Summary

- Donald Trump’s "Liberation Day" tariff announcements sparked a stock market selloff, given their implications for global trade;

- A baseline tariff of 10% on all US imports came into effect over the weekend. Higher "reciprocal" tariffs for specific products and countries started on 9 April, before the US president announced a 90-day pause on tariffs for dozens of countries ;

- Stock markets are volatile over fears of shrinking global trade;

- China and US continue to ratchet up tariffs on imports: Trump has increased the tariff to 145% on Chinese goods, after Beijing today upped its tariff on US imports to 125%;

- During the 90-day pause period, a "universal 10%" tariff will be in place for all countries except China;

- Democrat politicians have accused the Trump administration of insider trading.

MoneyWeek is reporting live on the developing global trade situation and its consequences for your money. We will bring you regular updates on the latest news, as well as analysis, reaction, and expert views on how to manage your money through the turbulence.

Scroll down for all the latest updates, and send us your questions related to the global trade war at: editor@moneyweek.com.

| Stock market turmoil | Protect your portfolio | Auto stocks plunge |

Good morning, and welcome to our global trade live blog

The stock market rout continues in the wake of a tariff regime that goes much further than many observers had expected Donald Trump would dare to do. The tariffs announced last week have the potential to completely upend the established patterns of global trade.

Follow our blog for live updates and analysis, as well as expert opinions on how to protect your money from the disruption.

FTSE 100 falls 11% on tariff fallout

The rate of inflation in the United States was 2.4% in March, down from 2.8% in February, according to official data from the US Bureau of Labor Statistics.

The fall is higher than expected – economists and analysts polled by Bloomberg thought that inflation would fall to 2.5%.

As the data was collected before ‘Liberation Day’, the March data does not reflect the potentially inflationary repercussions of Trump’s tariffs in full.

25% tariffs on steel and aluminium were implemented on 12 March.

Early indicators show this is welcome news for the market with stock futures going up, though they are still being traded below yesterday’s close.

Keir Starmer: the end of the world as we know it?

In an op-ed for the Sunday Telegraph over the weekend, prime minister Keir Starmer stated that “the world as we knew it has gone”.

“First it was defence and national security,” he wrote. “Now it is the global economy and trade.”

UK prime minister Keir Starmer last week, addressing a roundtable with UK business leaders at Downing Street. Starmer is expected to make a speech today on the possible responses to Donald Trump’s tariff trade war that has rocked global stock markets.

The new world, he continued, will be one driven by “deals and alliances” rather than “established rules”. This era, he wrote, “demands the best of British virtues – cool heads, pragmatism and a clear understanding of our national interest”.

The prime minister is expected to give a speech in the West Midlands today reiterating these themes, and highlighting the steps that the government is considering in order to protect the British economy.

These could include using industrial policy to protect British businesses.

“This week, the Government will do everything necessary to protect Britain’s national interest,” he wrote. “We have gone further and faster on national security, now we must do the same on economic security through strengthened alliances and reducing barriers to trade.”

It is expected that Starmer will announce a relaxation to the 2030 ban on new petrol vehicle sales, in a bid to support the UK automotive industry.

Send us your questions

We’ll be reporting live on global trade news throughout the week, and we’re particularly keen to bring expert opinion on the things that matter most to you.

If there are particular questions you want answered on the tariff story and how it might affect your money, send them to editor@moneyweek.com with the subject line ‘Tariff question', and we will do our best to answer them as the week goes on.

Could Chinese retaliation spark a global trade war?

Beijing was quick to respond to Trump’s tariff announcement, which included 34% tariffs on all imports from China.

On Friday, China announced that it will increase tariffs on all US imports by that same 34% figure – on top of the 10-15% tariffs on US imports that it imposed on agricultural and energy products earlier this year.

While many economists and countries had hoped that the tariffs would be short-lived; that they would be removed piecemeal as countries negotiated trade deals with the US, in exchange for whatever concessions the deal-oriented president demanded.

However, the world’s two largest economies now appear to have nowhere to go. China’s retaliation leaves little in the way of an off-ramp, and increases the antagonism between the two countries.

“That retaliation from China sparked a fresh wave of selling pressure at the end of last week, with futures on the S&P 500 moving sharply lower at that point, before the index fell to its worst-daily performance (-5.97%) since March 2020, at the height of the initial pandemic wave,” wrote Henry Allen, macro strategist at Deutsche Bank.

Global stock markets have fallen since, based on the fear that, rather than receding, the trade war will now escalate further.

What is a tariff?

If you’re reading this blog, you’re almost certainly aware that tariffs are having a major impact on the global economy and your investments in the stock market.

However, you might not be completely clear on what a tariff is. Thankfully, MoneyWeek’s Katie Williams has this excellent explainer: What are tariffs and what do they mean for your money?

S&P 500 opens 2.4% down

Another bruising day in store for the stock market?

The US flagship index has opened 2.4% lower than its close last week. It is the first time in nearly a year that the index has been below 5,000.

"We've got your back": Keir Starmer and Rachel Reeves address auto industry

Prime minister Keir Starmer and chancellor Rachel Reeves have delivered speeches at Jaguar Land Rover (JLR) in Solihull this afternoon.

Earlier today, the government announced that the Zero Emission Vehicle Mandate (ZEV) will be adjusted to make it easier for carmakers to upgrade to make electric vehicles (EVs). Hybrid cars will be able to be sold until 2035, and efforts to increase EV demand like increased charge point construction and further tax breaks for EVs were announced.

“We want to provide clarity and certainty for manufacturers like JLR,” said Reeves.

Car exports to the US will be hit by 25% tariffs thanks to Trump’s ‘Liberation Day’ directives.

The government is aiming to support auto manufacturers like Jaguar Land Rover, in the face of steep new tariffs that have been introduced by Donald Trump on exports to the US.

“These are challenging times, but we have chosen to come here because we are going to back you to the hilt,” Starmer told JLR workers gathered at the plant.

“There’s no doubt a challenge. But this is a moment for cool heads. Nobody wins from a trade war,” he said. “We’ve got to rise together as a nation. The great challenge of our age is that we’ve got to renew Britain.”

How does the stock market crash impact your pension?

As the stock market has tumbled in the wake of Trump’s swingeing trade tariffs, the general advice from the experts is to keep calm and to focus on investing as a long-term pursuit. Stock market drawdowns happen, but long term investors ought to be able to ride these out.

However, what about the impact of the falls on pensions – particularly for pensioners, or those approaching retirement?

“Pension savers may have already seen an alarming fall in the value of their retirement fund,” says Ed Monk, associate director, Fidelity International.

“There are lots of reasons, however, why they may not need to worry - and why panicking now is likely to be the worst response,” he adds.

Anyone who is 10 years or more from retirement “can probably afford to relax more in response to these developments”. Losses that pension funds suffer now will have plenty of time to recover their value.

In fact, the depressed prices at which global stocks are currently trading is an opportunity for anyone still contributing to their pension. They are snapping up more assets at lower costs, which “can boost your returns in the long run”.

Those closer to retirement might justly be worried that their pensions won’t have time to recover. Normally, though, pensions that are closer to being needed will have a higher allocation towards safer assets – especially bonds and cash.

“After a long period in which bonds have disappointed, they have performed the role of unlikely saviour in the recent market sell-off,” says Monk. “Fears of an economic slowdown has seen a flight to the safety of bonds pushing up prices.

“Many workplace pension schemes will automatically increase your allocation to bonds in the run up to retirement to protect against precisely the sudden losses for shares that we have seen this year.”

Those already in retirement may need to temporarily decrease their drawdown in order to preserve their pension pots.

“Withdrawing a fixed amount in this current environment will erode savings quicker if your investments are down,” says Monk. “If you can live off the natural yield this may be more suitable because it won’t deplete the investment itself and when the market does turn around the capital will still be there.”

Social media rumour sends stock market swinging

The S&P 500 briefly hit positive territory earlier today, following a social media report that claimed that White House national economic council director Kevin Hassett had said that Trump was considering a 90-day pause on tariffs, besides China. An X account that shares financial news appears to have misinterpreted a quote from Hassett.

