The charts that matter: the US election sends markets… soaring?

The uncertainty surrounding the US election has led many to believe that the Federal Reserve will print even more money. John Stepek looks at how that's affected the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Happy birthday to us! It was MoneyWeek’s 20th birthday earlier this week (our very first issue came out on 4 November 2000, slap bang in the middle of another disputed US election).

While everyone is focused on the short term of who will be president, we’re looking well ahead of that – to what will be the biggest investment themes of the next 20 years. We talk about everything from Britain’s green revolution to quantum computing to the five funds to buy and hold for the next two decades.

We’ve also got the verdict on our five questions for 2040 – thank you so much for all of your contributions, and judging by your answers, the one thing you’re all convinced of is that cash is on its way out. You can read the full results in the 20th anniversary issue, out now.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you haven’t already subscribed, now really is an excellent time to do so – you can get your first six issues free here.

Even more excitingly, Merryn recorded a 20th birthday video interview with none other than Jim Mellon, a man who contributed a multi-bagger share tip to our very first issue. Find out what he’s buying now and what he thinks will be the biggest trends of the next two decades by watching the video right here.

We have not one but two podcasts for you this week. In the first, Merryn talks to Pictet’s Alain Caffort about the appeal of family businesses, and which he feels are the most promising today.

And I was lucky enough to speak to one of our colleagues over in the States – Jim Patterson of The Kiplinger Letter – to get his expert view on the US election, what happens next, and what it all means for the longer term, including America’s relationship with China and the potential for civil disorder.

One thing that seems very likely is that government spending on both sides of the Atlantic is going to rise a great deal in the coming months. So you might start hearing the word “deficit” a great deal. Make sure you’re prepared – get the full rundown on deficits, what they are, and why they matter (and why some people think that in fact, they don’t matter) in our new “Too Embarrassed To Ask” explainer video.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Why you might want to add emerging market debt to your portfolio

- Tuesday: Does politics matter for investors?

- Merryn’s blog: Stakeholders or shareholders – where should capitalism’s focus be?

- Wednesday: Another shock US election result – who could have guessed this might happen?

- Thursday: Who is the Bank of England’s new £150bn of money printing really aimed at?

- Friday: The US election is a mess – and markets everywhere love it

Now for the charts of the week.

The charts that matter

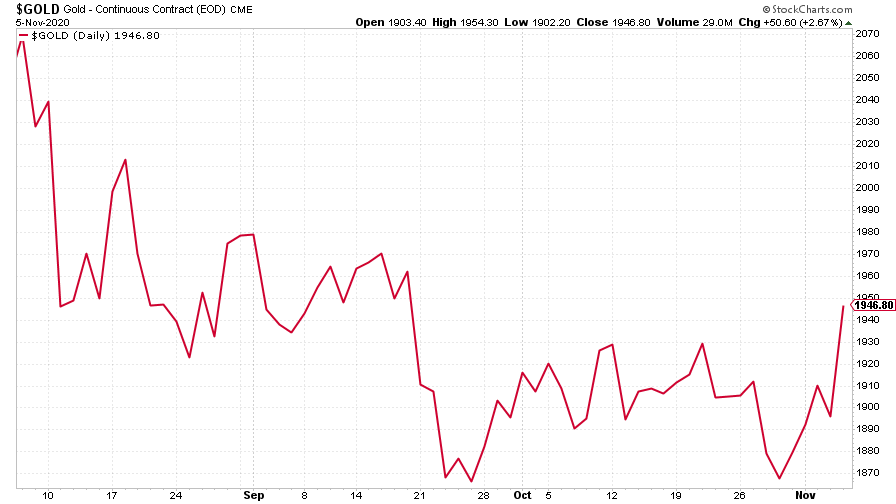

Gold had a rapid rebound this week as the uncertain result on the US election gave way to a certain amount of conviction in markets that this will mean the Federal Reserve has to do even more money printing. The US dollar slipped back and gold rose substantially.

