Nationwide: UK house prices creep up by 0.2% - are we heading for a rebound?

Nationwide’s latest house price index shows property prices inched up by 0.2% as demand warms up - will this trend go into 2024?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

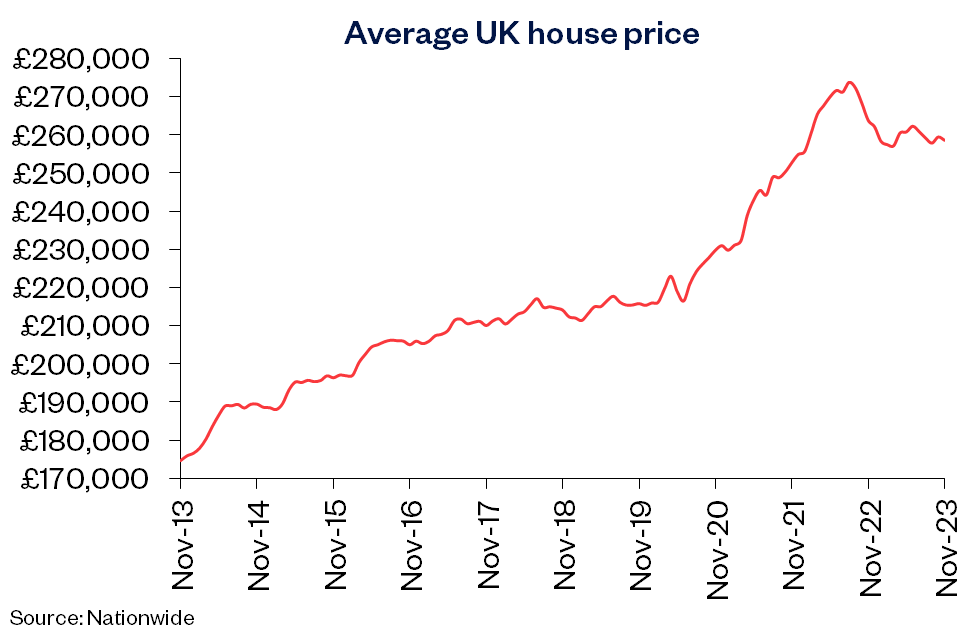

House prices have been showing ups and downs for most of this year, but the latest Nationwide house price index shows that prices rose 0.2% month on month in November, taking the average property price to £258,557.

This is the third month in a row Nationwide has recorded a slight rise in property prices amid mortgage rates coming down and demand returning to the market as wages rise.

But despite the rise, property values are still down 2% compared to a year ago. Annual growth remains weak, though is at its strongest since February 2023.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Robert Gardner, Nationwide's chief economist, said: “There has been a significant change in market expectations for the future path of bank rate in recent months which, if sustained, could provide much needed support for housing market activity.”

While the Bank of England has been hiking rates for almost two years, it has now held rates at 5.25% for two consecutive months. While we do not know what will happen to rates next year, experts suggest borrowing costs may have reached their peak and may come down to 3.5% in the years ahead.

“While mortgage rates are unlikely to return to the lows prevailing in the aftermath of the pandemic, modestly lower borrowing costs, together with solid rates of income growth and weak/negative house price growth, should help underpin a modest rise in activity in the quarters ahead,” Gardner said.

House prices at a 10 year high

It’s worth noting that while property prices have come down from their peak seen back in mid-2021 in the last year, today's house prices are still at a record high compared to a decade ago.

Here's how house prices have chances since November 2013:

Is it a good time to buy a house?

While a bump up in property prices for three consecutive months may suggest a rebound, Gardner stressed “a rapid rebound still appears unlikely”.

And while the market is warming up with buyers returning to the market, potential buyers are still considering whether now is the right time to buy; latest HMRC data this week showed a staggering 21% year-on-year fall in residential transactions.

“Limited housing stock and high rental costs are nudging people towards buying, yet the high cost of mortgages and economic uncertainties are weighing heavy on budgets holding back a full-scale market revival,” Karen Noye, mortgage expert at Quilters commented.

“The balance of recovery will hinge on how interest rates and the broader economic picture evolve in the coming months.”

Charles Breen, director at Weillingborough-based independent mortgage brokers Montgomery Financial, believes the market has reached the bottom and anyone looking to buy should start getting ready - especially first time buyers.

“Once the base rate begins to decrease, as it may well do by the summer of next year to stimulate the economy, it will cause a feeding frenzy in the housing market and prices will rise again.

“The window of opportunity will be quickly slammed shut. Oscar Wilde said “a pessimist is somebody who complains about the noise when opportunity knocks” - and, in my opinion, opportunity is knocking very loudly right now for first-time buyers. Now is their chance to get on the property ladder at a discount.

To put a rocket under the market and for it to really take off, the Bank of England needs to grow a backbone and reduce rates. People want to buy but 18 months of rate increases and a tsunami of bad news have sucked a lot of confidence out of the market.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.