Debasing Wall Street's new debasement trade idea

The debasement trade is a catchy and plausible idea, but there’s no sign that markets are alarmed, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Sometimes an idea is so catchy that it doesn’t matter whether it’s true. The “debasement trade” – the claim that investors are starting to price in a severe surge in inflation that will erode the value of money – is a good example. We see it everywhere in headlines at the moment. Yet it’s impossible to see much evidence in markets. To begin with, we have to agree on what is being debased. The US dollar is the favoured target. However, if you look at the dollar versus other major currencies, there is no sign of this happening. Yes, it is down since the start of the year, and still seems more likely to fall than rise against over the next few years if foreign sentiment towards US assets continues to cool. But it has been stable since June. We’re not even seeing weakness now, let alone debasement.

Maybe the debasement is in all fiat currencies, so they won’t fall against each other because they are all equally bad. Instead, they will weaken against real assets. The surge in gold and other precious metals seems to support this. Yet stocks are also doing well, even though they typically struggle in high inflation (they often rise during hyperinflation, but that is a different scenario). More likely, traders are latching onto gold because it’s been going up: record flows into gold exchange-traded funds (ETFs) support this idea. A few months ago, I noted that we were not seeing these flows – now it has changed.

Bond yields and the debasement trade

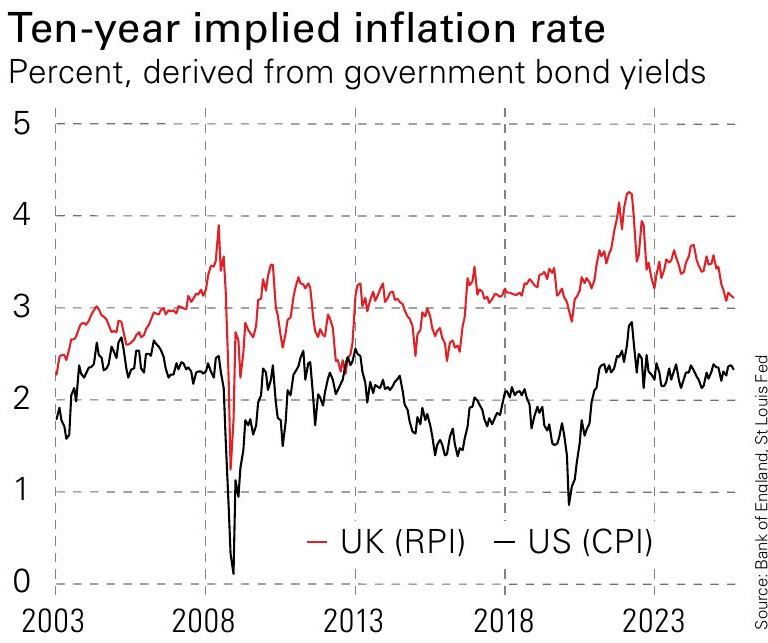

If markets were genuinely becoming much more worried about inflation, we’d expect to see it in bond yields. While many yields have risen this year – especially longer-term government bonds – this always felt more like markets were pricing long-term uncertainty about government policy and finances, not specifically forecasting inflation. It continues to look that way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yields have mostly come down in the last few weeks. Even more significantly, inflation breakevens – the difference between the yields on a conventional bond and an inflation-linked one of the same maturity – are not rising (see above). Breakevens are not a good forecast of inflation, but if markets are functioning normally, they will express fear of inflation through nominal yields that rise faster than inflation-linked ones and thus through widening breakevens.

Of course, we may well see high inflation if governments run large deficits while forcing central banks to cut rates and control yields. But it’s wrong to claim the market’s watchdogs are sounding the alarm. They are clearly not – yet.

What to do if inflation surges will be on the agenda at Turmoil, Tariffs and Trump 2.0, the MoneyWeek Wealth Summit, on Friday, 7 November in London. Our morning keynote speaker, Dylan Grice, will discuss the difficulties of investing in this “high-signal” environment, while our multi-asset panel of Charlie Morris (ByteTree), Charlotte Yonge (Troy), Frank Ducomble (RIT) and Jasmine Yeo (Ruffer) will share ideas on how to hedge the risks. See moneyweekwealthsummit.co.uk for details.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China