(Gold: three months)

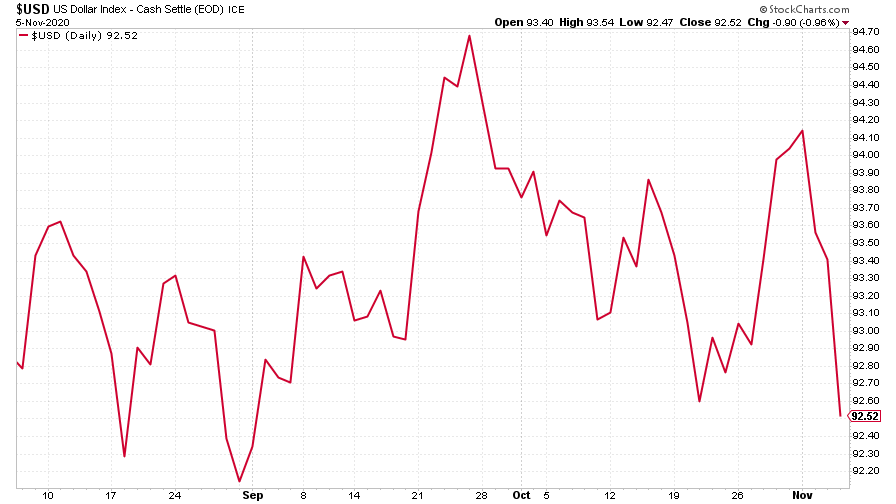

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) saw a pretty steep fall this week...

(DXY: three months)

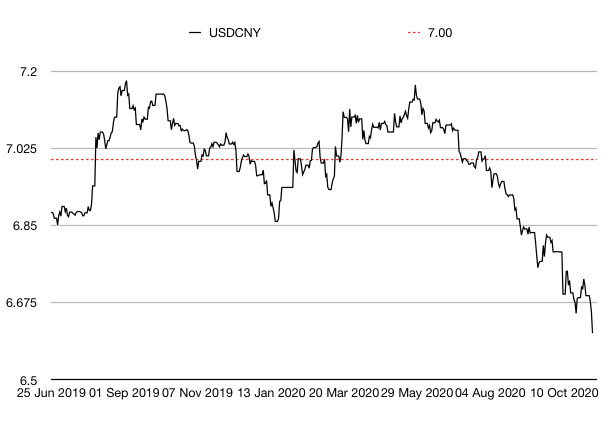

… and as a result, the Chinese yuan (or renminbi) strenghtened against the US currency (when the black line below rises, it means the yuan is getting weaker vs the dollar).

(Chinese yuan to the US dollar: since 25 Jun 2019)

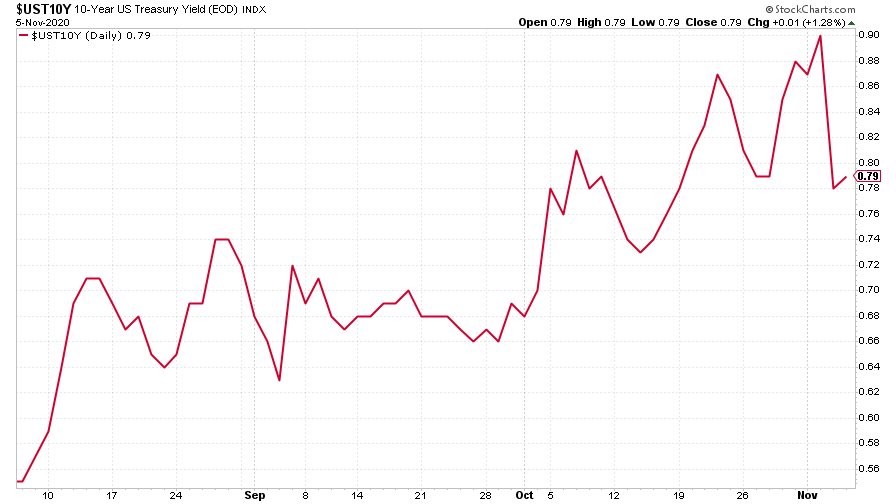

The yield on the ten-year US government bond slipped back this week after reaching its highest level in a few months.

