Summary

- The Bank of England’s Monetary Policy Committee (MPC) voted to hold the base rate at 4.5% today.

- The MPC voted 8-1 in favour of the proposition, with only Swati Dhingra voting against. Most experts had been forecasting a 7-2 split.

- The decision comes after inflation rose by more than expected in January, hitting 3%.

- The Bank of England has forecast that inflation could rise further to around 3.75% by the third quarter of the year.

The team at MoneyWeek is reporting live. Scroll for the latest updates and analysis.

| Bank of England predictions | MPC meeting dates | UK inflation forecast |

Good Wednesday morning. Welcome to our interest rates blog. We will be bringing you live updates on the Bank of England’s key decision tomorrow, starting with preview analysis today. Stick with us.

Interest rates expected to be held

Last time the Monetary Policy Committee (MPC) met (6 February), it voted to lower the base rate from 4.75% to 4.5%.

Anyone hoping that the upcoming meeting might bring another fall in interest rates is likely to be disappointed.

“We expect a largely uneventful affair at the March MPC meeting. The path ahead will be one of careful calibration,” said Sanjay Raja, senior economist at Deutsche Bank. “Uncertainty remains elevated. Growth has seemingly turned a corner… Price momentum, at least on a headline basis, points to more upward pressure – at least in the near term.

“We expect Bank Rate to remain unchanged at 4.5%.”

Above: The sun might be shining in London this week, but interest rates are expected to be kept on ice.

Interest rates: which way will MPC members vote?

At the MPC’s last meeting, the nine-person committee voted 7-2 in favour of a 25 basis-point interest rate cut, to 4.5%. The two members who voted against the proposition – Swati Dhingra and Catherine Mann – both favoured a more aggressive 50 basis-point rate cut.

The pair are widely expected to vote for a cut at the upcoming meeting, but will probably be outvoted by their fellow committee members, given inflationary pressures.

“We anticipate a 7-2 vote, with Dhingra and Mann supporting a cut, while the majority opts to hold steady for now,” said Steve Matthews, investment director at Canada Life Asset Management.

This echoes Deutsche Bank economist Sanjay Raja’s view: “The core of the committee has signed up to a 'gradual', 'careful', or 'cautious' calibration of monetary policy,” he says, which he views as more consistent “with a quarterly pace of rate cuts until uncertainty wanes or downside risks in the activity/inflation data emerge”.

He adds that “both Dhingra and Mann are likely to vote for a more 'forceful' rate cut given their views of demand-based weakness emerging in the UK economy, including more downside risks around inflation and wage growth”.

Above: In February's meeting, external MPC member Catherine Mann voted for a 50 basis-point cut, having previously voted to hold rates at December's meeting.

How dovish is the MPC?

While Dhingra and Mann both voted for faster cuts at the last MPC meeting, Paul Dales, chief UK economist at Capital Economics, cautions against reading a dovish stance into its approach to this meeting.

Referring back to the BoE analysis published alongside February's decision, he said: “The MPC as a whole placed ‘greater weight’ on scenarios in which both inflation and interest rates fall slower and the Bank dramatically revised up its forecast for CPI inflation.”

The MPC now expects inflation to peak at 3.7% in the third quarter.

Dales adds that the MPC’s emphasis on a “gradual” approach to interest rate cuts implies a 25 basis-point cut every other meeting. What’s more, in February, the committee for the first time indicated that it would be “careful” in its approach, implying that “there are both upside and downside risks to inflation”.

In other words, the MPC still thinks an easing in underlying inflation will allow it to reduce rates to less restrictive levels, but it doesn’t have enough confidence in that assessment to cut rates more quickly, Dales suggests.

Above: The MPC is not as dovish as February's vote might suggest.

