Halifax: House prices rise for the second consecutive month

UK house prices rose again in November, suggesting a resilient property market amid economic turmoil in the past year- but will they fall in 2024?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

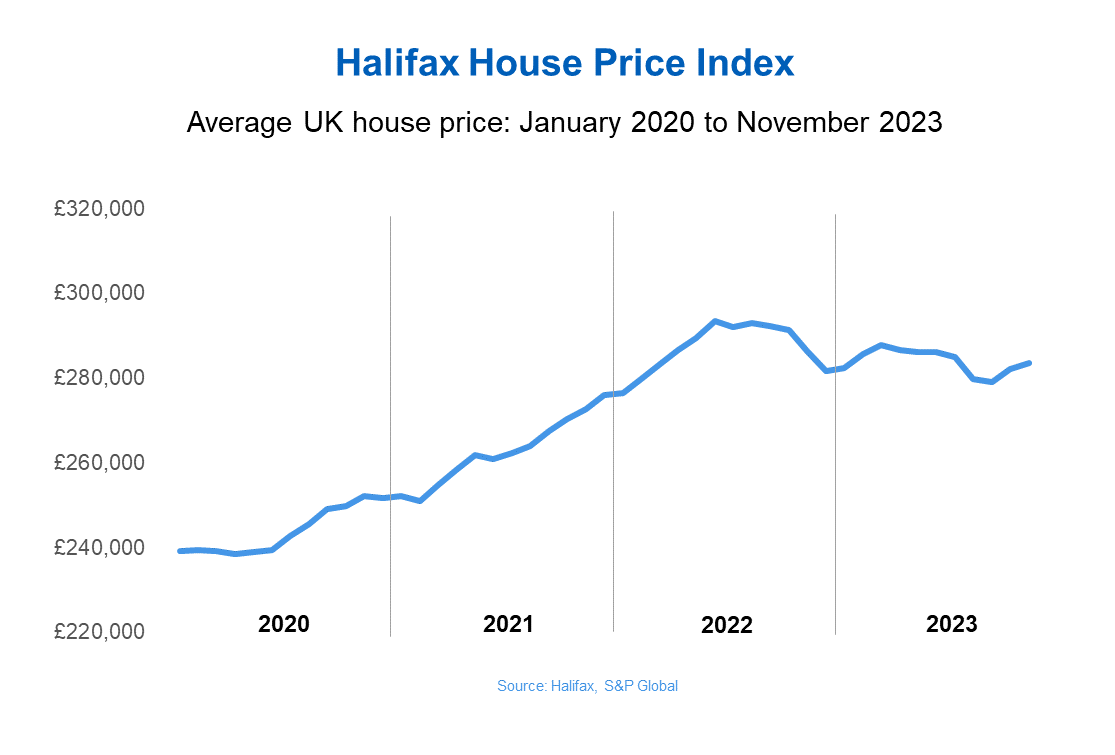

UK house prices rose by 0.5% in November, the second consecutive rise after a six-month streak in monthly falling house prices, the latest data from Halifax reveals. This follows a 1.1% monthly hike in October.

The average property price is now £283,615 - around £1,300 more than October.

Compared to this time last year, house prices are still lower, but only by a modest 1%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Despite the shortage of homes and affordability challenges for buyers in the past year, Halifax says the property market continues to demonstrate resilience amid high mortgage rates, aggressive interest rate hikes and cost of living pressures.

Imogen Pattison, assistant economist at Capital Economics, says: “The recent fall in mortgage rates from 5.9% in July to around 5% now probably explains this rise and suggests that despite stretched affordability, demand has recovered somewhat.”

Where did house prices rise the most?

Northern Ireland has shown the strongest growth, with a 2.3% annual rise in house prices.

This means the average home costs £189,684 - £4,294 more than a year ago.

Property growth in Scotland has flatlined at 0%, resulting in the average home now costing £203,116.

However, some regions were still hit by annual falls, with house prices in the South East showing the sharpest decline of 5.7%, when compared to the rest of the UK a year ago. This brings house prices down in the South East to £373,943 - a £22,702 drop.

Average house prices in London notoriously remain at an all-time high, at £524,592, but the city also saw an annual decline of 3.8%.

Meanwhile, Wales saw one of the smallest annual drops of 1.5%, resulting in the average home costing £215,787.

Is the property market heading for a crash?

With house prices on a surprising upward trajectory in October, and again in November, you may be asking where property prices will go in 2024, and if we are heading for a crash.

Some experts believe this could be a sign of recovery as inflation has fallen below the 5% mark, mortgage rates have shown a decline and interest rates are frozen, with anticipation of the base rate falling next year.

“The key is that sentiment has become more buoyant in recent weeks as the economic data improves and keeps downwards pressure on mortgage rates,” says Tom Bill, head of UK residential research at Knight Frank.

“Transactions numbers, which are a better indicator for the overall health of the market than prices, should be stronger in the next six months than the last six provided a general election is not called in the first half of 2024.”

The latest Nationwide House Price Index also revealed a rise in average monthly house prices of 0.2% in November, but similarly showed an annual decline of 2%.

However, Sarah Coles, head of personal finance at Hargreaves Lansdown warns we shouldn't take the house price rise at face value.

“Unfortunately, sellers face a problem that’s all too familiar now,” she says.

“On paper things are looking good, but they actually have to find a buyer first, and they’re still pretty thin on the ground.

“A Pick-up in mortgage approvals will take a few months to filter through into property figures. And even then, there’s every chance this is a blip rather than a bounce back.

“The Office for Budget Responsibility expects the economy to continue to stagnate, which could mean job losses and wage freezes. This would remove two of the most important things underpinning the market right now, so we are still expecting 2024 to be tricky for the property market.”

Bill adds that even as the economic backdrop improves, the political temperature is rising, “which is likely to be the biggest risk faced by the UK housing market over the next 12 months.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Vaishali has a background in personal finance and a passion for helping people manage their finances. As a former staff writer for MoneyWeek, Vaishali covered the latest news, trends and insights on property, savings and ISAs.

She also has bylines for the U.S. personal finance site Kiplinger.com and Ideal Home, GoodTo, inews, The Week and the Leicester Mercury.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how