The charts that matter: Tesla triumphs

As Tesla becomes the world's most valuable car-maker by market capitalisation, John Stepek looks at how that affects the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

We have another excellent podcast for you this week – Merryn speaks to Laura Foll of Janus Henderson, co-manager of several investment trusts including Lowland and Law Debenture. She and Laura discuss value stocks, small caps, income stocks – and the power of equity. Listen to it here.

Incidentally, Law Debenture is part of MoneyWeek’s model investment trust portfolio – a potentially useful “core” portfolio for those looking to invest for the long run. We don’t change it much but we do try to update you on its progress every six months or so in the magazine, and it’s done really very well for itself since we first came up with the idea back in 2012. If you don’t already subscribe to the magazine, you can pick up your first six issues for free right here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Fear of a second wave is getting a hold on the market

- Tuesday: The end of the bond bull market and the return of inflation

- Merryn’s blog: How “pent-up demand” could drive a V-shaped economic recovery

- Wednesday: This chart pattern could be extraordinarily bullish for gold

- Thursday: House prices in the UK are now falling – but will they crash?

- Friday: How can markets hit new record highs when the economy is in such a mess?

And if you’re interested in contrarian investing – always a timely topic – check out my book, The Sceptical Investor – you can get it on audio here, or print/ebook here.

On to the charts of the week.

The charts that matter

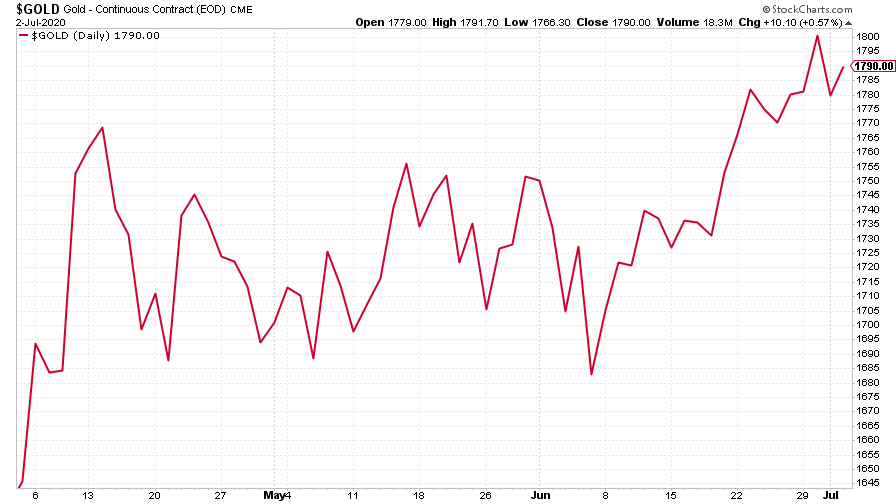

Gold had a solid week again. I suspect that the main thing for gold is to avoid fear that we’re heading back to full-on deflation – that’s the one most obvious thing that could drive “real” interest rates higher right now. Technical analysts are also getting very excited about gold just now, as Dominic noted earlier in the week

(Gold: three months)

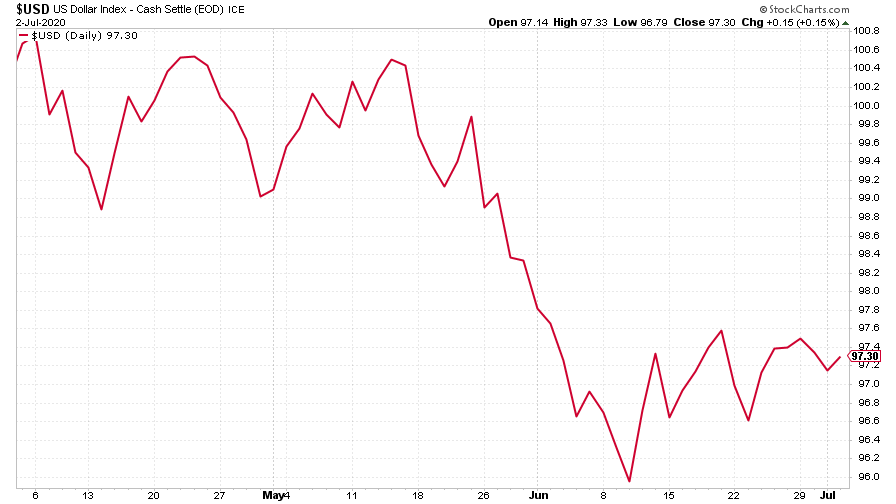

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) has done very little this week. The bulls would prefer to see it go down. My own feeling is that realistically, for that to happen, we need to see the euro properly resurgent. In turn, for that we need to see leaders of eurozone countries coming together to launch some sort of coronavirus rescue package funded by joint debt.