Rumours of the pause sparked optimism, but White House press secretary Karoline Leavitt has branded it “fake news”. Markets have since resumed their slump; the S&P 500 is down 2.1% today.

Trump threatens additional tariffs on China

The tit-for-tat trade war between the world’s two largest economies is ramping up.

Following China raising tariffs on US imports by 34% in response to ‘Liberation Day’, Trump has today threatened to impose additional 50% tariffs on Chinese imports if Beijing does not withdraw its tariffs.

This is what markets have been fearing; an endless ratcheting-up of the tariff regime, with neither side willing to back down.

EU trade negotiations with US

While the UK has been hit with a 10% tariff on all exports to the US, the EU has a higher rate, at 20%.

EU trade commissioner Maroš Šefčovič has told reporters today that the bloc is negotiating with US counterparts over a trade deal, but that the tariffs the US has imposed "forces us to look at additional steps".

European Commission president Ursula von der Leyen had stated earlier today that the bloc has offered a "zero-for-zero" deal with the US on industrial goods. Šefčovič, however, played down the chances of this happening in the near term.

"I hope that in future we would be ready to come back to this discussion, not now... I believe that in the future this would be still the possibility," he said.

Trump tariffs criticised by allies

Good morning, and welcome back to our live blog covering the latest in global trade, tariffs and their impact on the stock market.

US stocks held firm yesterday after wild swings during the session; the S&P 500 closed just 0.23% down, while the Nasdaq Composite finished a volatile day with 0.10% gains.

While Trump vehemently denied an earlier rumour that he was considering a 90-day pause on the imposition of tariffs, investors are apparently hopeful for some sort of reduction in their scope.

They have drawn criticism from a wide variety of business leaders, including erstwhile Trump allies.

Bill Ackman, CEO of the hedge fund group Pershing Square Capital Management – a former Democrat supporter who switched his allegiance to Trump ahead of the most recent election campaign – has warned the tariffs will cause an “economic nuclear winter” and called for “a 90-day time out” for further negotiations.

With Tesla shares having fallen 10% in the last five days, Elon Musk has joined in criticism of the tariffs. Musk posted a video on his X account yesterday that extolled the virtue of globalisation by explaining the widespread inputs that go into producing a lead pencil.

pic.twitter.com/azqwPMa0omApril 7, 2025

This comes on top of more politically distant figures like Richard Branson, who posted on LinkedIn yesterday warning that the tariffs’ sudden imposition is having “catastrophic results for ordinary Americans and for the rest of the world”.

FTSE 100 makes positive start

The FTSE 100 opened 0.9% higher this morning, and has posted further gains since, following the lead of US indices which ended a turbulent day broadly flat.

“However, this should hardly be seen as the end of the trouble, especially with President Trump showing no signs of easing his stance on perceived trade imbalances,” says Matt Britzman, senior equity analyst at Hargreaves Lansdown.

“Futures indicate a positive open this morning, but volatility remains the only certainty at this point,” Britzman goes on to say.

Could tariffs lead to faster interest rate cuts?

One reason for the more optimistic feel to stock markets today appears to be the possible implications of the tariffs for monetary policy.

“As far as crystal ball gazing goes, we would expect the BoE to now be more aggressive in its rate cutting path given the increased headwinds to economic growth,” says Phil Jenkins, CEO of corporate finance firm Centrus.

Lower interest rates are typically beneficial for equities, particularly in growth sectors like technology, because they increase the appeal of stocks relative to less risky alternatives like cash or bonds. It also encourages higher levels of borrowing (and therefore spending) by consumers – leading to higher corporate profits – as well as businesses, meaning they can invest in growth more cheaply.

However, on the flip side, if tariffs increase inflation this will be a strong argument against central bank rate cuts. The Federal Reserve and Bank of England will both have to balance these competing concerns when they meet in early May.

Is Trump rolling back a century of globalisation?

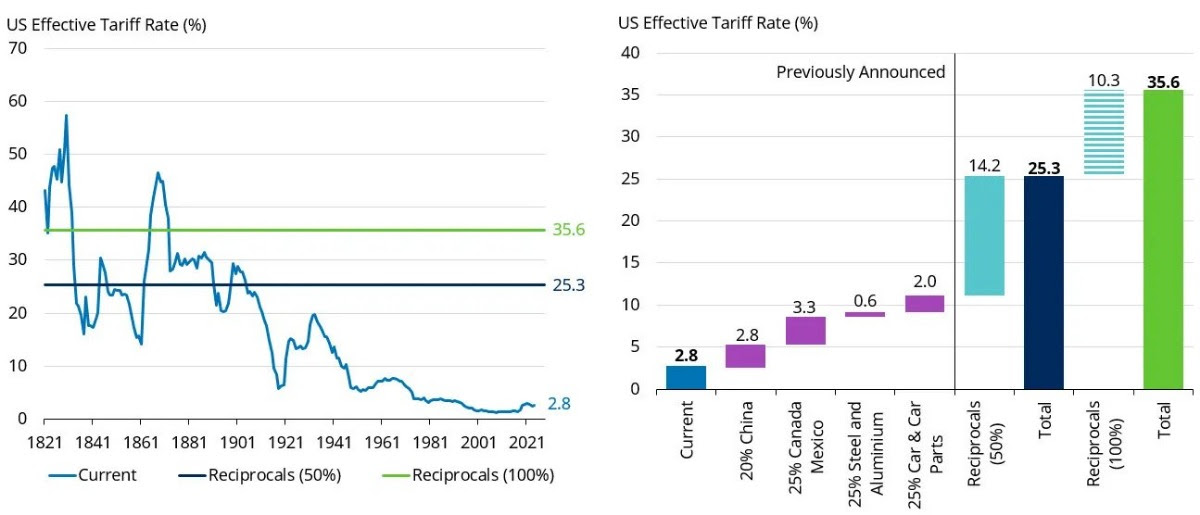

During the post-war era, US effective tariff rates have been consistently below 10%. That period has seen the rapid rise of globalisation – a trend that Trump is explicitly seeking to reverse.

Alex Tedder, chief equities investment officer at Schroders, says “the White House has indicated that the reciprocal tariffs could be negotiated down, most tariffs are likely to be kept in place which represents a major disruption and readjustment to the existing trade regime”.

Schroders’ economic analysis puts the US effective tariff rate as a result of the ‘Liberation Day’ tariffs at 25.3%. Full implementation of reciprocal tariffs would add another 10.3% points onto this.

US effective tariff rates rose to 20% during the Great Depression, but haven’t been higher than this for 120 years.

“The current US administration is seemingly willing to tolerate significant short-term economic pain in its ambition to reshape perceived global trade imbalances,” says Tedder.

“Given that the US relies on foreign nations to fund its twin budget deficits, this unconventional economic policy is likely to test investor confidence in US stability,” he adds.

JLR, Nintendo pause US shipments in response to tariffs

The trade disruption from the new tariff regime has already begun.

Jaguar Land Rover (JLR), whose Solihull factory hosted prime minister Keir Starmer and chancellor Rachel Reeves yesterday, has paused shipments to the US during April in response to the new tariffs – both on UK imports (10%) and car imports (25%).

Nintendo, meanwhile, has delayed pre-orders of its Switch 2 console in the US, as it assesses the impact of the tariffs. UK deliveries are, reportedly, unaffected.

Japan, where Nintendo is headquartered, was hit by a 24% tariff last week, but the Nikkei gained 6% today on reports that US treasury secretary Scott Bessent will head trade talks with the Japanese government.