The longer-term outlook for rates

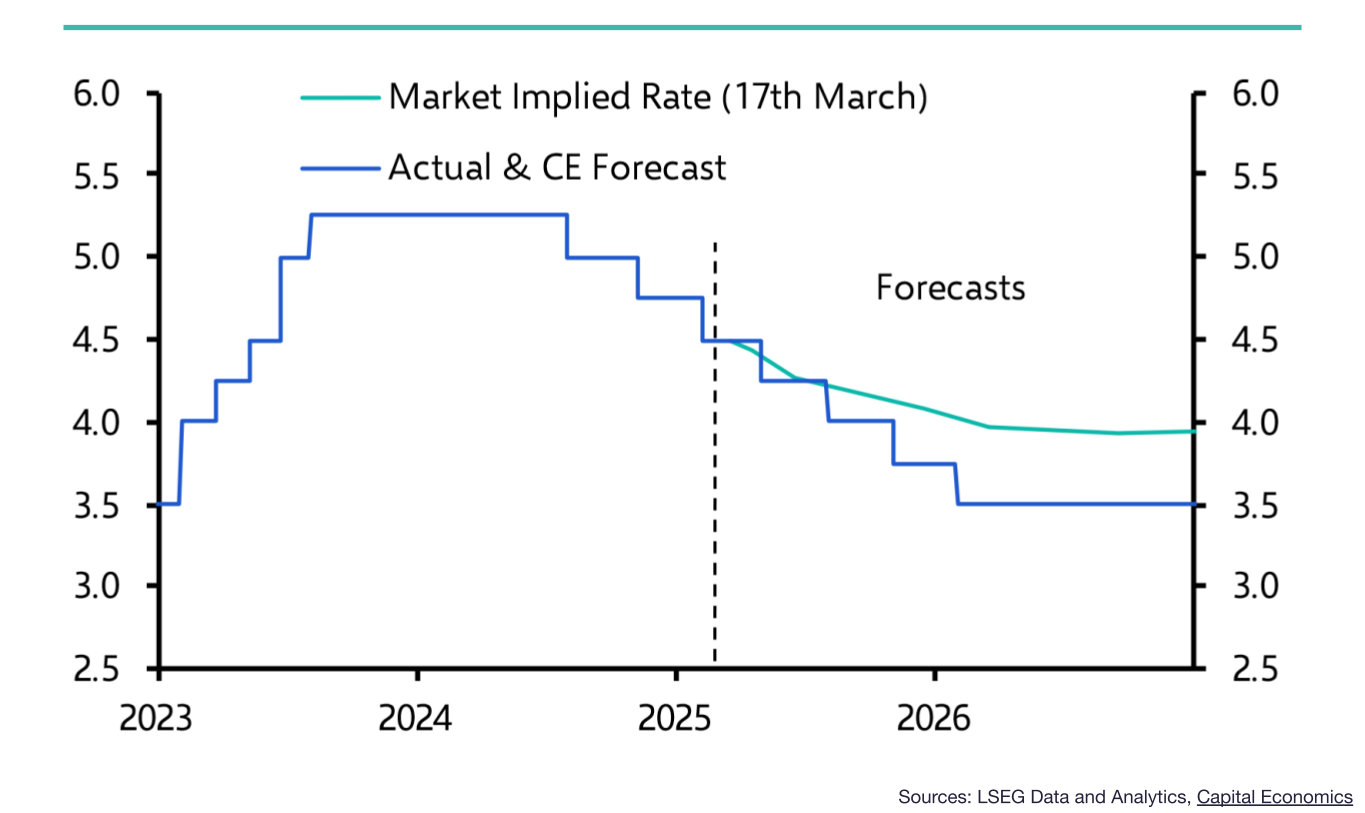

Consultancy Capital Economics is expecting three further interest rate cuts this year, and one in early 2026, taking the base rate to 3.5% rather than the 4% being priced into markets. A lot will depend on future inflation reports, though.

“What happens beyond March depends on a whole host of factors, but will largely boil down to how far inflation rises, if that prompts any second-round effects in the form of higher-than-otherwise wage growth and inflation expectations, and the weakness of the economy,” said Paul Dales, the consultancy’s chief UK economist.

He outlines three broad scenarios:

- If inflation rises beyond the 3.7% peak, the Bank will likely pause its rate cuts. “A pause after another two 25 basis-point rate cuts is similar to the scenario priced into the markets,” says Dales.

- Alternatively, slowing inflation might prompt a faster rate-cutting approach.

- If inflation is essentially as expected, the MPC’s current gradual approach will likely continue. This scenario, says Dales, is closest to Capital Economics’ forecast.

Reuters poll: strong likelihood of a “hold”

All 61 economists polled by news agency Reuters last week said they expect rates to hold steady at 4.5%.

A poll of MoneyWeek readers was more split. Sixty-six percent of readers expect no cut (165 out of 250), while 34% expect a reduction (85 out of 250).

Recap: What’s the latest with inflation?

Inflation rose by more than expected in January to 3%, up from 2.5% in December. Analysts had been expecting a reading of 2.8%.

The Bank of England has forecast that inflation will rise further this year, hitting 3.7% by the third quarter. It is primarily higher global energy prices that will drive the increase.

Despite this, the Bank isn’t overly concerned about the forecast currently, given that significant progress has been made with domestic price pressures. The MPC also expects the rise to be temporary.

Speaking at the February MPC press conference, BoE governor Andrew Bailey said: “While we expect inflation to rise again over the coming months, it is almost entirely due to factors that are not directly linked to underlying cost and price pressures in the economy, and factors that we expect to be temporary.”

That said, there are still some risks on the horizon. April’s increase to employers’ National Insurance contributions and Donald Trump’s erratic trade policy could both push prices higher.

Above: UK inflation rose to 3% in January. The next CPI report covering February will be published on 26 March.

How much attention will the Bank of England pay to Trump’s tariffs?

Trump’s erratic trade policy has dominated the headlines in recent weeks. Canada, Mexico and China have been the main targets, but the EU has also been slapped with more targeted measures (alcohol tariffs). Steel and aluminium imports from all countries are also subject to a 25% levy.

Trump has backtracked in several places, granting wide exemptions to Canada and Mexico shortly after initial measures kicked in, however significant damage had already been done. There has been a drop in business confidence as firms struggle to prepare for a landscape that is continually shifting, and consumers are bracing for higher prices as tariffs make goods more expensive.

How much attention will the Bank of England be paying to tariffs? Undoubtedly, Trump’s trade policy will be a concern. Tariffs won’t just push prices up in the US – the interconnected nature of the global economy means price pressures will be exported around the world, particularly when US trading partners respond with retaliatory tariffs of their own.

“The risks to the UK economy, and indeed the world economy, are substantial,” BoE governor Andrew Bailey recently told MPs.

That said, it is too early to determine whether tariffs will force the MPC to cut rates more or less quickly. On the one hand, tariffs are likely to push prices up. On the other hand, they could also act as a drag on economic growth.

Above: The president's erratic trade policy has spooked markets and even prompted talk of a 'Trumpcession' in recent days

“UK will also feel the effects as the trade war escalates”

While Trump hasn’t targeted the UK with tariffs so far other than the broader steel and aluminium tariffs, it would be foolish to believe we won’t be affected, experts suggest.

“Given how intertwined the UK is with the global economy, it will also feel the effects as the trade war escalates. Already growth is highly sluggish, only just crawling along by 0.1% in the final quarter of last year,” said Susannah Streeter, head of money and markets at investment platform Hargreaves Lansdown.

“There are hopes of a trade deal between the US and the UK, but given Trump’s capricious policymaking, until any agreement is signed, sealed and delivered, the UK is set to stay vulnerable,” she added.

With this in mind, Streeter believes we will have to wait until May at the earliest for another cut. The MPC doesn’t meet in April, so the next decision after tomorrow will be announced on 8 May.

UK growth has been slowing

The Bank of England has a dual mandate – as well as controlling inflation, it needs to support economic growth. UK growth has been limp for years, particularly since Brexit, but there has been a further slowing in recent months with some commentators issuing warnings about the potential onset of stagflation.

Monthly GDP contracted by 0.1% in January, and grew by just 0.2% on a three-month basis (versus the three months before).

“The Spring Statement is now less than two weeks away, and it is becoming increasingly clear that chancellor Rachel Reeves finds herself in a very difficult position,” said Richard Carter, head of fixed interest research at wealth manager Quilter.

“The Bank of England recently halved its forecast for economic growth from 1.5% to 0.75% in 2025. Given fiscal headroom is highly sensitive to changes in growth expectations, the previous £9.9bn of headroom will almost certainly no longer be available,” he added.

“The government is between a rock and a hard place given its repeated assurances that it will not raise taxes for working people. The alternative is to cut spending elsewhere and take from what are already stretched resources.”

