Summary

- The rate of UK inflation slowed to 2.5% in December in a surprise drop, down from 2.6% in November.

- Most analysts were expecting inflation to either hold steady at 2.6% or rise to 2.7%.

- The headline figure comes as good news to chancellor Rachel Reeves who has been dealing with the fallout from a gilt market crisis in recent days.

- Easing restaurant and hotel costs were a big driver of the change in the annual rate in December. They are still rising, but at the slowest pace since July 2021.

- This was partially offset by the effect of transport costs. Although this category is in deflation mode, prices are falling more slowly than they once were.

What does the latest inflation news mean for interest rates, households, savers and investors? Scroll for full analysis as it happened.

| What is inflation? | CPI versus RPI inflation | Inflation release dates |

Good afternoon, and welcome to MoneyWeek’s inflation live blog. This is Katie Williams and Dan McEvoy, reporting live ahead of tomorrow’s report.

It has been a whirlwind start to the new year for the UK economy. Just two weeks into January, higher inflation expectations have caused government bond yields to surge, prompting a crisis in the gilt market.

Some are even calling for chancellor Rachel Reeves to step down – although opinions diverge on whether the Autumn Budget or political developments in the US are more to blame.

Will there be better news tomorrow?

Reeves returned from a trip to China yesterday and is expected to address Parliament after 12.30pm today

Inflation forecast

Economists at Deutsche Bank expect inflation to come in at 2.68% in December, which would be rounded up to 2.7% by the Office for National Statistics (ONS).

Experts at Hargreaves Lansdown also expect the headline figure to inch up.

“Prices at the pumps ticked higher over the month, while food price inflation jumped to 3.7% in December, the highest level since March,” says Susannah Streeter, head of money and markets at the investment platform.

Not all experts agree though. Morningstar has indicated the figure is more likely to remain flat at 2.6%, based on FactSet consensus estimates.

Inflation has fallen considerably from its peak – what’s next?

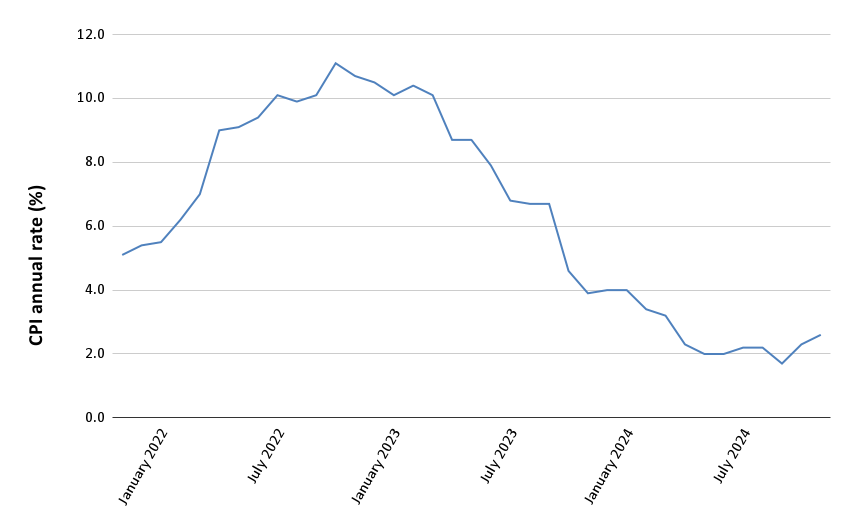

The rate of UK inflation has slowed considerably from its peak of 11.1%, reached in October 2022. However, new pressures now loom large on the horizon.

For example, employer National Insurance contributions will rise in April after changes announced in the Autumn Budget. The National Living Wage will also rise by 6.7%. Many businesses are planning to pass these higher staffing costs on to customers by putting their prices up.

Wide-ranging tariffs could also be imposed by incoming president Donald Trump if he follows through on his threats. This could disrupt supply chains, creating further costs for businesses.

Consumer Prices Index

To (mis)quote Shakespeare, the course of disinflation never did run smooth.

Reeves is currently in Parliament, where she is being challenged on the gilt market crisis and her decision to continue with a trip to China last week. Read the latest analysis on our gilt market blog.

What is the long-term inflation outlook?

The Office for Budget Responsibility (OBR) has said it expects inflation to average out at 2.6% in 2025. It then expects it to fall to 2.3% in 2026, 2.1% in 2027, 2.1% in 2028 and 2% in 2029.

