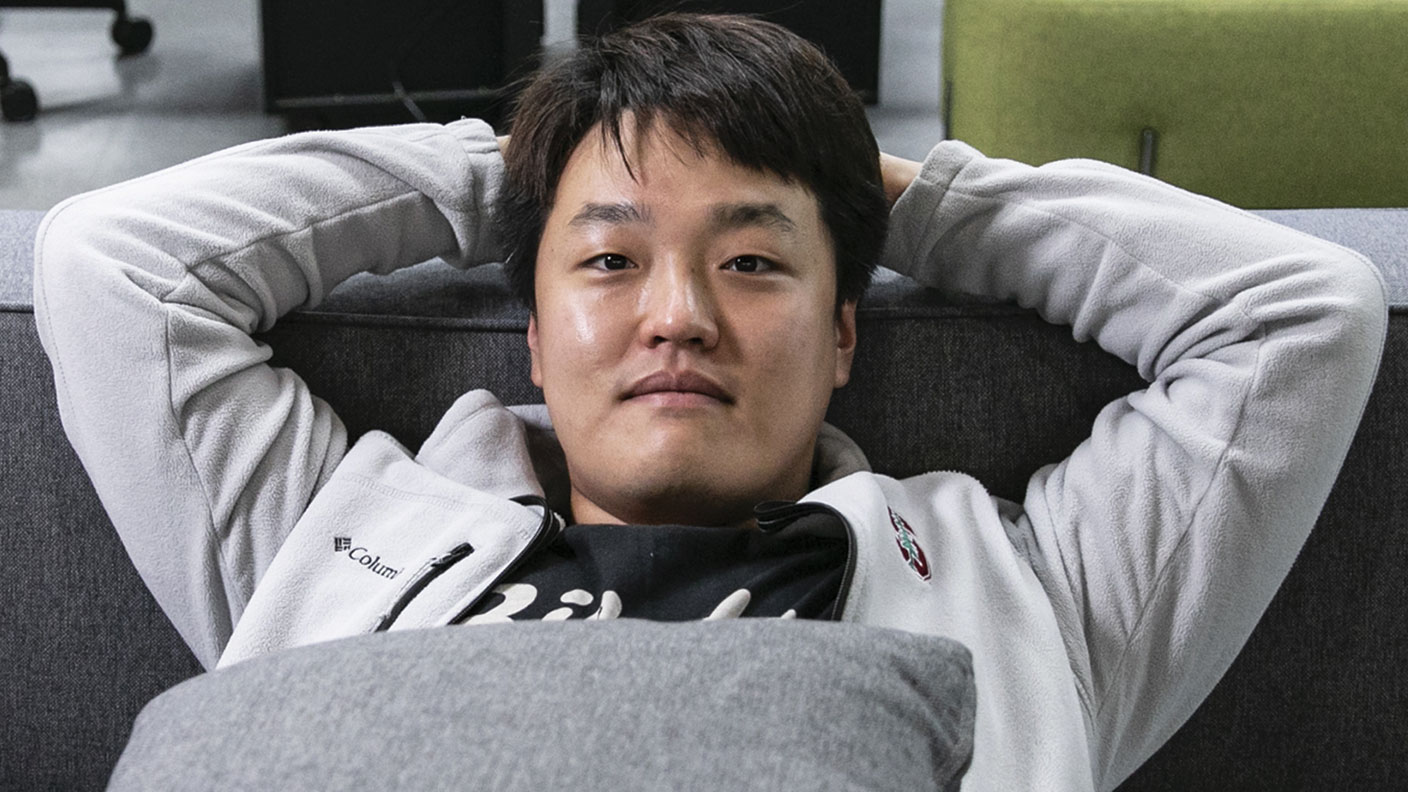

Do Kwon: the King of Crypto Lunatics

Cryptocurrency entrepreneur Do Kwon liked to ruffle feathers and stir things up in his industry. But the collapse of his empire has left investors desperate and angry.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

“Right now, my role in the crypto industry is a little polarising,” observed Korean entrepreneur Do Kwon in April. “Because, you know, we’ve been making a lot of big moves. And that ruffles some feathers.”

Back then the so-called “King of Lunatics” was riding high, thanks to the soaring value of two cryptocurrencies: Luna and its sister “stablecoin”, TerraUSD. Kwon’s vision was to create a stable digital “ecosystem” free from “the tentacles of Wall Street and government regulators”, says Bloomberg.

Boosted by the endorsement of crypto heavy-hitters such as Mike Novogratz of Galaxy Digital, he appeared to be succeeding: an influx of retail investors helped push Luna’s price to an all-time high of $116 and the overall Terra universe evolved into one of the biggest blockchain projects to date, with billions of dollars tied up in it.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The death spiral begins

Some critics likened it to “a ginormous Ponzi scheme”. The jury’s still out on that. But the devastating effect when both Luna and TerraUSD plunged into a market “death spiral” last week was arguably the same. “As the collapse of the Terra ecosystem” entered “its final, definitive stages”, signs of the real-world wreckage were impossible to miss, says CoinDesk. Luna backers globally reported “huge losses, despair and hopelessness”.