Reeves to speak to US treasury secretary “shortly”

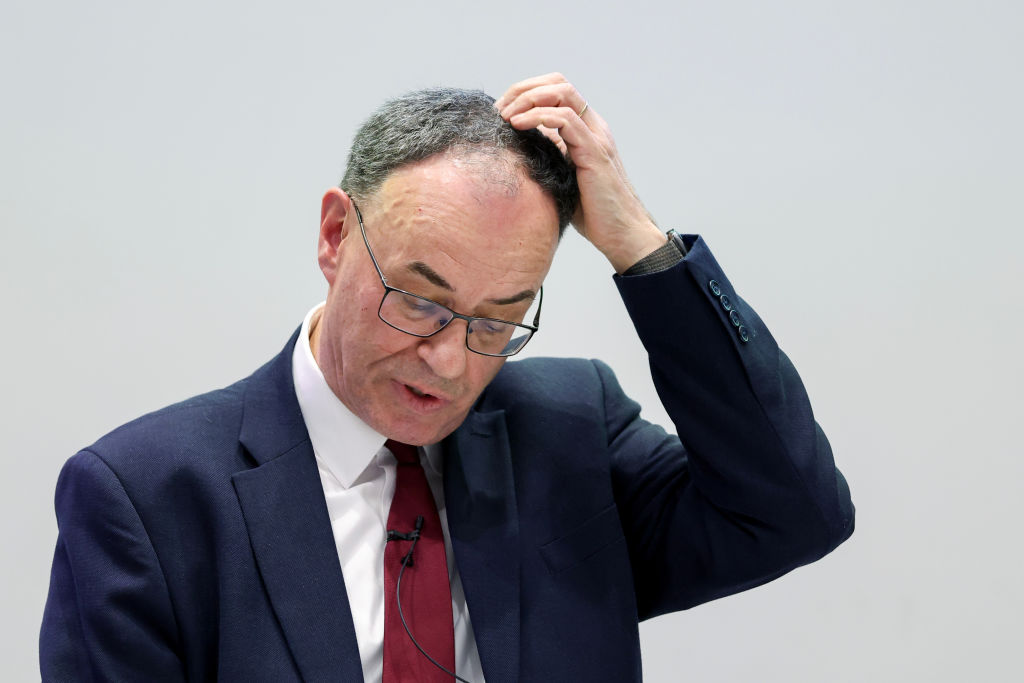

Chancellor Rachel Reeves has addressed the House of Commons on the tariff fallout, telling MPs that she has spoken to Bank of England governor Andrew Bailey this morning, who assured her “that markets are functioning effectively and that our banking system is resilient”.

She mentioned trade talks she had held recently with “Canada, Australia, Ireland, France, Spain, and with the European Commission”, and mentioned that tomorrow she will hold negotiations with India over securing a new trade deal with the country.

When pressed on discussions with the US by shadow chancellor Mel Stride, Reeves said “I will be meeting US treasury secretary Scott Bessent shortly”.

Reeves also issued assurances to businesses, referencing the support she and prime minister Keir Starmer offered to the auto industry yesterday, telling them and consumers concerned about the cost of living that “we have your backs”.

Keir Starmer and Rachel Reeves at JLR in Solihull yesterday, as they announced measures designed to support the automotive industry in the face of Trump’s tariffs.

More on tariffs and pensions

Yesterday we posted comments from Ed Monk, associate director at Fidelity International, on the impact of the tariff turmoil on pensions.

Today, we’ve heard from Mark Futcher, partner at professional services consultancy Barnett Waddingham, with his views on how the tariff volatility impacts those who were close to taking their pension.

For anyone planning to take it soon, “the impact will depend on how you plan to take your money”, he says.

“If you’re planning to take it gradually through drawdown, remember that your investments will still be working for you long-term through your retirement. And if you're aiming to buy an annuity and are in an annuity-focused fund, you’re likely already protected from much of the recent market dip because you won’t be heavily exposed to equities.”

Above all, Futcher stresses that it is important not to panic amid the uncertainty.

“The most important thing is not to make any sudden decisions. Make sure you understand what your pension is aiming for and speak to a professional adviser if you're unsure.

“It’s not easy when the headlines are crying crisis - but when it comes to your pension, you really must keep calm and carry on.”

US markets open strongly

The S&P is up 3.3% and the Nasdaq Composite up 3.8% shortly after the open of US markets.

Global investors are becoming more positive on where tariff negotiations are heading. More on that to follow.

One of the most in-demand people in the world right now is Scott Bessent. Earlier today he told CNBC that “up to 70 countries” had contacted the White House seeking negotiations on trade tariffs.

“Two clusters of countries are emerging in terms of their response to tariffs,” says Paul Diggle, chief economist at Aberdeen. Those queuing up to negotiate with the White House, which include the UK, Japan, and possibly the EU, are one group.

“The other [is] planning to retaliate,” says Diggle. “China appears committed to retaliation. Trump in turn threatened to impose an additional 50% tariff on China, which, if enacted, would push the average tariff facing Chinese exporters well above 100%.”

Politico has reported that Bessent lobbied Trump over the weekend to start emphasising negotiations as part of his tariff endgame.

US treasury secretary Scott Bessent – shown here arriving at the US Capitol last week ahead of the tariff announcement – has raised investors’ hopes that negotiated exemptions to the tariff regime could be incoming.

“President Trump has maximum negotiating leverage right here right now,” Bessent told CNBC. “It would be a mistake for anyone to think otherwise.” He added that countries that hadn’t retaliated would be given priority positions in the “queue” for trade talks.

A much more positive day for stock markets today. The FTSE 100 is up over 3.5% as we approach the close of markets in the UK.

The S&P 500 is up over 3.6%, and the Nasdaq over 4%.

The turbulence is far from over, but comments from the Trump team today have made markets believe that there is at least some hope for an off-ramp from the dramatic tariffs announced last week.

Could tariffs exacerbate stagflation?

Part of the reason that markets have been so glum over recent days is that tariffs have a dreaded quality: they can both increase inflation and slow down economic growth.

“Tariffs and trade wars (or wars of any sort) are not good for the global interconnected economies and world we live in,” Raymond Backreedy, chief investment officer at Sparrows Capital, tells MoneyWeek.

“Past evidence and data (1920s) has shown that isolationist policies tend to dampen global growth and push up inflation, neither of which is good for the economy,” he adds.

Read more: What is stagflation and what can be done about it?

Elon Musk hits out at Trump’s trade adviser Peter Navarro

Elon Musk has called Trump’s tariff tsar Peter Navarro “dumber than a sack of bricks” in a post on his social media site X (formerly Twitter).

The war of words came after Navarro described Musk as a "car assembler" rather than a "car manufacturer” because he claimed many components used in Tesla vehicles are imported.

In an interview with CNBC, Navarro called for Musk to bring the manufacture of all components needed to make Teslas to the United States.

“We just have to understand. Elon sells cars, and he’s in Texas assembling cars that have big parts of that car from Mexico, China, the batteries come from Japan or China, the electronics come from Taiwan,” he said.

Musk hit back against Navarro, calling him “a moron” and arguing the claims he made were “demonstrably false.”

He claimed Tesla has the most American-made cars of any manufacturer and said: “By any definition whatsoever, Tesla is the most vertically integrated auto manufacturer in America with the highest percentage of US content.”

The spat is the latest example of dissent by Musk over Trump’s universal tariff regime.

On Saturday (5 April), Musk, who is the richest person in the world, called for a “zero tariff situation” between Europe and the US, rather than the 20% tariffs imposed on ‘Liberation Day’.

Yesterday (7 April), Musk reposted a video of economist Milton Friedman explaining the supply chains required to make a pencil, which could be interpreted as support for free trade.

- Daniel Hilton, Junior Writer

FTSE 100 rebounds on dealmaking hopes

The FTSE 100 closed at 7,910.53 today, up 2.71%.

‘’With hints of negotiations in the air, relief has flooded through financial markets, with the FTSE 100 rebounding from a chunk of yesterday’s losses,” Susannah Streeter, head of money and markets at Hargreaves Lansdown, said.

“Investors have taken the chance to buy into beaten up stocks, with an eye on a longer-term recovery.

“They’ve also been buoyed by measured stances from leaders across the European Union, the UK, Japan and South Korea, who have shown a willingness to talk first and hold off from retaliatory action for now.”

However, sentiment remained “skittish” towards the end of the day, she warned.

