When will stockmarkets face reality?

Despite the economy being strangled by lockdown, US stockmarkets keep hitting mind-boggling new highs. Dominic Frisby explains why – and how long it can last.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The mind boggles – we struggle to compute it. Whatever; it happened.

What strange aberration is this?

That would be the US stockmarket: another day, another new high.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We’re living in an unreal world

If I had told you in January that in 2020 that there would be some kind of unprecedented global pandemic, to which governments would act dramatically with great force and incompetence...

That thousands would lose their lives, with America one of the hardest hit. Half the country would be wearing masks. Citizens would be locked down. City centres would be deserted. Restaurants, bars, theatres and sports arenas would close. The leisure industry would be decimated. The transportation industry would lose over 80% of its passengers. Schools would be shut down...

That the disease began in China – some conspiracies say deliberately – and so US-China trade relations would grow even more strained. Meanwhile, race riots, perhaps the worst America has ever known, would rear their ugly heads. There would be looting and violence; some city centres would be destroyed altogether...

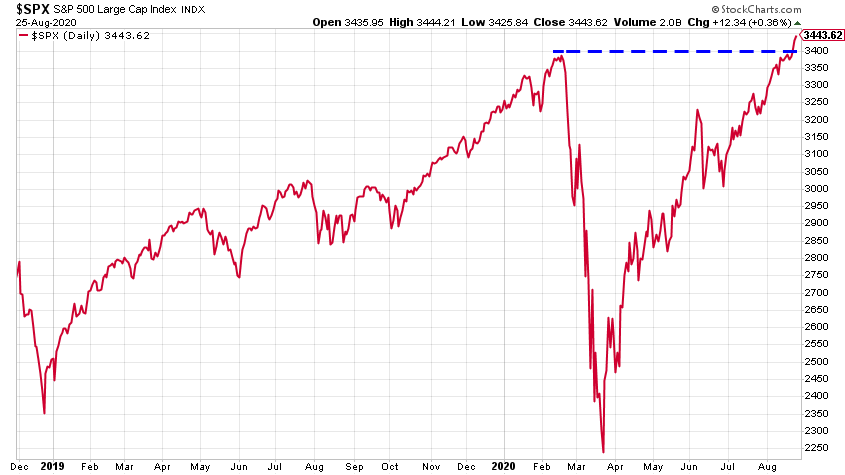

And, yet, the S&P 500 – the stockmarket index that tracks the performance of 500 of America’s largest companies, the most commonly followed equity index and the best representation of the US stockmarket – would break out to new highs.

If I said just 20% of that, you would have said – quite rightly – that I needed my head examined. And yet that is where we are.

But markets don’t reflect the wider economy

If ever you needed evidence that the stockmarket and the economy are two very different beasts, 2020, in all its madness, has provided it. The economy has all but ground to a halt; GDP has shrunk. Yet the stockmarket is at new highs.

One always wants to know why this has happened. The answer is simple: more buyers than sellers.

Yes, but why are there more buyers? The money printer went “brrr”, is why. Or, at least, that’s what started it all off. Now we have a strong uptrend, and as we are forever saying on these pages, trends are powerful things and they go on a lot longer than you think. This trend in US stockmarkets has been confounding people since March 2009 when the S&P was at 666. Today we are 3,440: five times higher.

Is the economy five times bigger? Of course not. Is the US citizen five times wealthier? You bet he isn’t. But the money printer went brrr.

They are not going to stop printing money, so you may as well get your share of the pie and be long US indices. Hedge it with a bit of gold, of course, but don’t get left behind. Taxation aside, the money printer is the greatest tool for economic inequality that mankind has ever invented. Don’t let it get you.

One day this will end in tears – but not quite yet

So what can we expect next?

More new highs. Far more often than not, new highs lead to more new highs. That is the nature of bull markets. One day they don’t of course; one day the new high is the last new high. The top. And buyers live in fear that that day is the day they buy, and so they don’t buy, and the market creeps up, and you have your proverbial wall of worry.

But the simple probability – in fact the overwhelming probability – is that one new high breed another, and another, and another until it stops.

When will the music stop? I wish I knew. It could be later today, but I doubt it. US president Donald Trump has an election to win, and new highs on the stockmarket are a key part of his strategy. “The economy is doing great”, he will say. “Look at the stockmarket. It’s at new highs. I’m doing a great job. Vote for me.”

And, having just read Dominic Frisby’s Money Morning, you will say that the economy and the stockmarket are not the same thing. And nobody will listen. And people will go on confusing the two until the end of time. Even Donald Trump probably knows the two are not the same thing. He will not care. He is happy to confuse the two when he has an election to win. Truth and politics are not known to share the same bed.

From false moves come fast moves in the opposite direction. Maybe this is a false move – new highs then crash. It’s possible. But if so, the money printer will go brrr once again. Brrr is the new normal.

One day this will all end in tears and risk will return. But for now it’s like it doesn’t exist. The trend is up. Let the trend be your friend until it ends, as they say.

There, in glorious technicolour, is your V-shaped recovery.

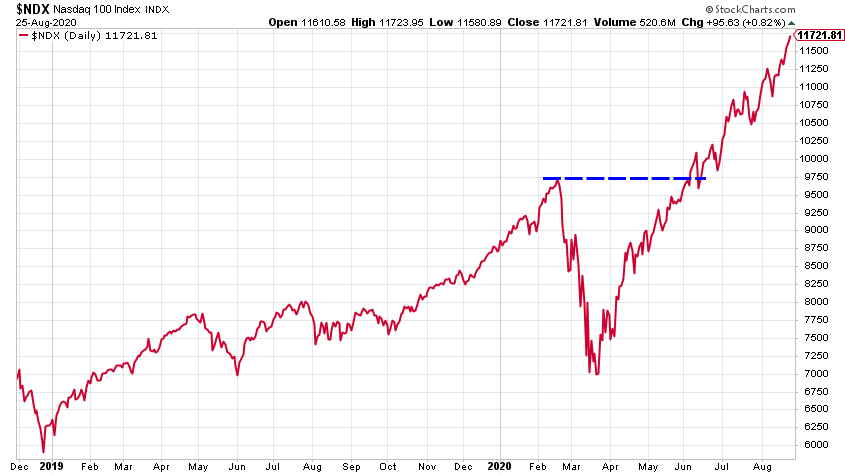

And, if you thought the S&P was extraordinary, then behold the Nasdaq.

That broke out to new highs in June (see dashed blue line). And do you know what came next? Yup. More new highs. It’s up over 20%.

Do you get my point?

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.