The Net Zero delusion will drive oil prices higher

The world needs more oil, but producers are not investing enough to meet rising demand. That suggests the outlook for prices, and oil stocks is bright says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Of all the investment subjects I cover, I will always get the most hits if I write about the UK housing market.

Vying for second place in the readership stakes we have gold and bitcoin, though these two subjects have come against a new challenger in AI.

But if I write about oil, however, few seem to care.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you frame oil around the Net Zero delusion or geopolitics, readership goes up, however. That way you are giving the subject a spicy political angle, which readers, in these polarised times, are attracted to.

There is one subject even less popular than oil: natural gas.

I don’t cover coal very often, though I imagine it would be down there in the dirt, forgive the pun, along with those other fossil fuels.

So it is with a certain amount of foreboding that we turn to the oil markets today. But turn to them we must. The world which we enjoy today would not be possible without the extraordinary energy that derives from fossil fuels.

Oil makes the world go round

Energy makes everything possible. Without it, we are doomed a fact (or is it an opinion?) which seems to be lost on many who determine policy in the Western world. These policymakers are committed in their drive to wean us off this incredible source of energy that has brought more people out of poverty and raised living standards more than anything else in all human history.

Global oil consumption is around 100 million barrels per day (m b/d).

Venezuela has the world’s largest oil reserves. Saudi Arabia is the world’s largest producer, with an output of 11,5m b/d.

The former is, of course, no ally of the US, but the latter is (broadly speaking). The US gives the Saudi government plenty of military and security “assistance”.

The Saudis, however, have made two announcements this past week, which will not please the Biden administration.

Over the weekend, the Saudis, along with other major producers, announced a surprise production cut of upto 1,15m b/d. The Saudis alone will cut by 500,000 b/d and Iraq by 211,000 b/d.

This comes after a previous reduction last October of 2 m b/d that, I think it’s fair to say, the Biden administration was not happy about.

Why do such reductions infuriate? They push up the oil price. That makes for even more discontented citizens in these inflationary times - citizens who will be less likely to vote Democrat next year.

They also increase the scarcity and thus the value of Russian oil exports. The last thing the US will want to see is anything that increases Russian economic strength in these times of weaponized finance. Every dollar rise in the price of oil sees a $2.7bn increase in Russian export value is one stat doing the rounds.

Then there is the issue of the US’s strategic oil reserves. In an attempt to put a lid on gasoline prices, the Biden administration sold 180m barrels from the reserve last year for an average of $96.25 per barrel.

With falling oil prices this was looking like a good trade - as long as they bought back.

The plan was to replenish the reserve and buy back on the open market when prices reached $67-$72. That target was reached, but the administration, along with the entire investment world, we now know in retrospect, only had two or three days in March to buy the sub-$72 dip. I doubt they managed it.

The US SPR now sits at 372m barrels - the lowest level since 1984. The all-time high was 727m barrels in 2010.

Oil prices react to market fundamentals

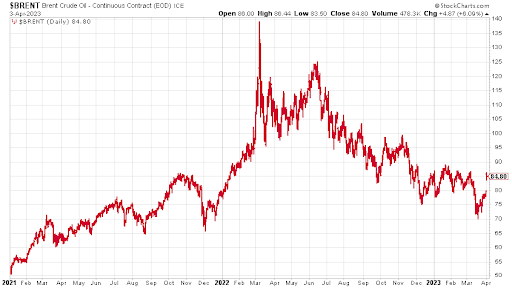

Since the March 20 intraday low at $70, Brent has shot up to $85.

So now we turn to irritation number two: the strengthening of Saudi energy ties to China.

These were demonstrated last week with the announcement of a $3.6bn deal that would see it supply 480,000 b/d to China’s Rongsheng Petrochemical.

“The traditional monogamous relationship with the US is now over,” said Saudi analyst Ali Shihabi.

This follows a trade deal between China and Brazil (China is Brazil’s largest trading to partner) to settle in yuan and reais, rather than dollars. It’s all part of this gradual de-dollarisation process that is happening. (China is already settling with Russia and Pakistan in yuan).

It’s not just de-dollarisation, it’s de-westernisation. At 5.4% of its holdings, Brazil’s yuan-denominated foreign-exchange assets now exceed its euros.

At the “Russian Davos” - the St. Petersburg International Economic Forum - which was held last week in New Delhi, one Russian official, State Duma Deputy Chairman Alexander Babakov, stated that a BRICS (Brazil, Russia, India, China and South Africa) alliance was working on a new currency secured by gold and other commodities, including rare-earth elements.

“Its composition should be based on inducting new monetary ties established on a strategy that does not defend the U.S.’s dollar or euro, but rather forms a new currency competent of benefiting our shared objectives,” he said.

This is not a new concept, but that does not mean it is not the broader diffraction of travel.

Coming back to the subject of oil, recession and sagging demand has seen the price slide since mid-2022. But we seem to have found a floor of around $70.

In 1980 OECD nations made up 70% of global demand. Now it is well below 50%. But demand forecast models tend to focus on developed nations, though in emerging markets consumption is resilient. As a result, global demand now exceeds 2019 pre-Covid levels. It is only going to increase.

Oil stocks will benefit from a lack of investment

As well as geopolitical factors, investment remains low. In 2014 it was $900bn, says the IEA. Today it is $400bn. Investment drives supply. Global stockpiles stand at 2003 levels. “If our models are correct,” says natural resource investment house Goehring & Rozencwajg, “inventories could end the year at the lowest reading since 1986.”

But “investors still refuse to allocate capital to the space”, they continue. “Over the last two years, energy has outperformed any other sector in the S&P 500 by 130 percentage points and the index by 150 percentage points. And yet, energy still represents less than 5% of the S&P500’s market capitalization – less than half its long-term average and 65% below the 2008 peak.”

Despite the outperformance, oil and gas are experiencing net outflows.

ESG plays a large role in this. Investment houses can’t invest even if they want to because of ESG guidelines. Misguided anti-fossil fuel narratives in the woke West that fail to take into account the amazing things that fossil fuels have made possible do not help either.

Western energy policy is steadily impoverishing Westerners.

No wonder so many nations are economically de-Westernising.

“Despite weaker-than-expected second-half demand, we estimate that global oil markets were in structural deficit by as much as 500,000 b/d throughout 2022,” Goehring & Rozencwajg continue. It will be higher in 2023, they say.

This won’t change until there is a radical re-think of energy policy, which means a huge change in the discourse, and thus of the personnel that determine it. We are years away from that. The lack of investment has been chronic for over a decade. It points to much further higher prices down the road.

The West is getting left behind.

Can you say why I feel it is so important in a portfolio to have allocations to both gold and energy?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.