AGMs: a unique selling point for investment trusts that investors should capitalise on

Shareholder meetings aren’t just a regulatory requirement – they are a way to communicate with investors

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

MoneyWeek is not dogmatic about how we invest. Passive funds, active funds, UK stocks, international stocks – all these and more should be on the table. Still, we tend to have a bias towards investment trusts rather than open-ended funds in our funds coverage. This is partly because investment trusts get a lot less attention than open-ended funds, and we can add more value by focusing on them, but also because we feel that there are certain structural benefits to closed-end funds for many types of investing.

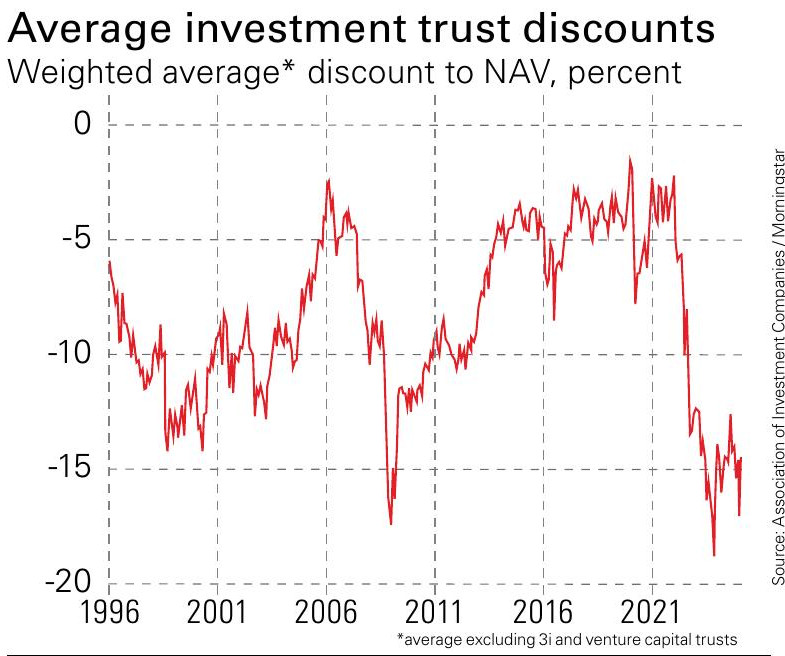

Some of the supposed advantages of trusts are less compelling for me than other investors think. Yes, it’s great to be able to buy at a temporary discount to net asset value (NAV), but it’s less compelling if discounts are still wide when you sell. The issue of persistent discounts has become an existential issue for the sector (see chart). The ability to use gearing (borrowing to invest) can boost returns in principle, but gearing plus poor management equals bigger losses.

Closed-end structures are unequivocally best for alternative assets and for more illiquid markets. For highly liquid assets – eg, large-cap, developed-markets stocks – there’s less advantage. For example, earlier this month I met with the Guinness European Equity Income Fund – a quality-income fund with a solid record and a clear process. Even though I usually favour trusts, I’d be happy to choose it as a Europe fund. Or take STS Global Income & Growth Trust (LSE: STS), whose managers run the same portfolio in the open-ended Trojan Global Income Fund. I’d probably buy the trust, but I’d view the open-ended fund as an equally good choice for a defensive equity fund with low US exposure.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A USP for investment trusts

Still, there is one structural benefit of trusts that is often overlooked. An open-ended fund is controlled by the fund manager. An investment trust is an independent entity. It has its own board, which is supposed to look out for shareholders, and can sack the manager if they are doing a bad job (some boards are much diligent than others). So, like all companies, they must hold annual general meetings, where investors get an update from the manager. If you go to these, you will often hear plenty of excellent questions from very engaged investors who have their own money on the line.

Encouragingly, many trusts clearly see that AGMs are a chance to present themselves to potential investors, and not just a regulatory requirement. Recently I was at the AGM for India Capital Growth Fund (LSE: IGC), one of MoneyWeek’s favourite long-term plays on India. It previously held its meetings in Guernsey, but shifted to London and saw a strong turnout. This week, I should be at the Vietnam Enterprise Investments (LSE: VEIL) forum at its AGM (you can register to attend here). In an environment where many trusts will face a growing threat from active ETFs (which will not be holding AGMs), this is a unique selling point that more should capitalise on.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Saba Capital: the hedge fund doing wonders for shareholder democracy

Saba Capital: the hedge fund doing wonders for shareholder democracyActivist hedge fund Saba Capital isn’t popular, but it has ignited a new age of shareholder engagement, says Rupert Hargreaves

-

Star fund managers – an investing style that’s out of fashion

Star fund managers – an investing style that’s out of fashionStar fund managers such as Terry Smith and Nick Train are at the mercy of wider market trends, says Cris Sholto Heaton

-

Exciting opportunities in biotech

Exciting opportunities in biotechBiotech firms should profit from the ‘patent cliff’, which will force big pharmaceutical companies to innovate or make acquisitions

-

How to add cryptocurrency to your portfolio

How to add cryptocurrency to your portfolioA new listing shows how bitcoin might add value to a portfolio if cryptocurrency keeps gaining acceptance, says Cris Sholto Heaton