Above: Reeves has previously committed to just one major fiscal event per year, suggesting the Spring Forecast was not intended to be a major 'tax and spend' event. Will she be forced to change her stance?

Ongoing wage pressure could encourage a cautious stance from the BoE

Chris Arcari, head of capital markets at consultancy Hymans Robertson, says ongoing wage pressure could feed into a decision to hold rates tomorrow.

“Average weekly private-sector wage growth (excluding bonuses) came in at 6.1% year-on-year in the three months to January. This, in turn, has kept upwards pressure on service-sector inflation, which accelerated to 5% year-on-year,” he says.

“Additionally, while survey data points to employers cutting their hiring in response to the national-insurance increase announced in the October Budget, the data also suggest that at least as many businesses intend to raise prices in response, which will further contribute to price pressures.”

Above: Wage growth is still coming in fairly strong, but changes to employers' National Insurance from April could result in fewer pay rises and potentially even redundancies.

What will a 'hold' mean for mortgage rates?

Prospective homeowners and those looking to remortgage may be disheartened to hear that rates are unlikely to fall tomorrow. That said, it is worth remembering that rate cuts are typically priced into markets in advance. Mortgage rates have already fallen so far this year in anticipation of future rate cuts, with some sub-4% deals returning to the market.

"Despite expectations that we’re unlikely to see the Bank of England make a move [on 20 March], the market is still expecting two more rate cuts this year – with the first possibly as early as May. As a result, fixed-term rates have been gradually falling over the past six weeks," said Sarah Coles, head of personal finance at Hargreaves Lansdown.

The average two-year fixed-rate deal has fallen from 5.52% at the start of February to 5.34% today, according to financial information company Moneyfacts.

Despite this, rates remain high compared to their long-term average. Those coming to the end of a relatively cheap five-year deal could find themselves paying significantly more in monthly repayments once they refinance.

Above: Mortgage rates are significantly higher than their long-term average, despite recent falls.

What about savings?

A hold on interest rates would be good news for savers, who have seen savings rates tumble over the past year or so – first in anticipation of rate cuts and then in response to them.

That said, the savings market (like any other market) takes forecasts into consideration as well as actual news. Around two or three more base rate cuts are expected before the end of the year, and are already priced into markets to a certain extent.

With this in mind, now could be a good time to put some money in a fixed-rate account, if you are willing to lock it away for a year or so. This will allow you to take advantage of higher rates before they disappear.

See our round-up of the best easy-access rates, one-year savings accounts, regular saver accounts and cash ISAs for the latest deals on cash savings.

Above: Interest rates have been falling but savers can lock in higher rates for longer by opting for a fixed-rate deal, if they don't need immediate access to a portion of their savings.

FTSE 100 continues to rise

The FTSE 100 is in the green so far this week. Investors are seemingly unconcerned about a likely 'hold' decision from the MPC tomorrow, potentially focusing on the longer-term outlook instead. Rates are expected to fall around two or three more times before the end of the year, which could give businesses a boost, provided economic growth doesn't take a significant downturn.

The FSTE is up around 2% over the past five days, and 5.4% year-to-date. It has outpaced both its US and global counterparts so far this year, which have been spooked by tariffs and the prospect of a Trumpcession.

Thank you for following our preview analysis today. We will be back tomorrow, sharing further insights as the Bank of England announces its decision at midday. Join us then.

Good morning and welcome back to our interest rates live blog. The Bank of England will announce its next interest rate decision at midday today.

A 'hold' vote is widely expected, keeping the base rate at 4.5%, but the summary documents published alongside the BoE's decision should still make for interesting reading, giving some hints about the future direction of policy. At the moment, most economists are expecting three further cuts this year, with the next one coming as early as May.

Stick with us.

What does the latest labour market data show?

The ONS published its latest labour market report this morning. The MPC watches this data closely. Wages are a big driver of inflation, while the unemployment rate gives a sense of the health of the overall economy.

The latest report showed that regular wages (excluding bonuses) grew by 5.9% on an annual basis between November and January. This marks no change from last month's report. Total wages (including bonuses) grew by 5.8%, down from 6% in the previous report.

The unemployment rate came in at 4.4% over the same period, unchanged from last month's report.

"Working purely with today’s numbers, things look pretty settled. Unemployment has held steady, wage growth has stayed firm and vacancy numbers have also remained pretty much where they were," said Danni Hewson, head of financial analysis at platform AJ Bell.

