Is India still a good investment?

India's long-term story is compelling, but after a spectacular bull run, warning signs are starting to show. Is investing worth the risk?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

“India: too expensive or the world’s best growth story?” asked one of the attendees during the emerging markets session at MoneyWeek’s reader conference earlier this month, concisely summing up the dilemma for investors. India has one of the simplest and most compelling narratives of any long-term bull market: young demographics, vast potential for catch-up growth, unusually large and high-quality stock market by EM standards, and a record of considerable progress in recent years. Yet it’s still hard to feel entirely comfortable about paying 25 times earnings for it.

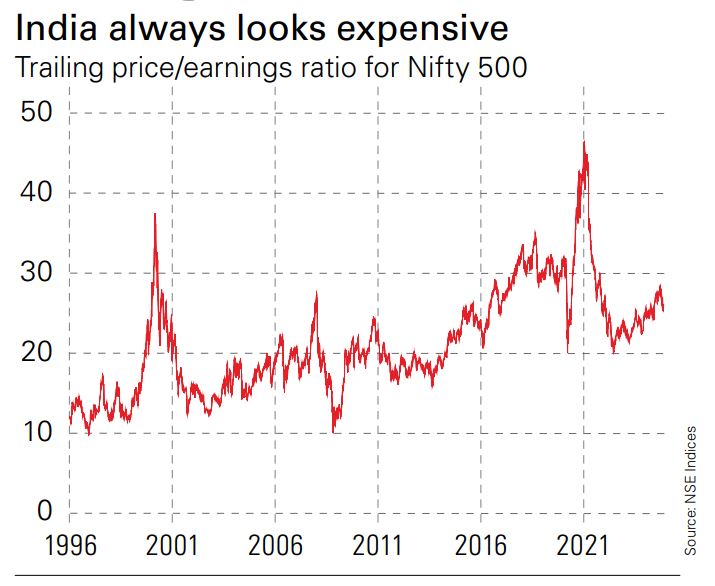

This is not a new dilemma. India has long been an expensive market relative to its peers. The chart shows the price/earnings ratio for the broad market stretching back almost 30 years: ignore the trough and spike in 2020/2021– caused by the pandemic panic and subsequent impact on earnings – and note that the market actually looks cheaper than it did at the end of the last decade, even though it has more than doubled since then. It has rarely dropped below 15 since the start of the 2000s, meaning that it has usually been at the upper end of the EM peer group.

There have been weak patches, accompanied by the kind of events that always worry EM investors: the market struggled in the early 2010s amid high inflation and a series of political and corruption scandals, and again towards the end of the decade amid a sharp economic slowdown and problems in the shadow banking sector. Yet, in both cases, earnings growth eventually came through and the market went on to new highs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Is investing in India too risky?

Still, there are growing reasons to wonder if another tricky spell could be on the way. The government did unexpectedly poorly in the general election in June, which could hurt the prospects for further economic reforms. Company earnings suggest that weak consumption growth is spreading from the rural poor (who have benefited least from the boom of the last few years) to urban residents – exactly the opposite of what we would hope to see. Rising delinquencies at microfinance lenders may be a sign the credit cycle is souring. Now the decision by US prosecutors to lay bribery charges against billionaire Gautam Adani, a close ally of prime minister Narendra Modi, recalls those early 2010s scandals that helped shuffle the previous government out of power.

It’s impossible to say what the consequences of the Adani case will be. There is no prospect of him facing any direct legal risks within India. However, the country depends heavily on a handful of large business groups, of which Adani’s is the newest, to undertake major projects. This requires a lot of foreign capital. The charges may make it harder for Adani to raise funding overseas and potentially affect the speed and cost of financing for other projects as well. Less investment will hinder growth. That may mean weaker earnings, which would surely take some momentum out of the market. It’s too soon to call the top, but after such a strong run, the odds of a setback are clearly rising.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China