The charts that matter: pre-election paralysis

Markets are caught in the headlights as the US election approaches fast – John Stepek looks at how the charts that matter most to the global economy are reacting.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

MoneyWeek’s 20th anniversary issue is coming up very soon – 6 November to be precise. If you don’t already subscribe, make sure you don’t miss out – sign up now and you’ll get your first six issues free.

It’s going to be a feature-packed issue, focusing on the big trends of the next 20 years, and how to go about investing in them. And we want your views! We’re asking our readers and contributors five questions on events that we’re all talking about today that may or may not have happened by 2040. You can see the questions so far on this page. Check it out and email your responses to 2040@moneyweek.com.

Why are Merryn and I thinking of hiring a huge warehouse with a short-term lease and a handful of armed guards? I’d like to say it’s to hold all of MoneyWeek’s 20th birthday presents, but no, that’s not it. You can learn more about our cunning plan in our latest podcast.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And this week I joined The Week Unwrapped team to discuss unions for social media stars, the new space race, and how Germany’s new bankruptcy laws have caused a stir because of their pronoun usage.

Meanwhile, our latest “Too Embarrassed To Ask” video is all about “momentum investing”. Don’t know what that is? Well, you can find out here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Is inflation set to return – and should you be worried?

- Merryn’s blog: Pandemics, politicians and gold-plated pensions

- Tuesday: Why it pays to take cries of “bubble” with a pinch of salt

- Merryn’s blog: Private vs public sector pay: who really gets more?

- Wednesday: Sterling or bitcoin? I know which one I trust more

- Thursday: What would negative interest rates mean for your money?

- Friday: Oil shares have never been this cheap – but will they just get even cheaper?

Now for the charts of the week.

The charts that matter

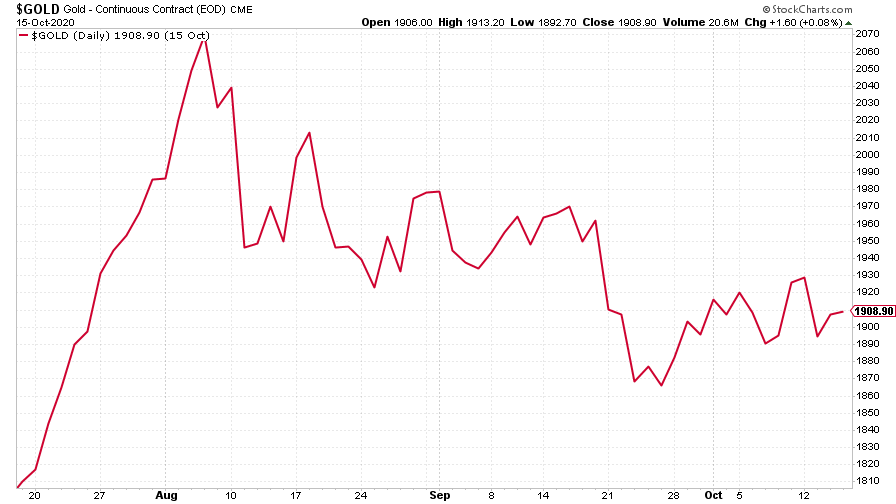

Gold clawed higher this week but it was a struggle. With the US election coming up we keep hearing rumours and counter-rumours that there will or won’t be more government spending before then. However, while agreement seems unlikely now, after the election, regardless of who wins, a splurge is seen as a near-certainty. That’s likely to keep investors interested in gold for the time being.

(Gold: three months)

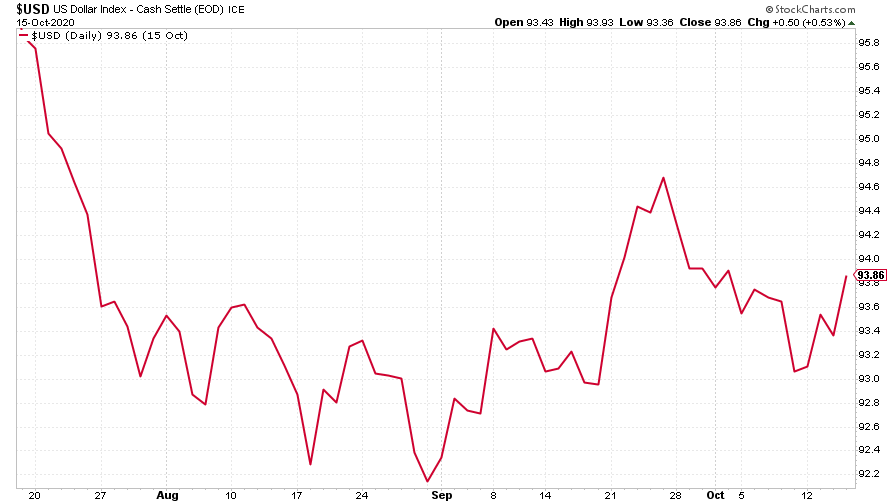

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) was again little changed this week.

(DXY: three months)

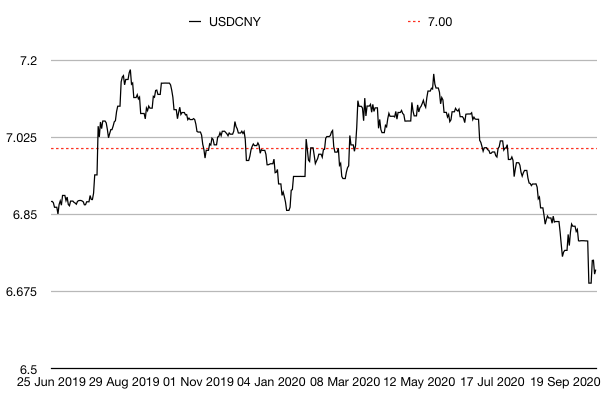

The Chinese yuan (or renminbi) continues to strengthen against the dollar (when the black line below rises, it means the yuan is getting weaker vs the dollar). Investors seem to be parking their fears about China’s lack of transparency in favour of its improving economic recovery.

(Chinese yuan to the US dollar: since 25 June 2019)

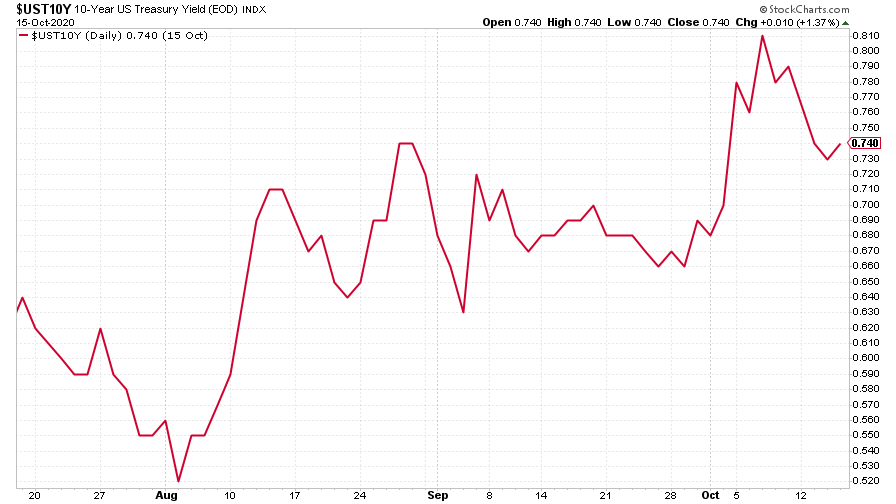

The yield on the ten-year US government bond was a little lower than at this time last week.

(Ten-year US Treasury yield: three months)

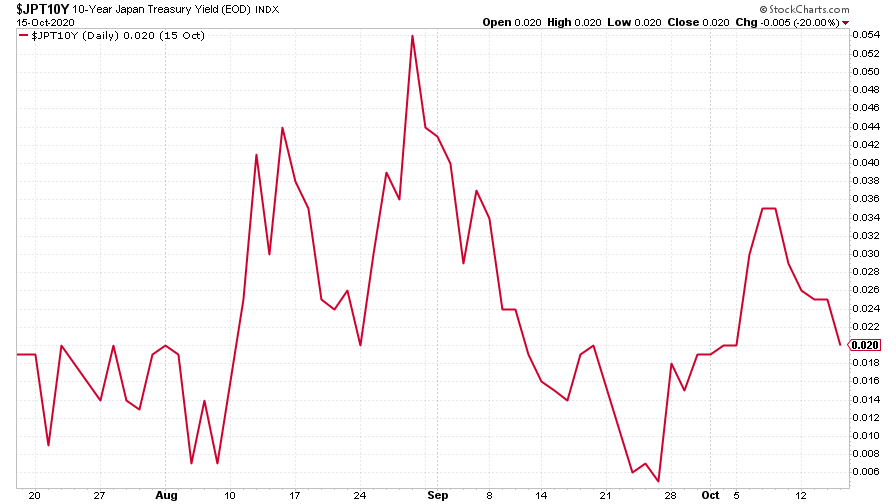

The yield on the Japanese ten-year remains tightly bound to the near-zero mark.

