Beefed up government loan scheme brings big help for small firms

The government’s Bounce Back loan package for small businesses affected by the Covid-19 crisis is exceptionally generous.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The government’s latest initiative for cash-strapped small businesses struggling to cope with Covid-19 pandemic went live on Monday and is likely to prove hugely popular.

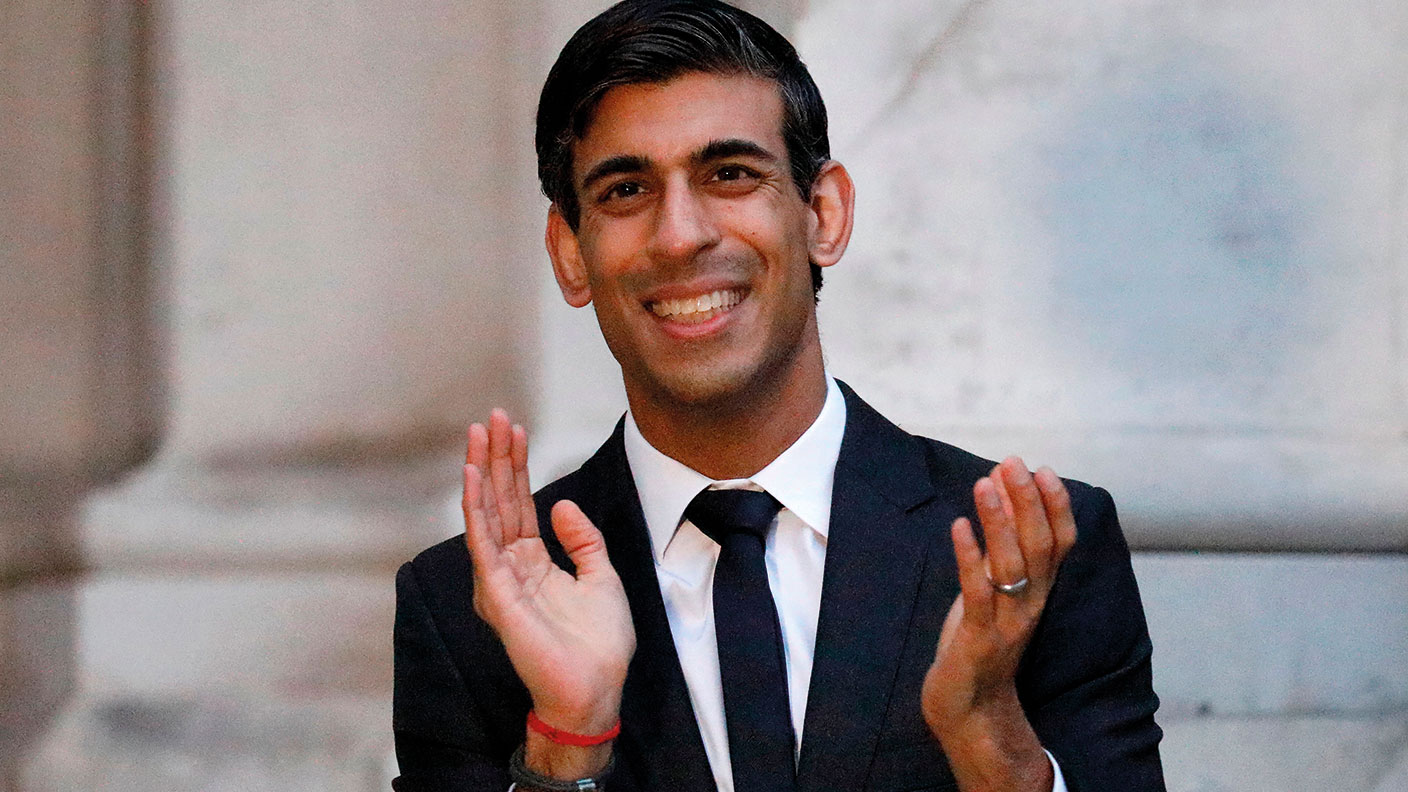

The Bounce Back loans scheme, announced by Chancellor Rishi Sunak, aims to help tens of thousands of small businesses struggling to secure finance from the Coronavirus Business Interruption Loan Scheme (CBILS), which has been criticised as overly bureaucratic and too exclusive.

Administered by the British Business Bank and the same panel of more than 50 lenders participating in CBILS, the terms of the Bounce Back scheme really are exceptionally generous.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Businesses can borrow up to £50,000 at a fixed interest rate of 2.5%, no matter which lender provides the advance (you don’t have to apply to your own bank).

The government guarantees the lender that it will stand behind the loan in full if the business defaults on repayments, which means lenders do not have to waste time conducting credit checks.

Receive your money in days

A simple standardised application form should also mean loans go through very quickly. Cash could be in companies’ accounts within days of their online applications.

Bounce Back loans will be repayable over six years, though early repayments can be made without penalty. There are no repayments to make in the first year and lenders are not allowed to ask for personal guarantees from the company’s directors.

Importantly, while the scheme is aimed at the smallest businesses, the eligibility criteria set no maximum size constraints, whether by number of employees, turnover or balance sheet. Borrowers simply have to certify they are UK-based, that they’ve been adversely affected by the Covid-19 pandemic, that they’re not currently in bankruptcy or liquidation and that they’re not making use of any other Covid-19-related government loan scheme.

The upshot is that for any business in need of less than £50,000 to see them through the Covid-19 crisis, the Bounce Back scheme is head and shoulders above any of the government’s other initiatives, including CBILS.

And even if you think you may need more than that in the end, Bounce Back is worth considering in the short term; it’s possible that you’ll be able to convert the loans into a CBILS facility later on.

Equally, CBILS loans of less than £50,000 can now be converted into Bounce Back finance, which is likely to be a good option for most borrowers.

Flagship grants scheme flagging

The government’s flagship grants scheme for retail, leisure and hospitality businesses was supposed to provide speedy cash payments to thousands of struggling small companies in these sectors. But more than five weeks after the scheme was announced, many have not received the money they were promised because the local authorities administering the grants are dragging their heels.

In March, Chancellor Rishi Sunak said he was awarding £20bn to local authorities to provide non-repayable grants to crisis-hit retailers, leisure companies and hospitality providers. He promised a grant of £10,000 for businesses in premises with a rateable value of up to £15,000, rising to £25,000 for those in properties with a rateable value between £15,000 and £51,000.

But local authorities have yet to hand over more than a third of the cash. In major towns including Nottingham, Sheffield and Manchester, less than half the cash has been distributed. Any business that thinks it is eligible for this support but has yet to hear from its local authority should now take steps to find out when their grant will be paid. The Treasury initially promised that businesses would receive their cash within ten days, providing a valuable lifeline in sectors where large numbers of companies have been forced to close their doors. Speak to your local authority as soon as possible.

However, even if you don’t need finance to survive the crisis, don’t overlook this new scheme. The terms are so good that this could be a valuable opportunity to refinance other types of debt – expensive credit-card borrowing or bank loans, for example – or even to finance investment.

This is legitimate under the terms of Bounce Back. The government says you must have suffered adverse impacts from Covid-19, but not that you must be in so much trouble that you need emergency finance. A business suffering any negative effects at all could therefore take advantage of this cheap finance.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.