That would be viewed as very bullish (it would remove the last big deflationary risk altogether) and would also help to push the dollar lower (the euro comprises the biggest part of the dollar index basket). Will it happen? We’ll get a better view of how much will is left to make it happen later this month. Definitely one to watch.

(DXY: three months)

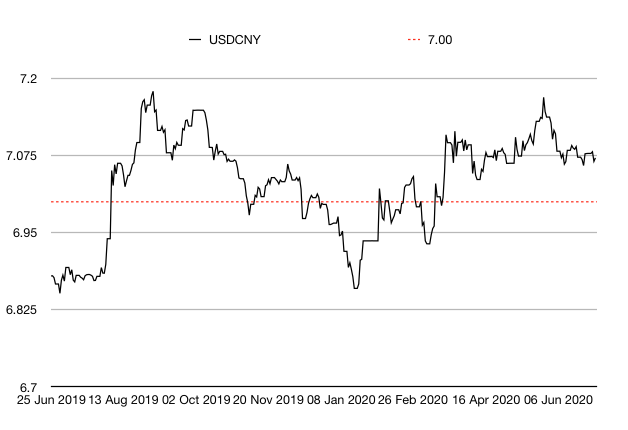

The Chinese yuan (or renminbi) remained little changed against the dollar, once again indicating that the market is parking concerns about US-China relations for now.

(Chinese yuan to the US dollar: since 25 June 2019)

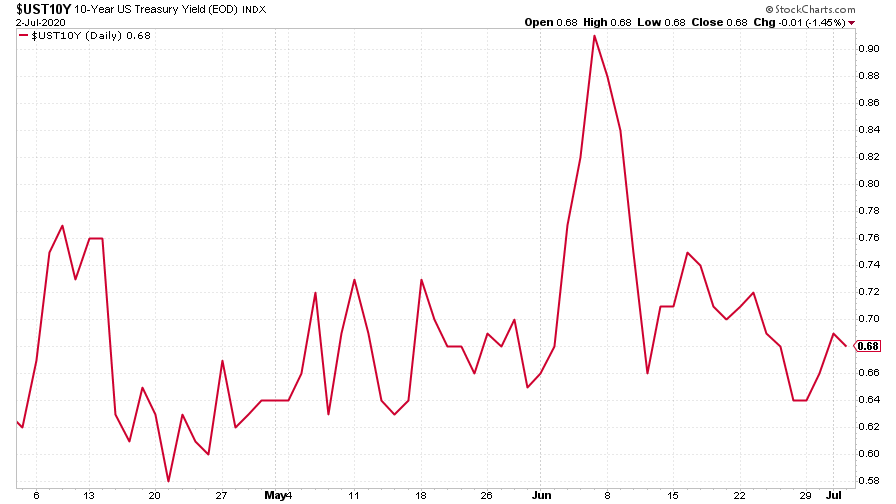

Government bond markets were almost static this week, reflecting markets neither rushing to safe havens nor especially willing to challenge central bank control of this particular market. The yield on the ten-year US government bond was little changed on the week.

(Ten-year US Treasury yield: three months)

