Out of America's shadow: Why Trump's tariff chaos may be good for non-US stocks

Upending global investment and trade could benefit other countries at the expense of the US market, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Trump tariff chaos and the broader sense that the world is changing profoundly makes it hard to remain optimistic at times like these. There’s a temptation to retreat to safe assets – such as cash or gold – which may well turn out to be the smart call in the shorter term. Yet there is a bullish way to think about these changes as well. They may end up being part of a long-overdue adjustment – just not quite in the way that the US president and his advisers hope.

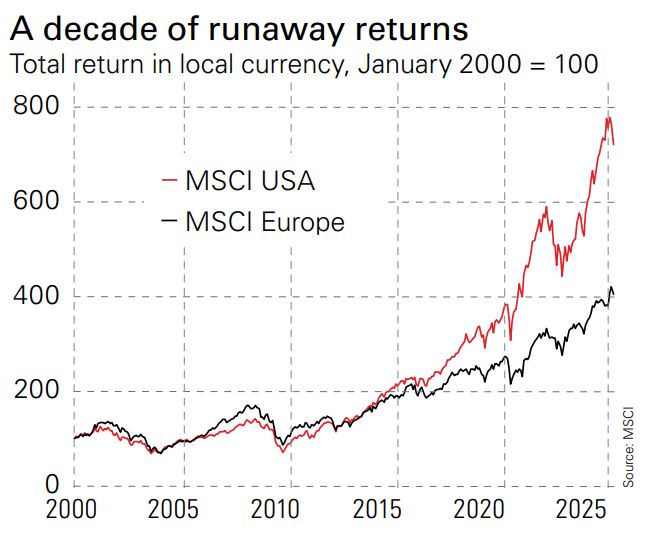

America has dominated global markets to an unhealthy extent over the past decade or more. The degree to which it has beaten almost everything else is striking: the MSCI USA index has returned 12.4% per year (in dollar terms) over ten years, while the MSCI World ex USA has returned 6% per year. There have been some solid reasons from this, ranging from America’s superior energy security after the shale revolution in the early 2010s to the greater dynamism of high-growth sectors (helped by capital markets that were willing to fund and scale up new companies in a way that the rest of the world was not). However, this cannot continue forever.

The US market trades at a large premium to the rest of the wold. The MSCI USA is on a forecast price/earnings ratio of around 20 times, the MSCI World ex USA on around 14 times. It may well still deserve some of that premium – but it cannot continue to expand the difference and keep outperforming. What’s more, to the extent that higher valuations reflected a superior business environment up until now, the premium may need to be smaller in future. Erratic policy making and weakening of the rule of law will surely make America a less attractive and more uncertain place to do business. It would be hyperbole to say that it now looks like an emerging market, but that contains a grain of truth: recent events are what you expect to see in a rather ineptly managed and somewhat autocratic country, rather than the lynchpin of the global order.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Two benefits for the rest of the world

If investors become a little more sceptical about the USA, it may benefit other markets in more than one way. The most obvious and immediate benefit is that a bit more cash going into the UK, Europe, Japan or emerging markets rather than America will – at the margin – help raise valuations there.

The more subtle and long-term benefit is the counterpoint to the Trump administration’s belief that the US trade deficit means that the rest of the world is simply harming America. After all, an alternative way to think about the real damage caused by this imbalance is that America’s capital surplus (the necessary offset to the current account deficit in the balance of payments) sucks in capital from the rest of the world, starving economies, markets and start-ups of investment.

While the US market was doing better, this was a rational decision for investors, but one that arguably created a virtuous cycle for America and a vicious cycle for other economies. If less capital now flows to the US, it may be good for growth elsewhere, which in turn will be good for earnings and create another tailwind for non-US stocks.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser