The charts that matter: don’t miss these podcasts

John Stepek ends the week with some quality listening material, plus the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

A lot of quality listening material for you this week – first, there’s a new MoneyWeek podcast. Merryn and I cover everything from the idea of offices being hubs of creative serendipity (I veer towards “no”, she’s a bit less negative), to house prices and the stamp-duty cut, to central planning, inflation and protecting your portfolio from it all. Tune in by clicking on this link.

I also had a very enjoyable chat with The Week Unwrapped team. I talked about the stockmarket versus the economy, while we also covered falling fertility (remember back when we were all worrying about overpopulation, oh, about two minutes ago?), working from home, and managed to throw in a brief mention of MMT – which stands for Modern Monetary Theory, or possibly Magic Money Tree. Listen to it here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And if you’d like to find out more about magic money trees, you should get hold of the latest issue of MoneyWeek magazine. Here’s the cover:

Get your first six issues free here!

And if you’re looking for some summer reading, my book The Sceptical Investor, is a timeless guide to contrarian investing, even if I do say so myself. You can pick it up on Amazon (or get it on audio here).

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday:Why the moving average is my favourite charting tool

- Tuesday:We’re spending more than at any time since World War II – how will we pay it back?

- UK house prices newsflash: OBR: UK house prices could fall by 12% next year

- Wednesday: Hang onto your gold miners – this boom has further to go

- Thursday: Where are the world’s fund managers putting their money right now?

- Friday: Will this weekend take the world a step closer to a federal Europe?

Also, don’t forget to sign up for our next webinar, ready to view on 28 July. Merryn will be interviewing James Dow, co-manager of Baillie Gifford’s Scottish American Investment Company, about where to find sustainable dividend income in a post-coronavirus world. Register to watch the interview here – it’s completely free.

On to the charts of the week.

The charts that matter

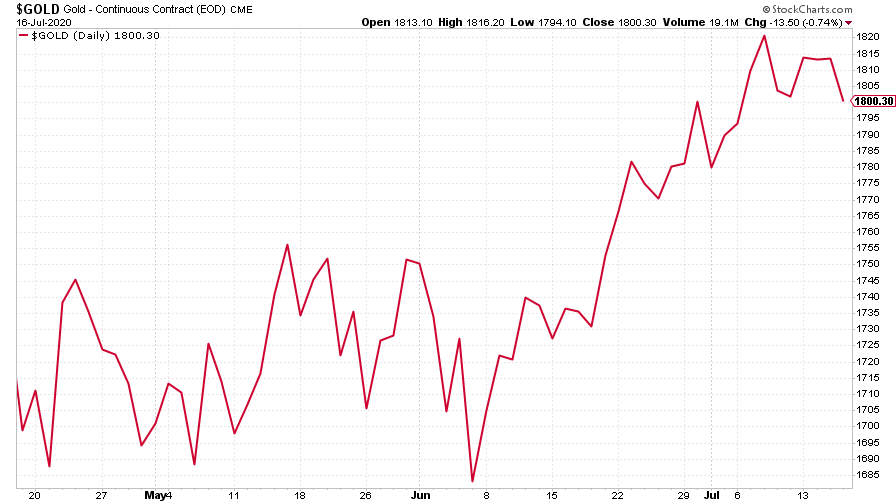

Gold had a solid week, trying to consolidate its position above $1,800 an ounce. As Dominic pointed out, we might be near a record high (in US dollars) but there’s still a good way to go in this bull market if history proves any guide.

(Gold: three months)