Trading activity spiked among retail investors after tariff announcement, says AJ Bell

Trading activity among retail investors in the UK has sharply increased in the wake of Trump’s new tariff regime.

Data from AJ Bell shows that on the Friday and Monday (4 and 7 April) after ‘Liberation Day’, activity on their investment platform doubled as investors moved to protect and reposition their portfolios.

The number of AJ Bell customers buying also outnumbered sellers by two to one on these days, indicating that they were attempting to make the most out of the global sell-off.

The moves came as stock markets across the world continued to fall on 4 April and volatility remained on 7 April despite a 2% climb during the day.

Charlie Musson at AJ Bell said: “Current market volatility has caught the attention of DIY investors, with significantly higher than usual trading activity in recent days as customers use the flexibility of our platform to protect and reposition their portfolios."

Some of the increase will be customers selling down positions and holding cash as investors wait to see how far the global sell-off goes, he pointed out.

Commenting on the volume of buy trades in the wake of the sell-off, Musson said it is a sign investors “are seeing this as a buying opportunity” and repositioning their portfolios towards ‘safer’ investments “in the expectation of a recovery in the months and years ahead".

– Daniel Hilton, Junior Writer

Will Trump’s tariffs send inflation to a new high?

We have already seen how Trump’s trade war has had consequences on global stock markets, but what is not yet clear is how the president’s actions will affect key economic indicators like inflation.

As tariffs increase the cost of foreign-made goods, it is inevitable that prices for imports will increase in America.

However, tariffs also impact global supply chains which mean that even domestically produced goods (such as fruit grown in the US) will likely increase in price too.

According to economists at Goldman Sachs, each time the average tariff rate increases by one percentage point, the rate of core US inflation goes up by around 0.1 percentage points.

Analysis from consultancy Capital Economics suggests Trump’s tariffs will push the effective tariff rate up by around 25 percentage points. As imports account for roughly 10% of consumption in the US, this could add roughly 2.5 percentage points to the CPI price level, the consultancy said.

Capital Economics expects US CPI to be “well north of 4%” by the end of this year, up from 2.8% in February. This would be a significant rise, but still lower than the post-pandemic peak of 9.1% in June 2022.

The inflationary impact of tariffs will not just affect the US – they could also send inflation higher in the UK.

Read our analysis on whether Trump’s tariffs will send inflation to a new high.

How have European markets performed?

Many European markets have started to recoup some of the losses they faced after the tariff regime was announced last Wednesday (2 April).

Britain’s stock markets are in the green with the FTSE 100 closing 2.71% higher today, while the FTSE 250 had an even stronger day, closing up 3.29%.

In Europe, Germany’s DAX index is up 2.48%, France’s CAC 40 is up 2.50%, and the EURO STOXX 50 (which measures the performance of 50 Eurozone stocks) ended 2.52% up.

While the trading day is over in Europe, markets remain open in America.

“It feels like a lifetime since stock markets were moving higher, but finally we’ve had the magic bounce-back day,” says Dan Coatsworth, investment analyst at AJ Bell.

“The majority of the stocks in the FTSE 100 were in positive territory as investors regained confidence and celebrated the end of the market bloodbath.

"The big unknown is for how long the rebound party lasts," Coatsworth warned, explaining it's not uncommon to see another "leg down after a moment of calm".

Whether it happens or not, he suggested investors continue to focus on their long-term goals rather than recent events.

White House press conference to begin shortly

Press secretary Karoline Leavitt is about to brief journalists in the White House's Brady Briefing Room. Tariffs will no doubt be discussed.

Stay with us as we cover the news as it happens.

Press secretary Karoline Leavitt says nearly 70 countries have reached out to president Trump to begin a negotiation since the "Liberation Day" announcement.

She adds: "The president's message has been simple and consistent from the beginning. To countries around the world, bring us your best offers, and he will listen.

"Deals will only be made if they benefit American workers and address our nation's crippling trade deficits."

"Trump is willing to talk"

Asked about the negotiations, Leavitt says: "I have maintained this position. The entire administration has always said that president Trump is willing to pick up the phone and talk, and the president met with his trade team this morning.

"He directed them to have tailor-made trade deals with each and every country that calls up this administration to strike a deal, and listen. Each and every one of these trade deals should be tailored and unique based on that country's markets, based on that country's exports, the imports here in the United States of America. What makes the most sense for the American worker and for our industry."

S&P 500 loses gains

The S&P 500 is currently at 5,050.30 down 0.23%. The index opened at 5,193.57 today, up from 5,062.25 at yesterday's close.

BREAKING: Additional tariffs of 104% on China will begin tomorrow

Additional tariffs of 104% against China start at 00:01 local time (05:01 BST) tomorrow, Leavitt has confirmed.

The briefing has now come to an end.

We will be back tomorrow morning as we cover the latest on the global reaction to Trump's tariffs.

As a reminder, the US is set to bring in a 104% tariff on some goods imported from China at 00.01 local time (05.01 BST) tomorrow.

If you have a question you'd like to ask on the ongoing tariff story, email MoneyWeek at editor@moneyweek.com with the subject line ‘Tariff question'.

Morning recap – stocks down as tariffs come into effect

Good morning, and welcome back to this ever-changing global trade story.

Trump’s sweeping additional tariffs came into effect overnight – including 104% tariffs on imports from China, after the country retaliated to the tariffs Trump unveiled last week.

The US stock market – which had made an optimistic start yesterday on hopes that most tariffs could be negotiated away in time – fell as it became clear that trade relations between the world’s two largest economies was only set to deteriorate. The S&P 500 closed 1.6% lower.

Follow today for more news, updates and expert views on how to protect your money from the escalating trade war.

FTSE 100 opens 2.3% lower

The FTSE 100 has opened 2.3% below yesterday’s close, following the onset of Donald Trump’s tariffs. That erases almost all of the gains the index made yesterday.

European and Asian stocks are falling too. The DAX is down 2.3% so far today, while the Nikkei 225 fell 3.9%.

Reeves meeting Indian officials for trade talks

As the global economy teeters on the edge of a trade war, chancellor Rachel Reeves and business secretary Jonathan Reynolds are today meeting Indian counterparts with the aim of strengthening ties between the two countries.

“In a changing world, this government is accelerating trade deals with the rest of the world to back British business and provide the security working people deserve.

“We are going further, faster to create the best possible conditions for British business by working to reduce barriers to trade.

“That’s why the business secretary and I are today meeting with India’s Finance Minister, Nirmala Sitharaman, as part of our two nations’ Economic and Financial Dialogue as we seek to secure a new trade deal.”

Reeves added that the meeting will focus on “growth and global issues, as well as how we can unleash potential across various sectors and defence to create jobs, investment and trade opportunities”.

Why are tariffs bad for the UK economy?

The UK has been placed on, relatively speaking, the lowest band of tariffs possible. However, the FTSE 100’s selloff has been every bit as marked as those of other countries’ stock markets. Why is this the case?

Put simply, the UK’s economy is one of the most interconnected in the world, so any disruptions to global trade weigh heavily on the country’s largest companies.

As the Bank of England notes in its Financial Policy Committee (FPC) meeting notes, published today, “as the UK is an open economy with a large financial sector, global risks are particularly relevant to UK financial stability”.

As of the end of 2024, Financials was the largest sector in the FTSE 100, accounting for 23.1% of its total weighting. Some of its other largest component sectors – like Industrials (14.5% of FTSE 100 weighting), Energy (10.8%) and Materials (7.4%) – are highly cyclical and exposed to the global economy.

This means that the UK economy is highly exposed to any global downturn – precisely what the trade war brewing between the US and China threatens to provoke.

The FPC continued: “Since the FPC’s previous meeting on 15 November, global trade policy uncertainty had intensified and some risks had crystalised.

“The United States had made a wide range of tariff announcements on 2 April and some governments had responded with their own tariff announcements. This had contributed to a material increase in the risks to global growth and a weakening of the central outlook, as well as increased uncertainty over the outlook for inflation globally.”

BREAKING: China raises tariffs to 84%

China’s finance ministry has announced an additional 84% tariff on all US imports, to take effect from midnight in China on 10 April.

