Don’t panic – there’s an obvious solution to the UK’s debt pile

Cutting spending or raising taxes won’t be enough to get the country out of debt. But there is another way out, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

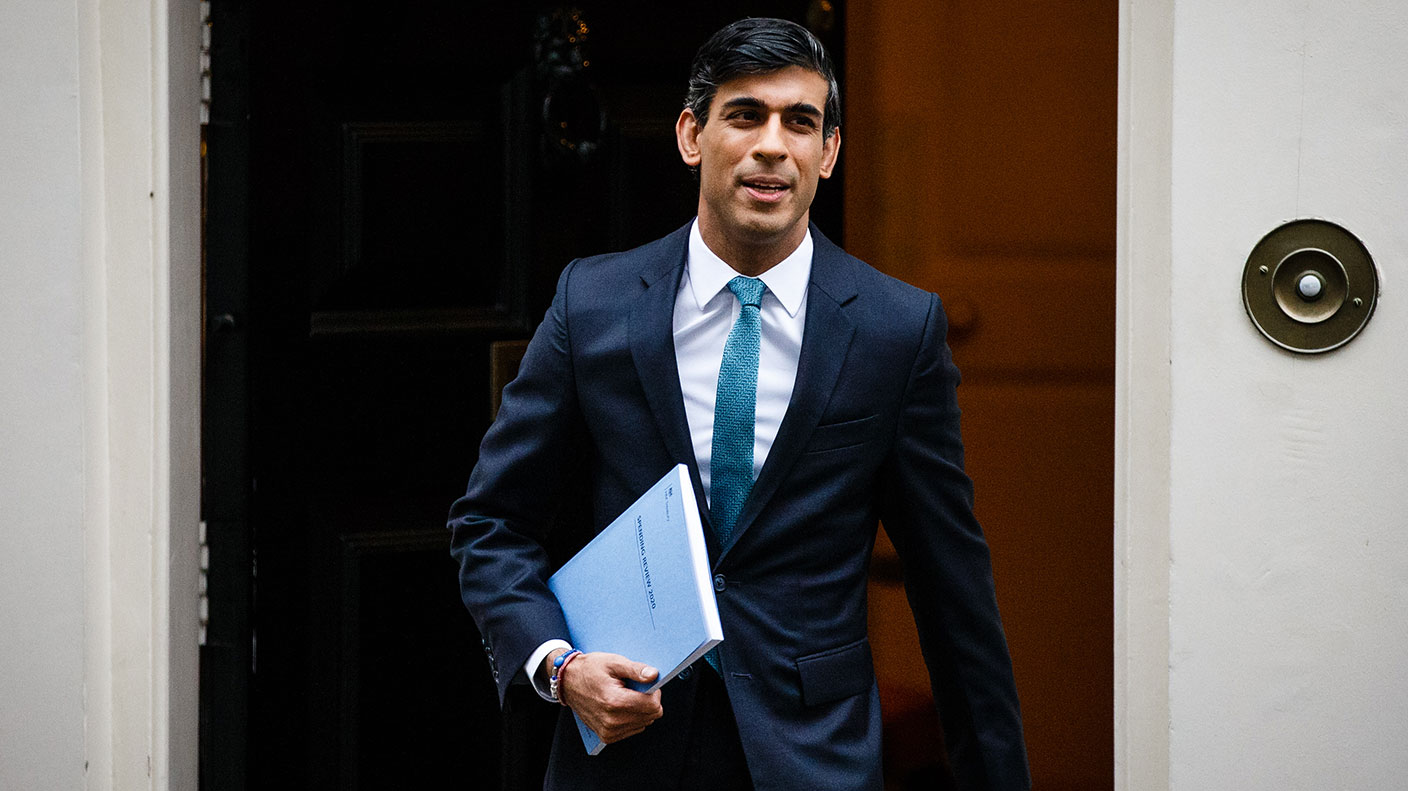

Rishi Sunak is in an extremely unusual position, in that he’s probably one of the only Cabinet members whose reputation has improved as a result of Covid-19. He’s the safe pair of hands. He’s the calming grown-up presence in a playground full of hysterical overtired kids. He’s got some idea of what he’s doing.