(Ten-year US Treasury yield: three months)

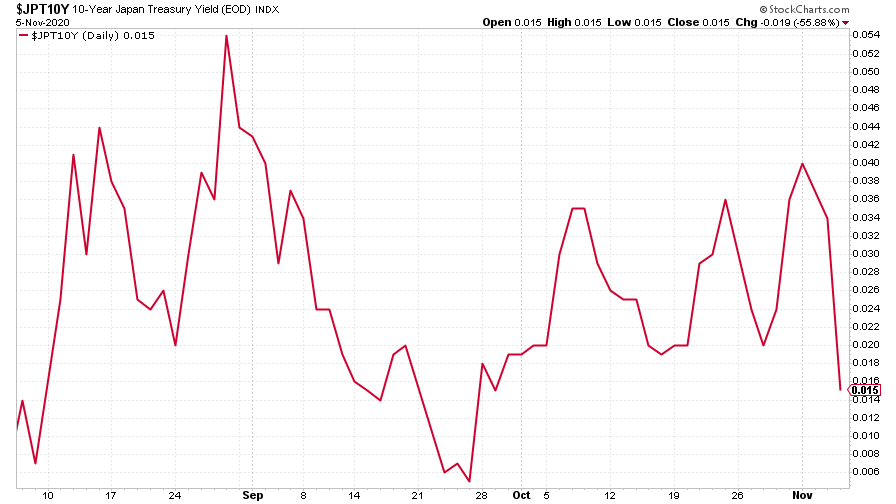

The yield on the Japanese ten-year remained pretty much where it always is – very near to zero.

(Ten-year Japanese government bond yield: three months)

The yield on the ten-year German bund was barely changed.

(Ten-year Bund yield: three months)

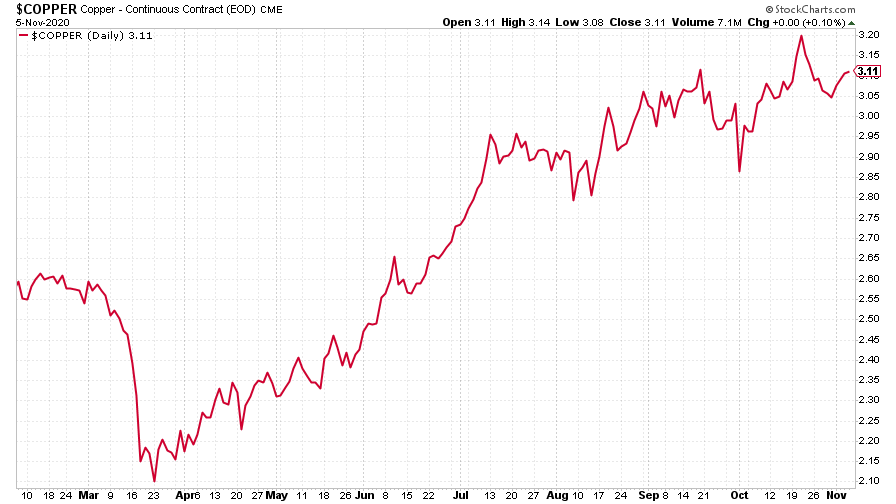

Compared to other risk assets, copper actually had a pretty mediocre week, rising gently compared to last week.

(Copper: nine months)

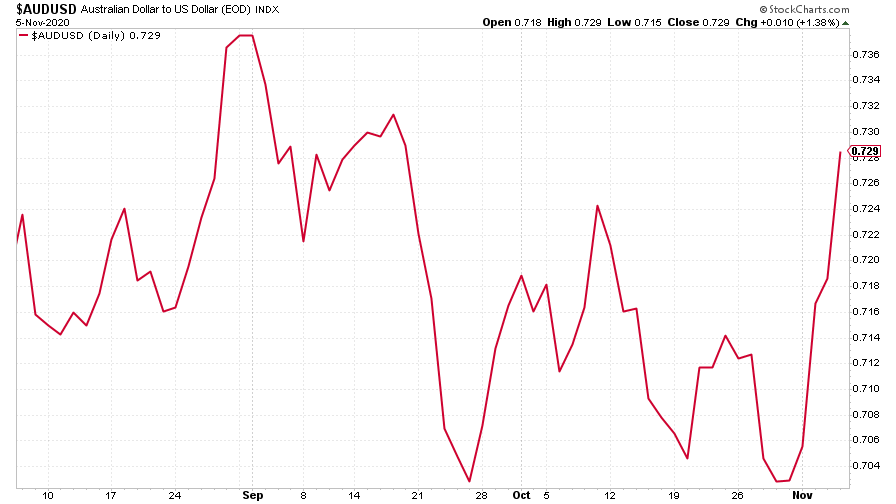

The Aussie dollar surged against its American counterpart as the latter declined.