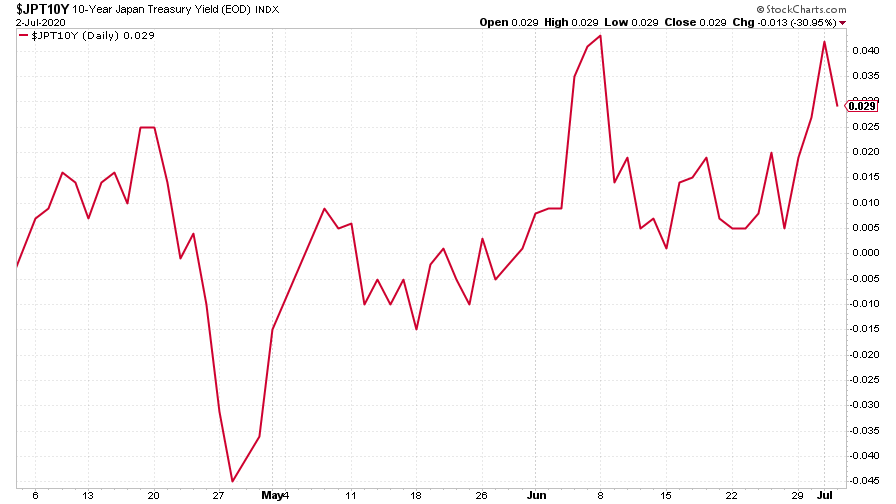

The same goes for the yield on the Japanese ten-year.

(Ten-year Japanese government bond yield: three months)

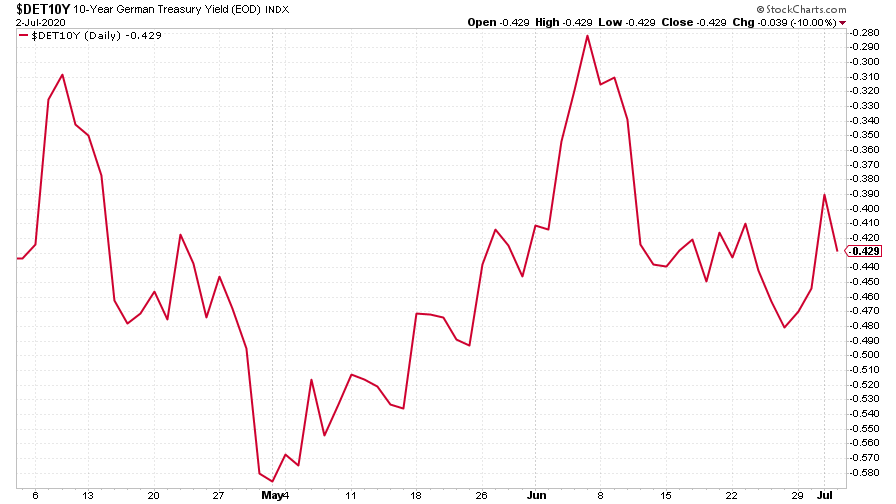

And even the yield on the ten-year German bund, which tends to be a little more volatile, just crept a little higher.

(Ten-year Bund yield: three months)

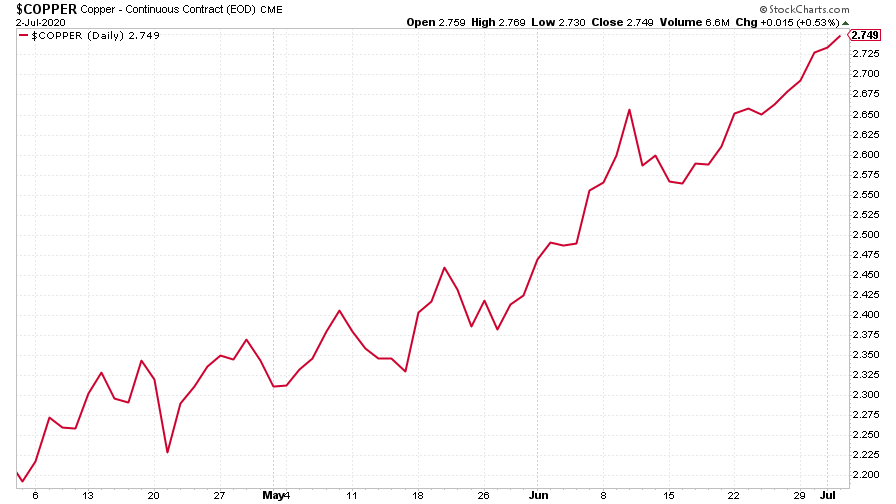

Copper continues to signal an economic recovery. It’s been recovering along a virtually straight line since the bottom and it soared even higher this week.