Trump’s Truss moment?

Yields on US government bonds – “Treasuries” – are climbing fast today.

In the immediate aftermath of the Liberation Day announcement, Treasury yields fell. That’s a fairly predictable move; as stock markets fall, government bonds, which are generally viewed as a much safer investment, typically fall. (Bond yields are inversely related to prices, so as demand for bonds increases, pushing the price up, yields fall).

However, with the trade war between China and the US escalating, yields on 10-year Treasuries have risen from 3.9% on Monday to over 4.46% today. There are clearly more complex dynamics coming into play.

US 10-year Treasury yields

“There is some speculation that ‘technical trading’ from large investors like hedge funds is having an impact. This could be in the form of having to sell assets to cover losses and Treasuries are typically the most liquid asset large investors hold, outside of physical cash," says Hal Cook, senior investment analyst at Hargreaves Lansdown.

Uncertainty over future US government tax and spending plans could also be playing a part.

China is one of the world's largest buyers of US government debt, holding around $760 billion worth. It’s possible that there is a mass selloff of its US government debt happening in the country as the trade war intensifies.

“US Treasuries are selling off at a pace we’ve rarely seen, levels that have historically triggered some form of intervention by the Federal Reserve (Fed),” says Lale Akoner, global market analyst at eToro.

Fed chair Jerome Powell said on Friday that it isn’t yet time for a “Fed put”, but in Akoner’s view, it might soon be time for the central bank to step in and guarantee market security.

All in all, it calls to mind the gilt yield crisis that followed Liz Truss’ mini-budget in 2022.

UK gilt yields following Treasuries upwards

The bad news as far as the UK is concerned is that UK government bonds (gilts) are often highly correlated with US Treasuries.

Yields on 10-year gilts reached 4.86% earlier this afternoon – as high as they’ve been since the gilt crisis back in January – though they have since fallen back to around 4.80%.

“This feels… like a move which is about relative value,” says Hal Cook, senior investment analyst, Hargreaves Lansdown. “If the Treasury yield falls, gilts become more attractive on a relative basis, so investors might sell Treasuries and buy gilts. The opposite is also true.”

Rising gilt yields imply higher interest rates, meaning more expensive debt and mortgages, though they also imply better interest on cash savings.

They also increase the cost of government borrowing – which will be of great concern to chancellor Rachel Reeves, who had a hard time balancing the government books at her Spring Statement, when gilt yields were much lower than the levels they’re reaching today.

Breaking: EU votes to impose tariffs on US imports

The European Commission has issued a statement confirming that member states have voted in favour of applying tariffs on US imports, in response to those imposed on the bloc by the US.

The Washington Post reports that levies of up to 25% will target US products including soybeans, meat, iron, steel, textiles, tobacco and ice cream, though the product list is yet to be confirmed by the EU Commission.

The tariffs will start to take effect from 15 April, but the bloc is hoping to reach a trade deal with the US in the meantime.

"The EU considers US tariffs unjustified and damaging, causing economic harm to both sides, as well as the global economy. The EU has stated its clear preference to find negotiated outcomes with the US, which would be balanced and mutually beneficial."

What do the Trump tariffs mean for UK interest rates?

Economists are starting to wonder whether Trump’s escalating trade war could prompt the Bank of England’s Monetary Policy Committee (MPC) to accelerate its interest rate cutting cycle.

“If global headwinds intensify, financial conditions tighten, and the real economy shows clearer signs of slowing, then the MPC will likely opt to move faster rather than slower,” said Sanjay Raja, chief UK economist at the investment bank.

However, cutting interest rates faster runs the risk of exacerbating inflation, which is already above the Bank’s 2% target rate and could be fanned further by the breakdown in global trade.

Deutsche Bank still assumes that the Bank will cut rates by 25 basis points at a time, four times this year. However, the odds of a faster cutting cycle are increasing, “albeit from a low base”.

Read more here: Will the Bank of England cut interest rates by 50 bps in response to Trump’s tariffs?

Governor of the Bank of England Andrew Bailey.

Wall Street analyst: Trump tariffs are “worst US policy mistake since 1930”

US stocks are, somewhat inexplicably, rallying today, with the S&P 500 up 0.5% and the Nasdaq Composite – predominantly comprised of big tech stocks – is up around 1.8%.

However, some Wall Street analysts are far from optimistic about the technology sector.

Daniel Ives, global head of technology research at Wedbush Securities, has called the ‘Liberation Day’ tariffs “Trump tariff armageddon” in a research note seen by MoneyWeek.

Ives said that the instigation of higher tariffs last night “will go down as the worst US policy mistake since Smoot-Hawley in 1930 in our view”.

For those too young to remember, the Smoot-Hawley Tariff Act raised tariffs on more than 20,000 imported goods in the hope of protecting US producers from foreign competitors during the Great Depression. The retaliatory actions of US trading partners ended up deepening the Depression, pushing down US exports and global trade.

The Washington Post yesterday compared the two tariff regimes, and according to Ives, Liberation Day is already having a negative impact on the US economy.

“These tariffs have already created significant enterprise demand destruction out of the gates as Cap-Ex and new projects are being halted across the US until this chaotic situation is better understood by CEOs and business leaders around the world,” Ives writes.

The technology sector, he adds, is particularly heavily impacted because “the hearts and lungs of the supply chain are cemented in Asia.” He highlights the fact that tariffs could double the cost of computer chips imported from China, and no domestic alternative is available.

“A US tech company CEO cannot decide last night ‘let’s call Smith Semi Fab Operations in the Midwest to get those semi chips’ as there is one slight problem.... IT DOES NOT EXIST,” says Ives, adding that building semiconductor fabs in the US will take years.

Reeves announces £400 million trade and investment deals with India

Following meetings today with Indian Finance Minister Nirmala Sitharaman, chancellor Rachel Reeves has announced a package of trade and investments worth £400 million with the country.

The package consists of £128 million of newly announced export deals and investments, as well as recent deals worth £271 million. These include planned investments in the UK from Paytm, India’s largest digital payment app, as well as major investments into their Indian operations and presence from Barclays and HSBC.

“We have listened to British businesses, which is why we’re negotiating trade deals with countries across the world, including India, so we can support them and put more money in people’s pockets as part of our Plan for Change,” said Reeves.

“Our relationship with India is longstanding and broad and I am delighted with the progress made throughout this dialogue to develop it further.”

Discussions between the two countries over a trade deal are ongoing.

“Both the UK and India are committed to delivering economic growth and giving businesses the confidence and stability they need to expand,” said Jonathan Reynolds, secretary of state for Business and Trade.

“That is why we are continuing to negotiate towards an ambitious trade deal that unlocks opportunities both at home and abroad for British businesses.”

Send us your pension questions

We’re aware that many of you will be concerned about how today’s government bond selloff, following the stock market fall, will be impacting your pension.

Email any questions to editor@moneyweek.com, and we will do our best to answer them.

Oil prices at lowest level since Covid

The price of oil has crashed in recent days as markets price in the prospect of a global economic slowdown.

WTI crude is around 4.8% down today at $56.7 per barrel. Brent crude is hovering at around $60.

These are the lowest oil prices since February 2021, as the world was emerging from the Covid pandemic.

Falling oil prices could alleviate some of the inflationary pressures of tariffs – though they imply significantly reduced economic output.

“Sharp oil price declines will show up in lower prices at the pumps. UK wholesale gas prices have also come down markedly, to levels not seen for six months,” says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Preparing your finances for Tariffs

While Trump was heard saying “These countries are calling us up, kissing my a**. They are dying to make a deal,” at Congressional Dinner in Washington, it does not look like countries are backing down, with China imposing an 84% levy on US imports. European Union members also voted in favour of imposing tariffs from 15 April.

But as markets continue to wobble, I am sensing real fear from consumers and how this may impact their money. When my phone goes ‘ping’ with people asking me ‘What shall I do about my money? Is my bank going to go bust? and so on - I know people are worried we may be hitting hard times again

And yes, we possibly may be hitting a high inflation period, lower rates and a possible recession - but putting measures in place could mean there is no real need to panic.