However, she adds that we can't look at these numbers without considering the bigger picture – notably the National Insurance changes that will kick in from April, and the global disruption being caused by Donald Trump's trade policy.

"Business after business has said that they expect the increased labour costs will impact their decisions in the year ahead and with growth expectations considerably softened, the case for investment might be one being pushed into the long grass," Hewson says. Meanwhile Trump's "chaotic implementation of tariffs has, in the words of Fed Chair Jerome Powell, ‘muddied the outlook’ for central bankers, governments and businesses alike," she adds.

It is still unclear whether NI changes and Trump's trade policy will boost the case for faster or slower rate cuts, though. Both policies are expected to push inflation up and slow economic growth down. While keeping interest rates high could help quash inflation, it could also act as a further drag on growth. The MPC has a tricky tightrope to walk.

Fed held rates steady yesterday – will the BoE follow suit?

Today's decision from the Bank of England comes a day after the US Federal Reserve's latest announcement.

The Fed voted to hold rates steady in a range between 4.25% and 4.5%, where they have been since December. The Fed also downgraded its annual growth expectations from 2.1% to 1.7% in 2025, and from 2% to 1.8% in 2026.

"Looking ahead, the new [Trump] administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation," Fed chairman Jerome Powell said.

"While there have been recent developments in some of these areas, especially trade policy, uncertainty around the changes and their effects on the economic outlook is high... We do not need to be in a hurry to adjust our policy stance, and we are well positioned to wait for greater clarity," he added.

The BoE is also expected to hold rates steady today, although most economists believe the BoE will cut rates more rapidly than the Fed this year overall. The BoE has already made one cut so far in 2025 (in February), and two or three more reductions are expected before the year is out.

Above: Chairman of the US Federal Reserve, Jerome Powell

Back to the UK... wage growth still "stubbornly high"

Let's turn our attention back to the UK, with some more analysis on the latest labour market stats that dropped this morning. Deutsche Bank's chief economist Sanjay Raja has described the wage growth figures as "stubbornly high" and says they will do "little to hurry the MPC in its rate-cutting cycle".

Just to recap, the report showed that regular wages (excluding bonuses) grew by 5.9% on an annual basis between November and January. This marks no change from last month's report. If there's any good news, Raja says it's that private sector pay is "tracking ever so slightly below the MPC's forecast".

Above: The rate of wage growth was unchanged compared with last month's report, but the figures are still higher than the Bank of England would like.

Job market looks resilient, for now at least

Stubbornly high wage growth figures and a stable unemployment rate could reduce the pace of future rate cuts (remember John Major's old phrase that "if it isn't hurting, it isn't working"), but they will come as good news to workers.

"The UK jobs market has held up surprisingly well so far despite the substantial economic pressures, and job vacancies were broadly unchanged on the quarter, coming in at 816,000 in December 2024 to February 2025," said Lindsay James, investment strategist at Quilter Investors.

"Demand for workers has by no means collapsed, and vacancies remain above pre-pandemic levels, but it is worth noting that there has been a consistent decline and we could see this pick up as businesses contend with higher costs."

ING: Bank of England becoming "more hawkish"

"Drama is not often synonymous with the Bank of England. But February’s meeting was nothing short of a bombshell," says James Smith, developed market economist at ING. Smith is referring to Catherine Mann's surprise decision to switch from a hold vote in December, to voting for a 50 basis-point cut in February.

"That posed the question: if the arch-hawk is prepared to vote for faster rate cuts, will the rest of the committee soon follow suit?," Smith explains. But the truth is somewhat different, in his view. He argues that the MPC as a whole has actually become more hawkish.

"Most officials that have spoken since [February's meeting] have struck a much more cautious tone," Smith says. He adds that the statement published alongside February's decision also had a "hawkish flavour".

This tallies with what the experts at consultancy Capital Economics are saying. They point out that, in its scenario analysis, the BoE is now placing greater weight on scenarios in which inflation and interest rates fall more slowly.

Above: Is the Bank of England becoming more hawkish?

MPC announcement due at midday

The BoE's latest decision will be announced in around five minutes' time. To recap, the Bank is expected to hold rates at 4.5% today.