These OBR figures were published alongside the Autumn Budget in October, but could change if factors on the global stage cause increased geopolitical volatility. Upside risks include Trump’s potential tariffs and an escalation in the Middle East.

What has Trump got to do with UK inflation?

Longer term, economists have warned that policies from the incoming president could push global inflation higher. Let’s take a closer look at how US policies and UK economics are linked.

“US exporters are likely to be hit by higher tit-for-tat duties if Trump introduces widespread tariffs. It’s likely that a fresh round of trade wars will be inflationary as the higher tariffs feed through to higher prices,” says Streeter.

Indeed, many UK businesses operate globally, importing and exporting goods. If tariffs disrupt international supply chains, it will almost certainly result in higher costs for businesses, which may be passed on to customers in turn.

Tariffs could also result in a stronger dollar, which would add to inflationary woes. “Many imports bought on wholesale markets are priced in dollars,” Streeter explains, “which will be more expensive if the greenback takes on more muscle”.

President-elect Donald Trump will be sworn into office on 20 January and has previously threatened to impose tariffs from "day one"

What is the difference between CPI and RPI?

CPI is the official measure of inflation monitored by the Bank of England, but another widely-quoted measure is the Retail Prices Index (RPI). RPI used to be the UK’s official measure until 2003. It tends to track higher than CPI because it includes costs associated with home ownership.

Where RPI does still have relevance is when it comes to setting cost increases for some bills and services. For example, it is used by the government to set annual rail ticket price increases. It is also used to set levies like road tax. Your phone and internet bills could well be linked to RPI too.

RPI came in at 3.6% in November. December’s figure will be released alongside the latest CPI figures tomorrow.

Where are core and services inflation heading?

Both core and services inflation are closely watched by the Bank of England.

Core inflation strips out volatile categories like energy, food, alcohol and tobacco, which allows it to give a more stable picture of the long-term inflation trend. Meanwhile, services inflation tracks price changes in the services sector, which accounts for around 80% of the UK economy.

Deutsche Bank expects core inflation to come in at 3.48% tomorrow, and services inflation to come in at 4.86%. These figures would be rounded to 3.5% and 4.9% by the ONS. This would leave core inflation unchanged compared to November (3.5%), but would constitute a downward movement for services inflation (5%).

Why is services inflation so important?

As introduced previously, the services sector is the biggest part of the UK economy. As a result, tracking price changes in this area can help us understand how embedded inflationary pressures are on a domestic level.

The Bank of England wants to see further disinflation in the services sector before cutting rates dramatically. Services inflation is still coming in quite hot.

Governor of the Bank of England, Andrew Bailey

Outlook for services inflation

It is possible that services inflation will experience a meaningful slowdown this spring.

As the economists at financial institution ING have pointed out, a large part of the services basket is affected by annual changes in index-linked prices. This includes things like your phone and internet bills. Price hikes generally come into play in March or April, and are often tied to CPI or RPI.

As the overall rate of inflation is considerably lower now than a year ago, bill hikes this year are likely to be less dramatic than last year. This should feed through to the headline services inflation figure.

Energy prices could surge higher in the spring

Although services inflation could slow down in the spring, the tug of war between different parts of the basket will continue. Energy prices are expected to rise further, for example.

The latest forecast from consultancy Cornwall Insight suggests the Ofgem price cap could surge by as much as 3% in April. Experts are blaming geopolitical instability, price cap reforms, and uncertainty over US liquified natural gas exports under a second Trump presidency.

Energy bills are expected to rise again in the spring, after surging 10% in October and 1.2% in January

Airfares and hotel costs “weaker” in December

Deutsche Bank’s chief UK economist Sanjay Raja says airfares and hotel costs probably weakened in December. This could contribute to a slowdown in the rate of services inflation. This is good news for consumers looking to book a flight or UK getaway. It is unlikely to mean much to the Bank of England, though.

In their extensive analysis on services inflation, the economists at ING have pointed out that some categories matter less than others. Airfares (which are notoriously volatile) are one such example.

Based on this analysis, the group has created its own metric – “core services inflation” – which strips out certain items. The good news is that ING expects this measure to get close to 3% this spring when things like phone and internet bills come down.

What’s next for UK interest rates?

In recent weeks, markets have been adjusting to the realisation that interest rates could stay higher for longer. It is unsurprising given inflationary risks have picked up – think higher energy prices, UK Budget fallout, and Trump’s tariffs. Gilt yields have surged as a result, creating a real headache for Reeves.