There are a few things to think about:

• Pensions: If you’re saving into a defined benefit pension, you’re not going to be impacted as your pension is ‘guaranteed’ and based on your final salary and years of service.

If you have a defined contribution pension - then you do not need to worry if you are years away from retiring, as the market will pick up again. Ignore the noise.

And if you are close to retirement, you may be somewhat concerned. If you can hold off accessing your pension money, you should. But in any case - if you are looking to access your pot soon, it is important you seek professional advice to discuss all your options.

• Savers: there is a chance the Bank of England may go in for a larger than anticipated base rate cut. If you’re lucky enough to have cash savings, bag those rates now as they will disappear. See our round-up of the best savings and cash ISA accounts.

But, there’s a silver lining for mortgages as lenders start to drop rates and if your fixed deal is coming to an end, start shopping for a new deal now.

• Inflation: Inflation may rise and there is an expectation the cost of goods will go up.

You may for example, find clothing and shoes get pricier, especially if they are made in Asia. Nike, for example, may find its supply chain is impacted, and your favourite trainers may well go up in price.

-Unemployment: Another threat is to jobs, especially in industries that export to the US. There is also a looming threat of a recession.

Do you have a question about tariffs and how it could impact your money? Get in touch at editor@moneyweek.com as we answer reader questions.

Property quietly outperforms during market chaos

Property equities and UK real estate investment trusts (Reits) have held up well during the market mayhem.

Matt Norris, head of real estate securities at Gravis, comments: “There’s an old saying, ‘in uncertain times, buy land, gold, and ammo’. Well, March and the start of April have delivered a modern twist on that survivalist mantra.”

The VT Gravis UK Listed Property Fund, which invests in property like care homes, student accommodation and warehouses, is up 1.31% since the start of March, while the MSCI UK IMI Core Real Estate sector is down 5.36%.

This compares to big falls in the FTSE 100 (down 9.67%) and S&P 500 (down a massive 17.40%).

Norris notes that gold has also performed well, but that UK property has been a “standout, reminding us of its diversification benefits”.

He adds: “In five weeks that shook the markets, owning the right kind of land — and the right kind of gold — still paid off. Ammo? Let’s hope we never need that.”

BREAKING: Trump pauses some tariffs but hikes China rate

Donald Trump has announced a 90-day pause on higher tariffs for some countries, but has hiked the rate for goods imported from China from 104% to 125%.

US stock markets rally on 90-day higher tariff relief

Stocks have surged after the US president announced a 90-day pause to some of the higher "reciprocal" tariffs.

The S&P 500 has climbed 6.82%, at the time of writing. The Dow Jones Industrial Average has risen 5.79%, while the NASDAQ is up 8.77%.

Trump's 90-day pause – statement in full

During the 90-day pause, countries facing higher tariffs will instead face a lower 10% tariff, Trump has confirmed.

Writing on Truth Social, the US president said the increased 125% tariff charged to China would come into effect immediately.

Here's the statement in full:

"Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately.

"At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.

"Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States, I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately. Thank you for your attention to this matter!"

US stocks have surged after Trump's 90-day pause announcement. However, it's currently unclear whether the rebound be enough after the falls seen in recent days.

Recap: reciprocal tariffs on hold

Good morning. What a difference a day makes.

The FTSE 100 is trading 4.2% higher this morning following Trump’s reversal on his reciprocal tariff regime yesterday. We’ll dig into the details and implications of his 90-day pause throughout the day, but the headlines are that – with the exception of China, where Trump has ratcheted tariffs up to 125% – all countries are, for the moment, on the 10% baseline rate.

World breathes a sigh of relief, but is the US permanently damaged?

The tariff pause gives the world a moment to breathe, collect itself, negotiate with the US, and prepare for the eventual resumption of tariffs – should those negotiations fail – in fuller knowledge of what they will entail.

While the rest of the world regroups, the question must be asked: has the US president permanently damaged his economy through his policy rampage over the last week?

“Even if the tariffs are permanently suspended, damage has been done to the economy via a permanent sense of unpredictability in policy,” says George Saravelos, global head of FX research at Deutsche Bank.

“More structurally, the events of the last few weeks will resonate amongst global economic partners during the upcoming negotiations on trade and indeed for many years to come. The desire to build greater strategic independence from the US across all fronts will be here to stay.”

In that context, it is notable that chancellor of the exchequer Rachel Reeves yesterday said that the tariff regime makes it “imperative” that the UK improves its trading relationship with the EU, on the same day she announced £400 million in trade and investment commitments following meetings with her Indian counterpart Nirmala Sitharaman.

Early signs of a post-US era?

Chancellor Rachel Reeves with India's finance minister Nirmala Sitharaman yesterday. Do these trade negotiations mark the start of a move away from global dependence on US trade?

BREAKING: EU pauses tariff countermeasures

The European Union has said it will pause its tariff countermeasures for 90 days, after Trump announced a 90-day pause to higher “reciprocal” tariffs on some countries yesterday.

European Commission president Ursula von der Leyen today said the EU “wants to give negotiations” a chance.

“If negotiations are not satisfactory, our countermeasures will kick in,” she said in a statement posted on X.

“Preparatory work on further countermeasures continues. As I have said before, all options remain on the table.”

Republicans accused of market manipulation

Democrat politicians have raised accusations of market manipulation against the Trump administration following yesterday’s sudden announcement of a tariff pause, which sent markets surging.

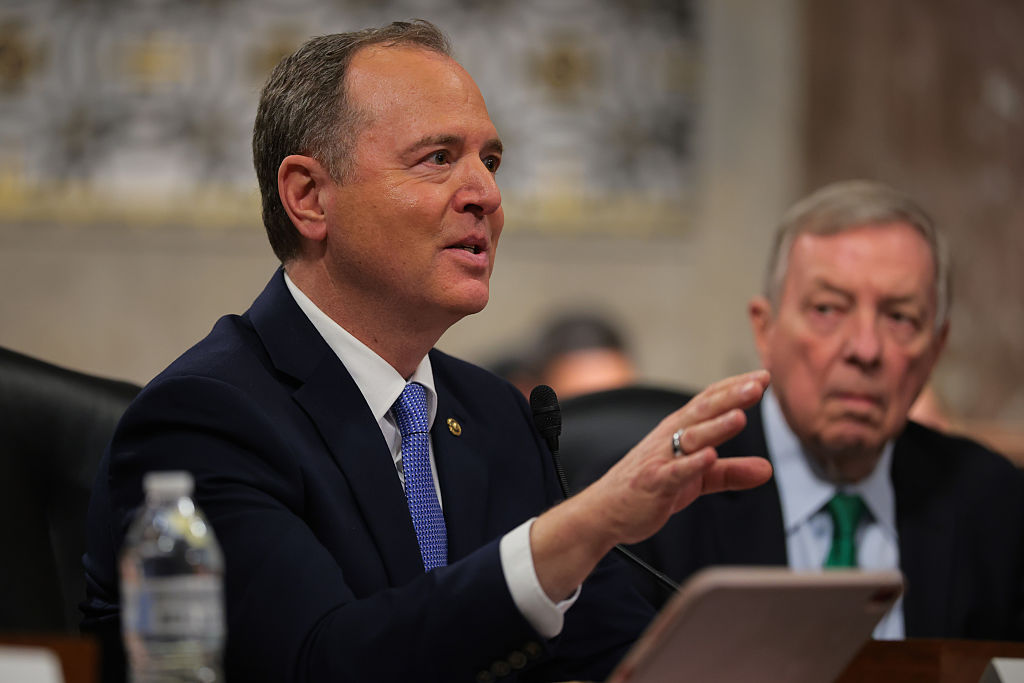

“There is all too much opportunity for people in the White House to be insider trading,” senator Adam Schiff told reporters yesterday. Schiff has called for an investigation of insider trading to be launched.

Hours before announcing the pause, which led to a huge rebound in the US stock market, Donald Trump posted on his Truth Social account “THIS IS A GREAT TIME TO BUY!!!”.