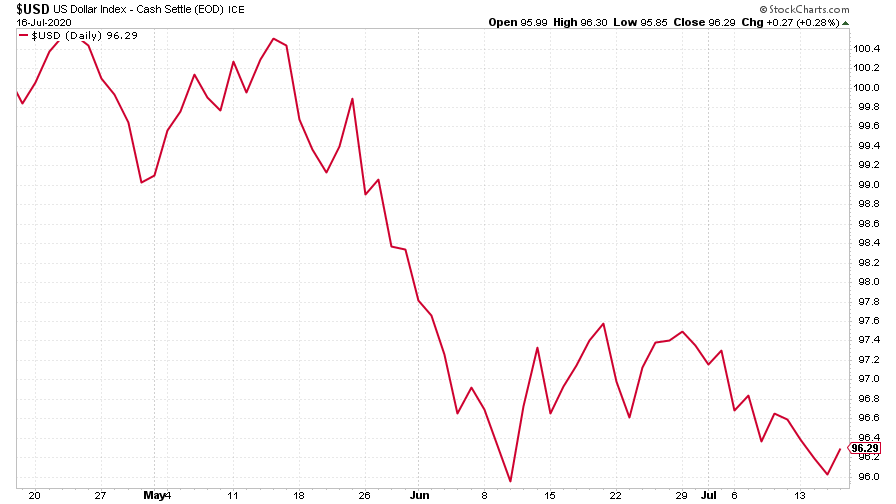

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) continued to drift lower this week. All else being equal, that’s good news for risk markets – in effect, a weaker dollar means looser monetary policy for the whole world.

(DXY: three months)

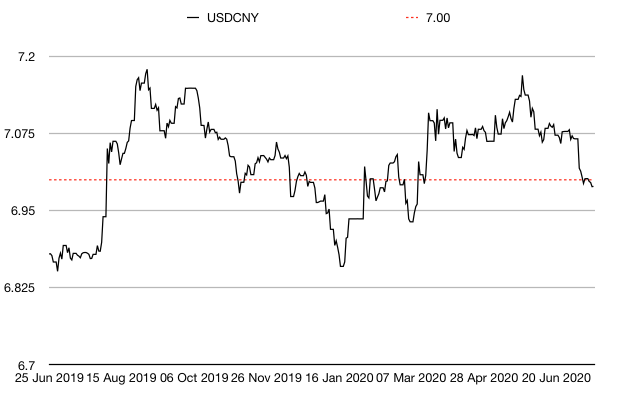

The Chinese yuan (or renminbi) continued to strengthen against the dollar (when the black line on the chart below falls, the yuan is getting stronger). The number of yuan to the dollar dropped below the ¥7/$1 mark once viewed as a warning sign of pending devaluation by the Chinese government. As a reminder, a stronger yuan is generally bullish – it means there’s less risk of China exporting deflation.

(Chinese yuan to the US dollar: since 25 June 2019)

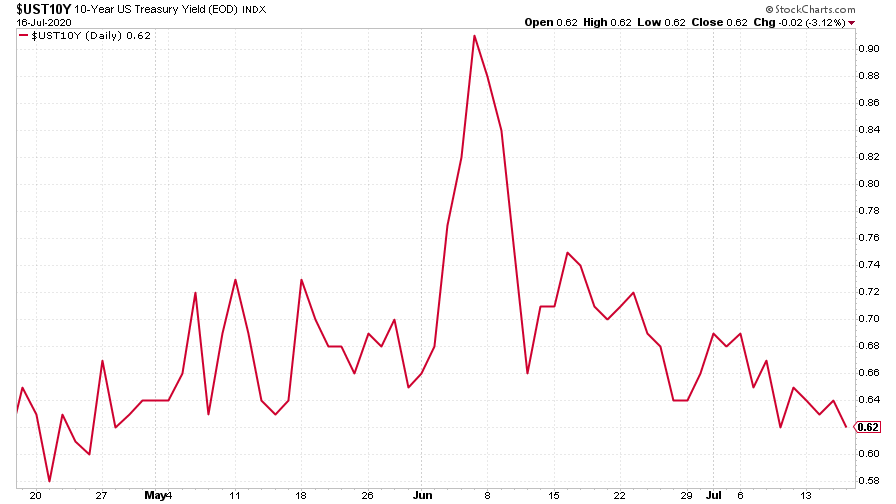

The yield on the ten-year US government bond was flat this week, though it’s close to a record low.

(Ten-year US Treasury yield: three months)