There are still several factors at play, though. If Reeves is forced to cut spending or raise taxes further (an attempt to balance the books in light of higher borrowing costs), it could dampen UK growth.

Tariffs from Trump could also have a negative impact on UK GDP, if production slows as a result of supply chain disruption.

In Streeter’s view, a scenario like this could prompt the Bank of England to cut interest rates a little faster than markets are currently expecting. Indeed, it is worth remembering that the Bank of England has a dual mandate. As well as controlling inflation, it is responsible for supporting economic growth.

Markets are now forecasting fewer rate cuts in 2025 than previously expected. Are they being overly bearish?

What does it mean for your personal finances?

Mortgage rates have increased slightly in recent days in response to the volatility in bond markets. Mortgage rates are closely linked to gilt yields, which have surged higher in response to new inflation risks. The average two-year fixed mortgage rate is now 5.49%, according to Moneyfacts. The average five-year rate is 5.27%.

The savings market hasn’t moved dramatically, but the latest developments have helped to normalise the market “with fixed-term bonds finally offering more interest than easy-access accounts,” says Mark Hicks, head of active savings at Hargreaves Lansdown.

What about annuity rates?

Annuity rates have surged too – a positive development for those thinking about buying a guaranteed income in retirement.

“The latest data shows a 65-year-old with a £100,000 pension can now get up to £7,425 a year from a single life level annuity with a five-year guarantee,” says Helen Morrissey, head of retirement analysis at Hargreaves Lansdown.

“This is up from £7,235 a year last week and up a whopping 48% on the £5,003 that was on offer this time three years ago,” she adds.

What do higher inflation expectations mean for bond investors?

If you are invested in a bond fund, you might have noticed some losses in recent weeks as a result of the selloff. Investors have been selling out of the market in response to inflation fears (inflation is a bond investor’s nemesis). There is also a lack of confidence in the UK economy after the Budget.

As a result, the government is now having to pay more to borrow money. Bonds also become less attractive on the second-hand market when new issuances come with higher coupons, so their price falls.

The silver lining is that higher yields have created new income opportunities. This could create buying opportunities – but remember that markets are notoriously difficult to time.

“You might think that yields could go higher, and you might want to try to time the peak in yields. That’s difficult to do and markets can move quickly, so it could backfire if yields suddenly reverse their current trend,” Streeter says.

Base rate cuts: is market pricing realistic?

Having shared some analysis on what the latest developments mean for your personal finances, let’s return to the UK economy and the outlook for interest rate cuts.

Markets are currently pricing in just 50 basis points of cuts this year – but is that realistic?

“This may sound conservative, but with inflation at 2.6% and services inflation being somewhat sticky, the BoE may not be able to lower rates more than this without upsetting the balance,” says Michael Field, European strategist at Morningstar.

“Markets usually start off overly optimistic at the beginning of the year, and then slowly adjust expectations downwards as the year progresses. However, this time around it appears we might have a realistic number from the off,” he adds.

That concludes our preview analysis for today. We will be back in the same place tomorrow, bright and early, to cover the inflation news as it breaks at 7.00am. Thank you for joining us.

Good morning, and welcome back to MoneyWeek's inflation blog. This is Katie Williams and Dan McEvoy reporting live. There is less than half an hour to go until December's inflation report is released. We will be walking you through it in real time.

Inflation forecast: what are analysts predicting from today’s report?

To recap from yesterday, some analysts believe inflation will hold steady at 2.6% this month, while others (including Deutsche Bank) believe it will inch up slightly to around 2.7%.

Higher food and petrol costs are expected to contribute to any rise, while airfares and hotel costs are likely to have eased.

Airfares – a notoriously volatile category that falls into the services inflation basket – are expected to have eased in December

BREAKING: SURPRISE DROP

In a surprise drop, inflation slowed to 2.5% in December, down from 2.6% in November.

Slowdown in restaurant and hotel costs

The ONS said: "The largest downward contribution to the monthly change in the CPI annual rate came from restaurants and hotels; the largest upward contribution came from transport."

The annual inflation rate for restaurants and hotels was 3.4% in December, down from 4% in November. This is the lowest annual rate since July 2021.

Meanwhile, although transport costs are actually in deflation mode (falling by 0.6% in the 12 months to December), they are falling at a slower rate than they once were. In November, the transport inflation rate was -0.9%.

