Another shock US election result – who could have guessed this might happen?

Despite predictions of a clear cut Biden victory, it could be weeks before we get a decisive result in the US election. John Stepek explains how it could affect your investments.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Gosh. A surprise election result. Who could've seen that coming?

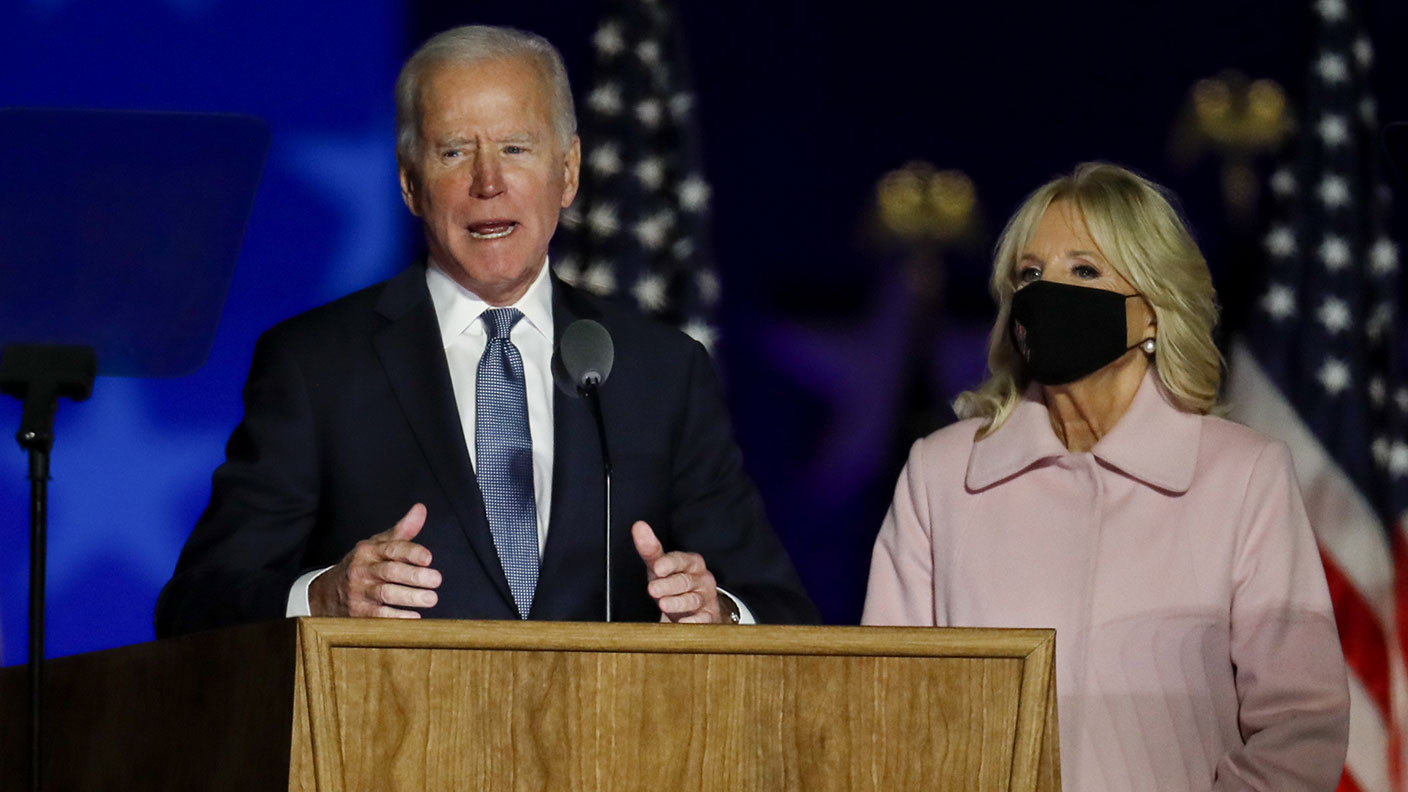

Turns out that Joe Biden didn’t win a landslide. For all we know, he might not have won anything.

