'My predictions for the next 25 years'

What will the world look like when MoneyWeek celebrates its 50th birthday? Matthew Lynn shares his predictions

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

1. The demise of the smartphone

It is hard to imagine life without them. There are 7.4 billion smartphones in the world and the typical user checks them 144 times a day. And yet, 50 years ago we would have said the same of cigarettes. Everyone smoked in cinemas, on trains and, though it seems unimaginable now, on aeroplanes. Once it was clearly shown that smoking was very bad for your health, it went into steady decline. We are just starting to work out just how bad smartphones are for our mental health. There is a growing body of evidence to show they have a negative impact on cognitive ability, memory, attention and sleep, and create addiction and anxiety. That’s just for adults. The impact on teenagers is worse. There are already moves to put age restrictions on usage, and those may get tighter. Over the next decade, people will give up on the smartphone, taking down one of the biggest industries in the world – and with it the app economy.

2. The robo-economy takes off

Despite all the hype, it will become painfully clear during the 2030s that the AI revolution was oversold. The chatbots don’t actually possess any intelligence and, apart from a few very limited tasks, can’t replace human work. Instead, it is robotics that will prove to be the next great wave of technological innovation. Domestic robots will be the biggest growth industry of the 2030s and 2040s, with smart machines performing dozens of small, dull tasks around the home, from mowing the lawn to cooking meals. People will be more than happy to pay for genuinely labour-saving devices, turning robots into a huge industry.

3. The Indonesian miracle

Lots of attention will be devoted to the contest between China and India to become the largest country in the world measured by population, and the only serious rival to the US as the biggest economy. But it is Indonesia that will really be rising up the rankings. By 2050 it will have a population of 321 million and will still be growing strongly (China will be in steep demographic decline by then). Add in a 5% annual growth rate, the annual average rate for the last quarter century, and by the 2040s Indonesia will have established itself as one of the major global economies. The Jakarta stock market will be home to the fastest-growing new companies.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

4. A global stock market emerges

The competition between rival financial centres consumes a huge amount of attention. The decline of London, the rise of the US and the emergence of the Gulf bourses worries finance ministers, and companies have to decide where to list their shares. By 2050 a lot of that will seem irrelevant. Even in 2025 it seems surprising that we still have national stock markets. Technology means that we can trade any bond or equity anywhere in the world at any time of day. Over the next 25 years a single global stock market will emerge, hosted on the cloud, with settlement in a universally recognised crypto currency that is accepted everywhere. National stock markets will turn into a relic of interest only to a handful of financial historians.

5. A British revival

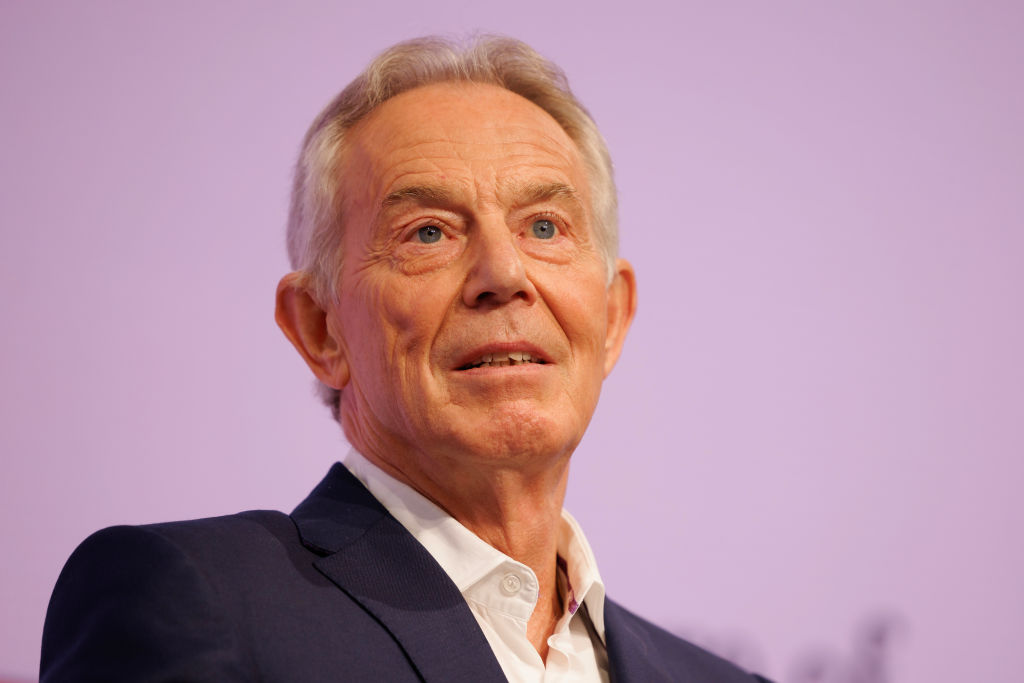

When we look back from 2050, it will seem that today’s problems were surprisingly easy to fix. A bond-market collapse late in the 2020s as the country’s debts spiral out of control will prove traumatic and will be followed by a chaotic series of coalitions as the party system fragments. But by the middle of the 2030s, a technocratic government imposed by the IMF, and led by a surprisingly youthful-looking Tony Blair, will start to get the country back on track. Two big changes will make a huge difference. Allowing fracking will enable the country to become the Saudi Arabia of Europe. That will make a corporation tax at Irish levels affordable and trigger a huge wave of inward investment. And switching to a Dutch-German-style social-insurance system for healthcare to replace the NHS will transform the 12% of GDP spent on the medical system. With those two reforms in place, Britain will start to boom again, just as it did under Mrs Thatcher in the 1980s.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems