Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

In this week’s issue of MoneyWeek, my colleague Cris looks at Southeast Asia. It was all the rage among investors a decade ago, but it has been hit hard by Covid-19, a series of “dreadful elections” in the region, and years of bad returns. But for the bold investor, it’s now got cheap enough to be worth a look. Cris picks some of the best bets in the region – and in a separate article picks a couple of emerging-market funds that cover other areas of the globe too. If you’re not already a subscriber, get your first six issues free here now.

No new podcast this week, I’m afraid, but we do have a new “Too Embarrassed To Ask” video. This week, we discuss what a “p/e ratio” is, and what it’s used for. Check it out here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: This indicator can help you decide when to buy and sell silver

- Tuesday: Inflation feels good at first – which is why politicians will pursue it

- Wednesday: When will stockmarkets face reality?

- Thursday: What is value investing?

- Friday: A very basic guide to valuing individual companies

Now a swift look at what’s been going on in the charts this week.

The charts that matter

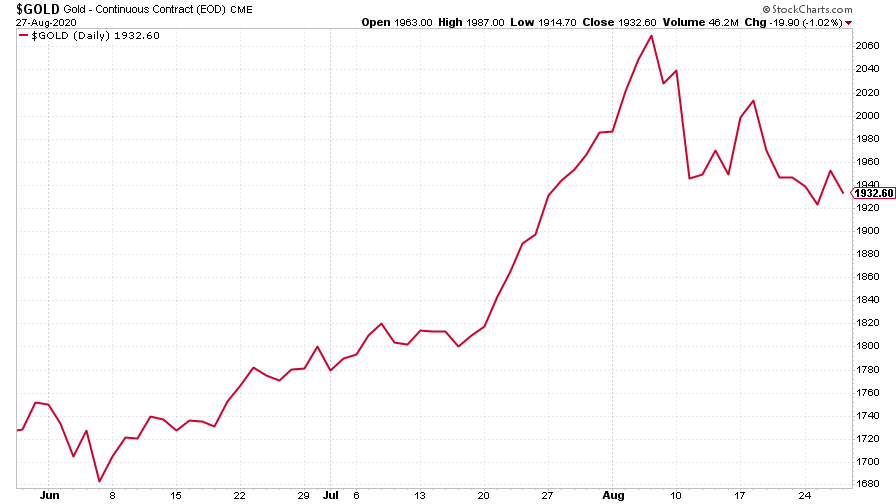

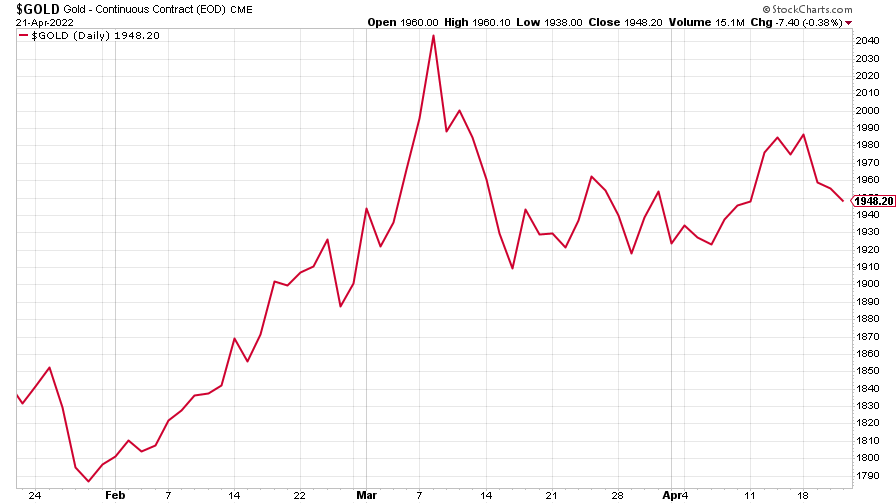

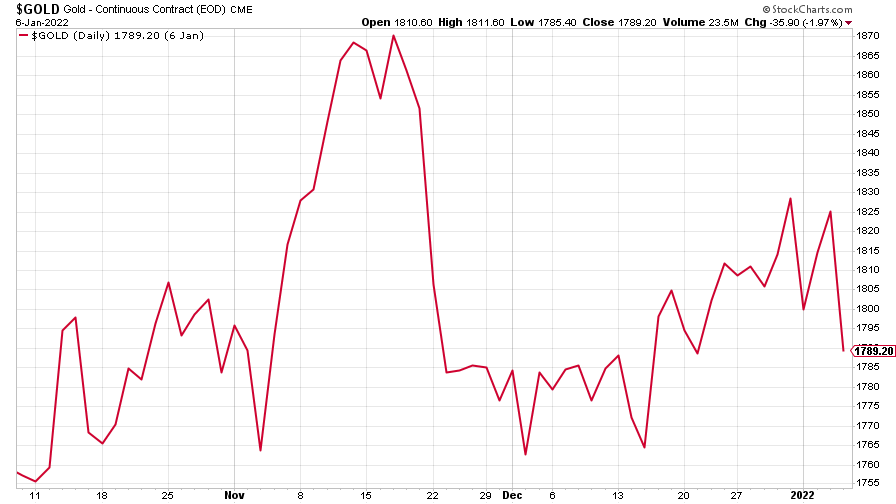

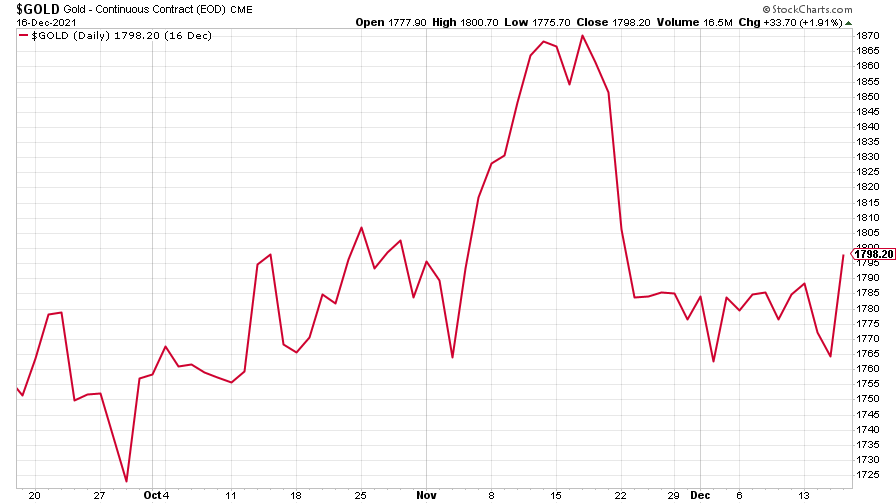

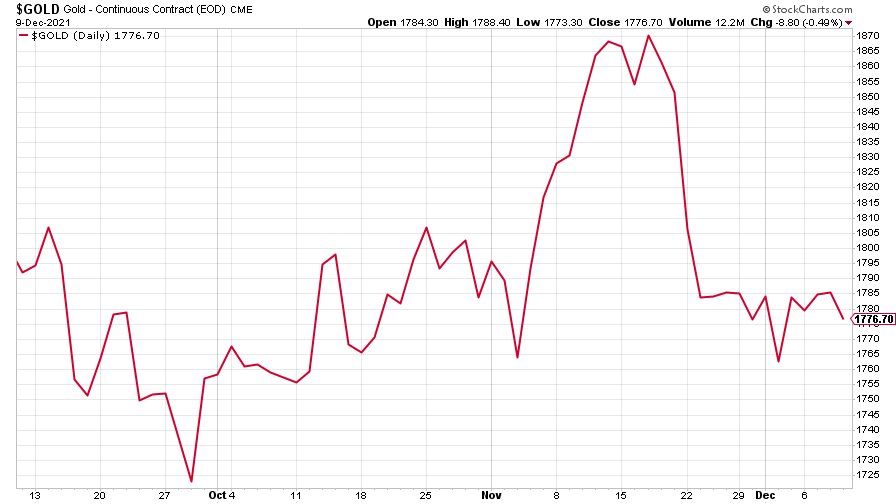

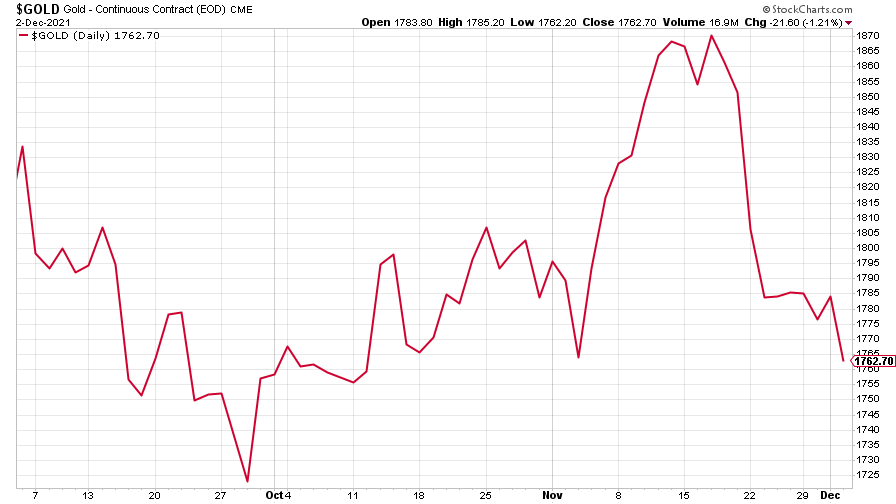

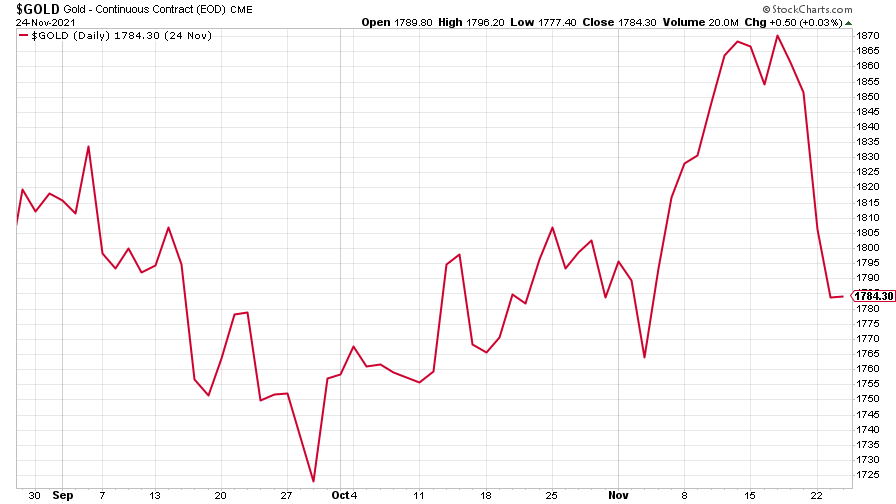

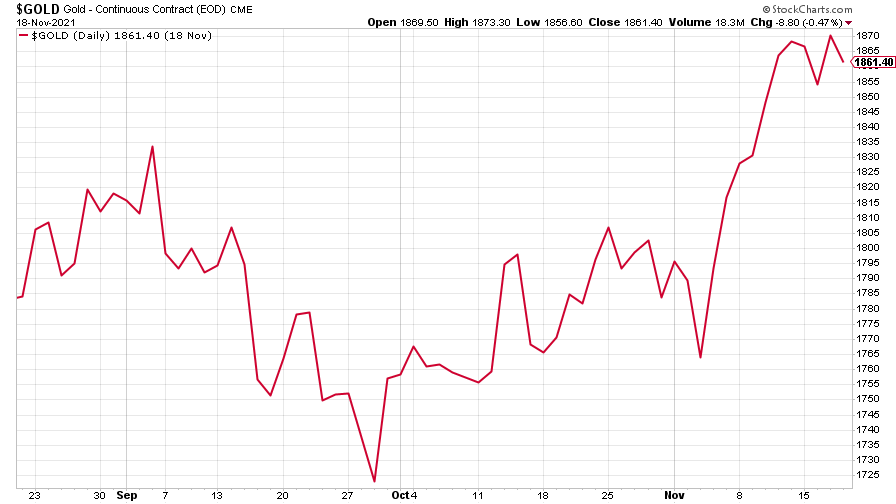

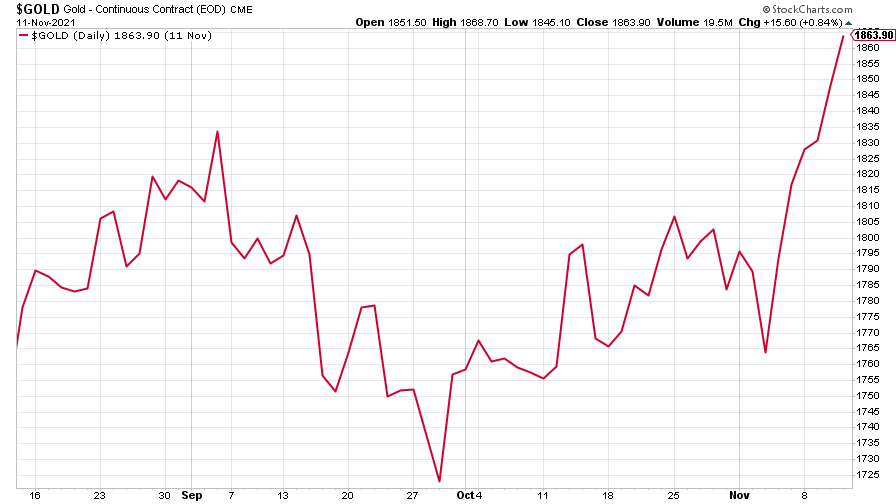

Gold’s bull run has paused for now. But don’t think that’s the end of it. Not by a long chalk.

(Gold: three months)

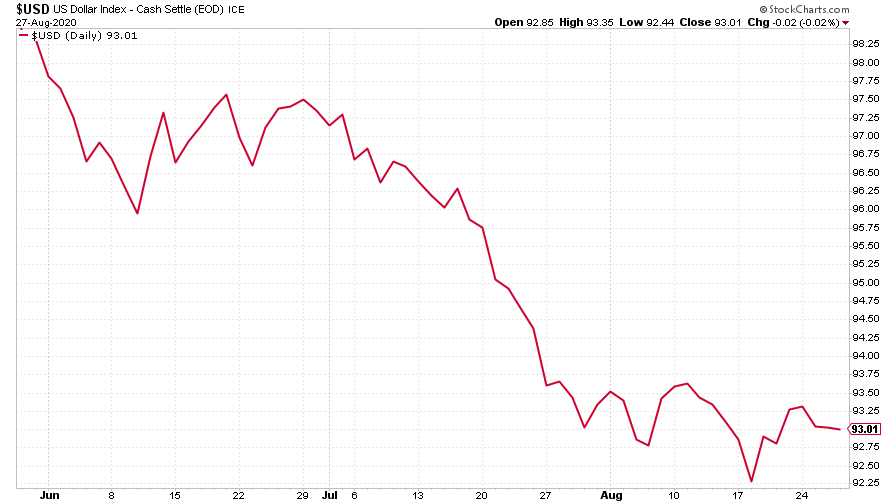

In the US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners), the greenback still faces a few headwinds, but many observers are pencilling in a potential bounce.

