Why there is still life in the energy bull market

A green power initiative on the Galapagos Islands demonstrates how the renewable energy transition will need to be supported by fossil fuels for some time to come.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today’s missive comes to you from the remote Galapagos Islands out in the eastern Pacific, where two stories of energy initiatives reflect the broader realities of energy around the world.

We tell these stories with a specific question in mind: how much gas, so to speak, is left in the tank of this energy bull market?

The Galapagos population is only around 30,000, but, as a fully functioning society, the same dynamics that I observed in this small ecosystem occur elsewhere, even if less visibly, so it serves as a useful case study.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So we come to the first of our two stories: not-so-green transport in the Galapagos.

The push for greener electricity

In order to limit traffic, protect the environment in this most ecologically delicate of places and protect the taxi industry, the local government made it extremely difficult to get a vehicle licence. All sorts of problematic bureaucratic hurdles had to be jumped, and most people ended up using bikes or public transport.

But then in 2016 the powers that be, with a brighter, greener future in mind, decided that anyone could get a licence to own a vehicle, no permit required – as long as it was an electric vehicle.

There was just one condition: the buyer had to have a family.

Given that most people on the islands have relations, that was a pretty easy condition to meet, even for the single folk.

There was a great deal of PR and fanfare about this new initiative: clean, green, sustainable – all that stuff – and a blind eye was turned to the increase in traffic, or of roadkill to the many tame birds on the streets of the island (this is a major problem).

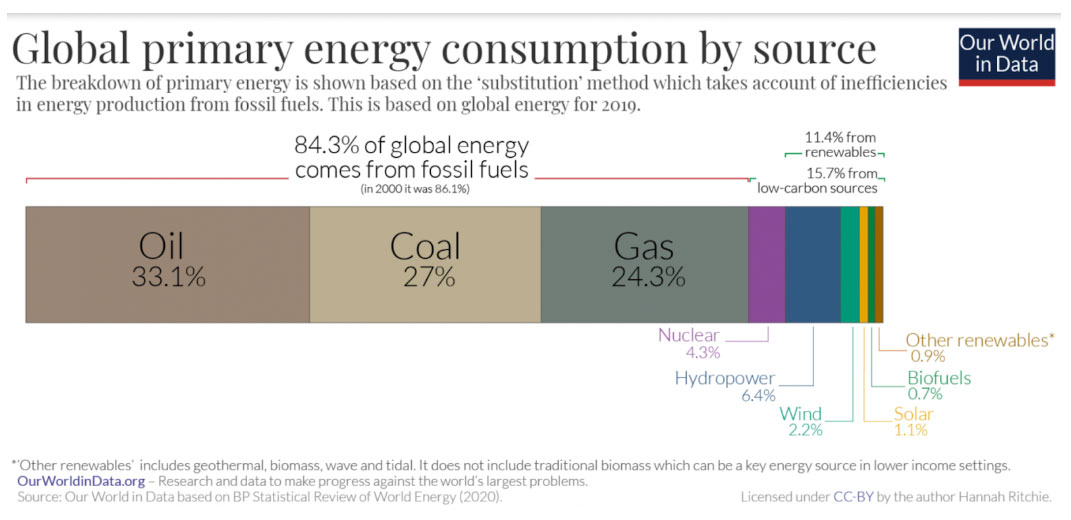

At this point it’s worth reminding ourselves that there are, around the world, three main areas of energy consumption – transportation, heating, and electricity. While cleaner forms of energy, such as nuclear or wind, might be increasing as sources of electricity, 84% of global energy still derives from the burning of fossil fuels, as the graphic below from Our World In

Data shows.

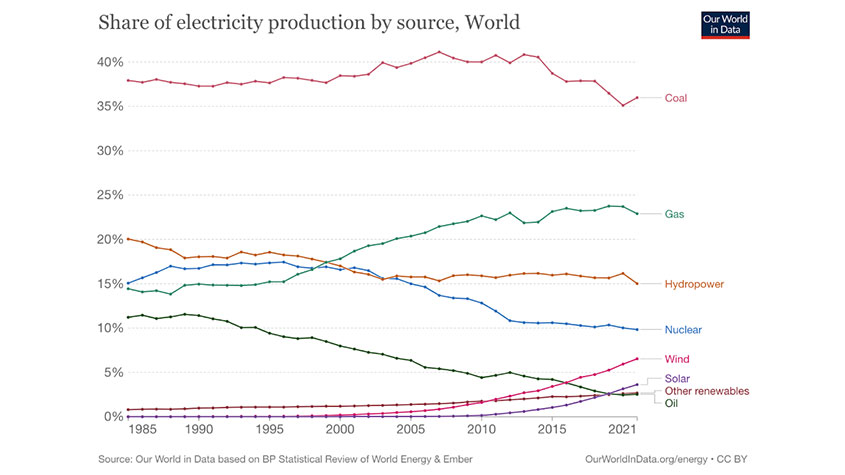

Even electricity, despite its green credentials, still relies on fossil fuels. The burning of the fossil fuel may be out of sight and, therefore, out of mind, but over 60% of global electricity still derives from it, as our second graphic shows.

