UK gilt yields summary

- UK borrowing costs have surged to the highest level since the global financial crisis.

- Some are blaming the Autumn Budget for the rise in yields, but borrowing costs are also rising in the US in response to heightened concerns about inflation.

- Strong US jobs data pushed gilt yields higher before surprise inflation dip reversed the trend.

Scroll for analysis from the team at MoneyWeek.

Good morning, and welcome to MoneyWeek’s live blog covering today’s big financial news: the spike in gilt yields that threatens to upend chancellor Rachel Reeves’ Autumn Budget just months after it was announced.

Dan McEvoy and Katie Williams here to take you through the news as it develops.

The background

Gilt yields – effectively, the interest rate the UK government pays on its debt – have skyrocketed over the last two days to their highest level since the financial crisis.

This puts chancellor Rachel Reeves in a tight spot. Her Autumn Budget – barely two months old – risks unravelling as the costs of servicing UK government debt soar.

Shadow chancellor Mel Stride has called Reeves to address the House of Commons on the crisis this morning. However, at the time of writing, it looks as though Reeves is pressing ahead with a planned trade visit to China instead.

Why are gilt yields rising?

Unsurprisingly, politicians have traded barbs over who is to blame for the increase in gilt yields in Parliament this morning.

Conservative MPs blamed Reeves’ Budget for spooking bond markets, while Labour MPs have attempted to push the blame back onto the previous Conservative government for running up the “black hole” that forced Reeves into tax rises.

Financial analysts also appear split on the matter.

Matthew Ryan, head of market strategy at Ebury, views the yields spike as “a damning indictment of Labour’s fiscal policies”. Ryan singles out the increase to employer NI contributions “which businesses have already warned will lead to higher prices and a worsening in labour market conditions”.

Laith Khalaf, on the other hand, points to the fact that bond yields have been rising in the US and the UK over recent months, and thinks that this week’s spike is more due to the potential impact of Donald Trump’s incoming presidency.

“The fact yields are rising on both sides of the Atlantic does suggest the new year has brought with it a focus on the incoming US president, and the potential for his trade and immigration policies to be inflationary,” says Khalaf.

Mike Riddell, portfolio manager, Fidelity International, seems to agree: “A common conclusion is to point fingers at the government. But this would miss the point; it is mainly a global fixed income story. UK gilt yields are broadly moving with US Treasuries.” He also points to similar moves in long-dated German government bonds over the past month.

Treasury response

A spokesperson for HMT responded to MoneyWeek with the following statement:

“No one should be under any doubt that meeting the fiscal rules is non-negotiable and the Government will have an iron grip on the public finances.

"UK debt is the second lowest in the G7 and only the OBR’s forecast can accurately predict how much headroom the government has – anything else is pure speculation.

“Kick-starting economic growth is the number one mission of this Government as we deliver on our Plan for Change. Over the coming weeks and months, the Chancellor will leave no stone unturned in her determination to deliver economic growth and fight for working people.”

The Treasury also iterated that “the current budget deficit is forecast to be £55.5 billion in 2024-25. From then, it improves in every year until 2027-28 when the current budget is in surplus”.

The spokesperson said that Reeves will “deliver a speech in the coming weeks on the Government’s economic strategy and plan for growth”, but did not respond to a question on whether or not she will address Parliament on the matter today. This appears unlikely given her scheduled trip to China.

Taxes to increase?

The fear is that increased borrowing costs will force the government either to raise taxes, or to cut back on public spending in response, having just raised taxes in the Autumn Budget in order to cover the so-called fiscal black hole.

“Higher yields put pressure on government finances and increase the risk that Reeves will come back with another tax raising Budget,” says Khalaf.

Over the long term this could impact the UK’s growth prospects.

“Weak demand for UK debt raises the risk of either government spending cuts or further tax hikes to balance the country’s finances, neither of which would be positive for growth,” says Ryan.

An opportunity for bond investors?

Is the latest spike in yields good or bad for bond investors? It largely depends on whether you are an existing bondholder or someone eyeing up new opportunities in the market.

Bond yields and bond prices have an inverse relationship, so when one rises, the other falls. Investors have been selling UK government bonds recently in response to the latest risks, and this has pushed yields up.

Those with gilt investments will have experienced some recent losses as a result of the latest developments. “The typical gilt fund is down 2.5% in the last three months, while the typical pension lifestyling fund is down 4.4%,” according to Khalaf.

The flipside is that the yields spike is creating income opportunities. “Fresh bond investors might be licking their lips as yields rise and they are able to lock into higher rates,” Khalaf adds.

2022 all over again?

It doesn’t take a particularly long memory for today’s events to recall the last time rising gilt yields threw the UK government into chaos.

Liz Truss’s infamous ‘mini-budget’ of September 2022 sent gilt yields up 1.2% within days of its announcement. This ultimately forced Truss to resign.