(DXY: three months)

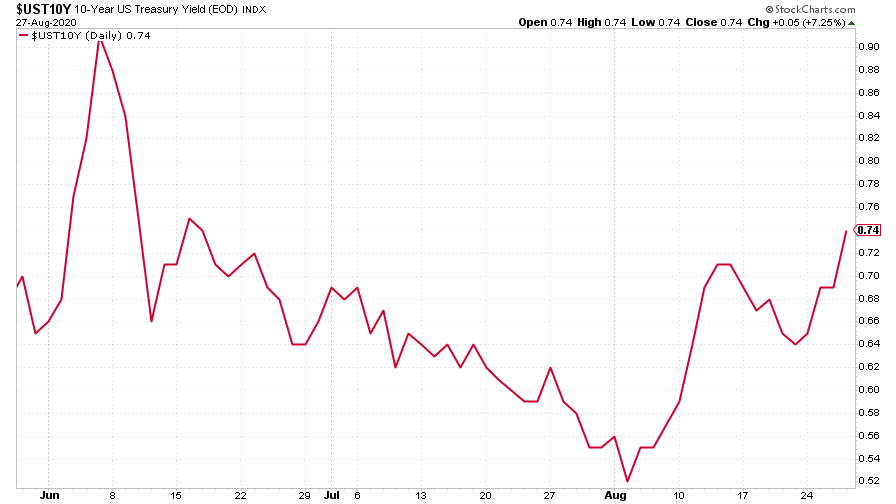

The yield on the ten-year US government bond picked up this week after slipping last week

(Ten-year US Treasury yield: three months)

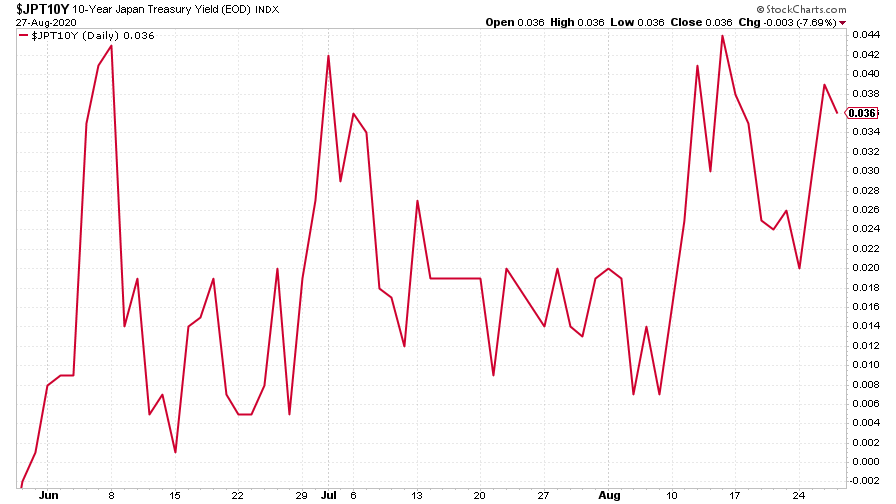

The ten-year Japanese government bond yield continued its erratic journey

(Ten-year Japanese government bond yield: three months)