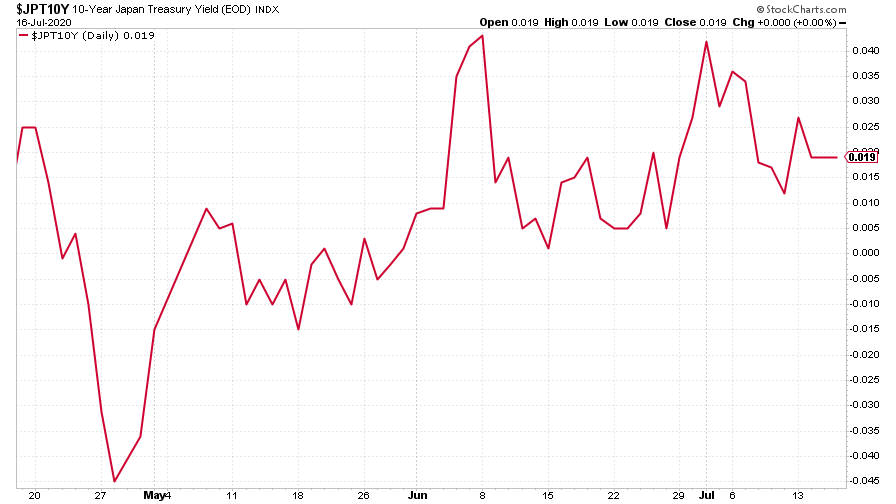

Similarly, the yield on the Japanese ten-year was barely changed.

(Ten-year Japanese government bond yield: three months)

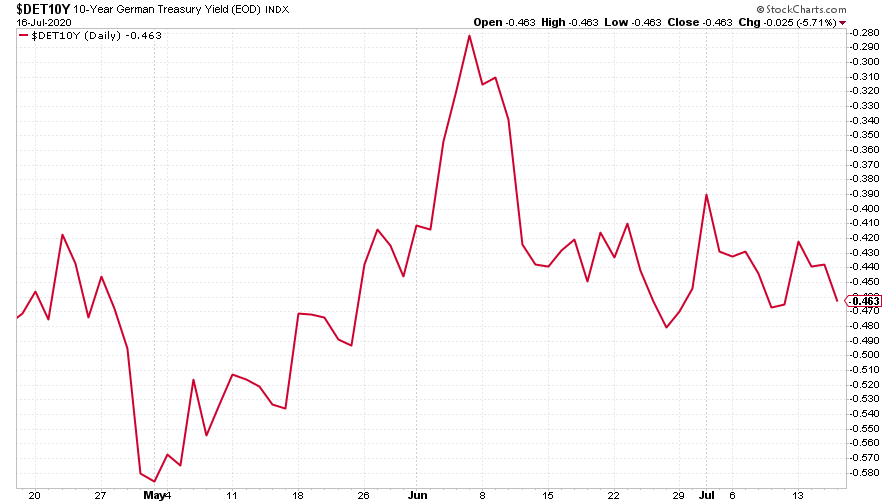

And it was the same story for the yield on the ten-year German Bund.

(Ten-year Bund yield: three months)

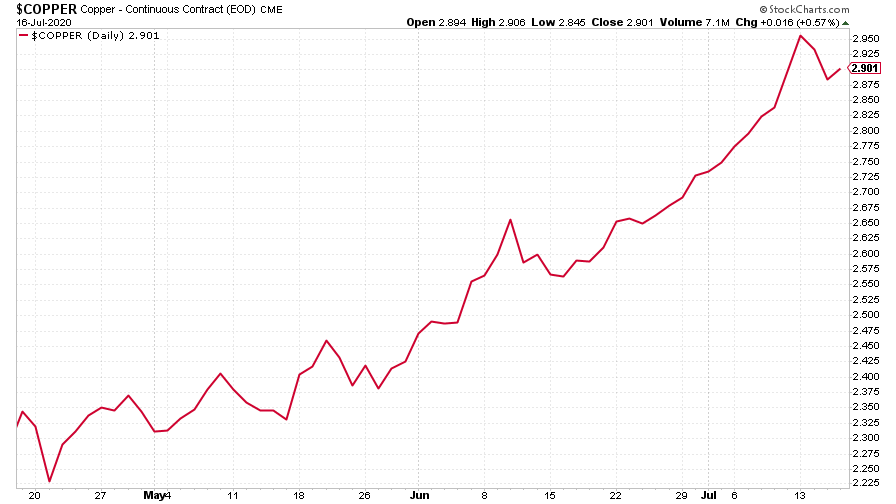

Copper continued its incredible record – it got a bit over-excited early in the week but still finished higher. It really has had an extraordinary run.

(Copper: three months)

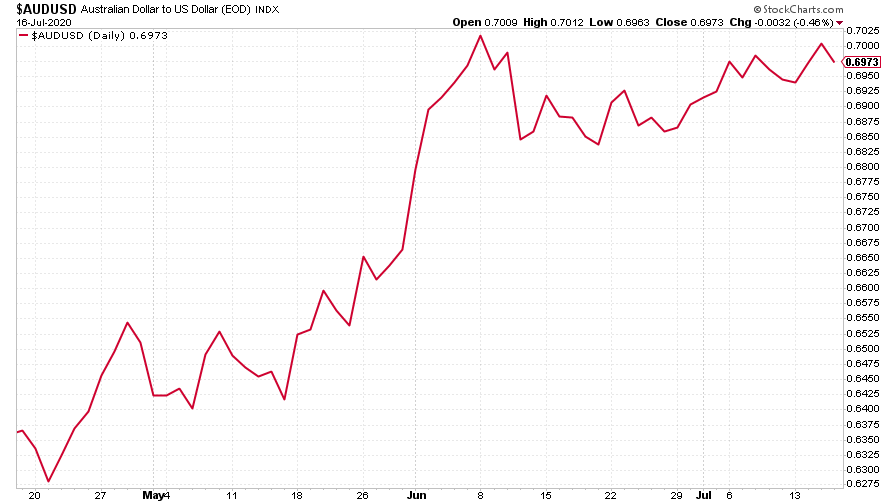

The Aussie dollar was little changed on the week.

(Aussie dollar vs US dollar exchange rate: three months)

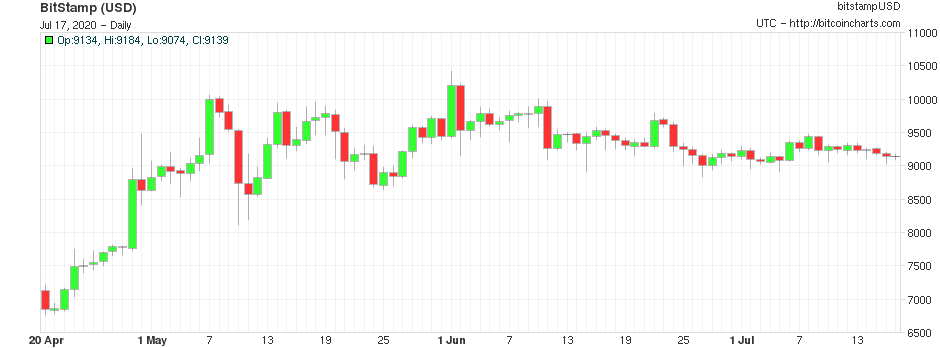

Cryptocurrency bitcoin’s trading range just seems to be getting tighter and tighter.

(Bitcoin: three months)

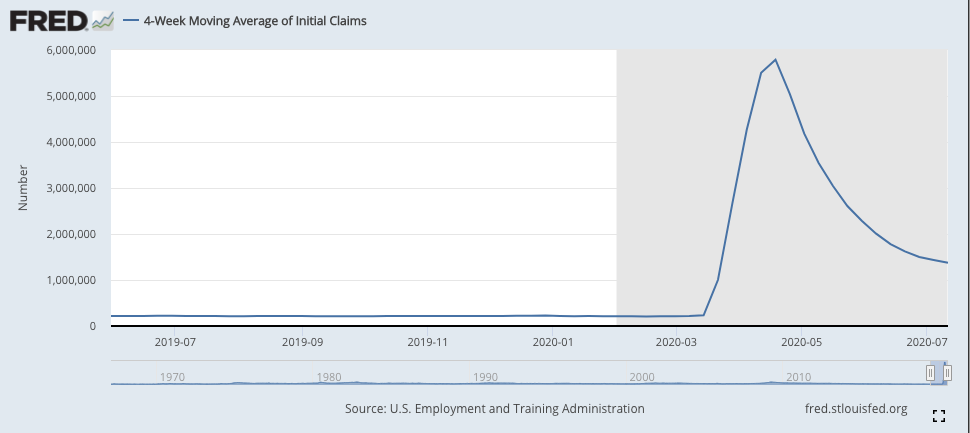

This week’s US weekly jobless claims figure was little better than last week. The number of new claims came in at 1.3 million (down from just 10,000 from 1.31 million last time). The four-week moving average now sits at 1.37 million, compared to last week’s 1.44 million.