“Today, the UK’s demons are back, driven by heightened fiscal concerns – evoking memories of Liz Truss’s chaotic 'mini-budget’ days,” says Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “Back then, markets lost confidence in the government’s spending plans, triggering an aggressive selloff that forced the BoE to intervene.”

However, George Saravelos, global head of FX research at Deutsche Bank, thinks the two gilt yield crises are distinct from one another.

“The 2022 crisis was self-inflicted,” he says. “It was a UK-driven policy shock. The easiest way to see this is that gilt moves back then completely decoupled from other markets and idiosyncratically sold off.

“This time round, all gilts are doing is mirroring US treasuries. The most straightforward way to demonstrate this is that the 10-year UST - Gilt spread is moving sideways and is exactly where it was six months ago.”

The bad news, though, is that “precisely because recent market volatility is not self-inflicted there is no easy way out”.

Saravelos argues that because the UK relies relatively heavily on foreign financing for its domestic debt, gilts are more exposed than other developed economies’ bonds to US Treasury sell-offs.

“The chancellor and central bank have an important job to do,” says Saravelos. “The Bank of England needs to maintain the credibility of the inflation target. The chancellor needs to signal sensitivity to the worsening global environment by potentially paring back some spending. Both need to avoid any signal of fiscal dominance.

“But beyond a few tweaks here and there, it is largely the currency that will do the work of stabilizing the bond market combined with an eventual peak of US yields.”

Mortgage rates could rise thanks to surge in gilt yields

When setting mortgage rates, lenders pay close attention to a range of factors including swap rates. These are closely linked to gilt yields. As a result, the latest increase in gilt yields does not bode well for those hoping to see mortgage rates fall further.

The average two-year fixed mortgage rate is currently 5.47%, according to comparison site Moneyfacts. The average five-year deal is 5.25%.

What do higher gilt yields mean for the pound?

It’s a pretty miserable time for sterling.

“Typically, higher inflation expectations or a hawkish adjustment to the BoE policy stance drive yields higher, and that is bullish for the pound,” says Kyle Chapman, FX Markets Analyst at Ballinger Group. “In this case, the move is driven not by the macro data, but by heavy gilt supply, concerns about the UK government’s debt sustainability, and the inflationary impacts of the extra fiscal spending in the pipeline.”

This has seen the pound fall by fractionally under 1% against the dollar earlier this morning, though it has since recovered some of these losses.

As Saravelos says, though, the pound’s fall is an important mechanism through which the gilt market can stabilise.

Every cloud has a gold lining?

While the surge in gilt yields has caused a headache for the government and some investors, it has meant good news for the gold price. Up 37.5% compared to this time last year, the gold price is now £2,172 per Troy ounce – a new GBP record.

“Because gold pays no interest, it usually falls in price when bond yields rise,” says BullionVault director of research Adrian Ash. “Gold rising together with government borrowing costs signals how uneasy the markets are becoming over the UK's budget deficits and long-term debt.”

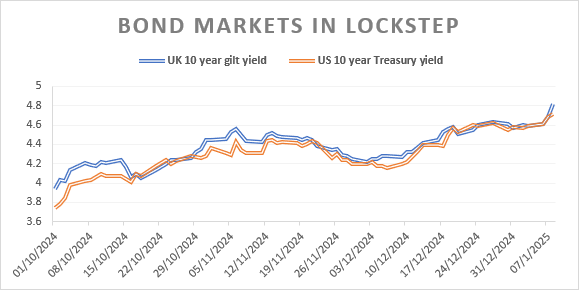

Gilts and Treasuries joined at the hip

Underscoring the point about gilts and Treasuries (the US equivalent) is this chart from AJ Bell, based on Refinitv data:

That’s not to say that the ramifications are the same, though.

“The US has the benefit of being the world’s reserve currency, which underpins demand for dollar denominated assets such as US Treasury bonds,” says Laith Khalaf, head of investment analysis at AJ Bell. “Here in the UK, higher yields put pressure on government finances and increase the risk that Reeves will come back with another tax raising Budget.”

Are higher gilt yields good news for annuity rates?

Many savers who are approaching retirement have a large allocation to bonds in their portfolio – part of their de-risking strategy. Their portfolios may have suffered losses recently as a result of the selloff in gilt markets.

However, there could be some good news for older savers on the cusp of purchasing an annuity with their pension savings.

“The surge in gilt yields could push up annuity rates in the coming weeks,” says Helen Morrissey, head of retirement analysis at Hargreaves Lansdown. “It would add a further boost to a market that has enjoyed enormous growth in recent years.”

She explains that a 65 year-old with a £100,000 pension could currently get up to £7,235 per year from a single life level annuity with a five year guarantee. “We could see this increase further from here,” she adds.

Do higher gilt yields point towards stagflation?