"The change in the annual rate was mainly the result of upward effects from motor fuels and second hand cars, partially offset by a downward effect from airfares," the ONS explained.

February interest rate cut is not a done deal

December’s drop in the rate of inflation means an interest rate cut is now more likely next time the MPC meets, according to one expert. However, it is far from a done deal.

“While this surprise decline provides some timely respite amid the financial markets turmoil, with the headline rate still decisively above the Bank of England’s 2% target and domestic and international inflation headwinds growing, any relief may be short lived,” says Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales.

He adds: “Despite December’s unexpected decline, the near-term outlook for UK inflation remains ominous with higher energy bills likely to push the headline rate above 3% over the coming months, aided by April’s expected rise in Ofgem’s energy price cap.

“Inflation could drift gradually lower in the second half of 2025, if the likely downward pressure on prices from slowing wage growth and a weakening labour market is not derailed by higher, more volatile global prices.

“While these figures make a February interest rate cut more likely, concerns over the current market turbulence and heightened global inflation risks mean the decision of whether to loosen policy next month is not quite nailed on yet.”

The upcoming MPC meeting will take place next month, with the interest rate decision being announced on 6 February

What about core and services inflation?

Core and services inflation made good progress in December. Core inflation fell from 3.5% to 3.2%, while services inflation experienced an even bigger drop from 5% to 4.4%.

Experts including those at Deutsche Bank were expecting these to be higher. The investment bank had predicted rates of around 3.5% and 4.9% respectively.

However, remember that within the services basket, some areas matter more than others. As the economists at ING have argued previously, the Bank of England is less concerned with categories like airfares.

Airfares fell on an annual basis in December. They also eased considerably on a monthly basis, only rising by 16.2% versus 57.1% a year ago.

“It is normal for fares to rise into December,” the ONS explained, commenting on the monthly data. “However, the rise in December 2024 was the lowest December rise since December 2019, and it is the third-lowest December rise since monthly price collection began in 2001.”

Hotel and restaurant costs also slowed considerably in December. Their annual inflation rate came in at 3.4%, down from 4% in November. This is the lowest annual rate since July 2021.

Good news, but GDP numbers could be key

Taken in isolation, the December inflation reading is positive. However, it doesn’t completely eradicate the spectre of stagflation.

“The slight dip in inflation in December is good news and revives hopes that expected rate cuts can still come through this year,” says Ed Monk, associate director at Fidelity International, “but it doesn’t remove the dilemma for the Bank of England or Downing Street.

“Inflation is stubbornly above target while growth has begun to slow down – that’s the path to stagflation. GDP numbers for November, due on Friday, will tell us more about whether the economy shrank overall in the final quarter of 2024.”

Markets are expecting two cuts to interest rates this year, and thanks to the December inflation reading that remains on track. “Higher rates are restricting economic activity, but the Bank clearly still fears any loosening of borrowing costs could let price rises accelerate,” says Monk.

What does the surprise drop mean for your personal finances?

The latest news may bring some comfort to households whose budgets have taken a knock after several years of rapidly rising prices. Those hoping for mortgage rates to come down will be keeping their fingers crossed that it translates into another rate cut in February – although this is certainly not a done deal. Higher gilt yields have actually pushed mortgage rates up in recent days.

“While the better-than-expected inflation figure opens the door for further interest rate cuts from the Bank of England, the drop in the headline rate is only expected to be temporary with inflation edging up again in the coming months,” says Alice Haine, personal finance analyst at the investment platform Bestinvest.

She adds: “With inflationary pressures still evident in the economy and energy prices now edging up again, the knock-on effect this will have on other household bills, such as fuel and food will also be a concern.

“Many households are likely to be feeling twitchy about a potential escalation in bills once again, particularly retirees on fixed incomes, who are already grappling with the government’s decision to scrap winter fuel payments for all but the poorest pensioners.”

Mortgage rates have inched up in recent days thanks to the surge in gilt yields

House price inflation

House price inflation figures will also be published today, at 9.30am. Official figures from HM Land Registry will show how much prices have risen on a national and regional basis. House price data is published with a two-month delay, so January’s report will cover November.

Inflation still needs to be watched

According to Jonny Black, chief commercial and strategy officer at abrdn adviser, the December inflation dip is “welcome news” but “doesn’t mean inflation won’t be something to watch in 2025.

“A volatile economic landscape is making it hard to say for sure where inflation is going to go next, but the Bank of England’s own forecast suggests that it could stay stubbornly above the 2% target for 2025-26,” added Black.

