Halifax: House prices to fall 4% in 2024

This year may have avoided a full-on property market crash, but the continued downward pressure on house prices will spill into 2024, with prices sliding or staying flat, both Halifax and Nationwide forecast

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

House prices are predicted to fall between 2% and 4% in 2024 as economic market conditions continue to put pressure on the property market, Halifax predicts.

In a separate report, Nationwide said it also expects a single digit decline in house prices in 2024 - or for them to simply remain flat.

Inflation and higher interest rates have continued to put pressure on the market, impacting affordability and fewer completions. Halifax says though it expects partial recovery in market confidence and transaction volumes as interest rates ease, property prices will slide in 2024.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

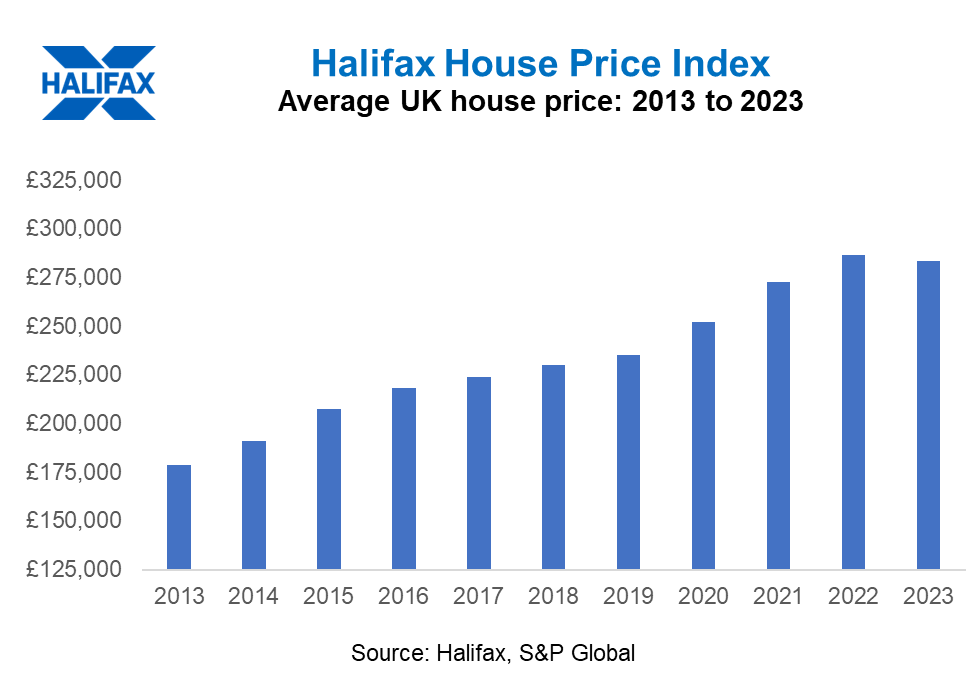

While a property crash was anticipated in 2023, UK property prices in fact held up better than expected over the last year, falling by just -1.0% on an annual basis - making the average property price sit at £283,615.

Kim Kinnaird, director, Halifax Mortgages, says: “This resilience – which owes more to the shortage of available properties for sale than strength of demand among buyers – means average house prices end the year just 3% down on August 2022’s peak (£293,025) but £44,000 above pre-pandemic levels.

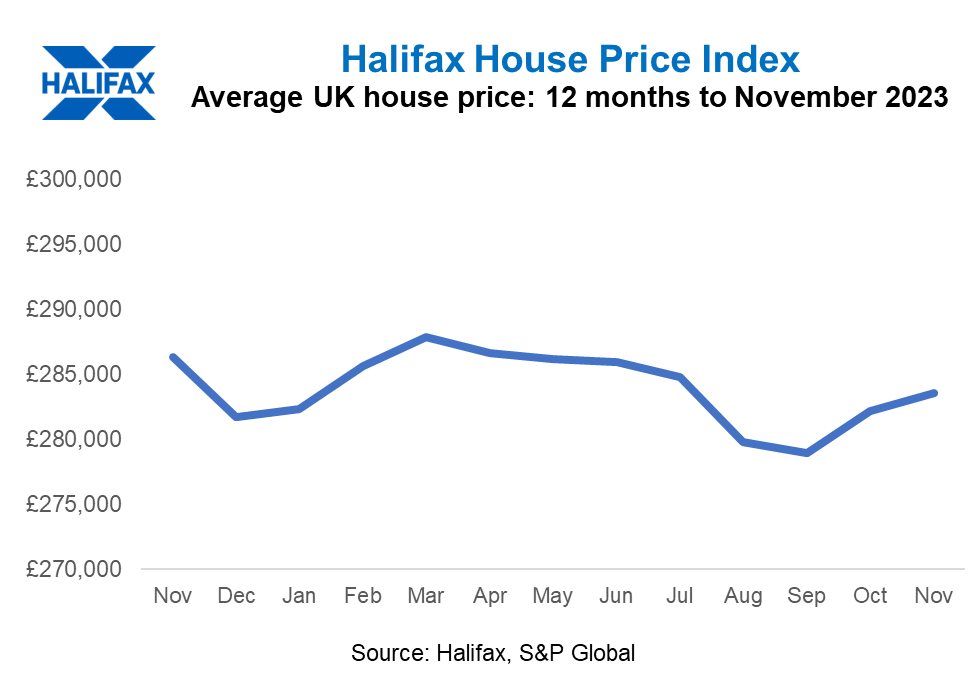

“To some extent this masks the fluctuations we’ve seen in the housing market throughout 2023. As wider economic headwinds began to bite, house prices fell for six consecutive months between April and September, before rising again later in the year as prospects improved. And it’s a mixed picture across the country too, with some areas still seeing annual growth, such as Northern Ireland at +2.3%, while in regions like the South East of England house prices continued to drop (-5.7%).

The latest house price index from Nationwide showed house prices crept up by 0.2% in November. Halifax’s own house price index painted a similar picture, showing an uptick in house prices in October by 1.1% and then 0.5% again in November.

What will happen to house prices in 2024?

With inflation falling, though still above the Bank’s 2% target, we can expect to see financial markets pricing in cuts to the base rate. Mortgage rates are also falling, with the typical fixed loan-to-value 5 year mortgages now below 5%.

Pay growth is also above inflation meaning the costs of living will ease for some - but other factors will continue to weigh on households’ spending power next year.

“Economic growth is expected to remain weak, with unemployment rising and frozen tax thresholds limiting any increase in take home earnings.

“Overall, with the combination of cost of living pressures and interest rate levels that are still much higher than even two years ago, we will likely see continued mild downward pressure on house prices. Our latest forecast suggests a fall of between -2% and -4% in 2024.”

Robert Gardner, Nationwide’s chief economist, adds that a rapid rebound in activity or house prices in 2024 appears unlikely.

“While cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, consumer confidence remains weak, and surveyors continue to report subdued levels of new buyer enquiries. Moreover, while markets are projecting that the next Bank Rate move will be down, there are still upward risks to interest rates. Inflation is declining, but measures of domestic price pressures remain far too high.

“If the economy remains sluggish and mortgage rates moderate only gradually, as we expect, house prices are likely to record another small decline (low single digits) or remain broadly flat over the course of 2024.”

Average UK house prices in last 12 months

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge