The charts that matter: precious metals and bitcoin swoon

As gold and bitcoin both slide, John Stepek looks at what else has happened this week in the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

This week in MoneyWeek – in a break from Covid-19 and the state of the UK’s finances (although we covered the spending review too) – my colleague Cris Sholto Heaton took a look at China’s crackdown on its tech giants and what it might mean for investors (it’s probably not good news). It’s a really fascinating story and one with a lot of insight into China’s shifting political environment. If you don’t already subscribe, get your first six issues free here.

On the podcast front, not one but two podcasts from Merryn this week. Firstly, she spoke to the fantastic Japan analyst Jonathan Allum – that’s an absolute must-listen, pick it up here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Then Merryn joined the team at The Week Unwrapped, with – believe it or not – a good news story about the coronavirus crisis. Have a listen here.

Our latest “Too Embarrassed To Ask” video tackles the subject of “value investing”. What is it and how do you go about it? Click here to find out.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Will the post-Covid recovery set us up for the Roaring 2020s?

- Merryn’s blog: What to buy as the pandemic’s pent-up demand is finally released

- Tuesday: Once Covid-19 is over, we’re going to see an economic boom

- Wednesday: Oil is dirt cheap and going higher – here’s the best ways to invest

- Thursday: Don’t panic – there’s an obvious solution to the UK’s debt pile

- Merryn’s blog: Was lockdown worth the cost?

- Friday: Are central banks about to start targeting house prices?

Now for the charts of the week.

The charts that matter

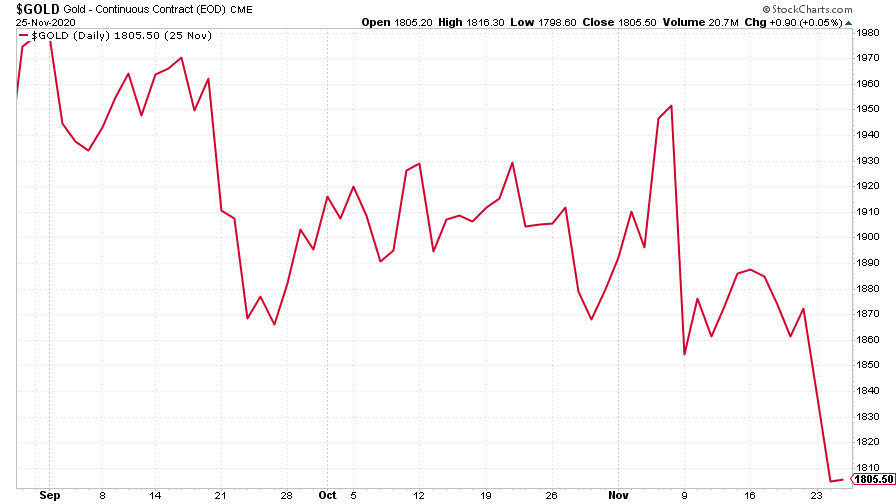

It’s been looking wobbly ever since the vaccine arrived, and this week the bottom fell out of gold. I’m still bullish for the longer run but the next bull phase for gold has to be when investors decide that inflation really is a risk. At the moment they’re caught between craving risk assets (because of the vaccine) while fearing a second-lockdown driven economy slump. Neither of those are helpful for gold demand.

(Gold: three months)

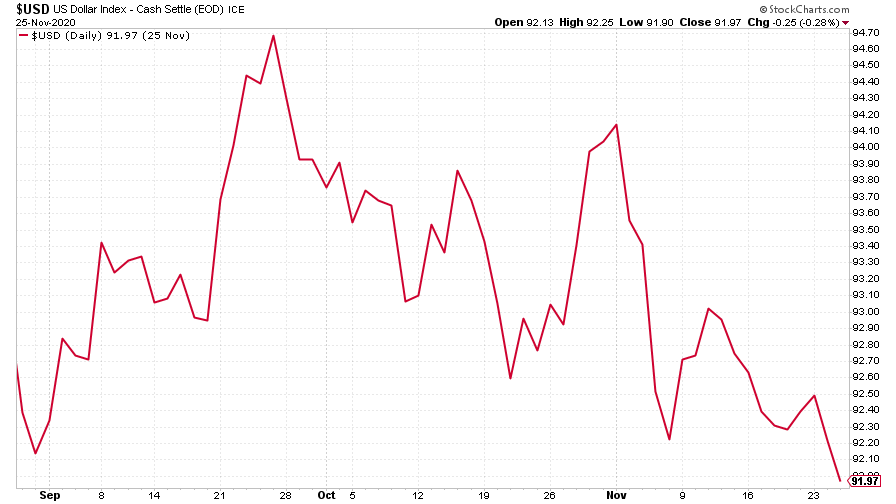

Meanwhile – and this may seem surprising given gold’s slide – the US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) also fell. I say surprising, because investors often assume that gold and the dollar move in opposite directions. However, that’s not always the case. In the most recent run higher, gold and the dollar moved hand in hand. And it seems the same is true on the way down, at least for the time being.

(DXY: three months)

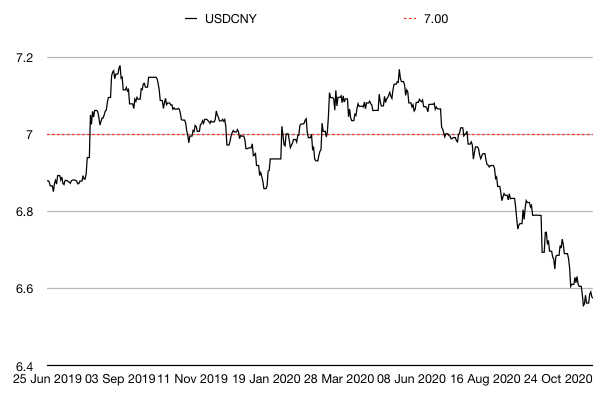

The Chinese yuan (or renminbi) strengthened was little changed against the US currency (when the black line below rises, it means the yuan is getting weaker vs the dollar) although it has enjoyed a very strong run in recent months.

(Chinese yuan to the US dollar: since 25 Jun 2019)

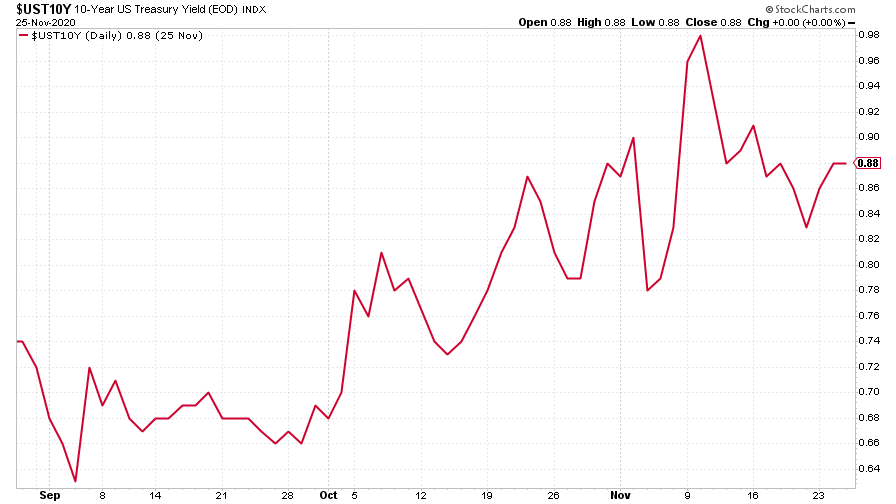

The yield on the ten-year US government bond was little changed, which I suspect reflects the fact that despite their vaccine joy, investors aren’t keen to let go of their deflation hedges just yet.

(Ten-year US Treasury yield: three months)

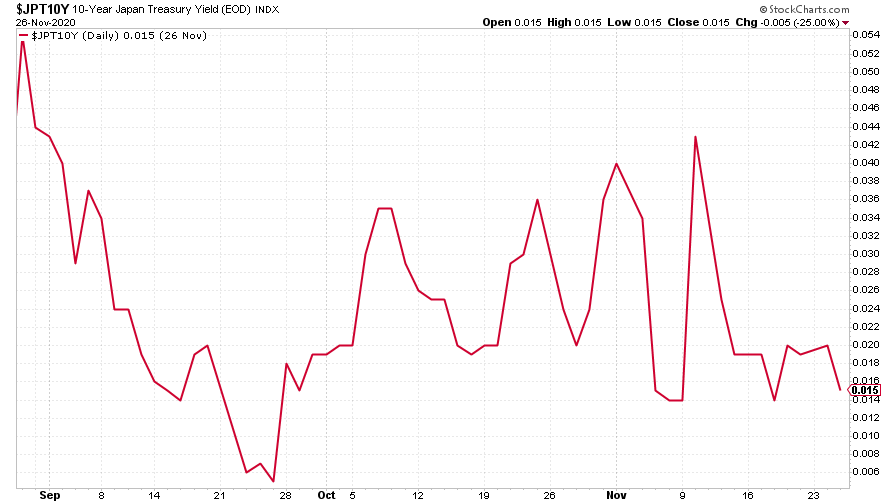

The yield on the Japanese ten-year stayed at zero, because that’s where the Japanese central bank wants it to stay.

(Ten-year Japanese government bond yield: three months)

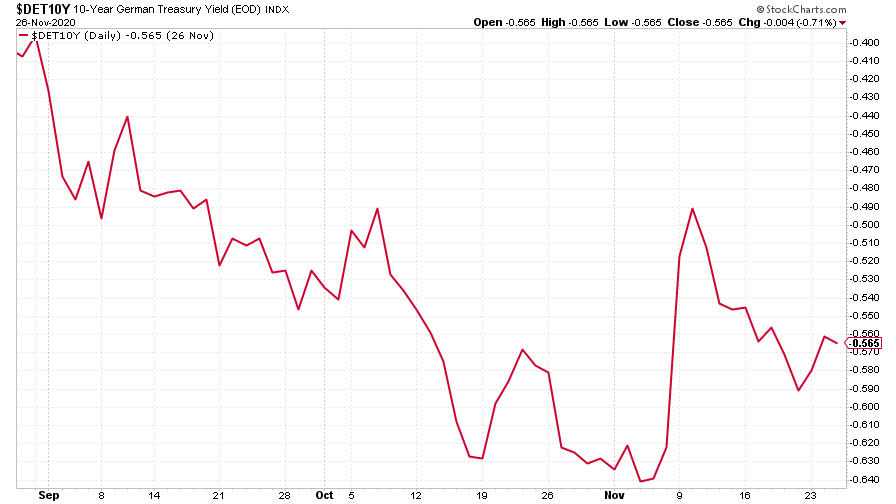

And the yield on the ten-year German Bund saw the same lack of action as the US ten-year.

(Ten-year Bund yield: three months)

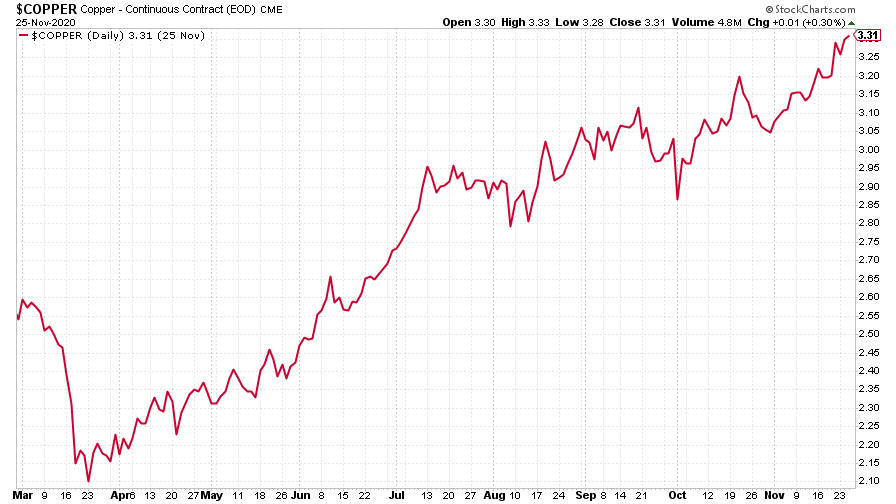

The clear hopes for the reflation trade continued to be manifested in the copper price, which surged to a new post-Covid high this week.

(Copper: nine months)

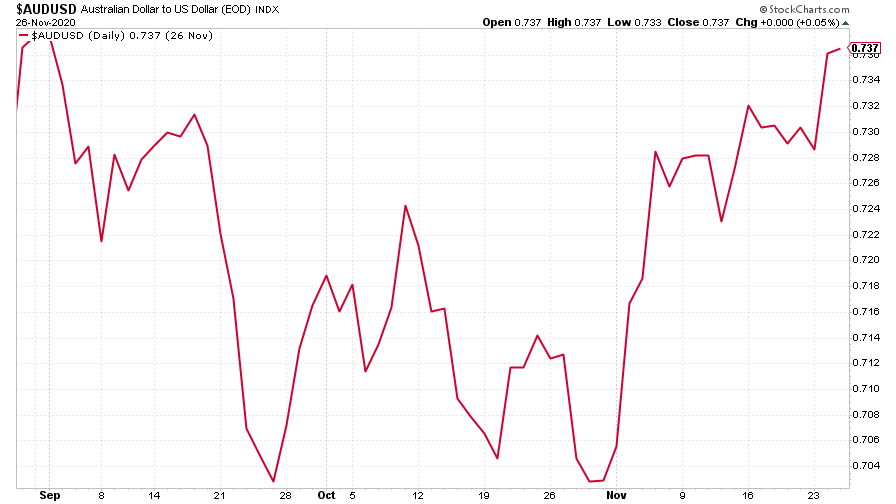

The Aussie dollar climbed against the US dollar too as investors looked to get exposure to commodity currencies.

(Aussie dollar vs US dollar exchange rate: three months)

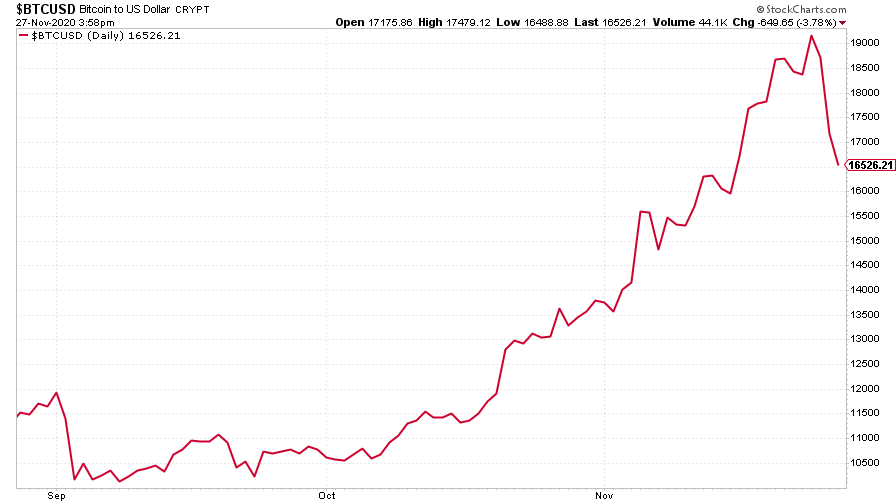

Turns out that cryptocurrency bitcoin needed a breather this week, not the week before as I’d first pondered. The digital currency had a crack at its previous record, above $19,000 a coin, then promptly gave up a couple of thousand dollars. In the context of bitcoin, this so far just counts as a healthy correction rather than a bubble popping, but let’s see what happens next.

(Bitcoin: three months)

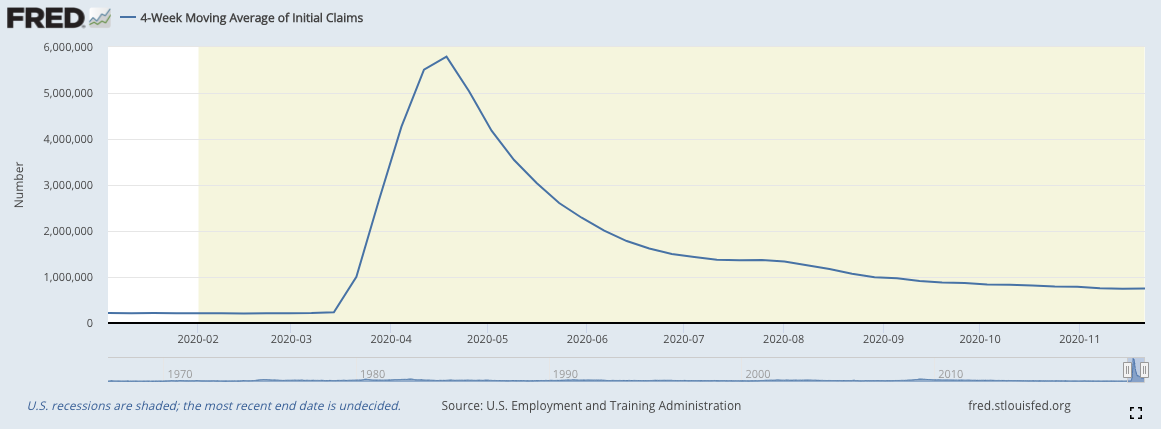

US weekly jobless claims rose to 778,000, from 748,000 last week (revised up from 742,000). That’s the first time claims have risen for two weeks in a row since July. The four-week moving average rose a little to 748,500 from 743,500 the week before.

(US jobless claims, four-week moving average: since Jan 2020)

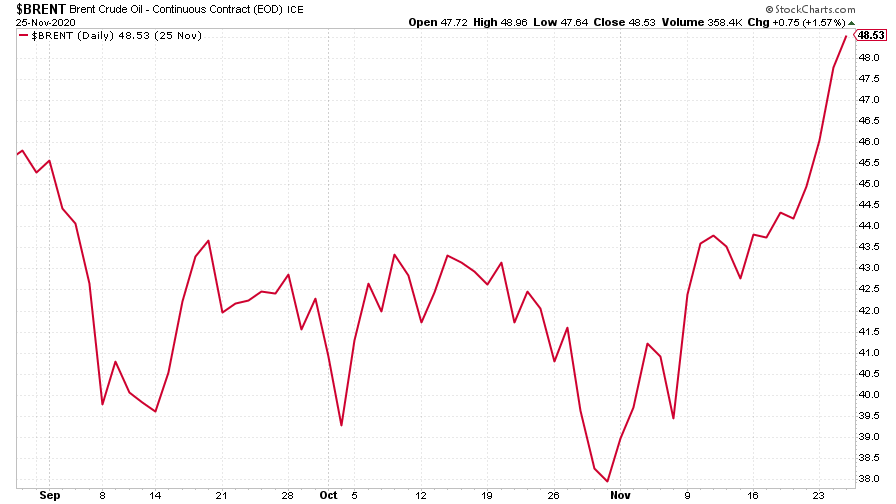

The oil price (as measured by Brent crude) finally seems to be gaining traction - alongside the copper price it surged to a new post-Covid high this week. Dominic wrote about how he’s investing in it here.

(Brent crude oil: three months)

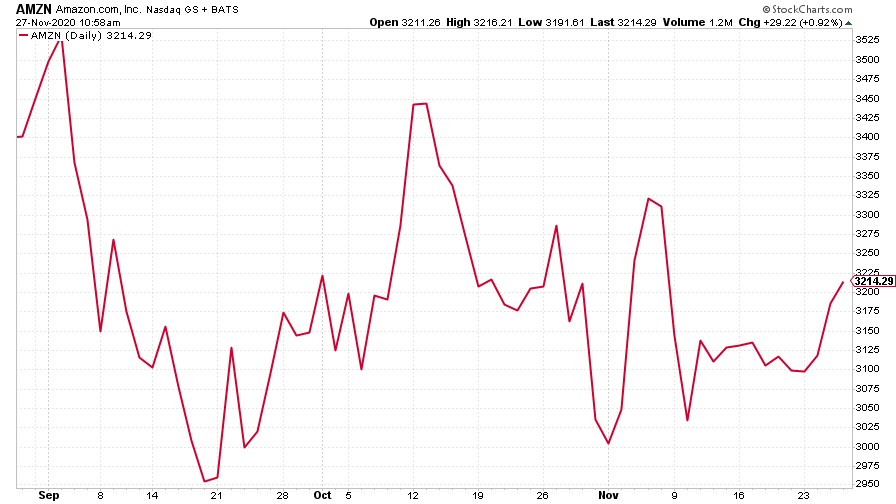

Amazon climbed a little this week. Just ahead of Black Friday – the big American day of discounts – the company announced that it will pay a one-off Christmas bonus to its staff. Apparently the move came amid calls for strike action over the weekend.

(Amazon: three months)

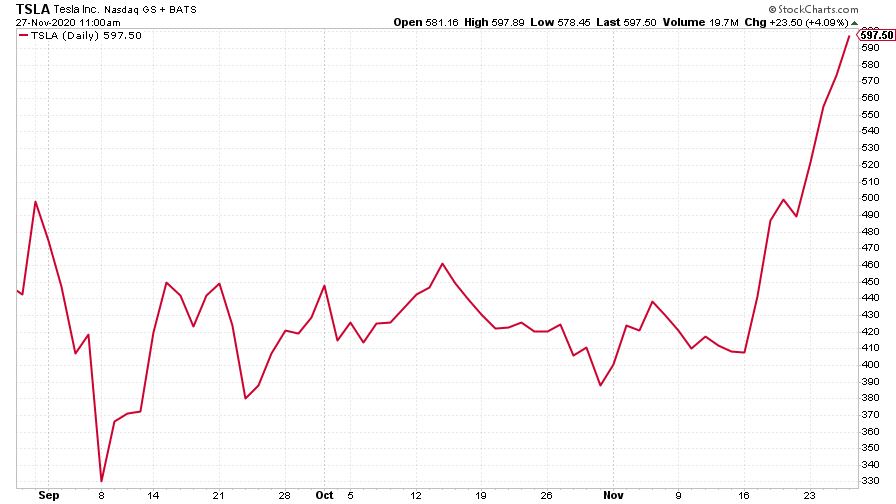

And Tesla just keeps powering ahead.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.