(Ten-year Japanese government bond yield: three months)

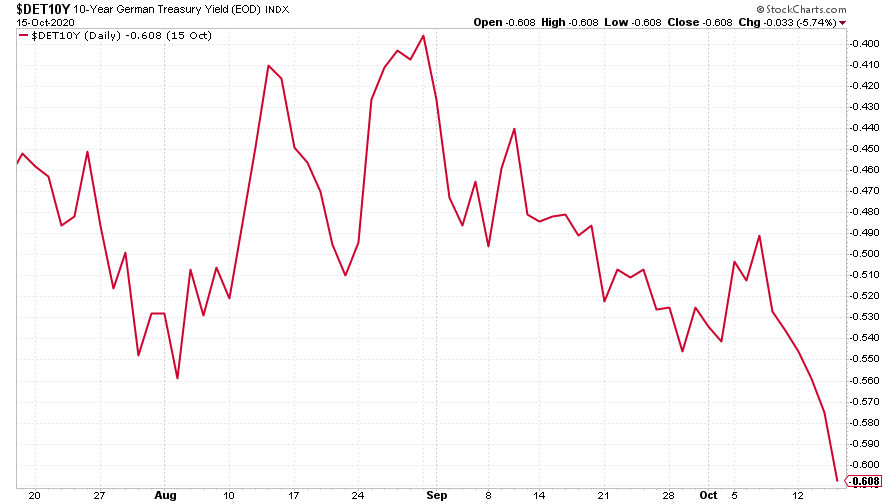

The yield on the ten-year German Bund headed lower.

(Ten-year Bund yield: three months)

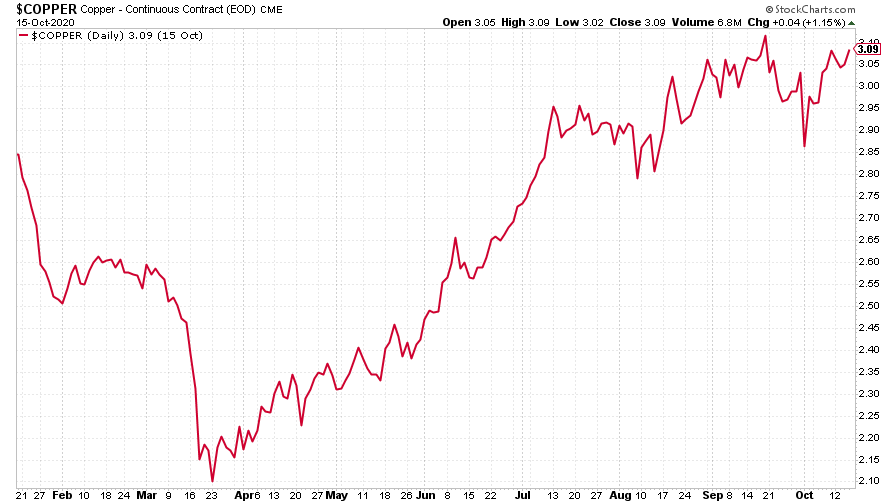

Copper continued higher, helped by investor appetite for China-related investments.

(Copper: nine months)