(Copper: three months)

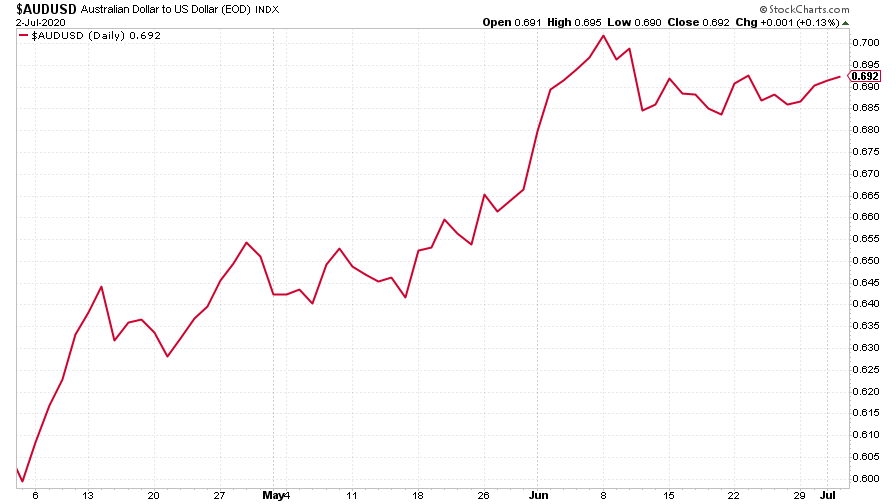

The China and commodities-sensitive Aussie dollar by contrast, was little changed this week.

(Aussie dollar vs US dollar exchange rate: three months)

Like most other assets this week, cryptocurrency bitcoin didn’t really do very much.

(Bitcoin: three months)

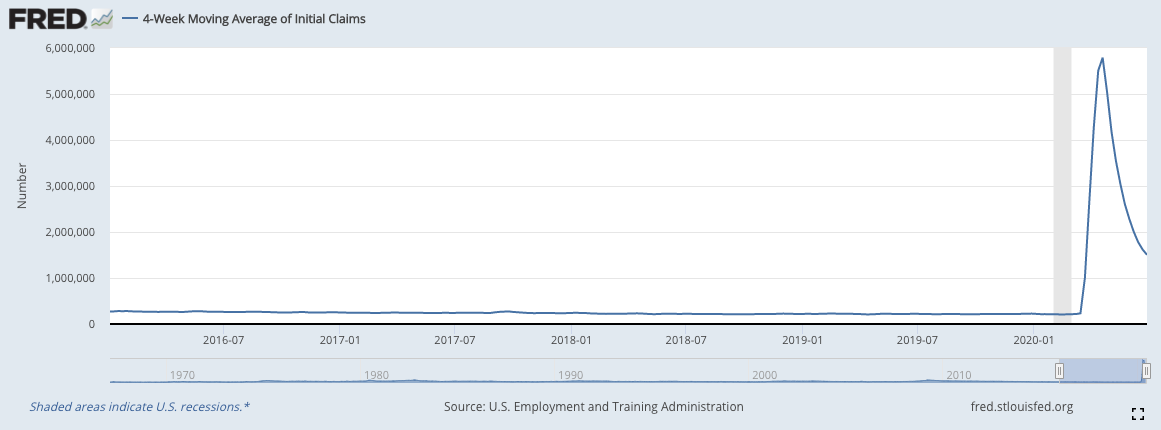

This week’s US weekly jobless claims figure was little changed on last week, and was once again a bit worse than expected. The number of new claims fell to 1.43 million (down from 1.48 million last week). Economists had, once again, expected the figure to come in at closer to 1.3 million. The four-week moving average now sits at 1.5 million, compared to last week’s 1.62 million.