“This means it will continue to be essential for savers and investors to factor price rises into their financial plans and consider ways to mitigate the impact of inflation on their money, including through investing.”

READ MORE: Is there hope for the UK economy in 2025?

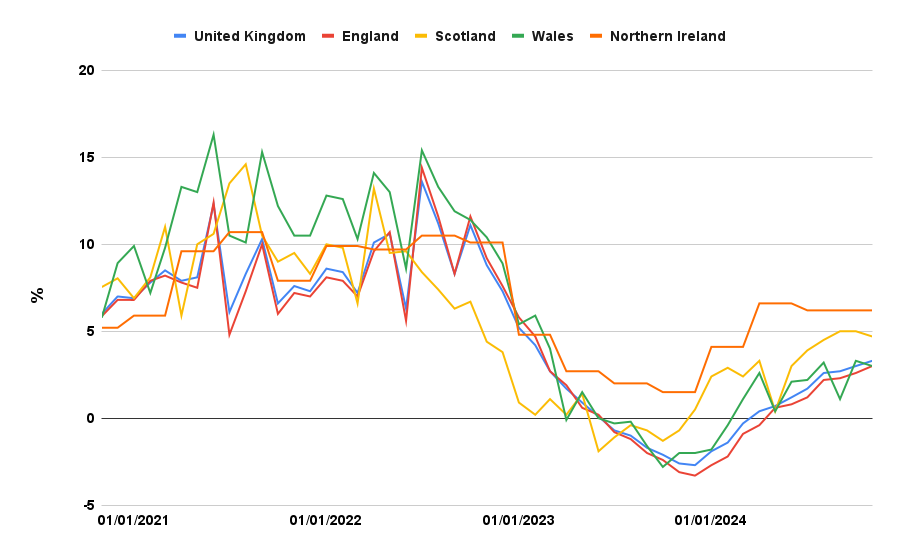

BREAKING: UK house prices increased 3.3% in November

House price inflation figures live

The average house price in the UK during November 2024 was £290,000, implying house price inflation of 3.3% year-over-year. This is up from the 3.0% year-over-year increase that October saw, though, counterintuitively, average house prices actually fell 0.4% month-over-month.

Average house prices increased 3.0% in England and Wales, but 4.7% in Scotland.

Reeves responds to inflation data

Earlier this morning, under-fire chancellor Rachel Reeves issued the following response to the December inflation reading:

“There is still work to be done to help families across the country with the cost of living. That’s why the government has taken action to protect working people’s payslips from higher taxes, frozen fuel duty and boosted the national minimum wage.

“In our Plan for Change, we were clear that growth is our number one priority to put more money in the pockets of working people. I will fight every day to deliver that growth and improve living standards in every part of the UK.”

Reeves has been under close scrutiny in recent days following a crisis in the gilt market

Markets relieved by falling inflation

The FTSE 100 is up by around 0.7% this morning, as the unexpectedly low inflation data raises hope of a February rate cut.

“The UK inflation snapshot will come as a relief and is already acting like a balm to calm unruly markets,” says Susannah Streeter, head of money and markets at Hargreaves Lansdown. “The FTSE 100 has opened higher as investors appear to have taken some comfort from the easing of inflationary pressures.”

Housebuilder stocks have led the surge, as the prospect of rate cuts is particularly beneficial for the sector. A positive update from Vistry, showing profit guidance is on track, gave housebuilders a further lift.

“Vistry has finally broken its streak of bad news,” said Aarin Chiekrie, equity analyst at Hargreaves Lansdown. “Looking forward, Vistry expects profits to grow in 2025, albeit from a very low base.”

House prices have proved surprisingly resilient

Talking of houses, let’s return briefly to house price inflation and take a closer look at some of the trends that are playing out.

As the below chart shows, the rate of house price inflation is lower than we have seen in recent years. Despite this, prices have now recovered after falling in 2023 and have reached a new peak in recent months (around £290,000). The previous peak was recorded in late 2022 (around £288,000).

Stephen Perkins, managing director at Norwich-based broker Yellow Brick Mortgages, says the latest data “continues to demonstrate the resilience of house prices, as demand remains stronger than expected despite all the misgivings surrounding the economy”.

Demand is likely to remain high in the first three months of the year as buyers rush to move before stamp duty changes kick in on 1 April. Many will find themselves paying more tax after this date. Experts have warned the market could dampen after this point.

