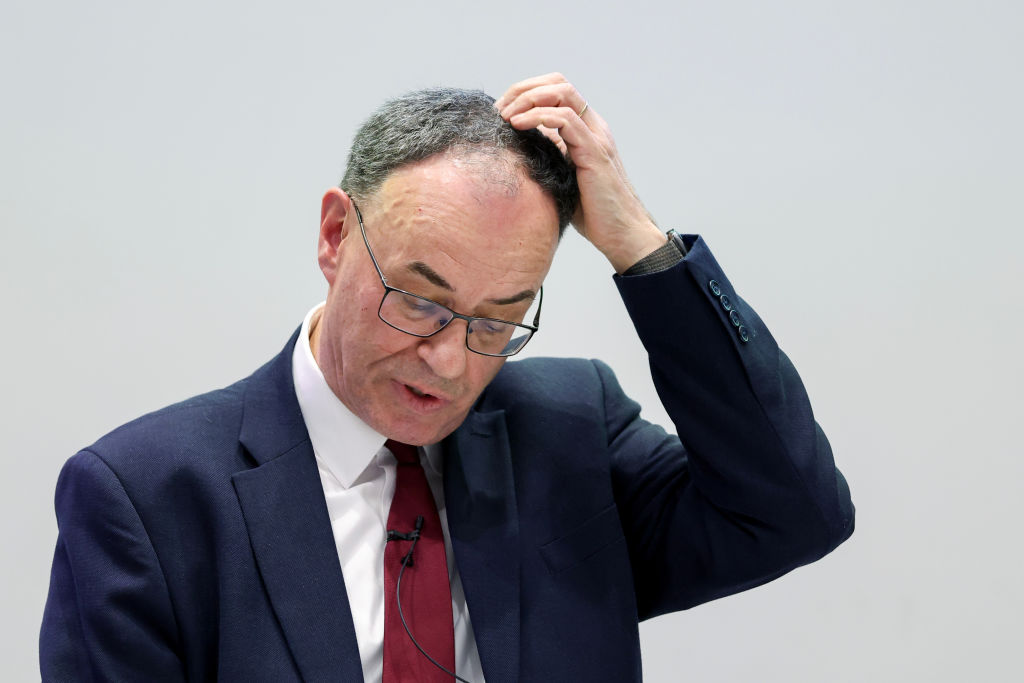

Will the Bank of England cut interest rates by 50 bps in response to Trump’s tariffs?

The Monetary Policy Committee could opt for a larger-than-usual cut in May, as Donald Trump’s tariffs threaten to pour cold water on economic growth

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Bank of England had been sounding more hawkish in recent weeks, but sweeping tariffs from US president Donald Trump could force it to take a more aggressive approach with interest rate cuts.

Markets are currently pricing in a 25 basis-point cut when the Monetary Policy Committee (MPC) next meets on 8 May, but economists at Deutsche Bank believe a 50 basis-point cut is possible under certain circumstances.

It would take three things for the Bank to surprise markets with a larger-than-expected cut, Deutsche Bank said: a sharp drop-off in business activity, an excessive tightening of financial conditions, and further labour market cooling.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

For now, Deutsche Bank’s base case is still four more rate cuts this year with the MPC sticking to 25 basis-point steps. However, it argues that the odds of faster rate cuts are growing as a result of Trump’s tariffs, “albeit from a low base”.

“If global headwinds intensify, financial conditions tighten, and the real economy shows clearer signs of slowing, then the MPC will likely opt to move faster rather than slower,” said Sanjay Raja, chief UK economist at the investment bank.

Former deputy BoE governor: rates should be cut to “at least 4% in May”

In an interview with The Guardian this week, former deputy governor of the Bank of England Charlie Bean said rates should be cut by “at least half a percentage point to 4%” in response to the tariff turmoil.

Bean said tariffs would force businesses to delay investments and consumers to be more cautious with their spending. This could pour ice water on economic growth.

The former deputy governor referred back to November 2008, when the Bank of England surprised markets with a 1.5 percentage-point cut.

“The markets expected a 0.25 percentage point cut, or maybe a half a percent. But we were talking to our agents in the regions and they said business orders had fallen off a cliff. It was obviously a very serious situation,” he told The Guardian.

Bean said the tariff situation is not of the same magnitude as the 2008 financial crisis, but still described it as a “disinflationary shock” and called on the Bank of England to “react very strongly”.

Are tariffs inflationary or disinflationary?

While most experts agree that tariffs will drag on growth, the impact on inflation is less clear. It is worth pointing out that the Bank of England has a dual mandate. As well as supporting growth, it needs to keep inflation under control.

Prices are likely to rise in the US in response to tariffs, as businesses pass import taxes on to consumers. Consultancy Capital Economics expects tariffs to add roughly 2.5 percentage points to the US CPI price level.

Global supply chains will also face disruption, which could push costs up more widely. However, this could be offset by a reduction in business activity and consumer spending.

James Smith, developed markets economist at European bank ING, said the fact that the UK government hasn’t retaliated means the impact on UK inflation should be minimal.

“If anything, it could prove deflationary further down the line as economic growth cools and the threat of dumping from other big global producers rises.”

Research company Pantheon Macroeconomics takes a different stance and believes prices could rise.

“Supply shocks, of which tariffs are an example, are stagflationary. So, we think that UK rate-setters will have to be more cautious about responding to weaker growth, weighting inflation more highly than usual,” said economist Robert Wood.

For this reason, Pantheon views a 50 basis-point cut in May as “very unlikely”.

“Ultimately, we are looking at a global stagflationary recession if Trump fails to change course soon. In that worst-case scenario, the MPC would likely respond with deeper rate cuts in late 2025 or early 2026.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.