The MPC has cut rates three times so far from their peak of 5.25% – twice last year (August and November) and then once last month.

BREAKING: Bank of England holds rates at 4.5%

The Bank of England has voted to hold rates at their current level of 4.5%, as widely anticipated. All 61 economists polled by Reuters last week predicted this outcome.

We are looking at the MPC’s summary statement as we speak and will bring you the latest.

MPC voted 8-1 in favour of holding rates

The MPC voted by a majority of 8-1 to hold rates at 4.5%. Just one member (Swati Dhingra) voted against the proposition, preferring to cut rates by 25 basis points to 4.25%.

That means that Catherine Mann, who previously voted for a 50 basis-point cut in February's meeting, voted in favour of the 'hold' decision today.

Above: Swati Dhingra was the only MPC member to vote for a cut this time.

"We expected no rate cut"

Reacting to the latest decision, Marion Amiot, chief UK economist at S&P Global Ratings, said: "We expected no rate cut and a cautious, gradual approach from the Bank of England.

"These are challenging times for the BoE. Like elsewhere, inflation in the UK has declined, but the persistent strength of wage growth – despite weak demand – remains puzzling, with the latest reading close to 6%.

"This suggests an underlying weakness in the country’s growth potential, likely stemming from the lasting effects of Covid and Brexit, which have constrained the labour force, alongside stagnating productivity."

BoE: Global trade policy uncertainty has intensified

The Bank of England likes to stay out of politics, but it has been forced to acknowledge the disruption being caused by Donald Trump's erratic trade policy.

In its meeting minutes, the MPC said: "Since the MPC’s February meeting, there had been a further increase in geopolitical and global trade policy uncertainty, and it was likely that this elevated uncertainty would persist."

As a result, "the Committee judged that the consequent risks around the near-term outlook for activity in a number of advanced economies, including the United Kingdom, remained to the downside."

Above: Trade tensions have escalated further since February's MPC meeting.

BoE: Impact of Trump's tariffs on UK inflation still unclear

The BoE said that the impact of Trump's tariffs on UK inflation remains unclear for now. It will "depend on where other countries’ trade policies settle and how these transmit through different economic channels, including exchange rates," the MPC explained.

The MPC called it a "rapidly-evolving situation", which it will continue to monitor closely.

What did the Bank say about inflation?

When it comes to inflation, the MPC reiterated some of the language used in February's summary report: "Domestic price and wage pressures are moderating, but remain somewhat elevated".

The Bank added that although global energy prices have "fallen back recently", they are still higher than a year ago, with CPI inflation "still projected to rise to around 3¾% in 2025 Q3". The figure mentioned in last month's report was 3.7%.

Which factors will influence the BoE's decisions going forward?

The Bank of England used the "gradual and careful" phrase again this month when talking about the path of future rate cuts, wording that was introduced for the first time in February.

When making an assessment, the BoE is looking at supply and demand in the economy:

- "Should there be greater or longer-lasting weakness in demand relative to supply, this could push down on inflationary pressures, warranting a less restrictive path of Bank Rate," the MPC said.

- "Should there be more constrained supply relative to demand and more persistence in domestic wages and prices, including from second-round effects related to the near-term increase in CPI inflation, this would warrant a relatively tighter monetary policy path," it added.

Central banks unlikely to sway from quarterly rate cuts

"The pound has pared losses against the dollar and has jumped to a two-week high against the euro, as traders trim their bets for further rate cuts this year," said Kyle Chapman, FX markets analyst at Ballinger Group. Generally speaking, a currency weakens when rates are cut and strengthens when they are raised.

Chapman says today's decision was no surprise: "Every central bank on earth right now is banging on about uncertainty, and it means no reason to expect policymakers to sway from their quarterly pace of rate cuts".

Will the BoE cut rates at its next meeting in May?

The MPC won't meet in April, meaning the next interest rate decision will be announced on 8 May. Before then, two more inflation reports will be published (covering February and March). We will also have the next set of economic growth figures (covering February).

"The financial markets are pointing to May [for the next rate cut] – although there are no guarantees," said Myron Jobson, senior personal finance analyst at investment platform Interactive Investor.

"The BoE would prefer to cut the base rate in response to easing inflationary pressure, but a string of disappointing economic data could force its hand, with GDP growth – or the lack thereof – remaining a key concern," he added.