Rate of house price inflation in the UK

Inflation-busting savings accounts

There are currently 1,597 savings accounts that beat inflation, according to financial information company Moneyfacts. This includes:

- 216 easy-access accounts

- 181 notice accounts

- 192 variable-rate ISAs

- 313 fixed-rate ISAs

- 695 fixed-rate bonds

The following providers currently offer the best savings rates, according to Moneyfacts. Their calculations assume a deposit of £10,000 (although some of the deals will be applicable for savers with a smaller balance than this) and show the gross interest rate:

- Easy-access: Chase (4.89%)

- Notice: BLME (4.85%, 90-day notice)

- One-year fixed bond: Vida Savings (4.77%)

- Two-year fixed bond: Atom Bank (4.70%)

- Three-year fixed bond: SmartSave (4.62%)

- Four-year fixed bond: UBL UK (4.54%)

- Five-year fixed bond: SmartSave (4.78%)

Two-thirds of UK retailers planning price hikes

Although inflation dipped this morning, it might prove short-lived with two-thirds of UK retailers planning to hike prices in response to the impending increases in employers' National Insurance contributions. According to a survey by the British Retail Consortium, 67% of retailers said they would raise prices in response to the Budget change.

Odds of a February rate cut from the BoE

Today’s news has boosted the odds of a February rate cut.

“From just 60% predicting a cut at the next meeting, expectations since the ONS figures were released have shot up to over 80% according to Refinitiv data and there is growing optimism that more cuts could be on the cards for 2025 than had been anticipated,” says Danni Hewson, head of financial analysis at AJ Bell.

It isn’t in the bag yet though – and the inflationary headwinds we have discussed previously (potential tariffs, an employer NI hike, and higher energy costs) haven’t gone away.

BREAKING: US inflation higher than expected in December

Inflation data has also been published in the US today. The headline figure hit 2.9% in December, in line with a Reuters poll of economists but above the 2.8% projected by FactSet analysts.

Services inflation could hold the key to Bank of England policy

Cooling inflation raises hopes for interest rate cuts, even though inflation remains above the Bank of England’s 2% target. This is largely because changes in interest rates are recognised as having a lag effect – they take time to be felt across the economy and to manifest in inflation data.

With that in mind, today’s reading “throws a bit more weight” behind hopes of a rate cut in February, according to Dan Lane, lead analyst at trading platform Robinhood.

“The first step in the BoE’s ‘gradual’ easing gradient will feel a lot more comfortable with a nice fall in the all-important services inflation,” says Lane. “The narrative around an expected near-term uplift in headline inflation has been wearing thin, so a 0.25% February cut would at least signal the BoE’s intentions to follow a cutting path with a view to its effects kicking in with a lag.”

When it comes to services inflation, though, it is worth mentioning that some components in the services basket matter more than others. The Bank of England isn’t overly concerned about things like airfares, as the economists at ING have pointed out previously. See our previous post on services inflation for further analysis.

A further softening in services inflation is still required

The Bank’s job is also complicated by the potential impact of US policy. “If the BoE starts cutting and the Fed chooses to pause, it could end up in a sterling selloff, prompting a rise in import inflation,” says Lane.

“To get quarterly cut hopes back on track we really need to see further softening in services inflation but, given how much staff costs weigh on UK services businesses, the rise in employer NI could hinder that progress.”

Inflationary concerns still linger

“The threat of lingering inflation hasn't gone away entirely – so we’re not out of the woods just yet,” says Sarah Coles, head of personal finance, Hargreaves Lansdown.

On both sides of the pond, inflation has remained stubbornly above central bank targets. While it’s hard to predict Trump’s administration with any certainty, there is the potential for his policies to be inflationary, both in the US and globally.

“There has been a lot of negative news building up over the past few months following Trump’s election in the US and UK Budget,” says Oliver Faizallah, head of fixed income research at Charles Stanley, “so concerns around fiscal policy still linger.

“In the UK, it's likely that the CPI miss is not a trend, and we could see [inflation] tick back up again.”

When is the next inflation report?

The ONS publishes official inflation data once a month. The next report covering January will be published on 19 February. See our roundup of CPI release dates for 2025.

That concludes our inflation coverage for today. Thank you for joining us. We will be back with more live analysis in the weeks to come, with a special focus on the US as incoming president Donald Trump takes office. What will it mean for markets and the economy? Stick with MoneyWeek to find out.