The previous evening, Trump’s press secretary Karoline Leavitt had told a press conference that the president was “not considering an extension or a delay” in the imposition of the reciprocal tariffs.

Yesterday, Leavitt told the US press that the media had “missed the art of the deal” – implying that the point of the tariffs all along was to bring other countries to the negotiating table and to isolate China.

Trump’s trade representative Jamieson Greer was testifying to a House committee yesterday when the U-turn was announced, and faced a barrage of questions from Democrat representative Steven Horsford.

“If it was always the plan [to pause the tariffs], how is this not market manipulation?” Horsford demanded. “If you came here knowing that … these tariffs were going to be turned off… why didn’t you reference that as part of your testimony?”

US senator Adam Schiff has called for an investigation into alleged market manipulation over yesterday's tariff announcements.

US Futures down ahead of market opening

The US stock market staged an incredible rally last night after President Donald Trump announced a 90-day pause on the implementation of “reciprocal tariffs”.

The S&P 500 ended around 9.5% up by the close of trading on 9 April, the eighth largest daily percentage gain of the index in history.

However, early indicators suggest this rally could be weaker when trading starts today.

S&P 500 futures are down around 1.7%, Dow Futures are down around 1.3%, and NASDAQ futures have fallen further, down around 1.9%.

The US market opens at 14:30 UK time.

Reduction in 25% tariff on UK cars and steel could be more likely than escape from blanket 10%

Despite Donald Trump rowing back on his “reciprocal tariffs” promise last night, the UK is not out of the woods quite yet.

British steel, aluminium, and cars are still subject to a 25% tariff despite Trump’s desescalation last night, though prime minister Keir Starmer is keen to negotiate this down.

Starmer’s team thinks it is unlikely that the UK will achieve a reduction in the blanket 10% tariff, but headway could be made to decrease tariffs on steel, aluminium, and cars, according to the Financial Times.

The paper reported that a British official said negotiating a reduction in the 10% tariff was unlikely, but “when it comes to the 25 per cent on autos, there is more optimism.”

If a deal is brokered to reduce tariffs on British cars and steel, it would limit much of the damage done to British manufacturers, especially carmakers.

The UK’s biggest export to the US is cars, with 18.4% of manufactured cars ending up in the US, bringing in £6.4 billion of value, according to the ONS.

Meanwhile, steel is a smaller export to the US with 180,000 tonnes of it being shipped across the pond in 2024 worth £370 million, according to trade body UK Steel.

Some in Labour’s camp say the good relationship fostered with Trump by Starmer will help a more favourable deal manifest. They point to the fact that Britain escaped with only 10% tariffs as evidence of this.

However, the unpredictable nature of the president means it is anyone’s guess whether or not a deal will be reached.

Daniel Hilton, Junior Writer

US inflation fell to 2.4% in March

The rate of inflation in the United States was 2.4% in March, down from 2.8% in February, according to official data from the US Bureau of Labor Statistics.

The fall is higher than expected – economists and analysts polled by Bloomberg thought that inflation would fall to 2.5%.

As the data was collected before ‘Liberation Day’, the March data does not reflect the potentially inflationary repercussions of Trump’s tariffs.

Early indicators show this is welcome news for the market with stock futures going up, though they are still being traded below yesterday’s close.

US will charge 145% tariffs on China

Chinese goods entering the US will be charged a 145% tariff, a White House official has told CNBC.

Yesterday, Donald Trump announced a 125% tariff would be placed on China. However, the White House has now said the true tariff rate would be 145%.

This is because the 125% tariff would be applied on top of a 20% fentanyl-related tariff that was previously imposed, they said.

What does it all mean for your personal finances?

While stock markets rallied yesterday after Trump announced the 90-day pause of the higher “Liberation Day” tariffs on most countries, the landscape remains volatile.

Uncertainty seems to be the only thing that’s certain right now, with Beijing retaliating with 84% levies on the US today, after Trump escalated tariffs on China from 104% to 125% last night.

“Markets have responded with dramatic swings, reflecting both relief at signs of pragmatism and concern over the potential for a deeper trade rift between the world’s two largest economies,” Ian Futcher, financial planner at Quilter says.

“For households, the implications are wide-ranging with the prices on goods likely to rise, while broader market volatility can affect pensions, ISAs, and investment portfolios.”

We look at what the latest developments mean for your money.

Pensions

Despite markets staging a partial recovery, it would be “premature to assume the volatility is behind us,” Futcher says.

“Pension pots, which are often heavily invested in equities and bonds, remain exposed to global market movements, and further swings in sentiment are highly possible.

“Those nearing retirement may see their pension values fluctuate more than expected and should consider whether their portfolios reflect an appropriate level of risk given the uncertainty.

“Annuity rates – tied closely to long-term gilt yields – may also face downward pressure if rate cuts are used to cushion the economic impact of tariffs.

“For those considering converting pension savings into a guaranteed income, timing will be key.”

Futcher suggests seeking professional financial advice to ensure retirement plans stay on track.

READ MORE: Has your pension plunged in stock market turmoil? Why you must not panic

Mortgages

Some lenders have cut mortgage rates since Trump’s “Liberation Day” tariff announcement and the subsequent stock market turmoil, in a silver lining for borrowers.

Swap rates – which lenders use to price their fixed-rate range – decreased in recent days, leading to some lower mortgage rates.

The pausing of some tariffs “does change the picture slightly”, Futcher says, but warned there is “still a huge amount of ambiguity in how things will play out”.

Homeowners on fixed-rate mortgages should “plan ahead”, he says, adding: “Ideally, borrowers should have their paperwork in order at least six months before their current deal ends. That allows them to move quickly and secure a competitive rate as they approach the end of their term.

“With mortgage pricing often fluctuating in response to economic news, being ready to act early can make a significant difference to monthly repayments. A conversation with a mortgage adviser can help ensure no opportunity is missed.”

Savings

Amid speculation the Bank of England could take a more aggressive approach with interest rate cuts following Trump’s tariffs, savings rates could well fall.

"Lower interest rates, while beneficial to borrowers, tend to erode savings rates, particularly in easy-access accounts,” Futcher explains.

There’s also concern the tariffs could drive inflation higher, which could weaken the real returns savers get, although the impact on inflation is not currently clear.

Futcher urged savers to be “proactive” – “locking into fixed-term deals where higher rates still exist or considering a diversified investment strategy tailored to their time horizon and risk appetite”.

– Jessica Sheldon, Deputy Digital Editor

How have European markets fared today?

European markets soared when they opened this morning, with the FTSE 100 opening 5% up.

However, as the day continued and trading opened up across the pond, stocks started to slump from the morning’s high.

At the close of trading, the FTSE 100 was up 3.19%, while the FTSE 250 fared a bit better, going up 3.38%.

Some of London’s biggest winners were 3i, a private equity and VC firm, whose stock price grew by 7.75%, and Barclays which rose by 7.70%.

In Europe, Germany’s DAX closed up 4.53%, and the EURO STOXX 50 (which measures the performance of 50 Eurozone stocks) was up 4.26%.

Markets remain open in America, but here’s a quick snapshot of how they’ve fared in the first two and a half hours of trading.

The S&P 500 fell sharply by 1.9% when markets opened, and continued its decline. At 16:55 BST, the index was down around 3.85%.

The Dow Jones Industrial Average tells a similar story. It opened down 1.5% and is down 3.69% at time of writing.

The NASDAQ composite has had the worst day of the three indices so far. It opened down 2.85% and, at time of writing, is down a colossal 5.32%.

As markets remain open into the UK evening, American stocks could still reverse their losses, or fall even further. Come back to our live blog tomorrow morning to find out how they fared.

Daniel Hilton, Junior Writer

Deutsche Bank: Reeves’ fiscal headroom is “diminished significantly” thanks to tariff-induced bond bonanza

Chancellor Rachel Reeves has likely had a significant amount of her fiscal headroom wiped out just two weeks after her Spring Statement thanks to Trump’s tariff announcements, Deutsche Bank has warned.

