Why emerging markets are waiting for a weak dollar

Emerging markets have had a better year but, like everything else, are still lagging far behind the US

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

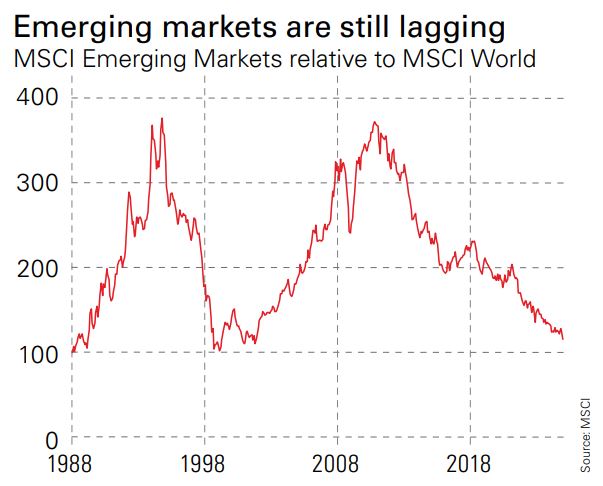

I am a longstanding bull on emerging markets – a position that feels more difficult with every passing year of disappointing returns. Emerging markets have lagged developed ones for more than a decade: 3.7% per year over 10 years, versus 9.1% for the MSCI World and 4.7% for the MSCI World ex USA. Still, we can at least say that 2024 has been a bit underwhelming rather than awful.

The MSCI Emerging Markets index is up by 13% so far this year (12% in sterling terms), which sounds reasonable until we note that the MSCI World is up by 22%. The exceptional performance of America plays a large role in this, and emerging markets have actually beaten the MSCI World ex USA (up 11%), but it’s difficult to claim that’s enough reward for the extra risk. Still, emerging markets are a very diverse group and some have done very well.

Winners and losers in emerging markets

India has returned 19%, despite recent signs of nerves, and China is up by about the same after a sharp rally in September driven by hopes that government policy is turning more pro-growth.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Taiwan is up by 41%, although that’s due to one stock – chipmaker TSMC, which accounts for half the index and rose 75%. Almost anybody who bought a Taiwan fund on the basis that the economy is heavily geared to the tech boom would have done worse than this since most funds have to cap their exposure to a single stock.

Of course, Taiwan is an emerging market only in an investment sense (there are certain technical restrictions on market access): in reality, it is a highly developed country, as is South Korea, which had a poor year (down 12.5%, and 21% in sterling terms) even before the president tried to declare martial law recently. This is also partly due to one stock: Samsung Electronics, a quarter of the index, which has slumped 30% amid problems with its own chip-making business.

These are the four key markets, together amounting to 75% of the index. Elsewhere, Brazil struggled with rising interest rates and concerns about government spending, leaving the market down 11% (and more than twice that in sterling terms due to the slump in the real). Mexico has fallen a similar amount on concerns that a landslide victory for the governing party may undermine the rule of law. Middle East markets have suffered from weaker oil prices.

Southeast Asia has been lacklustre, even though Singapore (which is part of the developed index, but economically geared to its neighbours) is up 32%. A single stock again accounts for part of that – internet group Sea, headquartered in Singapore but listed in New York, rallied 200%.

The good news is that emerging markets still look cheap, both in aggregate (a forecast price/earnings ratio of 12) and individually – except India and perhaps Taiwan. What’s missing are tailwinds to lift more markets at the same time. History suggests a weak dollar would be helpful, but we’re certainly not seeing that at the moment. Still, if US stocks overheat, emerging markets are the obvious contrarian value play.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?