The nightmare scenario is that elevated UK government debt hinders the government’s ability to kickstart growth in the economy, and coincides with an inflationary environment – a combination that economists call ‘stagflation’.

“There is also particular concern brewing about stagflation taking hold, given that inflation has been creeping up and pay growth is still hot, while the economy has been stagnating,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown. “It’s unclear to what extent the UK government’s investment in infrastructure will provide a boost to growth over the longer term.”

Streeter adds: “it seems appetite to buy long-term dated UK government debt has fallen amid the increased uncertainty gripping global bond markets.”

Mortgage costs unlikely to fall any time soon

The start of the year can sometimes be a good time to shop around for a mortgage deal. That was certainly the case last year, when lenders sparked a pricing war as they jostled with one another to attract customers with lower rates.

The start of 2025 looks a little different, though. Ben Thompson, deputy chief executive at Mortgage Advice Bureau, expects mortgage rates to “rise in the near term at least”.

He says: “Some of the factors underlying the recent spike may well soften soon, but it has felt for a while that inflation would persist at a slightly higher level than targeted and as such the cost of borrowing would remain broadly at current levels and isn’t about to fall meaningfully anytime soon.

“What we have seen is the market gradually adjust to a higher rate environment in part helped by wage growth and that means that those who have waited to buy or move home for a few years will now just want to commit and get on with it, as opposed to waiting for mortgage rates to drop much further.”

“We think that bonds will recover before long”

The selloff in the UK government bond market has sparked further criticism of Reeves’ Autumn Budget this week. However, experts at consultancy Capital Economics have called the latest developments a “global bond market storm in a British teacup”.

“We think that bonds will recover before long, with yields falling back more in the UK than elsewhere,” says Hubert de Barochez, senior markets economist at the consultancy.

“One reason is that we expect Trump to fail to cut taxes as much as planned, and therefore that worries over US public finances will abate a bit,” he adds. “What’s more, with inflation near to target in most places, central banks have more room to cut rates if necessary.”

Although UK markets are only pricing in one or two base rate cuts in 2025, most economists think this stance is overly cautious. Capital Economics thinks inflation will fall more quickly than currently forecast and, as a result, expects the base rate to reach 3.5% by early 2026.

“This is why we forecast the 10-year gilt yield to fall back to 4.0% by the end of the year, from roughly 4.8% now,” de Barochez explains.

That concludes our coverage of the UK gilt market today. Thank you for following along with us. We will be back with more live analysis on markets, inflation and interest rates in the coming weeks, with a special focus on the US in the lead-up to Trump’s return to office.

Good morning, and welcome back to our live coverage of the ongoing gilt yields story.

Dan and Katie here, bringing you live coverage and analysis throughout the day.

Eyes on US jobs data as gilt yields edge upwards

10 year gilt yields have crept slightly upwards this morning, though are still below the 4.93% peak that sparked Parliamentary panic yesterday.

US jobs data being released this afternoon is likely to be the next big driver of gilt yield movements. With UK and US government bond yields moving in lockstep over recent months, macro changes in the US market will have a big impact on gilt yields this side of the pond too.

Reuters predicts that approximately 160,000 jobs will have been added during December, with the unemployment rate holding steady at around 4.2%. ING suggests that unemployment could tick up to 4.3%, but predicts that anything above the 150,000 jobs mark would “maintain upside momentum for yields”.

According to Reuters, stronger economic data than that could drive 10-year US government bond yields to a 13-month peak and strengthen the dollar.

A disaster in the making for Reeves?

Chancellor Rachel Reeves rejected calls to address Parliament over the gilt yields crisis yesterday, instead flying to China for a pre-planned three-day visit aimed at strengthening the UK’s trade and economic ties with the country.

While culture secretary Lisa Nandy has defended Reeves’ decision to go ahead with the trip, Reeves will surely have half her mind on the implications of the yield spike for her domestic agenda.

“The recent spike in government borrowing costs is in danger of turning into a political disaster for Rachel Reeves,” says Tom Selby, director of public policy at AJ Bell, “who will no doubt be sweating over the risk that any wiggle room in public finances could evaporate.”

Silver linings

While increased gilt yields are a potential nightmare for Reeves and the government, there are winners and losers as far as personal finances are concerned.

Rising gilt yields are bad news for borrowers, especially anyone with a mortgage that is pegged to the Bank of England base rate, says Selby.

“However, there will have been plenty of people cheering as gilt yields jumped to highs not seen since the 2007/08 financial crash,” he adds. “Returns on cash investments should be bolstered if gilt yields remain elevated, meaning people’s rainy-day savings should grow by more than previously expected. Companies administering defined benefit (DB) pension schemes could also see the value of their accounting liabilities substantially reduced, potentially swinging from a deficit to a surplus as a result.”

As mentioned yesterday, annuities are another potential winner from the gilt yields spike.

