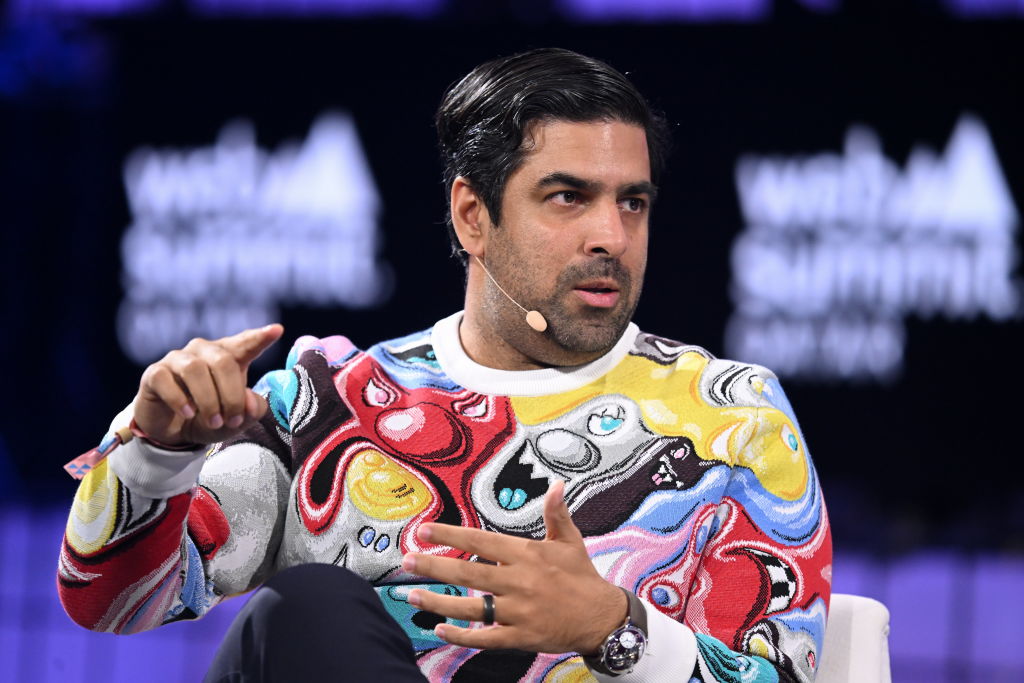

Sachin Dev Duggal's Builder.ai – the first big bust of the AI boom

Some of the world’s top tech investors rushed into Sachin Dev Duggal's Builder.ai, a start-up claiming it could use artificial intelligence to build apps. Its revenues turned out to be equally artificial

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last summer, Sachin Dev Duggal and his family moved to Dubai, leaving behind an unexploded bomb. The self-proclaimed “chief wizard” of Builder.ai – the London start-up that grew into one of Europe’s biggest and buzziest AI unicorns – was already facing board concerns about “gaps” between the sales it reported and actual revenues. Debt was mounting and, although you might not have guessed it from Duggal’s glamorous Instagram account (yachting in Monaco, tennis in Capri…), money had become an issue. It was the start of the first big bust of the AI boom.

It took less than a year for Builder.ai to collapse, leaving a trail of creditors and some of the world’s top tech investors reeling in its wake, says the Financial Times. Duggal, 42, had raised more than half a billion dollars from the likes of Microsoft and Qatar’s sovereign wealth fund – with the simple pitch that the start-up could use AI to make building apps “as easy as ordering pizza”. Realising they’d backed a business whose seemingly healthy revenues were equally “artificial” was a shock.

The tech may be new, but the story’s as old as they come – the triumph of “hype over substance”. But building hype, or “vision”, came naturally to Duggal, says Bloomberg, and he was equally adept at transforming it into respectability. The catalyst that opened up the cash spigots for his idea of “democratising programming for the masses” was the launch of ChatGPT in late 2022. By the following summer, both Microsoft and Qatar’s fund were on board, along with several other investors, including Lakestar, Iconiq Capital, Singapore’s Jungle Ventures and Jeffrey Katzenberg’s WndrCo. Duggal, meanwhile, had become a fixture on the tech conference circuit. Months before the first signs of trouble began appearing in 2024, he was at Davos sponsoring “glitzy events with celebrities”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Can Sachin Dev Duggal bounce back?

A deeper dive into Duggal’s business history might have exposed his feet of clay. He enjoyed a dazzling start – at least according to online biographies – and colleagues at his first venture in 2004, cloud-computing firm Nivio, described him as “smart and charismatic”. But the company, based in Switzerland, always struggled with profitability, and one investor later alleged Duggal “inappropriately transferred” a large sum of cash to his personal bank account (an allegation never upheld in court).

Duggal claims that when he exited Nivio, which collapsed in 2013, it was worth $100 million. In fact, he was ousted by the board. Duggal’s next venture – a photo-sharing app called Shoto – was also short-lived, but his struggle to find competent software developers provided the inspiration for Engineer.ai in 2016. Yet within three years, he stood accused by his former chief business officer of overstating the firm’s technical abilities, using two sets of books and making transfers to his private accounts. The parties later settled the dispute, but it prompted a rebrand to Builder.ai in 2019.

Renowned for his love of globe-trotting and luxury, Duggal is currently keeping a low profile in Dubai, while investigations into the collapse of Builder.ai continue. “I’m proud of the team who dared to build a bold ambition. Every success was theirs; the failures were mine,” he says nobly. Meanwhile, he is actively fundraising for a new venture – “to help others navigate the wild world of start-ups and AI”.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King