I was hoping that this morning we’d be able to put all this unpleasantness (by which I mean, our obsession with US politics) behind us.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Apparently not.

Fiscal stimulus might not be as quick to arrive as markets had hoped

As I write this morning, it looks as though we’re not going to know who’s won the US election for a while.

Donald Trump has already said that he’s won. Joe Biden has also said that he thinks he’s going to win. There are loads of ballots still to count in various key states (this is one of the many elements of the US system that baffles me).

Whoever ends up winning on paper, we’re almost certainly going to see legal challenges. We’ll now be on edge about civil unrest, rogue headlines, angry recriminations on all fronts, and the minutiae of the voting systems of individual states for days, possibly weeks, maybe months. It’s like an angrier version of Bush vs Gore in 2000. In other words, from an uncertainty point of view, this is your worst-case scenario.

What does it all mean for markets though? The real issue for markets right now is not the question of unrest, or any of the other more overtly political issues that the pundits will be throwing about for the next few weeks. It’s not even mostly about who ends up being president. The real issue for markets is this: they’ve been hoping for a reflationary blast of refreshing fiscal stimulus, all funded merrily by the Federal Reserve under Jerome Powell.

Powell, along with the rest of the world’s central bankers, has made it very clear that money is there to be had. Governments just need to ask. And it seemed a sure thing that whoever won – Democrats or Republicans – there’d be an appetite for that extra spending. Democrats wanted a “Green New Deal”, while Trump is hardly known for his fiscal rectitude.

But now it looks as though no one party will be entirely in charge. That means they need to compromise and deal with one another to get any sort of big “stimulus” deal pushed through Congress. The odds of that seem… slim. As John Authers put it in his newsletter for Bloomberg this morning, “with a Republican Senate, we either have the economic status quo, dominated by monetary policy, under President Trump; or a Biden versus Mitch McConnell dynamic in which fiscal policy would become even more frugal.”

There’s also the concern that this might take a long time to be resolved. While that’s happening, stimulus is definitely not happening.

What does this mean for your investments?

So what does it all mean for your money? In the short term, my advice is not to worry about it. This is all noise. It’s very noisy noise, and obviously it’ll be a lot worse for any of our US readers (my sympathies). But it’s noise. As I’ve said before here, at some point America will have decided on a president.

You might bewail the democratic process, but bear in mind that only 15 years ago or so, we were all moaning that people were disengaged because politicians were all the same. You can’t say that now. Turnouts are huge, and results are tight, and candidates have very different positions to one another. This is what happens when large groups of people disagree over the best way to run a country. Don’t throw democracy out just because it’s working differently to the way you wished it did (although I’ll grant you that the admin side of the US system could do with improving).

In the longer term, the thing that would have the most impact from an investment point of view is any stalling in the handover from central bankers to politicians. What it boils down to is that Jerome Powell and his colleagues may be left propping markets up again.

Can they do that? Well, yes, frankly. There’s always more money to be printed – and who knows? In the absence of more spending from the government, maybe they would contemplate negative interest rates. So I’d expect looser monetary policy in the absence of fiscal policy picking up the slack.

So overall, I wouldn’t be making any changes to your investment plans off the back of this result (or lack of result). Don’t panic, don’t pay too much attention to the news (it's mostly speculation – I listened to three or four reporters in a row on BBC Radio 4 this morning re-state precisely the same point, only using different words), and stick to your plan.

And subscribe to MoneyWeek magazine. We’ll let you know the longer term impacts as and when the result becomes clearer. You can get your first six issues free right here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Can Donald Trump fire Jay Powell – and what do his threats mean for investors?

Can Donald Trump fire Jay Powell – and what do his threats mean for investors?Donald Trump has been vocal in his criticism of Jerome "Jay" Powell, chairman of the Federal Reserve. What do his threats to fire him mean for markets and investors?

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.

-

US inflation rises to 3.7% as energy prices surge - will the Fed hike rates?

US inflation rises to 3.7% as energy prices surge - will the Fed hike rates?US consumer price index rose in August but markets do not expect a rate hike this month

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.