought half a billion dollars’ worth of shares in gold miner Barrick. That’s a big deal, says Dominic Frisby. We could be at the beginning of a bull market in gold-mining stocks.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Gold – and, more specifically, gold shares – received an unexpected endorsement this week from the most unlikely of sources.

Warren Buffett’s Berkshire Hathaway announced it had bought roughly half a billion dollars’ worth of stock (21 million shares) in Barrick Gold (NYSE: GOLD).

The reason so many are so excited is that Buffet has always been so outspoken against gold. Yet now, perhaps the most successful investor that ever lived has gone long.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Let’s delve a little deeper. We’ll start with Buffett's long stated dislike of gold.

Buffett doesn’t like gold, but he understands it

“It gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Gold, as we have stated many times, is a store of wealth. It is inert and useless. It’s very uselessness is why it makes it such a good store of wealth – such good money. But that’s the reason Buffett dislikes it: he likes “investing in America”; in businesses that are active; he doesn’t like inactivity.

“The problem with commodities is that you are betting on what someone else would pay for them in six months. The commodity itself isn’t going to do anything for you… it is an entirely different game to buy a lump of something and hope that somebody else pays you more for that lump two years from now than it is to buy something that you expect to produce income for you over time.”

“I have no views as to where it will be, but the one thing I can tell you is it won’t do anything between now and then except look at you. Whereas, you know, Coca-Cola will be making money, and I think Wells Fargo will be making a lot of money and there will be a lot — and it’s a lot — it’s a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that.”

I’m a gold diehard, as you know. And this argument against gold is one that frustrates many diehards, particularly when it comes from a position of ignorance. It’s one, however, that I have some sympathy with. Gold’s purpose is to store what you have, to hedge against inflation, debasement of money, and so on. Buffett’s never been interested in that. He is interested in businesses, in people, in growing his wealth. No wonder he doesn’t like gold.

And his position does not stem from a position of ignorance. He grew up in a pro-gold household. His father, the congressman Howard Buffett, championed a return to a gold standard and repeatedly spoke out about it. “Human freedom rests on gold redeemable money,” he said. “Paper systems end in collapse… Taxpayers must regain their right to obtain gold in exchange for the fruits of their labour.”

Who knows? Warren Buffett may feel the same way as to America’s money. That doesn’t mean he likes gold as an investment. “Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time”, he said. “But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money; if they become less afraid you lose money, but the gold itself doesn’t produce anything.”

Buffett may not like gold, but for sure he understands it.

Gold-mining stocks could be in the early stages of a bull market

It’s worth stressing at this point, that Berkshire Hathaway has not bought gold. It has bought a dividend-paying, gold-mining company that happens to have the ticker symbol GOLD. So Buffett’s “lack of utility” complaint is satisfied.

Barrick, once the world’s largest gold producer, used to be a laughing stock. Its hedging policy meant that in the 2000s it was selling gold for around $300 an ounce when the market price was more than double that. As a result the stock became a perennial underperformer.

Even today, its shares are still trading at around the same price as they were in 2006, when gold was a third of the price it is today. But Barrick, under the management of CEO Mark Bristow, who effectively took Barrick over via the much slicker operation Randgold Resources, is a different beast altogether and a better-run company.

It is also worth noting that, although Berkshire’s buying and selling is attributed to Warren Buffett, he is now 90 and his partner Charlie Munger (who is even less of a gold fan than Buffett) is 96. They do not play the same role in the Berkshire strategy that they once did. There is a good chance that the purchase came from either one of their lieutenants, Ted Weschler or Todd Combs, who each manage about $15bn of Berkshire’s equity portfolio and, especially, the sub-$1bn investments such as this, that for Berkshire are tiny. The Barrick investment amounts to one thousandth of Berkshire Hathaway’s $500bn market cap.

Nevertheless the change of direction is a big deal for gold and gold miners. The sector, tiny relative to the stock and bond markets, will be taken more seriously by big players. There are goodness knows how many Buffett trackers and copycat vehicles that will now follow. Gold miners get more coverage, more analysis, more publicity. And with the increased analysis, many will discover better value further down the food chain, and so new money will work its way down.

All in all, for gold mining investors, this is a good thing. At the same time, also significantly, Berkshire announced reduced exposure in financial stocks, and a complete exit of airline and restaurant stocks.

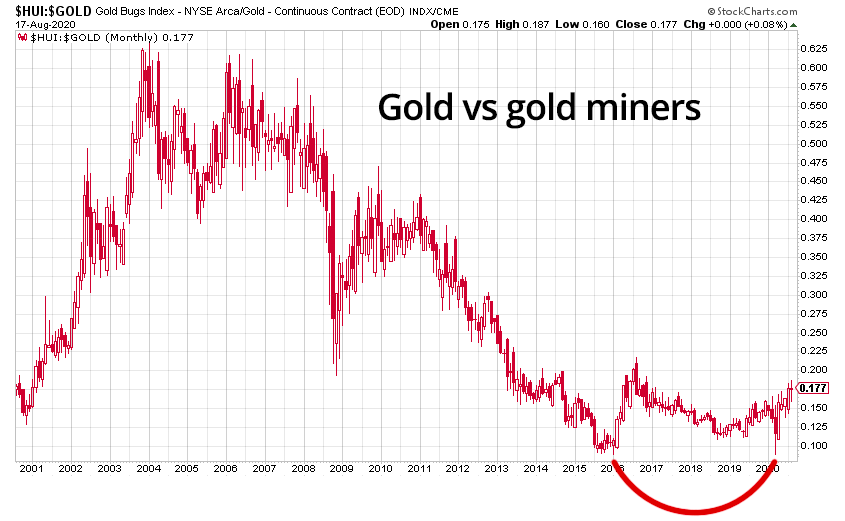

After some 15 years of bear market, the ratio between gold and gold miners has finally turned up.

That looks like a multi-year double bottom to me. We could be in the early stages of a secular bull market for gold-mining stocks. Hang on to your hats. And, more importantly, your positions.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

How to beat Warren Buffett – and the fund and trusts that have managed it

How to beat Warren Buffett – and the fund and trusts that have managed itWarren Buffett has achieved stellar returns for investors over a long and illustrious career. Can you rival his investment performance?

-

Fractional shares: what are they and why HMRC is worried?

Fractional shares: what are they and why HMRC is worried?Investors who have flocked to investment apps offering fractional shares in an Isa could lose the tax-free status of their portfolios.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say