In Kwon’s home city of Seoul, there were fears of a rash of suicides prompting local police to strengthen patrols around key bridges as a preventative measure, reported The Korea Economic Daily. The fear extended to Kwon’s own household. His wife reportedly sought police protection after an unidentified man broke into their apartment building.

As Kwon, 31, surveys the wreckage of his nascent empire, he might reflect that “there have been few falls as sudden and humbling in business history”, says CoinDesk. It was certainly “the largest destruction of wealth… in a single project in crypto’s history”, says Charles Hayter of analytics firm CryptoCompare. At the start of last week, the project’s market capitalisation was $41bn. By Monday of this week, Luna’s value was zero; Terra was trading at $0.11.

Kwon’s ascent was as rapid as his decline. After attending Daewon Foreign Language High School in Seoul, he won a place at Stanford University to major in computer engineering, says The Korea Economic Daily. Jobs at Microsoft and Apple followed, but Kwon was increasingly hooked by the crypto craze and, in 2018, he returned to South Korea to found Terraform Labs with a fellow entrepreneur, Ticket Monster founder Shin Hyun-sung.

The pair quickly won backing for their idea of launching an “algorithmic” stablecoin – pegged to the US dollar but, unlike traditional stablecoins, not backed by dollar assets. The plan instead was to create a sister currency, Luna, whose fluctuations would help maintain the peg. An early investor was Dunamu, which operates South Korea’s largest crypto exchange.

Puerility is a red flag

Online, Kwon seemed “to relish stirring up trouble” with a persona built on “combative and at times puerile tweets”, says Bloomberg. He raised a “figurative middle finger” at SEC regulators and often dismissed critics as “cockroaches”. With hindsight, Kwon’s “vitriol” was “a huge red flag”, says CoinDesk.

So too, perhaps, was his hidden history – it emerges that he was “one of the pseudonymous co-founders of the failed algorithmic stablecoin Basic Cash, which crashed in 2021. “Now history seems to be repeating.” At the end of last week, Kwon broke his silence and apologised to Luna and Terra investors. “I am heartbroken about the pain my invention has brought on all of you.”

That may not be enough to stop a deluge of likely lawsuits and possibly criminal investigations.

Did Kwon really believe in his project, or was this “a lengthy and complex deception”? There’s still a good deal of unravelling to be done.

SEE ALSO:

The biggest threat to crypto comes from stablecoins

Why has the Terra stablecoin broken its US dollar peg and should you care?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

VICE bankruptcy: how did it happen?

VICE bankruptcy: how did it happen?Was the VICE bankruptcy inevitable? We look into how the once multibillion-dollar came crashing down.

-

What is Warren Buffett’s net worth?

What is Warren Buffett’s net worth?Warren Buffett, sometimes referred to as the “Oracle of Omaha”, is considered one of the most successful investors of all time. How did he make his billions?

-

Kwasi Kwarteng: the leading light of the Tory right

Kwasi Kwarteng: the leading light of the Tory rightProfiles Kwasi Kwarteng, who studied 17th-century currency policy for his doctoral thesis, has always had a keen interest in economic crises. Now he is in one of his own making

-

Yvon Chouinard: The billionaire “dirtbag” who's giving it all away

Yvon Chouinard: The billionaire “dirtbag” who's giving it all awayProfiles Outdoor-equipment retailer Yvon Chouinard is the latest in a line of rich benefactors to shun personal aggrandisement in favour of worthy causes.

-

Johann Rupert: the Warren Buffett of luxury goods

Johann Rupert: the Warren Buffett of luxury goodsProfiles Johann Rupert, the presiding boss of Swiss luxury group Richemont, has seen off a challenge to his authority by a hedge fund. But his trials are not over yet.

-

Profile: the fall of Alvin Chau, Macau’s junket king

Profile: the fall of Alvin Chau, Macau’s junket kingProfiles Alvin Chau made a fortune catering for Chinese gamblers as the authorities turned a blind eye. Now he’s on trial for illegal cross-border gambling, fraud and money laundering.

-

Ryan Cohen: the “meme king” who sparked a frenzy

Ryan Cohen: the “meme king” who sparked a frenzyProfiles Ryan Cohen was credited with saving a clapped-out videogames retailer with little more than a knack for whipping up a social-media storm. But his latest intervention has backfired.

-

The rise of Gautam Adani, Asia’s richest man

The rise of Gautam Adani, Asia’s richest manProfiles India’s Gautam Adani started working life as an exporter and hit the big time when he moved into infrastructure. Political connections have been useful – but are a double-edged sword.