“Additional government spending, global uncertainty and higher taxes are all contributing to the recent increase in the cost of government borrowing,” says Nick Flynn, Retirement Income Director at Canada Life. “Whilst there are no cast iron guarantees, if this trend continues, then it’s a strong possibility that annuity rates will be maintained or even increase in 2025.”

READ MORE: Annuity rates rise 7% - is now a good time to buy an annuity?

Gilt yields and taxes

The challenge for Reeves is that the gilt yield increase could completely erase the £9.9 billion headroom contained in her Autumn Budget.

“In order to maintain fiscal credibility, there is a real chance that the Chancellor will be forced to announce at the fiscal update scheduled for 26th March lower government spending and/or higher taxes compared to existing plans,” says Ashley Webb, UK economist at Capital Economics.

While Webb feels that it is more likely Reeves would opt for tighter fiscal policy, he speculates that she might consider raising capital gains tax, alcohol and tobacco duties, air passenger duties or vehicle excise duty. Stamp duty and/or council tax increases on second homes could also be considered, but all of these taxes combined make up just 11% of total tax revenues.

This could potentially force Reeves into raising more tax revenue through, for example, reducing relief on pension contributions for high earners, scrapping the lifetime ISA, or extending the freeze on personal income tax thresholds.

Or, the government could expand the tax base by introducing VAT on products or services that are currently exempt – much as it has recently done with private schools.

All this assumes that Reeves won’t break Labour’s manifesto promise not to raise taxes on “working people” – which Webb calls “the government’s least politically palatable option”.

However, “it could easily raise a lot of revenue from only a small increase in the rate of VAT, income tax or national insurance tax. A 1 percentage point rise in each would raise £9.0bn, £7.3bn and £4.7bn respectively by 2026/27.

“Overall, while a lot can change between now and the fiscal update scheduled for 26th March,” says Webb.

When is US jobs data released?

Stay tuned: the US jobs data release is due at 8.30am US, 1.30pm time in the UK. The results are expected to be a key driver for gilt yields today.

BREAKING: Gilt yields up on strong US jobs data

Employers added 256,000 jobs to nonfarm payrolls in December, far more than the 153,000 FactSet analysts had expected.

Gilt yields have ticked upwards this afternoon as a result. Analysis to follow.

Yields on UK ten-year gilts have ticked up to 4.88% this afternoon, jumping from around 4.83% in the wake of that US jobs report.

Despite new jobs coming in above expectations, and unemployment unexpectedly falling to 4.1%, gilt yields haven’t (yet) exceeded yesterday’s highs.

Why has strong US jobs data pushed gilt yields higher?

In essence, strong US jobs means a strong US economy. A strong US economy means the Fed is less likely to cut interest rates, meaning rates in the country are likely to remain higher for longer.

“The larger-than-expected 256,000 gain in non-farm payrolls in December and drop back in the unemployment rate to 4.1% supports the Fed’s decision to slow the pace of rate cuts and has heightened speculation that the loosening cycle is already over, putting further upward pressure on Treasury yields,” says Thomas Ryan, North America economist at Capital Economics.

UK government bonds (gilts) have moved in tandem with US government bonds (Treasuries) over the past year. A strong US labour market therefore means higher gilt yields.

Market strop out intensifying

The jobs data has dented markets: the pound has fallen 0.58% today against the dollar, hitting a 14-month low, while the FTSE 100 is down 0.25%.

The S&P 500 – which was closed yesterday due to a national day of mourning for former US president Jimmy Carter – opened 0.47% below Wednesday’s close, and has fallen a further 0.35% since then.

“Worries about interest rates staying higher for longer have been reignited by this stronger-than-expected labour market data,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown. “Sentiment has soured on equity markets and the bond market strop out is showing signs of intensifying.”

Further yield increases on the way?

“2025 has already seen notable increases in gilt and US Treasury yields,” says Hal Cook, senior investment analyst, Hargreaves Lansdown. “Today’s employment data out of the US is likely to cause further increases from here.

“The 10-year US Treasury yield spiked just under 10 basis points on the announcement. The 10-year UK gilt yield jumped 5 basis points at the same time. Volatility is expected to continue as the information is digested.”

Cook cautions, though, that US non-farm payroll data is often subject to significant revisions further down the road.

“Data for December, given the holiday season, could well see a big revision in future,” he says, “but that won’t stop markets reacting in the meantime.”

Bond market on the move

Gilt yields have fallen back again this afternoon, after spiking in the wake of the US jobs report.

As of 4pm, they’re sitting around the 4.84% level – a little above where they were prior to the US data release, but well below the afternoon peak.

There could be plenty more shifts in store, though, as Laith Khalaf, head of investment analysis at AJ Bell explains:

“The whole global bond market is on the move as investors shift their expectations for 2025. There is no one smoking gun which explains why bonds are selling off now, but a strong US jobs report is only going to add fuel to the fire. That points to a hot US economy and consequently less scope for rate cuts in the US, with Trump’s potential controls on immigration tightening the labour market even further.