Trouble for him is, he’s also been playing Santa Claus for most of the year. And now, just as we’re coming up to Christmas, people are murmuring about what the bill for all of this will be. So what’s Sunak going to do? And what might it mean for your pocket?

Sunak’s dilemma – cutting spending or raising taxes aren’t enough

Rishi Sunak had yet another session in the spotlight yesterday. The Spending Review had been awaited with some trepidation. And little wonder. The UK’s balance sheet is a mess, to be frank. It looks like we’ll have a deficit (annual overspend) of nearly 20% of GDP this year, at just under £400bn. Our overall debt-to-GDP ratio is heading towards 109% in the next few years. And unemployment is set to peak at 7.5% in the second quarter of next year. The obvious question is: how do we pay for all this?

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is where it gets difficult. Politically speaking, the Tories can’t just say: “Let’s throw caution to the winds” because that’s not their image. If people want to vote for fiscal irresponsibility, that’s what the Labour Party is for. But politically speaking, they also don’t want to be associated with the old days of “austerity” either. So ultimately, they have to make it look as though they’re trying to pay it back, but they have to do that in a politically palatable manner.

What does that mean? Let’s deal with the pretending to pay it back first of all. It’s not politically OK to cut spending. That’s clear. Sunak is not going to allow himself to be associated with anything that smacks of “austerity”. And Boris Johnson isn’t exactly an austerity kind of guy either. So while Sunak talked up the warnings, all that happened on this front was that the pay of public sector workers who earn more than £24,000 a year and don’t work in the NHS was frozen and the overseas aid budget was cut from 0.7% of GDP to 0.5%.

The loud moaning that ensued after the cutting of the overseas aid budget – even although that’s probably one of the most politically popular cuts that could have been pushed through – shows just how hard it is to get rid of any sort of spending once it’s been in the budget for more than five minutes. And the sacrosanct nature of the NHS means trimming spending on that behemoth is out of the question for the politically foreseeable future.

OK. So they can’t cut spending. What about tax? Well luckily it’s OK to tax “the rich” and “the privileged”. This is where capital gains tax comes in. This wasn’t discussed in the spending review but you can bet it’ll come up in the next Budget. At some point, if Sunak is at all serious about making a token move towards paying this debt, then those with assets will be targeted.

And to be fair, of all the tax hikes you could do just now, this is arguably the one that makes the most sense. You can’t tax people’s incomes if you want them to go out and spend. Taxing wealth has other effects, but it's not likely to have a big impact on the short-term economic rebound.

There’s a problem here though. If you want to raise enough money, you have to implement tax measures that hit a lot of people, not just a small proportion of very very wealthy people. And – astonishing as it may seem – tax rises are only politically popular when they are tax rises on “other people”. When most people say “tax the rich” they mean “anyone who is richer than me”. As soon as you start in on their savings or investments, they rapidly start looking for someone else to vote for.

Here’s how we’ll get rid of the debt

OK, so that’s the dilemma. The good news for Sunak is that there is another way out. And I suspect that’s the one we’ll be taking. We have to pay the debt as we’re a developed country. But we can’t do it by cutting spending, and we can’t do it by raising taxes. So what do we do? We inflate it away.

Firstly, there’s no urgency to sort this debt out. Low interest rates help. But it’s not even that. We’ve moved into a world where everyone is indebted, so relative to other countries, Britain is not especially bad. We’ve also moved into a world where markets have largely accepted (for now) that a central bank printing money to hand to its own government is actually OK. So rates can be relied on to stay low for the foreseeable future.

Secondly, as Ruth Gregory of Capital Economics points out, the recovery may well go a decent way to plugging the gap in the nation’s finances. It’s easy to be too gloomy about these forecasts, and as you might expect from the name, the "Office for Budget Responsibility" has a record of pessimism.

You add those two together, and you end up with a scenario where the world is returning to normal more quickly than expected, at a time when there’s massive pent-up demand from locked down consumers, combined with a lot of liquidity sloshing about the system due to deflation-fearing central banks. If we can’t get inflation going in the next few years under that scenario, it’ll be a big surprise.

That of course, has implications for your portfolio, which we’ll be looking at in much greater detail in coming issues of MoneyWeek magazine. Subscribe now and get your first six issues free.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.