(US jobless claims, four-week moving average: since January 2016)

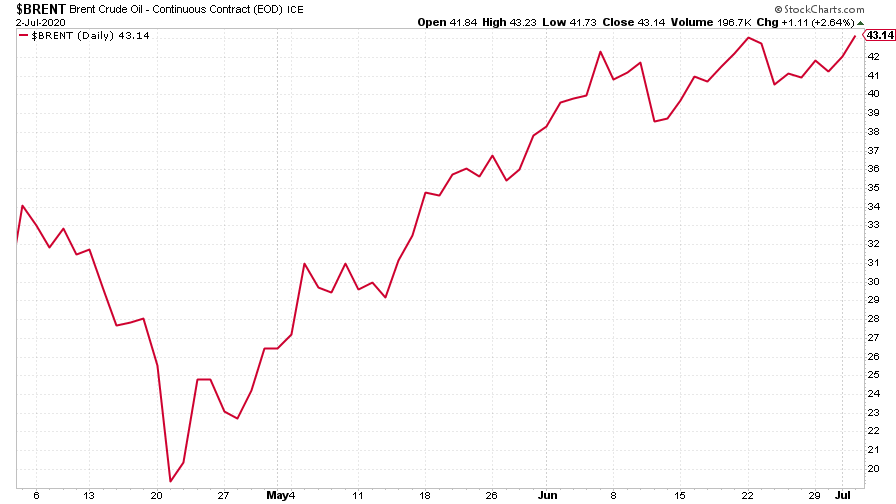

The oil price hasn’t rallied quite as consistently as copper, but it’s still pointing to a pretty solid economic recovery.

(Brent crude oil: three months)

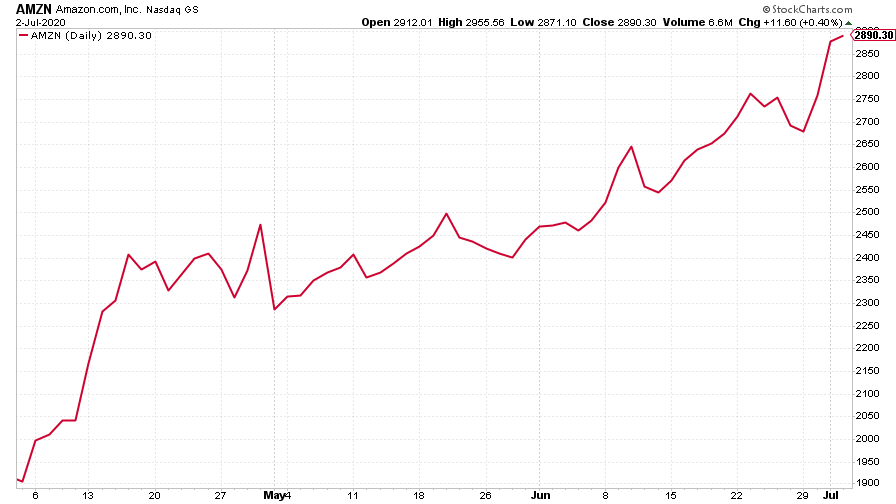

Amazon had another good week as the Nasdaq hit another record high.

(Amazon: three months)

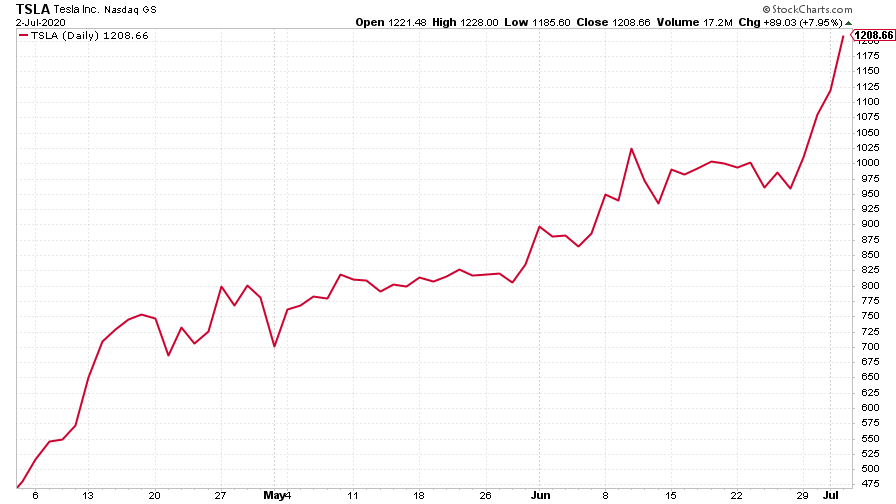

Electric car group Tesla had a spectacular gain this week as quarterly sales beat expectations by a long way. What can I say? Maybe the market really is correct to view it as the most valuable car maker in the world.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?