“The US bond market exercises a heavy influence on UK gilts so we can expect some spillover to our own bond market. A strengthening dollar also puts upward pressure on UK inflation which is another byproduct of markets scaling back their forecasts for US interest rate cuts.”

Gilt yield increase is “a problem, not a crisis”

“This week’s leap in gilt yields creates more problems for the Chancellor and is an extra headwind for the economy. But it is not a crisis,” says Paul Dales, chief UK economist at Capital Economics.

While “it is always worrying when UK bond yields rise by more than yields elsewhere and the pound weakens”, Dales says that “the current situation is nothing like the sterling crisis of 1976 or the Liz Truss episode in 2022 as has been suggested”.

The recent moves have been smaller and lower; 30-year gilt yields have increased 70 basis points in the last six weeks, compared to 150 basis points in six days following the Truss mini-budget. That also saw the pound fall by 3%, compared to 1% this time around.

“That’s because the causes are different” says Dales. “The crises of 1976 and 2022 were due to loose fiscal policy at home that led to the government losing credibility. This time, the cause has been global, with the markets concluding that real interest rates need to be higher for longer everywhere to trim inflation.

“The UK has been hit harder than others mainly because of its reliance on overseas investors to fund its current account and government budget deficits. Indeed, the UK’s ‘twin deficits’ are bigger than every other G7 economy, and the euro-zone, except the US, which is seen as a safe haven as the dollar is the world’s reserve currency.

“So when global risk sentiment declines, the UK is more vulnerable to funds flowing to safer shores.”

That said, the gilt yields spike “does cause problems”. Capital Economics estimates that the increase in the debt interest payments will be sufficient to break the fiscal rules Rachel Reeves has previously set out. As discussed, that could force her into either new spending cuts and/or new tax rises – with the former of those “more likely”, according to Dales.

Time to buy bonds?

Does the rise in gilt yields present a bond buying opportunity?

“Bonds are very attractively priced at the moment”, Oliver Faizallah, head of fixed income research at Charles Stanley, tells MoneyWeek. The current climate – one in which inflation is relatively low and stable, while bond yields are high, is “as good a time as it’s ever been to buy bonds”.

He also explains that, while government bonds like gilts are traditionally allocated to the safer parts of a portfolio, high yield bonds can be thought of similarly to equities, and can form part of investors’ allocation to risk given their yields.

See our full explainer on why now might be a good time to invest in bonds.

That's all from us this week. Goodbye for now, but join us next week when we'll pick up the latest news and developments with the ongoing gilt rate story.

Gilt yields up Monday morning

Good morning, and welcome back to our live blog as we continue to keep an eye on the latest in gilt yields.

Yields on 10 year gilts have hit a new high this morning, hovering at around 4.9% as of 9am.

We’ll bring you all the latest updates and analysis as the situation unfolds.

Reeves issues China trade update

Having been called to address Parliament about the gilt yield crisis on Thursday, chancellor Rachel Reeves instead pressed ahead with a planned trade visit to China.

The treasury announced on Saturday that the visit has resulted to agreements to deepen economic cooperation between China and the UK, with the agreements worth an estimated £600 million to the UK over the next five years and a potential £1 billion over the longer term.

“The agreements we’ve reached show that pragmatic cooperation between the world’s largest economies can help us boost economic growth for the benefit of working people – a priority of our Plan for Change,” said Reeves.

“More widely, today is a platform for respectful and consistent future relations with China. One where we can be frank and open on areas where we disagree, protecting our values and security interests, and finding opportunities for safe trade and investment.”

Rumour mill still grinding

The government is clearly keen to broadcast the good news out of China, and for good reason.

Capital Economics estimated on 7 January (last Tuesday) that the rise in gilt yields had wiped out £8.9 billion of the £9.9 billion fiscal headroom that was built into the Autumn Budget. Yields have increased still further since then. There is a very real possibility that all of it will be gone by the time the Office for Budget Responsibility (OBR) revises its forecasts on 26 March.

“With the UK still in the eye of the storm of concern worrying bond markets, it’s set to keep the rumour mill grinding about difficult tax and spending decisions ahead for Keir Starmer’s government,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown. “The government is attempting to wrest the narrative away from painfully high borrowing costs and a plunging pound.”

Part of this attempt involves prime minister Kier Starmer's initiative to invest heavily into AI, announced on Saturday.

The government is "going all out on an AI pitch with recommendations to unleash the power of the technology to help public services become more efficient and help boost growth via special development zones", says Streeter.

The gilt yield drama is playing out against a backdrop of the government desperately wanting to improve economic growth, and improving international trade and domestic productivity are seen as key levers for the government to pull.