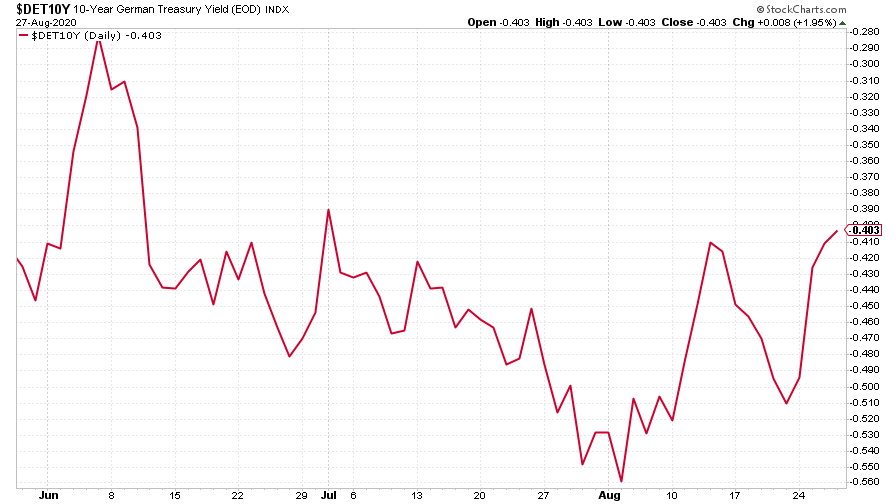

And the ten-year German bund yield picked up a little too

(Ten-year Bund yield: three months)

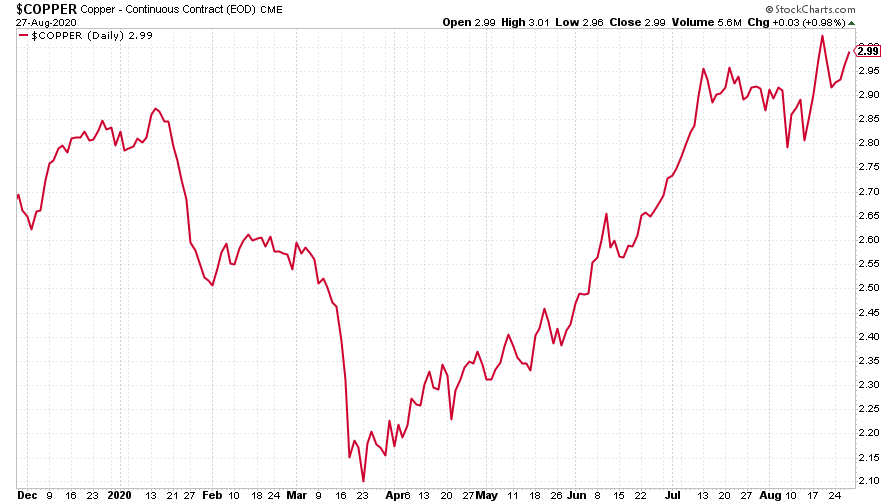

Copper continued its rise – China recently said it would be building a load more infrastructure including new railways, power lines and electric car charging points.

(Copper: nine months)

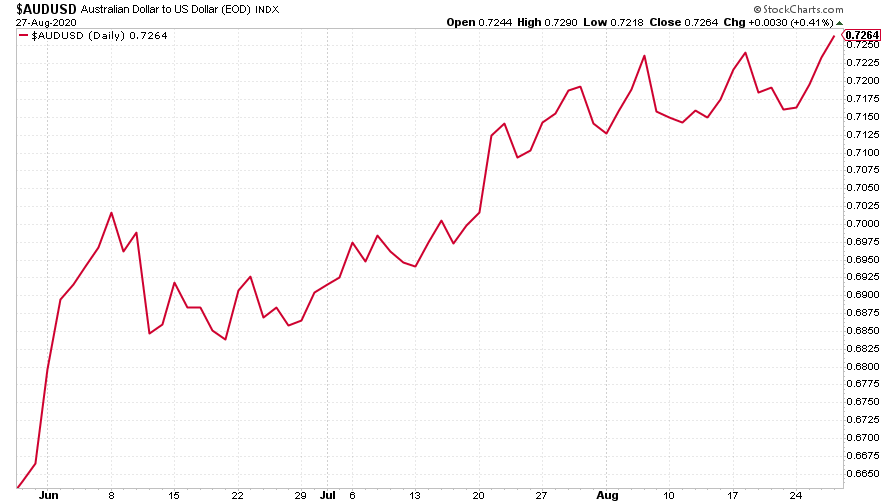

The Aussie dollar continues to appreciate against its US counterpart

(Aussie dollar vs US dollar exchange rate: three months)