The £9.9 billion of fiscal headroom that was maintained at the Spring Statement is under threat from lower equity prices, the tariff shock, higher gilt yields, and higher borrowing, according to Samjay Raja, senior economist at Deutsche Bank.

“With regards to fiscal policy, chancellor Reeves finds herself in a similar place to

where she was at the start of the year,” Raja said, referring to gilts yields soaring in January.

“For all intents and purposes, her £9.9 billion headroom (against her primary stability rule) has likely diminished significantly – if not fully.”

In order to minimise the damage that Trump’s tariffs could bring, Raja expects that the government will use industrial policy to make UK businesses more competitive.

He points to the recent amendment to the ban on the sale of new petrol and diesel cars as evidence of this, as well as the recent talk about the re-nationalisation of British Steel.

More measures are expected, however, with Raja saying that capital spending announcements could be brought forward, deregulation efforts could be enhanced, and defence spending could be doubled down on.

Secondly, Raja thinks the government will take steps to shield UK firms from tariff exposure: “In our minds, business support will be likely should the trade war continue into the next several weeks – especially if the UK is unable to secure a better trade deal.”

This could take the form of making credit and grants easier for UK firms to access.

For the time being, Deutsche Bank does not expect the UK to go into a recession as a result of Trump’s tariff regime.

Daniel Hilton, Junior Writer

Baseline 10% tariffs will stay long-term, says Hassett

Blanket tariffs of 10% will stay in place for the long-term, according to National Economic Council president Kevin Hassett.

In an interview with CNBC, Hassett said: “Everybody expects that the 10% baseline tariff is going to be the baseline and it’s gonna take some kind of extraordinary deal for the president to go below there.”

It comes as Hassett says trade deals are on the table “for more than 15 countries”, two of which are “almost closed as of last week.”

The comments were made after Donald Trump announced a 90-day pause on the “reciprocal tariffs” on dozens of countries, but not China.

Elsewhere in the interview, Hasset admitted that elevating US Treasury yields added “a little more urgency” to the tariff pause, but did not cite it as a direct reason for the policy U-turn.

“There’s no doubt that the Treasury market yesterday made it so that the decision that, you know, it is about time to move was made with, I think, perhaps a little more urgency. But it was going to happen,” he said.

Daniel Hilton, Junior Writer

Former US treasury secretary: Tariffs are “the worst self-inflicted wound” in US history

Joe Biden’s treasury secretary Janet Yellen has called Donald Trump’s economic policy “the worst self-inflicted wound that I have ever seen an administration impose," in an interview with CNN.

She defended her and Biden’s record in office and said they left behind a “very well-functioning economy and President Trump has taken a wrecking ball to it”.

Elsewhere in the interview, Yellen argued that rising yields on Treasuries likely played a part in Trump’s decision to pause tariffs last night.

Yellen served as the 78th US Treasury Secretary for the entirety of Joe Biden’s premiership. Before that, she was the 15th Chair of the Federal Reserve from 2014 to 2018.

Daniel Hilton, Junior Writer

BREAKING: China raises tariffs on US imports to 125%

China has raised tariffs on US goods to 125%, as the trade war rumbles on.

Beijing announced US goods would be tariffed at 84% on Thursday morning, but the White House subsequently confirmed Chinese goods would be subject to a 145% tariff.

The Chinese finance ministry called the US tariffs “abnormally high”, but added that China would not match any further tariff rises by the US, “given that at the current tariff level, there is no market acceptance for US goods exported to China.”

“If the US continues to impose tariffs on Chinese goods exported to the US, China will ignore it,” they added.

The new tariffs will come into effect tomorrow (12 April).

Tesla halts new orders in China for its US-made cars

Tesla has suspended new orders in China for its US-imported cars amid the escalating tariff war between the two superpowers.

The models no longer being sold in China are the Model S and Model X which are imported from America.

The Model 3 and Model Y, which are made in Tesla’s Shanghai factory, are still available to purchase in China.

The suspension came just hours before China announced it would respond to US tariff escalation by upping their 84% tariff rate on American goods to 125%.

However, factors outside the ongoing trade war could have prompted the decision.

Data from the China Automotive Technology and Research Center shows the Models S and X accounted for fewer than 2,000 Tesla sales in China in 2024. Conversely, sales for the Models 3 and Y totalled around 661,820.

With such low sales, the suspension of new Model S and X orders is unlikely to affect Tesla hugely, but is still a setback for the carmaker amid increasing competition in the Chinese market.

Though the Tesla Model Y remained the highest-selling electric vehicle in China in 2024, the American maker is losing ground in the country.

In 2023, the Tesla Model Y had a 119,904 unit lead against the second-highest selling electric vehicle in China that year. But 2024 saw that lead diminish to just 38,124 units, according to EV Volumes.

This has come as a result of increased competition from Chinese rivals such as BYD.

Daniel Hilton, Junior Writer

UK GDP grew unexpectedly by 0.5% in February

Britain’s economy grew by 0.5% in February, surprising many analysts who expected a measly growth rate of 0.1%.

Much of the growth was thanks to the UK’s manufacturing sector as production output grew by 1.5%.

The positive figure is a welcome reversal from January, which had initially shown a 0.1% contraction – though the ONS has revised this to no growth in the latest release.

The growth rate, though comparatively small, will be welcomed by the government who have made boosting economic growth their number one priority.

Chancellor Rachel Reeves said: “These growth figures are an encouraging sign, but we are not complacent [...] The world has changed, and we have witnessed that change in recent weeks.”

The change Reeves was referring to was, of course, Trump’s 25% tariffs on British cars, steel, and aluminium, alongside a blanket tariff of 10% on all imported goods.

The February GDP growth figures were collected before the charges were introduced, so the negative impact of the tariffs could have on British economic growth are not yet represented.

The next set of GDP data will be published by the ONS on 15 May. This data will be in a better position to illustrate the impact of tariffs on Britain’s economy.

Read our full report on UK GDP in February, and what Trump’s tariffs could mean for future growth.

US stock futures tick slightly higher

Pre-market trading is marginally up ahead of US stock markets opening at 14:30 BST.

As of 13:15, Dow Futures are trading 0.32% up, S&P 500 Futures are up 0.43%, and NASDAQ Futures are up 0.52%.

Pre-market trading can be a good indication of how markets will act when they open, but nothing in financial markets can ever be truly predicted – not least in the last few days.

Last night, the S&P 500 closed 3.46% down, the Dow 2.50% down, and the NASDAQ ended the day 4.31% down.

Trump: America is “doing really well” thanks to tariff policy

In a post on his social media site Truth Social, President Trump has said that his tariff policy is “doing really well” for America.

He added: “Very exciting for America, and the World!!! It is moving along quickly.”

The post is the US president's first statement since China announced tariffs on US goods would be raised to 125%.

FTSE ends day up while Europe slumped

The FTSE 100 has ended the day up by 0.64% following a turbulent day of trading.

The index had a strong start to the day before stocks briefly slumped down around 0.5% after China announced it would raise its tariffs on US goods to 125%.

However, London recovered shortly afterwards and, despite many sharp drops and surges, ended the day up 0.64%.

The biggest winners on the LSE include Fresnillio, a mining company, which gained 7.37%. Endeavour Mining ended the day up 6.43% too, while Tesco also ended the day 4.16% higher than yesterday.

The same story can’t be said of European markets.

Germany’s DAX ended the day down 0.92%, France’s CAC index was also down 0.30% at the end of trading, while the EURO STOXX 50 ended the day down 0.66%.

Markets remain open in America, but here’s a snapshot of how they’ve fared in the first few hours of trading.

The S&P 500 is, at time of writing (17:22 BST), up 0.57%, the Dow Jones Industrial Average is up 0.44%, and the NASDAQ composite is up 0.73%.

As markets have been especially volatile in the past few days, there is no guarantee that the US stock market will continue to grow as their trading day continues.

Daniel Hilton, Junior Writer

As Europe takes a breather after a turbulent week for global trade, we will pause our live blog for the weekend.

Thank you for following along with us, and we will be back next week.