MoneyWeek's best calls of the last 25 years – the key trends we got right

From the early days of the gold bull market and the credit crunch to the advent of populism and post-Covid inflation, MoneyWeek has made some excellent calls. Andrew Van Sickle reviews them

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We didn’t make any specific calls in our first edition, but flicking through it at the British Library the other day (none of us have a copy), I was struck by how we managed to highlight important themes that recurred during the subsequent 25 years and remain relevant today. They included the flaws inherent in the euro, the burgeoning British public sector, the need to hold technology stocks for the long term, cybersecurity, and the wisdom of investing in gold. It proved an auspicious beginning.

What MoneyWeek got right

The commodities supercycle (Oct 2001)

By issue 50, we had started to notice that raw materials were historically cheap following a bear market throughout the 1980s and 1990s. Commodities, like other assets, move in long cycles, and a turnaround seemed likely. Supply had dwindled as producers discouraged by low prices had cut output, while some commentators were beginning to factor in a step-change in demand as Chinese industrialisation moved up a gear. The developing world’s improving living standards also implied strong demand for agricultural raw materials and soft commodities such as coffee.

Oil was subject to the same demand-and-supply fundamentals as the rest of the raw-materials complex, while the notion that the earth’s oil supplies were peaking (Peak Oil) added impetus to the bullish story. Merryn suggested buying in April 2004, when the price was around $30 a barrel. By the summer of 2008, a global recession looked imminent, and oil would fall with worldwide output. Black gold had hit a record peak of more than $140 a barrel earlier that year. We said sell at $115. It slid all the way to $30 before bouncing back in 2009. The Peak Oil narrative, meanwhile was revised.

Buy gold (Sep 2002)

It wasn’t the first time we’d mentioned gold in a bullish context, but we looked at it in detail on the cover of our 96th issue. In her editor’s letter, Merryn noted that “in the face of dollar weakness and America’s fast-rising money supply, gold has begun to reclaim its natural position as a financial hedge in troubled times”. US dollar weakness has come and gone over the past 25 years, and a lower greenback is, of course, bullish, but the main driver of the structural gold bull market that started in 2001 has been concern over the ultimate impact on fiat currencies of far-too-easy money and continual monetary experimentation. Central banks have piled into the market to ensure their reserves are not too skewed towards paper money, and investors have joined the party.

The long-term bull market is certainly closer to the end than the beginning, but recent gains are still dwarfed by the sort of progress made in the final run-up to the 1981 peak (300% between 1976 and 1980). And the list of concerns investors need the oldest form of insurance to protect themselves from is still long and weighty – beyond excessive liquidity we face record global debt levels, possible danger in the private-credit market and geopolitical upsets.

The US housing bubble (March 2005)

Most of the US market commentators we enjoyed reading were not based on Wall Street, so they tended to look beyond CNBC’s talking points. This is the earliest warning I could find in MoneyWeek that the run-up in the American property market was starting to look overdone. Of course, it kept going for another couple of years (we are often a bit early, as our bullish Japan cover in 2004 illustrates). But when the bubble eventually burst, it turned out that the market was at the centre of a web of inter-related, vastly complicated credit-based financial instruments that transformed a downturn into a 1930s-style meltdown.

The credit crunch (July 2007)

That brings us neatly to one of the most prescient and insightful articles the magazine has ever published. In September 2006, almost two years to the day before the Lehman Brothers went broke, Cris Heaton wrote a beginner’s guide to credit derivatives and their potential for causing trouble. It included the most complicated flowchart any of us had ever seen. “Far from cutting risk, the spider’s web of derivatives could push it through the financial system, with losses in unexpected places.”

By the summer of 2007, we were starting to find out exactly where those losses were appearing. US house prices were falling, subprime mortgages and collateralised debt obligations were appearing in the business press, and credit markets were becoming more volatile. Then-Federal Reserve chairman Ben Bernanke might have insisted that everything was fine, but we disagreed: “The cheap money boom is giving way to the credit crunch.”

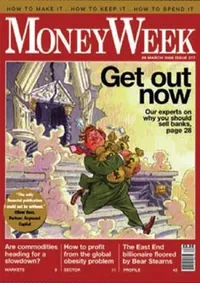

Sell the banks (Feb 2008)

When it came to wealth protection during the credit crunch, our regular contributor James Ferguson (now at the MacroStrategy Partnership) had a fantastic run. In February 2008, he told readers to stay away from the Icelandic banks, despite the tempting 6%-plus interest rates on offer. “If it’s Icelandic, then be afraid; these banks are starting to be priced for bankruptcy risk, and it’s not clear what protection UK savers might have with these foreign accounts.”

In October 2008, the Icelandic banking sector collapsed and British savers with their money in them faced a long wait to get their cash back. Then, in March, James warned that “your default position should be that the banks will lose 80% of the value of their equity”. At that stage, Royal Bank of Scotland, while well off its 2007 high, was trading at £2.85 a share; Lloyds’ stock cost £2.23. And even then, the idea that either could be nationalised was still outlandish. Yet if anything, James’s gloomy prediction was an understatement. When it comes to investing, avoiding nasty losses is just as important as making gains. Seeing the credit crunch coming and anticipating its consequences were our two best calls in this regard.

Trump, Corbyn and populism (Sep 2015)

In September 2015 most pundits would have laughed if you had said Donald Trump could become US president or that the newly elected Labour leader Jeremy Corbyn could do well in a general election. We warned readers that in truth, Trump and Corbyn were just the vanguards of a new political reality and that they’d better prepare their portfolios accordingly. Since then, populism on both the left and right has proliferated, and the atmosphere on both sides of the Atlantic has become ever more febrile. We also pointed out that populism meant central banks would almost certainly print vast sums of money come the next recession. Once Covid arrived, that is exactly what happened.

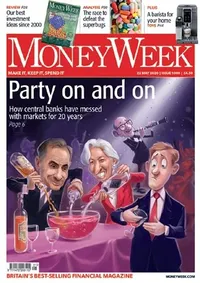

Post-Covid inflation (May 2020)

In the markets section of issue 1,000, we reviewed how central banks had subverted capitalism by constantly interfering in market and economic cycles. Artificially low or zero-interest rates prevented Schumpeterian creative destruction, leading to zombie companies and resulting in continual bubbles in asset markets. We said we thought all the monetary dysfunction would be resolved through a nasty bout of inflation. It was. Milton Friedman used to say that inflation follows money printing with a “long and variable lag”. The artificially created cash on the demand side collided with fractured supply chains and a jump in energy prices following Russia’s invasion of Ukraine on the supply side.

Central banks, of course, didn’t see it coming, and once they noticed the problem, they assumed it would be “transitory”. They then rushed to raise interest rates once they realised their mistake. Inflation has fallen, but remains stickier than expected. Throw in stagnant growth in much of the developed world, and the stagflation-lite scenario we have been warning readers about for the past few years endures.

What MoneyWeek got wrong

We are all instinctively value-orientated (it tends to beat growth in the long term), and this meant we were often too sceptical of technology stocks. We said Google was overvalued at its flotation in 2004, when the share price was $85. Now it would be $2,330 if the stock hadn’t split in 2022. Being structurally bearish in view of the endless money printing, and central-bank interference in the business cycle, sometimes meant being insufficiently cyclically bullish over the years – that liquidity has to go somewhere, after all.

Columnist Max King has been a useful bullish corrective to our scepticism over the past decade or so. He is also sceptical when he needs to be, however: he rightly urged readers to get out of Neil Woodford’s Patient Capital Trust in early 2018.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems