Hold on to your oil and gas stocks

Oil and gas stocks have done very well in the last few months. But they’ve got a long way to run yet, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Today we consider energy and oil and gas stocks once again.

While oil and gas prices have done a great deal over the last six months – up a bit, down a bit, then sideways – the associated companies have done very well: the producers, the service companies and so on.

Many years of bear market belt-tightening are now paying off.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, in my opinion, we are not yet at that point of excess and decadence that marks the end of a cycle – crazy mergers and acquisitions, insane valuations and Bacchanalian behaviour from the executive classes. So I venture today, as last week, that there is still plenty of gas left in the tank of this bull market.

With that in mind, I wanted to share a few charts with you today that give an idea of what is possible.

Oil and gas stocks are on the rise

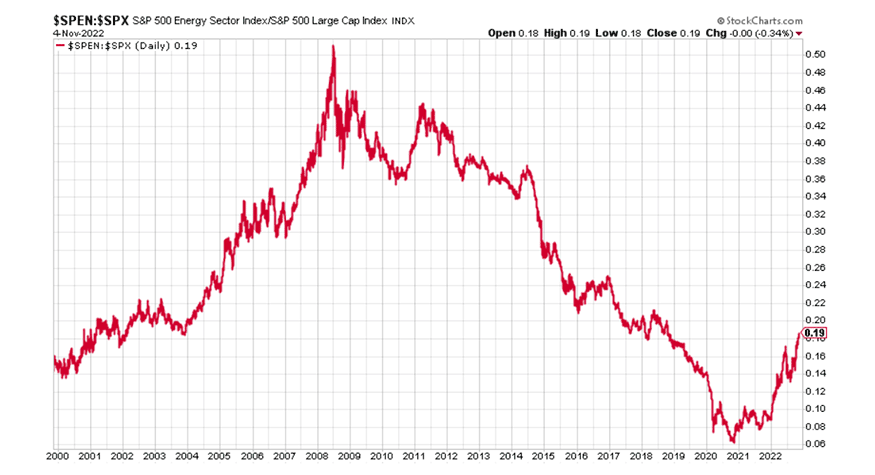

The first chart shows the ratio between energy stocks and the rest of the market.

Indeed, without energy stocks there would not be a rest of the market. This a simple point that many, especially those who make policy, don't seem to understand. The world we live in today and the economic benefits we enjoy, relative to our ancestors, have been made possible by fossil fuels.

So here is the energy sector relative to the S&P 500. The higher the chart goes, the bigger the relative market cap of oil and gas stocks.

You can see that, even with the rally we have seen in energy companies since 2020, on a relative basis, energy companies are, give or take, where they were at the turn of the century, when oil itself was around $10/barrel and that secular bull market was only just getting started.

You can also see that we are in an uptrend. Energy stocks are increasing in value, while the broader S&P500 is flat or falling.

It’s also worth noting that the relative market capitalisation was almost three times as large in mid-2008 when oil went to $147/barrel.

The inference is that the bull market has a lot further to run.

Oil and gas stocks are cheap compared to the broader market

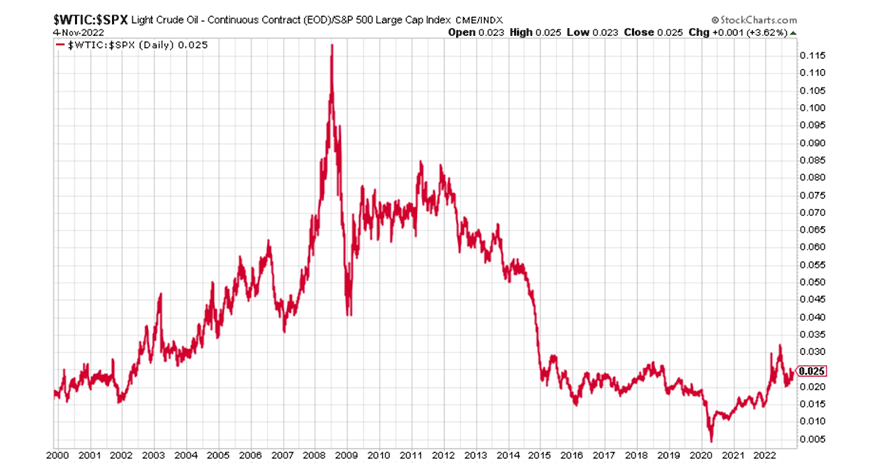

Next, the ratio between oil – West Texas Intermediate – and the S&P 500.