(Aussie dollar vs US dollar exchange rate: three months)

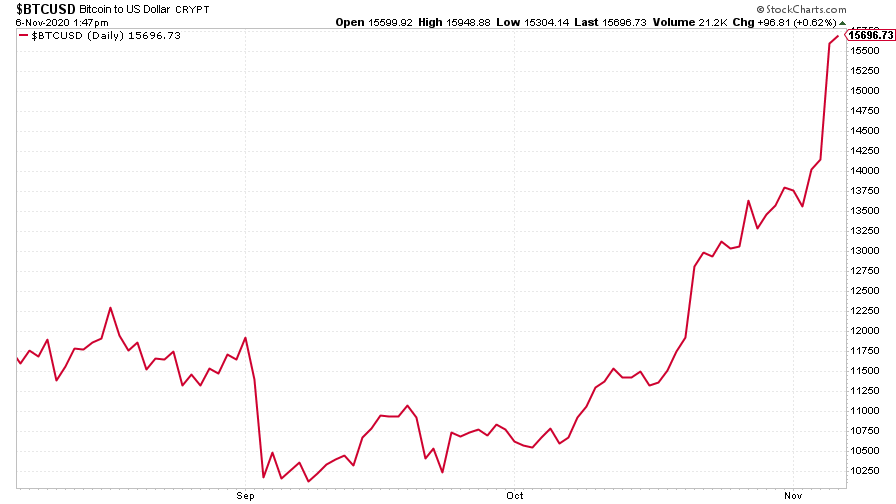

Cryptocurrency bitcoin had an extraordinarily good week. It’s hard to pin down exactly what drives bitcoin but it certainly seems to like the idea that inflation might take off and that investors will seek safety in scarce assets. But perhaps more importantly than that is human nature. Bitcoin now has a demonstrable history of boom and bust and boom, so when it starts to move, ever-increasing numbers of people are going to pile in to make sure they don’t miss out on the next big wave.

(Bitcoin: three months)

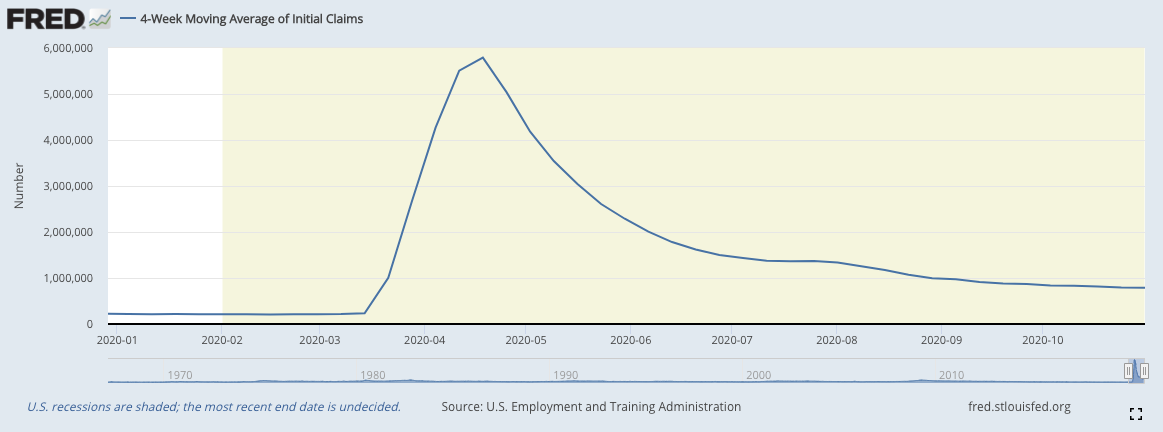

US weekly jobless claims came in at 751,000 which was a little lower than last week (which was revised higher to 758,000). The four-week moving average came in at 787,000 from 791,000 (revised a little higher) previously.

Meanwhile, non-farm payrolls data for October revealed that 638,000 new jobs were added last month. That was a bit better than expected but not massively out of line with most analysts’ expectations, and as a result, didn’t do much to move the market, although the overall unemployment rate was a good bit lower than expected at 6.9%.