The BoE's job is challenging. As Jobson points out, it takes up to 18 months for interest rate changes to have their full effect, meaning the Bank has to anticipate what the economy will look like at that point. A former colleague of mine at Invesco once likened this process to a surgeon operating with a blindfold on.

What does a hold mean for your personal finances?

"Fourteen consecutive interest rate rises between December 2021 and August 2023 – a strategy needed to keep rapidly rising inflation in check – sent borrowing costs skyrocketing at a time when households were already grappling with the cost-of-living crisis," said Alice Haine, personal finance analyst at investment platform Bestinvest.

"While rates have since eased with three cuts since August last year, many households are still in recovery mode, with the outlook for personal finances littered with challenges," she added.

A slew of price hikes is on the cards next month, with energy bills, water bills, council tax and more all going up in April. The rate of inflation is also expected to rise further over the course of the year, hitting around 3.75% by the third quarter.

"Consumers should tread carefully from here," Haine warns. "Pessimism about the direction of inflation and the wider economic outlook is mounting, so running down emergency funds or borrowing to fund a major lifestyle cost should always be assessed very carefully to ensure repayments are fully affordable over the long term."

There should be "barely a ripple" in the mortgage market

Given that today's result was widely anticipated, there should be a limited knock-on effect in the mortgage market. "Barely a ripple effect" is the exact phrase David Hollingworth, associate director at L&C Mortgages, uses.

"Lenders remain highly competitive and continue to make small adjustments to improve rates wherever they possibly can. That trend looks likely to continue," he says.

"The Bank of England has consistently suggested that interest rates can fall further, adding to the three cuts since last summer," Hollingworth adds. "Consequently, fixed rates have already priced in further reductions to the base rate, but this is still expected to be a gradual process. Unless there is a marked shift in the Bank’s messaging, mortgage rates look set to remain relatively stable in the near term."

The average two-year fixed deal currently costs 5.33%, according to Moneyfacts, while the average five-year deal costs 5.18%. Borrowers can find lower rates than this by shopping around, with some lenders even offering sub-4% deals.

Savings rates are still falling, despite a 'hold'

Savers will be pleased with the 'hold' decision, but the top savings deals have been disappearing over the past year or so – both in anticipation of cuts and in response to them.

"Data from Moneyfacts found that the average easy-access savings rate has dropped by 0.33 percentage points in the past year. For someone with £15,000 of savings that equates to almost £50 a year in lost interest" said Laura Suter, director of personal finance at investment platform AJ Bell.

"Savers can get much higher rates by shopping around – and the tax year end is the perfect time to pick up a juicy rate from savings providers who want to lure in more customers," she added. "In particular, ISA interest rates have seen healthy competition so far this year."

It could also be worth opening a different type of account, if you only make use of variable-rate accounts currently. For example, opting for a fixed-rate deal will allow you to lock today's rates in for longer, if you have a pot of savings you are willing to lock away for a set period.

See our round-up of the best easy-access rates, one-year savings accounts, regular saver accounts and cash ISAs for the latest deals on cash savings.

Above: The savings market has been cooling over the past year.

Deutsche Bank: "The MPC has given itself more flexibility"

Let's turn our attention back to the documents published by the MPC today. Sanjay Raja, Deutsche Bank's chief UK economist, points to two important developments in the MPC's meeting minutes.

"First, while there remains growing uncertainty around the demand outlook – as per the latest Bank Agents' Survey – there is increasing concern around the near-term inflation outlook, including the persistence of supply-led inflationary pressures," he says.

"Second, the MPC has given itself room for flexibility noting that there 'was no presumption that monetary policy was on a pre-set path over the next few meetings'. In our minds, this opens the door to a rate path that deviates from a quarterly pace of rate cuts – at least in the near-term," he adds.

That concludes our live coverage for today. Thank you for joining us.

The Monetary Policy Committee won't meet in April, which means the next interest rate announcement isn't due until 8 May. See our round-up of all MPC dates in 2025. A spring cut currently looks like a possibility.

We will be back with more live analysis before then, covering the next inflation report on 26 March, and also the Spring Forecast which will be delivered by chancellor Rachel Reeves the same day. Join us then.