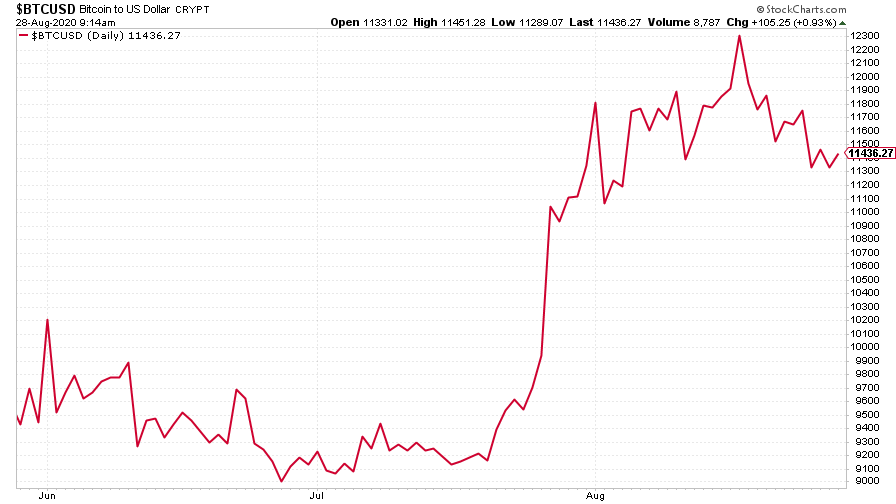

Bitcoin slipped further from its recent highs, but is holding on to most of its recent big gains

(Bitcoin: three months)

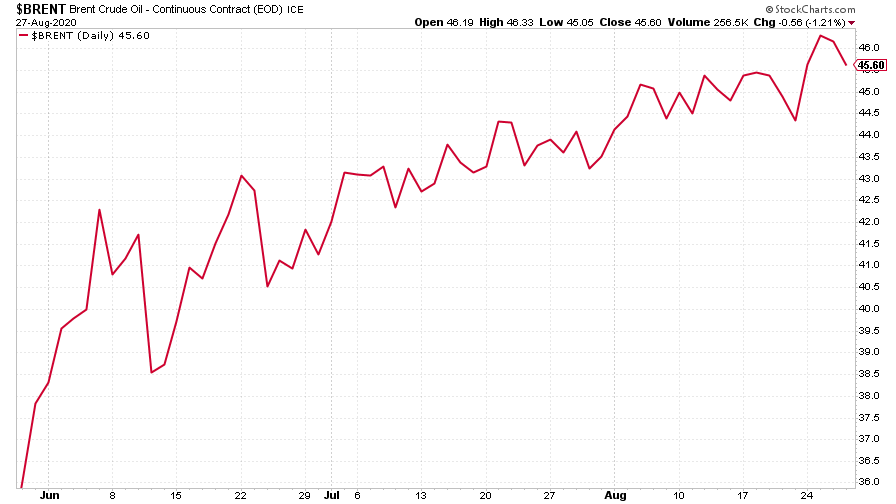

The oil price (Brent crude) continues its slow recovery

(Brent crude oil: three months)