(US jobless claims, four-week moving average: since June 2019)

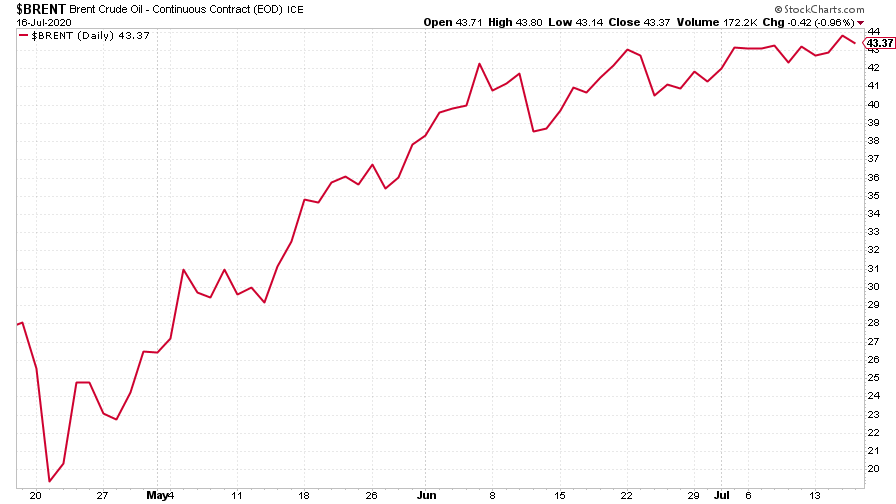

The oil price (as measured by Brent crude) was little changed on the week.

(Brent crude oil: three months)

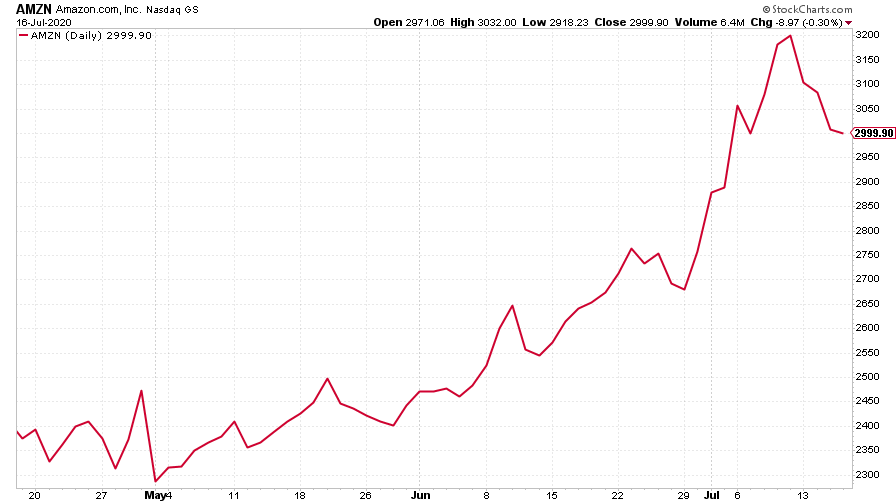

Amazon fell back below the $3,000 mark as the Nasdaq hit a speed bump early in the week, surging to a record high then slipping back on Monday.

(Amazon: three months)

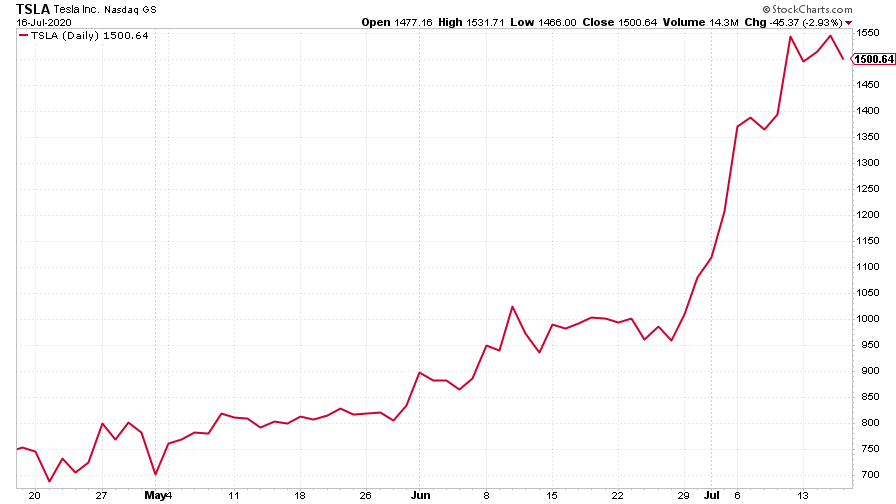

But electric car group Tesla had yet another dramatic move higher, partly on speculation that it could end up joining the S&P 500 soon (which means it would end up in all those lovely tracking funds that everyone buys these days).

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?