Pound hits 14-month low

The gilt crisis has pushed the pound to a 14-month low against the US dollar. “The combination of a robust dollar and a weakening pound is accelerating the capital flight from sterling,” says Nigel Green, chief executive of advisory and asset management firm the deVere Group.

He adds that investors are “turning to safer currencies and assets, as the UK appears increasingly fragile in this turbulent environment”.

A weaker pound is bad news for UK businesses who rely heavily on imports, pushing their costs higher. It could also spell bad news for consumers if businesses look to pass higher costs on by putting their prices up.

Consumers are already staring down the barrel of cost increases this year after changes announced in the Autumn Budget. Chancellor Rachel Reeves hiked employer National Insurance contributions – a change that will kick in from April – in an attempt to balance the state’s books.

Many businesses plan to pass these higher staffing costs on to their customers. A survey from the British Chambers of Commerce, conducted after the Budget, found that 55% of firms plan to raise their prices in the next three months, up from a previous reading of 39%.

Oil prices put further upward pressure on bond yields

While gilt yields are currently correlated with US Treasury yields, movements of both are driven by inflation expectations. Inflation erodes the real value of bond yields, pushing prices down and yields up in response.

So, inflationary pressures on both sides of the pond are likely to contribute towards further increases in bond yields.

On that note, rising oil prices could push gilt yields still higher. Brent crude was trading above $81 per barrel today.

The increase “comes amid renewed concerns amid supplies of crude after the US slammed more sanctions on Russia”, says Streeter. “These are targeted at vessels and tankers, which is aimed at disrupting trade with China and India, leading to expectations of higher demand from suppliers in the Middle East”.

Annuity rates rise further

As anticipated, annuity rates have surged higher in the wake of the gilt market crisis. Annuity rates determine how much you can earn when you buy a guaranteed income in retirement. They are closely linked to long-term gilt yields. The higher the annuity rate, the higher your regular payout. The rate is locked in at the point of purchase.

“The latest data shows a 65-year-old with a £100,000 pension can now get up to £7,425 a year from a single life level annuity with a five-year guarantee,” says Helen Morrissey, head of retirement analysis at Hargreaves Lansdown. “This is up from £7,235 a year last week and up a whopping 48% on the £5,003 that was on offer this time three years ago.”

She adds that annuity rates could rise even further over the coming weeks, potentially hitting the highs seen in the aftermath of the mini-Budget.

Mortgage rates edge up - will they rise further?

Some mortgage lenders like Coventry Building Society, Virgin Money and TSB have hiked their rates, and experts warn that we could see more increases as the bond market turmoil continues.

So far, mortgage rates have only edged up slightly. According to data analyst Moneyfacts, the average two-year fixed mortgage rate is 5.48%, up from 5.47% on Friday. The average five-year deal is 5.26%, up from 5.25%.

Nicholas Mendes, mortgage technical manager at the broker John Charcol, tells MoneyWeek: "Increased government borrowing and ongoing economic uncertainty have pushed gilt yields higher, which in turn drives up swap rates. Lenders are absorbing these increased costs for now, but they can only do so for a limited time before being forced to adjust their mortgage products."

Frances Haque, chief economist at Santander UK, agrees that mortgage lenders “may well – in the short-term - nudge up pricing to reflect the higher swaps”.

Thankfully, there is no sign (so far) of the mortgage market panic that followed the 2022 mini-Budget.

In the wake of Liz Truss's mini-Budget, two and five-year fixed deals went up by more than a percentage point, and 1,700 lender products - 40% of the market at the time - disappeared from sale in the space of a week.

Yields spike sees investor gilt purchasing increase

Unlike in the wake of 2022’s infamous mini-budget, the current gilt selloff isn’t a sudden thing, but has been brewing steadily since the autumn.

Data from Hargreaves Lansdown shows that its clients took advantage of increasing yields during December, with gilt purchases through its platform increasing 33% year-over-year.

Last week – as gilt yields reached highs not seen since 2008 – gilt purchases reached their highest level in a week by Hargreaves Lansdown investors since October.

“Given the increase in yields, it’s not a surprise we are seeing a spike in gilt purchases,” said Hal Cook, senior investment analyst at Hargreaves Lansdown. “The yield on the 2-year gilt at the end of December was around 4.37% but is now pushing 4.6%. And it was nearer 4.2% at the start of December. For the 5-year gilt, the story is the same – it was yielding about 4.05% at the start of December, 4.33% at the end of December and nearer 4.65% today. Looking back to the end of 2023, the 2-year gilt yield was around 4% and the 5-year nearer 3.5%.”

That's all from us today. Thanks for following all our coverage of the gilt rates story as it unfolds. Stay tuned for future updates.

Reeves to address Parliament

Good morning, and welcome back to our live coverage of the gilt yield spike.

