What we can learn from Britain’s surprise vaccine success story

Britain’s response to Covid-19 has been wanting. But we should also learn from what we got right, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In most ways, Britain’s response to Covid-19 has been the most chaotic in the world. We didn’t close our borders when it first started even though, as an island, it would have been relatively simple to control the flow of people. We let the virus escape into care homes. We locked down too late, then lifted restrictions too early. And we never managed to make a track-and-trace system work. The net result? One of the worst fatality rates in the world.

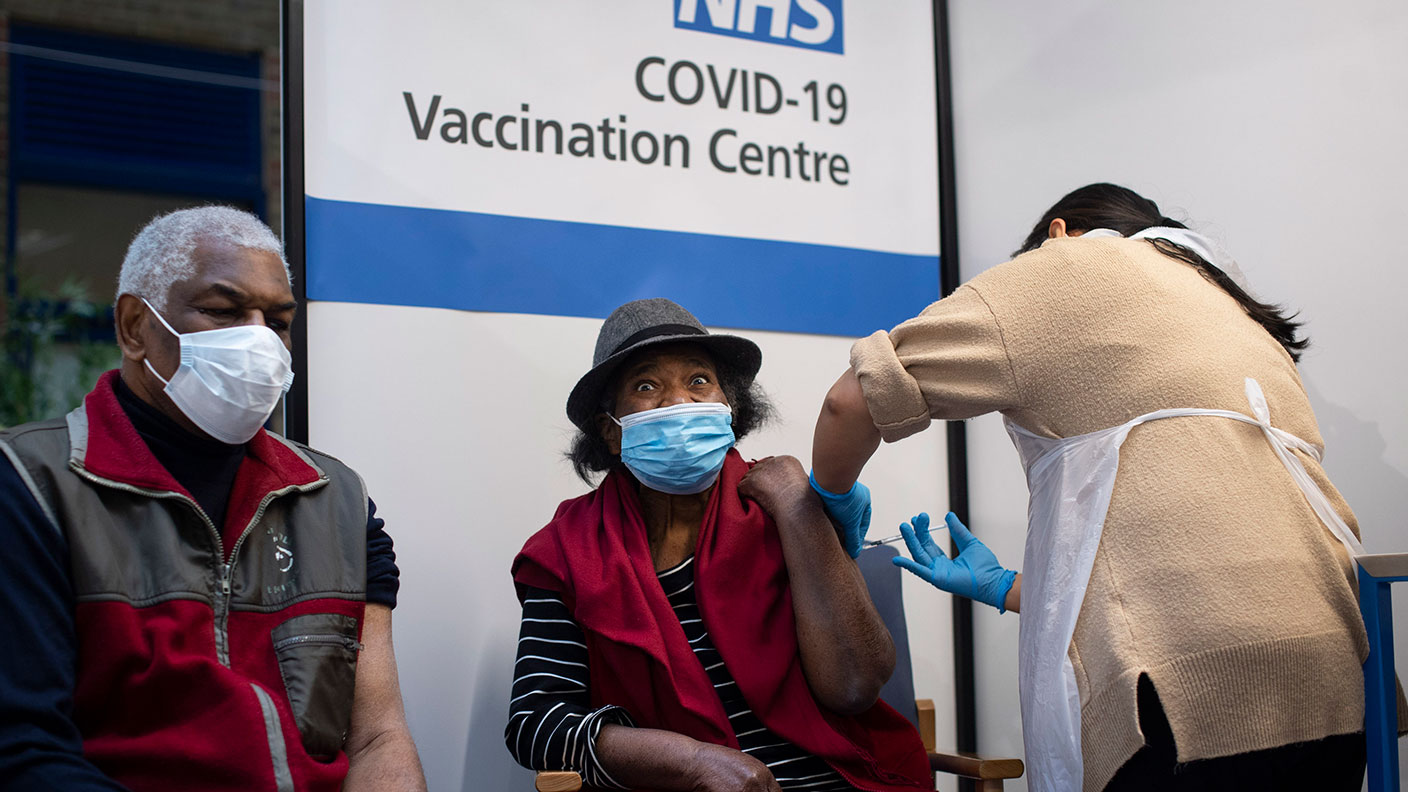

There has, however, been one success. We managed to secure more vaccines than just about anyone, including a home-grown one from Oxford University and AstraZeneca. We approved them earlier and rolled out a rapid plan for getting them into people’s arms. By the start of this week, only tiny, plucky Israel among major countries had done better than we had and the rest of Europe was lagging woefully behind. If vaccines, as we all hope, are the way out of this mess, then Britain’s recovery will be faster than anyone else’s.

That wasn’t inevitable. France has a great tradition in life sciences; Germany has more money and technical expertise and is often more efficient as well. But neither country is close to our vaccination rates. We came up with a great strategy, chose the right people to implement it and committed plenty of money to the programme. That has paid off. There are three lessons for chancellor Rishi Sunak here that could be applied to the rest of the economy.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

1. Reform the state and bring in business

The vaccines programme was run by a venture-capital specialist, Kate Bingham. The civil service, with its reports, committees and inherent cautiousness, was put safely on the sidelines. We collaborated with the companies making the vaccines rather than treating them as an enemy. And we moved quickly when we had to, taking some big risks along the way. True, not all of them paid off. We placed an order for 60 million of the Sanofi-GSK vaccine, for example, in July (just as the EU did), but that stumbled in clinical trials. But by spreading the risk around we secured enough supplies overall. The result? The programme was flexible and innovative, and delivered results. We could use that kind of flair and fresh thinking in lots of other areas, from levelling up the regions, to re-writing regulations now that we have left the EU, to reforming education, welfare and healthcare. Traditional civil servants are fine at keeping the machine ticking over, but they are hopeless at innovating.

2. Spend big where it matters

The vaccine programme made some big bets that look to have paid off. That made sense. Millions spent on vaccines in 2020 was always going to translate into billions in extra output from a swifter recovery in 2021 and 2022. Overall, the UK spent €24 per head of population, and the US spent €25, on pre-ordering vaccines while the EU spent a little over €2. Sure, some of the money was wasted, but that was always inevitable. It is the overall outcome that counts and you can’t expect every experiment to come good. The UK can’t afford to spend unlimited sums on everything, but we could pick one or two key technologies and spend big to make the UK a world leader – in gene-based vaccines, for example, to combat a range of cancers, and in lab-grown meats.

3. Boost British production

The vaccine programme didn’t just pick winners. It invested heavily in ramping up UK production. The Oxford AstraZeneca shot is manufactured at scale in the UK, and so will the Novavax one be when it is approved, as seems likely. A new state-of-the-art vaccine-testing and manufacturing centre is opening soon in Oxfordshire. Over the last 30 years we have let manufacturing wither in the UK. That may have been the right decision for many declining industries such as cars, steel and chemicals, but in a handful of key technologies we can build it up again – especially when we control the key technologies as well. Research and manufacturing expertise in the same country can be a powerful combination.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?