Wind and solar power between them account for barely 10%.

As we are all now discovering to our cost, despite many years of considerable investment, some might say over-investment, in green energy, there have, simultaneously, been many years of underinvestment in fossil fuel exploration and extraction, nuclear power (the use of which in electricity has, on a relative basis, been declining since the 1990s) and public grids. Hence the current energy shortages especially in Europe.

The Galapagos Islands followed the international trends in this regard – which is one reason this story makes for such an interesting case study.

“Green” energy isn’t always so green

Here on the Galapagos Islands, the majority of electricity, despite what you may read, is produced by burning diesel. And at this point we deviate to story number two: the Galapagos wind turbines.

There were, once upon a time, some wind turbines built by a consortium of overseas energy corporations, looking to advertise their green credentials to the world. Said corporations conducted a one-year study of wind on the island and concluded that next to the airport, where they would also conveniently be seen by everyone arriving at and leaving the islands, was the best place to erect the turbines. The turbines were duly installed, the publicity was had – here is the world’s first airport that runs 100% on wind and solar, all that stuff – and the energy companies retired back to their nation states.

It turned out that year of the study had been an outlier for winds, and they hadn’t built the turbines in anything like the windiest spot.

Then the wind turbines stopped working, but nobody on the islands knew how to fix them. Nor was it clear whose responsibility they were.

Ever since, the turbines have sat there, stuck – even when the wind is blowing up a storm. Ask a local for the story, and you’ll get a wry shake of the head and a smile at the stupidity of it all. Lord knows how much fossil fuel was burnt mining the necessary materials, manufacturing the turbines, transporting them to the islands and erecting them, only for them not to work, but that is, despite the good intention, what has happened. There they remain, motionless, like statues from a fallen empire. But how now to get rid of them?

The episode is neither clean, green nor sustainable.

The laws of unintended consequences

So back to the attempt to make the islands greener with electric vehicles (EVs).

With the easing of regulation in 2016, the locals who had previously wanted a vehicle but couldn’t get one (a lot) piled in and bought electric vehicles, much to the benefit of the EV manufacturers.

But as diesel is the major source of electricity on the islands, so more diesel than ever was now burnt. Again, neither clean nor green.

In fact so much diesel got burnt, and so much electricity was consumed, that the shortcomings of the grid and the lack of investment therein were exposed. Power outages soon followed. Multiple and regular.

The power outages got so bad that just three years after the EV fanfare, in 2019 a moratorium on electric vehicles was discreetly declared – no fanfare this time – and the islands went back to their old ways.

We still need fossil fuels

I can’t help thinking that the West is travelling a similar path. As consumers, encouraged by the green credentials, adopt more electric vehicles, has there been a concomitant investment in power grids to meet the new demand? In many – dare I say most? – countries there hasn’t. What proportion of this rising new electricity demand will entail more burning of fossil fuel, coal especially? Will there be power outages as a result?

It’s stupid to expect us to consume less energy. As civilisations progress, they consume more energy. They also get better at consuming energy. A civilisation that consumes less energy is a civilisation in recession and decline.

We should not be advocating the consumption of less energy, but advocating the better and more efficient consumption of energy, and that means we have to invest in the exploration and production of fossil fuels.

How else is the developing world to pull out of poverty without the benefits of fossil fuels?

The International Energy Agency (IEA) forecast in 2020 in its World Energy Outlook that growth in global oil demand will only end in 10 years and that “global natural gas demand growth might stop around 2040”. Those two landmark years – 2030 and 2040 – are not when we stop using oil and gas, just when the demand for them stops increasing. (And they are probably optimistic forecasts).

That means that, to meet demand, not only do we have to maintain oil and gas production at current levels, we have to increase them – or prices will go a lot higher. That means greater investment in coal, oil and gas is required. And that means this bull market is far from over.

The whole narrative needs to change, as it is slowly starting to do.

There have been at least ten years of underinvestment in coal, oil and gas – partly because of the excesses of the last secular bull market and partly because of the powerful anti-fossil fuel story. That now needs to be corrected.

There is also now a strong case for a reversion to traditional vehicle manufacturers, as opposed to the likes of Tesla. But that’s a subject for another day.

Remember to get your tickets for the MoneyWeek Wealth Summit hosted by Merryn Somerset Webb, on 25 November 2022! – we’ve got some brilliant speakers lined up and, given everything that’s going on, we’ll have an awful lot to talk about.

Book your place now at moneyweekwealthsummit.co.uk

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.