(US jobless claims, four-week moving average: since Jan 2020)

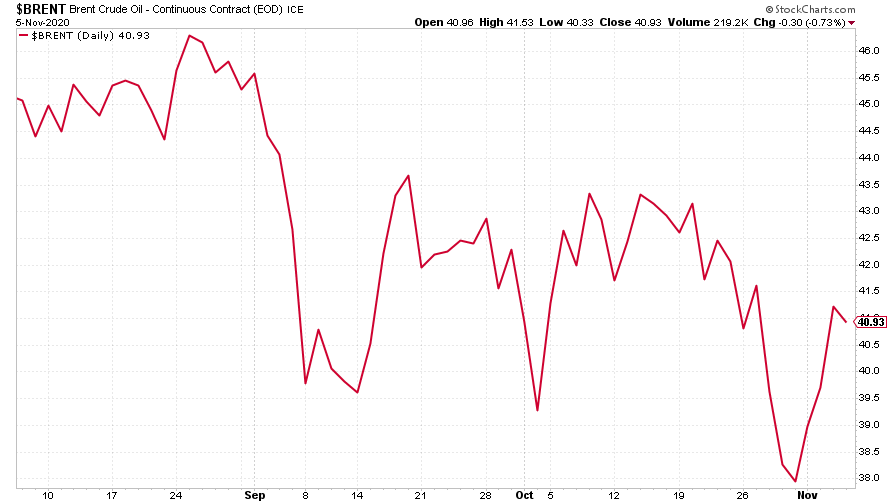

The oil price (as measured by Brent crude) rebounded somewhat this week as Russia and Saudi Arabia both made noises about continuing with existing production cuts.

(Brent crude oil: three months)

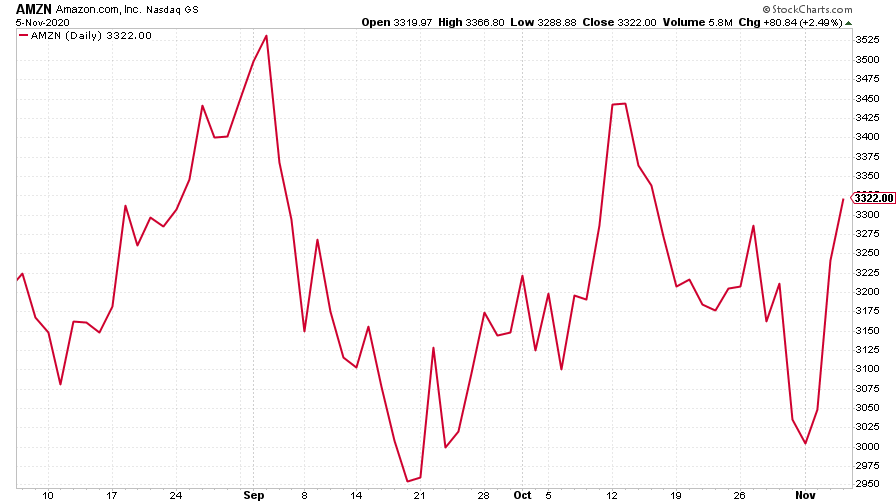

Amazon enjoyed a strong rebound this week, partly in line with wider markets and also due to a perception that a gridlocked US government represents less of a threat to Big Tech than one party or another having control.

(Amazon: three months)

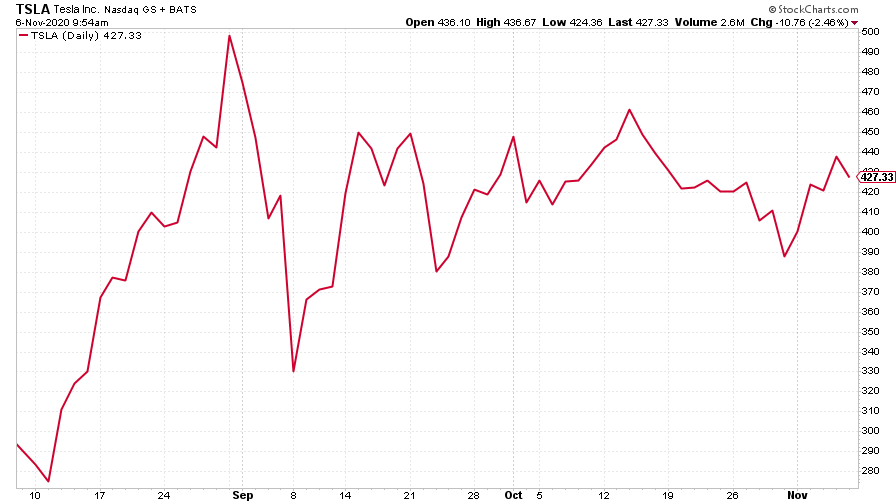

Tesla had a pretty tame week all things considered, ending the week a little bit higher.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.