A cyclical case for UK stocks

Depressed margins and relatively low valuations mean the UK market could rally strongly as conditions improve, says Cris Sholto Heaton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

China is undoubtedly the major stock market least popular with foreign investors. Yet there is another economy with consumers who are reluctant to spend, an unhealthy obsession with residential property, and more than a decade of anti-business governments with no idea how to boost growth – but where valuations are low (relative to other markets) and sentiment has been at rock bottom.

To be fair, that could describe a number of countries – but I am, of course, talking about Britain. My comparisons are more than a little glib (for a start, China has built too much housing, while the UK cannot build enough). Still, just as there is a case for at least a cyclical rally in Chinese stocks, you can make one for the UK.

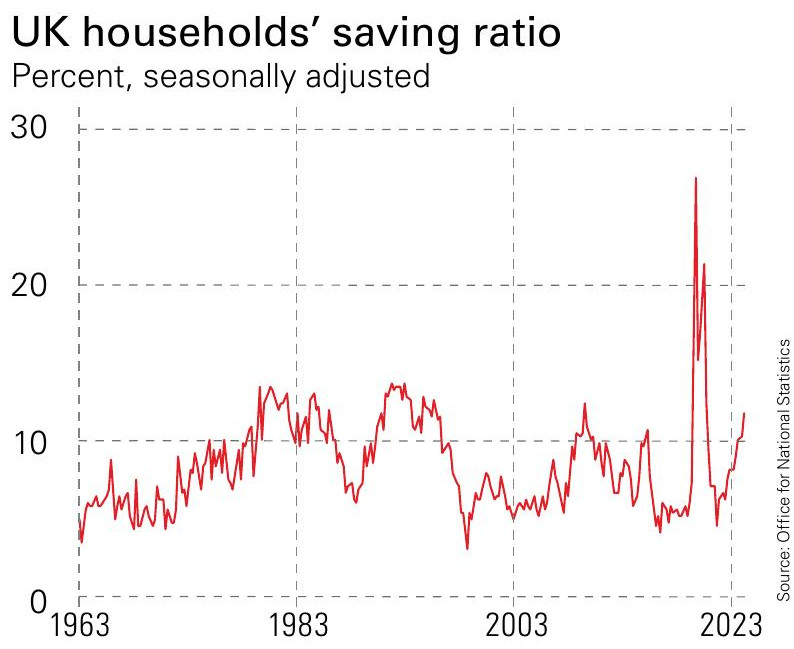

High savings and lower rates

The UK savings rate has risen significantly in recent years (ignoring the distortion caused by the pandemic). Starting from that high level means that there are savings and income that might be freed up to drive solid gains in consumer spending once people feel more confident, as Julian Cane of CT UK Capital and Income Investment Trust (LSE: CTUK) and James Thorne of CT UK Smaller Companies Fund point out.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

With inflation seemingly coming down – at least for now – there is plenty of scope for interest rate cuts. This should benefit housing-related businesses in particular: firms involved in property sectors are saying that if rates fall to 3.75% or so, the market should take off again, say Cane and Thorne. However, lower rates should reduce the blow for mortgage holders who are having to refinance expiring deals, which should be good for sentiment and consumption broadly.

All this could flow into an improvement in corporate profitability, as companies in a wide range of sectors with relatively high operational leverage benefit from a bit more demand. UK corporate profits as a share of GDP are around 20% at present, compared with a longer-run average of around 22%, notes Thorne.

Investors in the right kinds of companies (he points to brick makers as an example) could therefore benefit both from a significant boost in profits as depressed margins get back to more normal levels, plus rising valuations as the UK becomes a bit less of a pariah. Thus the upside is greater than valuations alone suggest.

A virtuous circle?

Other UK small-cap specialists are making a similarly persuasive argument. A structural bull case for the UK remains more tricky for me to believe. I am sceptical that the government has any idea how to deliver the investment that Britain needs (as shown by the chancellor’s muddled “Mansion House Compact”). Still, brokers have a solid pipeline of UK smaller companies wanting to list once valuations become more attractive, say Cane and Thorne. In that case, a cyclical upturn could still become a virtuous circle that reverses the hollowing-out we have seen in recent years and makes the market far more compelling.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Star fund managers – an investing style that’s out of fashion

Star fund managers – an investing style that’s out of fashionStar fund managers such as Terry Smith and Nick Train are at the mercy of wider market trends, says Cris Sholto Heaton

-

How to add cryptocurrency to your portfolio

How to add cryptocurrency to your portfolioA new listing shows how bitcoin might add value to a portfolio if cryptocurrency keeps gaining acceptance, says Cris Sholto Heaton

-

Investing in forestry: a tax-efficient way to grow your wealth

Investing in forestry: a tax-efficient way to grow your wealthRecord sums are pouring into forestry funds. It makes sense to join the rush, says David Prosser

-

The MoneyWeek investment trust portfolio – early 2026 update

The MoneyWeek investment trust portfolio – early 2026 updateThe MoneyWeek investment trust portfolio had a solid year in 2025. Scottish Mortgage and Law Debenture were the star performers, with very different strategies

-

Pundits had a bad 2025 – here's what it means for investors

Pundits had a bad 2025 – here's what it means for investorsThe pundits came in for many shocks in 2025, says Max King. Here is what they should learn from them

-

New year, same market forecasts

New year, same market forecastsForecasts from banks and brokers are as bullish as ever this year, but there is less conviction about the US, says Cris Sholto Heaton