Emerging markets must deliver growth

Emerging markets have benefitted from the rotation away from the US – but can the rally last?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There are two obvious points to make about emerging markets at a time like this. One is that the idea of emerging markets as a single type of investment feels nonsensical and has done for a long time. The emerging-market universe covers a huge range of economies that have far less in common than the developed-market universe, which is already diverse enough. The other is that – regardless of the above argument – one rule still holds: when the US dollar goes down, emerging markets are much more likely to go up.

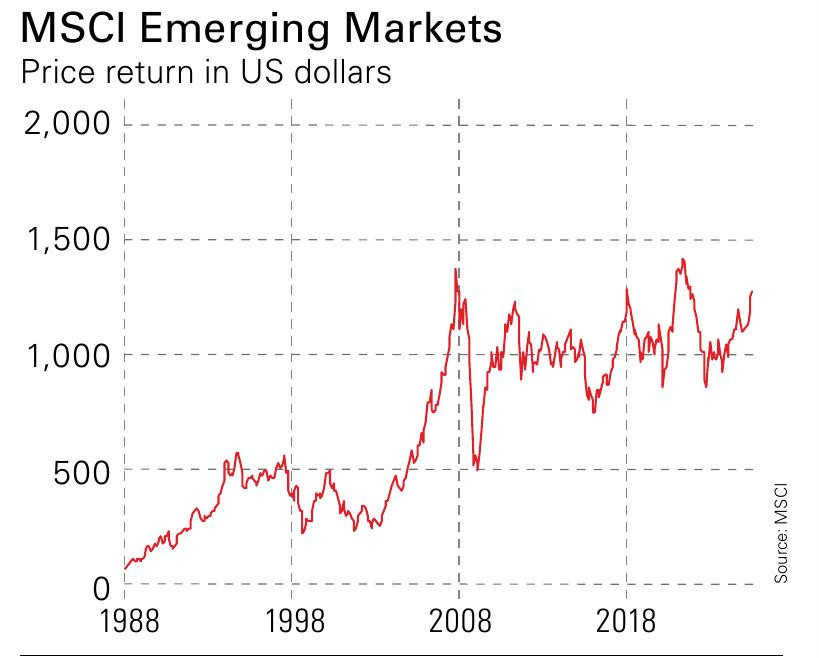

We have seen the same pattern playing out again this year. The MSCI USA is up by about 7% since the beginning of January, while the MSCI Emerging Markets is up by almost 16% in US dollar terms. Currency moves play a part here, but they are not the whole story: the index is up by almost 13% in local currency terms. This does not mean that every emerging market is doing well. India is notably weak. So is most of Southeast Asia. The mainland China A share market is unimpressive. Still, Hong Kong-listed shares, Korea, Eastern Europe, most of Latin America and the Middle East (excluding Saudi Arabia) have all been fair to outstanding.

Will emerging markets outperform others?

The natural explanation for why a weaker dollar and stronger emerging markets go together is down to capital flows. The dollar is weaker because money is flowing out of US assets (or at least no longer flowing into them) and instead going elsewhere. That money is not only heading into emerging markets, but economies that do not have deep pools of domestic institutional investors are very sensitive to foreign flows and so small shifts can make quite a difference.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The question then is whether this short-term rally can turn into a longer-term bull market. Certainly, the MSCI Emerging Markets looks cheap on a forward price/earnings ratio of about 13. The differential between this and the USA (on a forward p/e of around 23) is far wider than it was a decade ago. The caveat here is that emerging markets looked even cheaper back then (when the forward p/e was about 11). Yet subsequent returns were disappointing, which was in part because earnings growth was weak, though emerging economies grew faster (on average) than developed economies.

This will need to change for the rally to run – and there are signs that it may. Earnings per share for the MSCI Emerging Markets rose 10% last year and JP Morgan forecasts are for a further acceleration to 17% this year (although in this environment, forecasts should be treated as even more uncertain than usual). If so, this should turn into a virtuous circle: better results from emerging markets encourage more investment, more spending and lead to more growth. Note too that even though emerging markets have had a strong 2025 so far, they have actually lagged behind European markets. That feels natural at this stage, since pessimism about Europe has been extreme. However, if the rotation away from the US continues, one would expect them to ultimately outperform.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Star fund managers – an investing style that’s out of fashion

Star fund managers – an investing style that’s out of fashionStar fund managers such as Terry Smith and Nick Train are at the mercy of wider market trends, says Cris Sholto Heaton

-

Three promising emerging-market stocks to diversify your portfolio

Three promising emerging-market stocks to diversify your portfolioOpinion Omar Negyal, portfolio manager, JPMorgan Global Emerging Markets Income Trust, highlights three emerging-market stocks where he’d put his money

-

Exciting opportunities in biotech

Exciting opportunities in biotechBiotech firms should profit from the ‘patent cliff’, which will force big pharmaceutical companies to innovate or make acquisitions

-

How to add cryptocurrency to your portfolio

How to add cryptocurrency to your portfolioA new listing shows how bitcoin might add value to a portfolio if cryptocurrency keeps gaining acceptance, says Cris Sholto Heaton