Today’s big news: chancellor Rachel Reeves will answer questions in the Commons today for the first time since returning from a trip to China, the timing of which was criticised by political opponents for coinciding with a week of volatility for the pound and soaring yields on UK bonds. She returned from her trip on Monday as concerns mounted that the government is in danger of failing to meet its own fiscal rules.

The pound regained its footing on Tuesday, after hitting fresh 14-month lows on Monday. Yields on 10-year gilts are presently hovering at around 4.87%, having peaked at 4.89% earlier this morning.

Will Rachel Reeves be sacked?

In the manner of a Premier League manager on a dire run of results, Rachel Reeves received the full backing of her boss prime minister Keir Starmer, yesterday – though only once the cameras were off. At an earlier televised press conference, he avoided making any firm guarantees about her future.

Speculation is rife that Reeves’ position as chancellor could be under threat. Both the Telegraph and the Independent are asking who could replace the chancellor if the situation doesn’t improve, while the Daily Star has revived its infamous lettuce that symbolised the demise of Liz Truss’s premiership.

Former shadow chancellor John McDonnell told the Today programme that further spending cuts would “be politically suicidal” for Reeves. The fiscal rules she set herself ahead of Labour’s election win appear to have boxed her into a corner.

Chancellor Rachel Reeves is expected to make a Commons statement about her visit to China after 12.30pm today, where she will no doubt face questions about the spike in gilt yields.

BREAKING: Reeves addressing Parliament

The chancellor's statement is essentially a rationale behind her decision to visit China last week, as gilt yields were spiking. Her opening speech is concentrating on the importance of the UK's trading relationship with China.

Her opening line stated that "growth is the number one mission of this Labour government".

The questions that follow, though, are likely to focus on the implications of higher borrowing costs on the UK economy and Reeves' economic policies.

Stride shifts focus to rising gilt yields

Shadow chancellor Mel Stride, unsurprisingly, used his opening statement to outline the economic turmoil that rising gilt yields have provoked.

"The pound has hit a 14-month low. Government borrowing costs are at their highest in 27 years... This is a crisis made in Downing Street," he asserted, before asking Reeves why she didn't address Parliament on the issue last week.

Stride finishes his opening statement by asking Reeves which of her promises she will break should the OBR judge that she has breached her fiscal rules in March.

"Wil she cancel promised spending? Will she ramp up borrowing? Or will she raise taxes yet again?"

The chancellor has reiterated her commitment to her fiscal rules. There hasn't been a direct response to the question of where she'll give way should the OBR rule in March that she's breached them.

However, when asked to rule out future spending cuts, Reeves replied "I'm not going to write five years' worth of budgets".

Gilt yields touch 4.9%

Gilt yields are moving relatively quickly while all this is going on. They fell from 4.89% to 4.86% just before 1.30pm, then rapidly jumped upwards to touch 4.9%.

These moves mirror US 10-year Treasury yields, though, so there is every chance that this is the main driver.

What can policymakers do about higher gilt yields?

The debate in Parliament is over (for now), but it highlighted some of the fault lines that the gilt yields increase has exposed. In effect, the government and the opposition benches both blamed each other for the increase in borrowing costs.

Naturally, this raises the question of what, if anything, Reeves or anyone else can now do to reduce them. According to analysis from Ruth Gregory, deputy chief UK economist at Capital Economics, Reeves has three options if her fiscal credibility is undermined:

- Muddle through until the spending review on 26 March before announcing new tax/spending plans;

- Announce potential tax increases before the spending review, in the event that the OBR finds she has broken her fiscal rules;

- Front-run the spending review by pre-announcing lower public spending.

So far Reeves is sticking to option 1, but if her hand is forced into a change of approach Gregory thinks that 3 is more likely than 2 given yesterday’s commitment to be “ruthless” in spending review decisions.

It isn’t just Reeves with the power to respond, though. The Bank of England is another key component in the gilt yields mix.

“The situation is more straightforward for the Bank,” says Gregory. “If there are no clear signs of dislocation in the bond market, the Bank will wait until the next Monetary Policy Committee meeting on 6th February to cast its judgement on the outlook for interest rates.

“But should there be clear signs of significant dislocation in the bond markets… the Bank could say it will do whatever it takes to keep markets functioning smoothly and remind investors of the tools at its disposal. If that doesn’t work, it could take temporary and specific action to restore orderly market conditions, by buying gilts as it did in October 2022 and pausing Quantitative Tightening (QT) (i.e. selling gilts). QT would then continue once market functioning is restored.

“To be clear, this is a last resort. The Bank won’t pause or cancel QT unless there is clear dislocation in bond markets.”

Chancellor to fast-track growth strategy announcement

The BBC says the Chancellor is likely to bring forward the detail of a range of new growth strategies in the next few weeks as she promises to move “faster and further” on the economy.

It says she will deliver a major speech on the overall growth strategy before the end of the month.

