Investment trust boards are rushing to sell at a discount

Persistent discounts seem to be making investment trust boards too hasty about backing opportunistic offers

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The net asset value (NAV) of an investment trust is supposed to represent what would be left if you sold all its assets and paid off all its liabilities. For trusts investing in liquid, large-cap listed stocks, the NAV should be pretty close to what you would get in reality. For small-cap funds, you might receive less if you were selling large stakes or liquidating very quickly, but you would hope that it’s a fair reflection of what you would eventually get if you were not a forced seller.

Funds that invest in unlisted assets – private equity, real estate, infrastructure and so on – are different. There’s no continuous market price for the assets, so the NAV is calculated from other data. These might include: recent private transactions for stakes in the same assets; prices at which comparable assets have sold; net present value based on forecast cash flows discounted back to today; or some other method.

So, NAVs for these funds are estimates. Still, one would hope to find that the assets should be worth close to NAV (or better) in the event of a non-forced sale, unless the board or manager are telling investors – as sometimes happens when a troubled trust is winding up – that they are no longer confident of achieving these prices.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lowball offers

So it feels frustrating to see many bids in sectors such as real estate and infrastructure that are pitched at a significant discount to NAV and still recommended by boards. With many of these funds trading cheaply, buyers are coming in with an offer that is above the prevailing price, but still below NAV. Sometimes, boards seem too quick to back lowball buy-out offers when many shareholders would prefer to remain invested.

The battle for Assura – which has happily swung back in favour of a merger with its peer Primary Healthcare Properties – is a case in point.

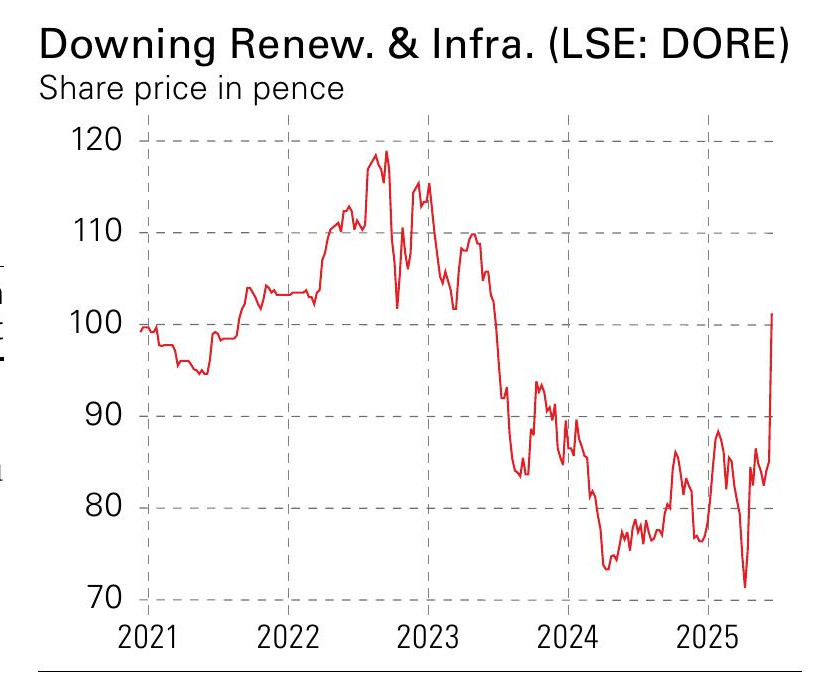

This week’s bid for Downing Renewables & Infrastructure (LSE: DORE) – which I hold – seems less likely to end satisfactorily. DORE has received a 102.6p per share bid, which the board has agreed. This is an 23% premium to the undisturbed share price, but a 7.5% discount to NAV (adjusted for the next dividend). DORE is small (net assets of £191 million) and consolidation in renewables is inevitable, especially when discounts remain this large. Still, a sale this far below NAV feels like a poor deal given that the trust appears to have a decent portfolio of assets and seems to be performing fairly well.

What makes this messy is that the bidder is Bagnall Energy, an inheritance tax relief investor that is run by Downing – ie, the manager of DORE. Bagnall has been invested in DORE since the initial public offering and increased its stake from 16% in early January to 25% by mid-February. This enlarged stake gives it a blocking vote on other bids, so a competing bid is unlikely. It is galling to see a big shareholder acquiring the full business at below NAV (no control premium). It is unpalatable that the manager has been getting fees based on higher NAVs, but argues that it is worth less when it wants to buy. And it is not persuasive to see the board say that this offer is “in the best interests of DORE’s shareholders as a whole”. Long-term investors will probably disagree.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Saba Capital: the hedge fund doing wonders for shareholder democracy

Saba Capital: the hedge fund doing wonders for shareholder democracyActivist hedge fund Saba Capital isn’t popular, but it has ignited a new age of shareholder engagement, says Rupert Hargreaves

-

Star fund managers – an investing style that’s out of fashion

Star fund managers – an investing style that’s out of fashionStar fund managers such as Terry Smith and Nick Train are at the mercy of wider market trends, says Cris Sholto Heaton

-

Exciting opportunities in biotech

Exciting opportunities in biotechBiotech firms should profit from the ‘patent cliff’, which will force big pharmaceutical companies to innovate or make acquisitions

-

How to add cryptocurrency to your portfolio

How to add cryptocurrency to your portfolioA new listing shows how bitcoin might add value to a portfolio if cryptocurrency keeps gaining acceptance, says Cris Sholto Heaton