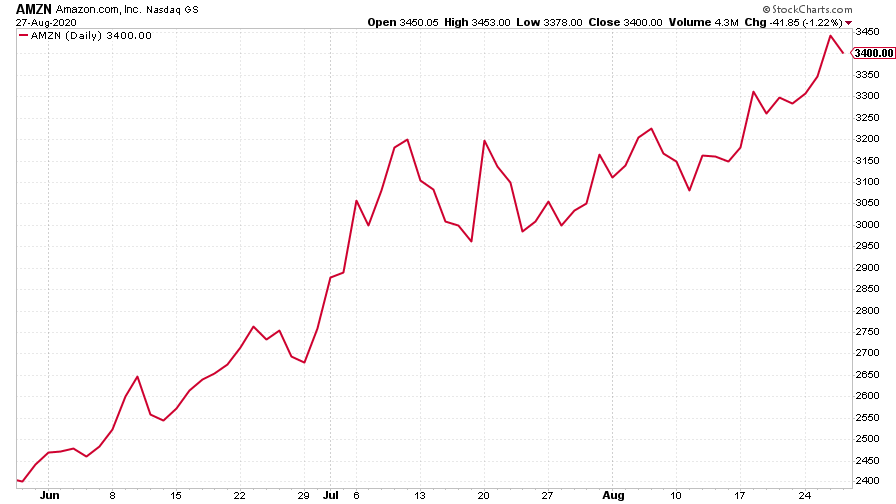

In common with many other tech shares, Amazon’s rise continues, topping $3,400

(Amazon: three months)

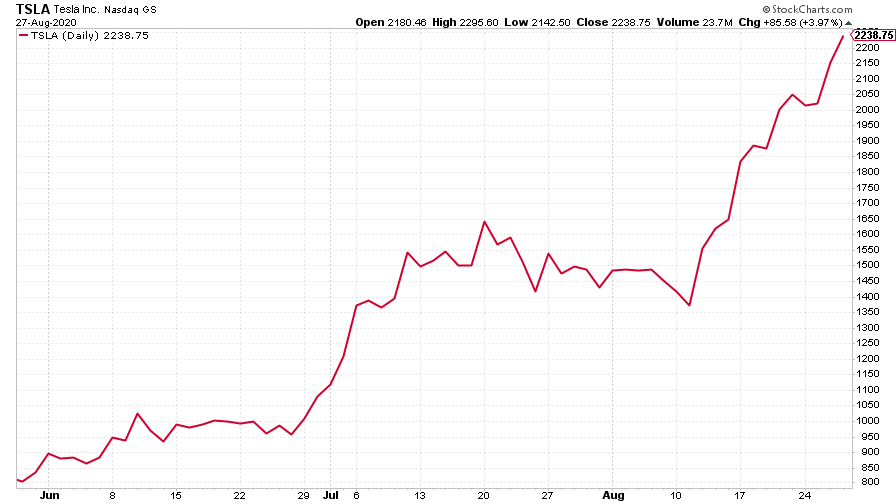

And Tesla did a stock split this week, jumping on the bandwagon with the likes of Apple, handing shareholders four additional shares for each one they held at the end of last week. It shouldn’t have affected the share price too much – but it did. The post-split shares will start trading on Monday.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

The charts that matter: bond yields and US dollar continue to climb

The charts that matter: bond yields and US dollar continue to climbCharts The US dollar and government bond yields around the world continued to climb. Here’s what happened to the charts that matter most to the global economy.

-

The charts that matter: markets start the year with a crash

The charts that matter: markets start the year with a crashCharts As markets start 2022 with a big selloff, here’s what happened to the charts that matter most to the global economy.

-

The charts that matter: Fed becomes more hawkish

The charts that matter: Fed becomes more hawkishCharts Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: a tough week for bitcoin

The charts that matter: a tough week for bitcoinCharts Cryptocurrency bitcoin slid by some 20% this week. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: omicron rattles markets

The charts that matter: omicron rattles marketsCharts Markets were rattled by the emergence of a new strain of Covid-19. Here’s how it has affected the charts that matter most to the global economy.

-

The charts that matter: the US dollar keeps on strengthening

The charts that matter: the US dollar keeps on strengtheningCharts The US dollar saw further rises this week as gold and cryptocurrencies sold off. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: gold hangs on to gains while the dollar continues higher

The charts that matter: gold hangs on to gains while the dollar continues higherCharts The gold price continued to hang on to last week’s gains, even as the US dollar powered higher this week. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: inflation fears give gold a much needed boost

The charts that matter: inflation fears give gold a much needed boostCharts US inflation hit its highest in 30 years this week, driving gold and bitcoin to new highs. Here’s how that has affected the charts that matter most to the global economy.