Morgan Stanley: Short GBP positions highest since November

Investment bank Morgan Stanley has today published a research note highlighting that FX options pricing data in the week ending Friday 10 January showed investors are shorting the pound at levels not seen since November.

“Overall, Options data suggest that tactical investors are long USD (DXY), while being most short GBP and EUR,” said the note.

Since the start of the year, the pound has fallen roughly 3% against the dollar.

That's all on gilt yields for now. Thanks for following so far. We'll continue to follow the story here at MoneyWeek.

Be sure to check out our inflation live blog, as the latest UK CPI reading is released tomorrow morning.

BREAKING: gilt yields fall on surprise inflation dip

Good morning, and welcome back to our gilt yields live blog.

Yields on 10 year gilts have dropped to around 4.84% this morning – the lowest they’ve been so far this week.

The catalyst for the drop is an unexpected dip in UK core inflation during December, to 2.5%. Head over to our other live blog for more inflation information.

Respite for the government

Experts are in agreement that the lower-than-expected inflation reading provides welcome relief for chancellor Rachel Reeves, whose position in the government has been under pressure following rising gilt yields.

“A lower-than-expected inflation print will provide some relief to the recent sell off in gilts that we’ve seen so far this year,” says Mark Hicks, head of active savings, Hargreaves Lansdown.

“The surprise fall in inflation offers much-needed respite for the government after a tumultuous week for gilts,” says Myron Jobson, senior personal finance analyst at interactive investor.

Scott Gardner, investment strategist at J.P. Morgan owned digital wealth manager, Nutmeg, says “policymakers and treasury officials will be breathing a small sigh of relief as new data shows that inflation fell during the final month of 2024, beating market expectations.

“While it might be odd to be welcoming above target inflation, these results have grown in significance after an unstable start to the year for the pound and government borrowing,” he adds.

Gilt yields fall further

10 year gilts are now trading at around 4.82%, as they continue to fall through the morning. They dipped briefly below 4.80% earlier this morning.

UK inflation data has clearly calmed the gilt markets – for now. However, US inflation data will be released this afternoon. That will likely have a strong impact on gilt yields, given how closely they have been correlated with Treasuries in recent months.

Bad news for the pound?

Gilt yields have fallen back below 4.80%. Corks won’t yet be popping at the Treasury (especially as US inflation data later today could reverse the momentum), but there will be some deep sighs of relief.

However, while the inflation reading has calmed the gilt market, it’s not such good news for the pound, which has fallen slightly against the dollar this morning.

“The dip in headline inflation, particularly in services, will be welcomed by the Bank of England but leaves the pound vulnerable to further weakness as it reinforces the case for additional rate cuts,” says Nikos Tzabouras, senior financial writer at Tradu. “Such action is undoubtedly needed amid weak economic activity and soaring borrowing costs, especially with UK debt exceeding 98% of GDP.”

Further weakening of the pound could create its own inflationary momentum – but aggressive monetary easing appears unlikely at this stage, which has helped the pound find a degree of support.

Gilt yields fall further as US inflation data lands

US inflation rose to 2.9% during December, according to the latest release from the US Bureau of Labor Statistics. That’s slightly higher than FactSet analysts had expected, but matches expectations of economists polled by Reuters.

US Treasury yields have fallen on the announcement, and gilt yields have gone with them. 10 year gilt yields dipped as low as 4.72% before rebounding to 4.76%.

Government bond yields fall in US and UK

10-year gilt yields have continued to fall throughout the day. They even dipped below 4.7% this afternoon – though have now climbed back up to around 4.72%. It means that the gains over the last week that prompted Parliamentary panic have largely been reversed, though they will have to fall a good deal further before chancellor Rachel Reeves will be feeling comfortable about her borrowing plans.

10-year US Treasury (UST) yields have also fallen today, to around 4.67%.

“Following both the UK and US CPI numbers, there has been a bit of respite in both gilts and USTs,” says Oliver Faizallah, head of fixed income research at Charles Stanley.

Underscoring the fact that the government bond yield saga is far from over, though, Faizallah adds that “in the US, concerns around an inflationary government policy and large deficits will likely keep yields elevated for some time.”

That's all from us today. Thanks for following the blog - and if you haven't already done so, pop over to our other one covering today's inflation data to get up to speed there!

We'll keep you up to date with any further developments on gilt yields, which settled well down today at around 4.73%.

Good morning, and thanks for following our gilt yields blog over the last week or so.

10-year gilt yields have come down from their recent peak; today, they’re around 4.64%. They are still at generational highs, though, which will be a concern for the government.

We’re going to wrap our live coverage of the gilt yields story here for now. However, we’ll leave you with this explainer on what gilts are, and whether or not now is a good time to invest in them.

That’s far from the end of the live blogs on MoneyWeek though. Join us on Monday for live coverage of Donald Trump’s return to the White House.