You would expect this chart to trend lower over time because oil production and extraction techniques should improve over time, while broader economies and the companies that operate in them grow.

Nevertheless, we are below the levels we were in the early part of the century. You can see how high this ratio went in 2008 – and how low in the corona panic of 2020, when oil futures, somehow, went into negative territory.

Relative to the S&P 500, oil is roughly where it was three or five years ago – I’d say it’s at its three- or five-year average. And it’s a lot cheaper than it was throughout that entire 2003 to mid-2014 timeframe.

So even with the gains of the last two years, oil does not look expensive relative to the S&P 500. It is at the cheaper end of the range. Another sign there is more gas left in the bull market tank.

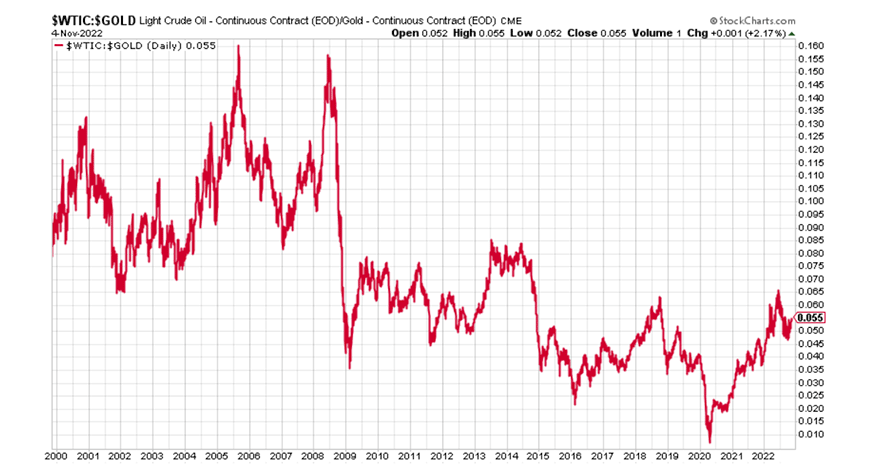

Here's the price of oil relative to gold. These two – as hard commodities – tend to trade in a much tighter range over time, but my observation again is that it is in the low to middle of the 20-year range and not at one of those points of extremity whereby you might consider rolling out of one and into the other.

For sure we are nothing like where we were went oil went to $147 in 2008. In fact, we are below where we were for most of the 2000s. On the basis of this chart, oil is probably the cheaper of the two.

As regular readers will vouch, oil is a drum I have been beating since 2016 when it was $25 or so, declaring it our “trade of the lustrum”. A lustrum is a five-year period – a useful and underused word, I’d say.

That lustrum is now becoming a decade. We continue to beat the drum on oil, gas, coal and related oil and gas stocks. Fossil fuel demand will continue to grow until at least 2030 the IEA has forecast (2040 in the case of natural gas).

There is still a strong case for fossil fuels

That means it is not just enough to maintain current production levels; they need to increase. Yet there have been seven or eight years of underinvestment – leading to today’s shortages.

There are multiple reasons why production isn't keeping up with demand. ESG policies are deterring investment, capital is flooding into green energy-related companies rather than fossil fuels and the excesses of the previous oil bull market still needed to be purged.

Still, the market conditions remain good and I think oil and gas stocks will go higher in the long term.

I’m a big believer in narratives within markets. The fossil fuel story is only slowly starting to change. Many are realising just how important they are and what they have made possible. Indeed, there is a strong moral case for them, not against them.

But the narrative is not yet at end-of-cycle levels. When people start talking about Peak Oil again – that’s the sort of thing you want to be looking out for. The need for alternative energy sources is not because fossil fuels are bad, but because we have consumed them all.

I don’t know what the end-of-bull market narratives will be – that’s a story that is yet to be told. But if legislators and subsidisers start abandoning electric vehicle initiatives because the ultimate source of electricity remains the burning of fossil fuels, and it’s really quite inefficient, never mind hypocritical – that is one possible scenario

So hold on to your positions in oil and gas stocks – enjoy the ride.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.