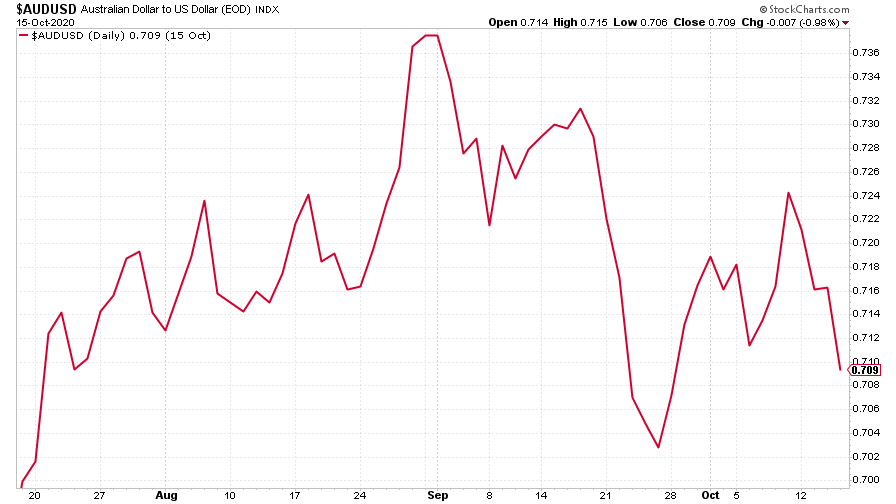

The Aussie dollar was little changed.

(Aussie dollar vs US dollar exchange rate: three months)

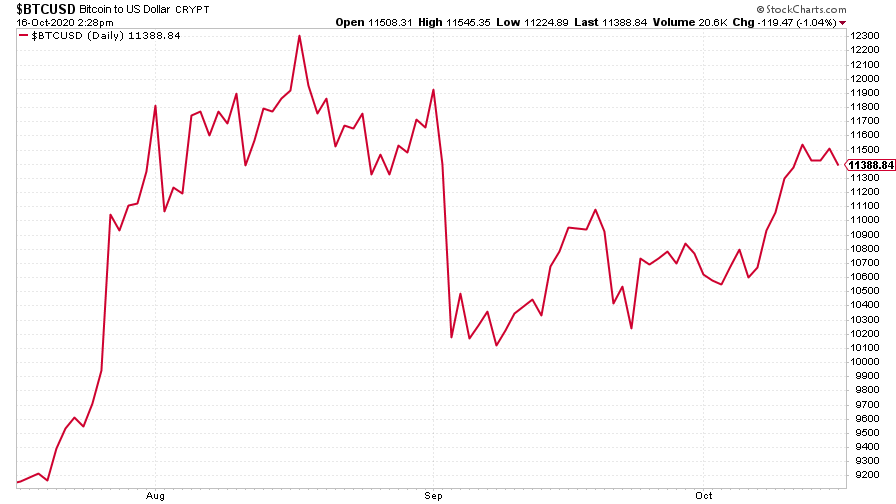

Cryptocurrency bitcoin continued higher this week.

(Bitcoin: three months)

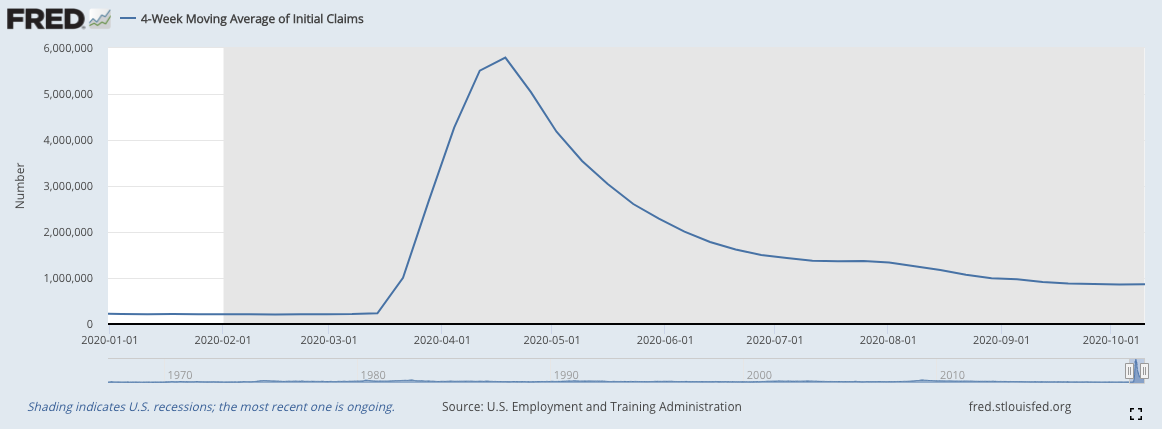

US weekly jobless claims came in at 898,000 this week, well up on the 845,000 seen last week (which was revised higher from 840,000), and well up on economists’ expectations. The four-week moving average ticked higher to 866,250 from a revised 858,250 previously.

(US jobless claims, four-week moving average: since Jan 2020)

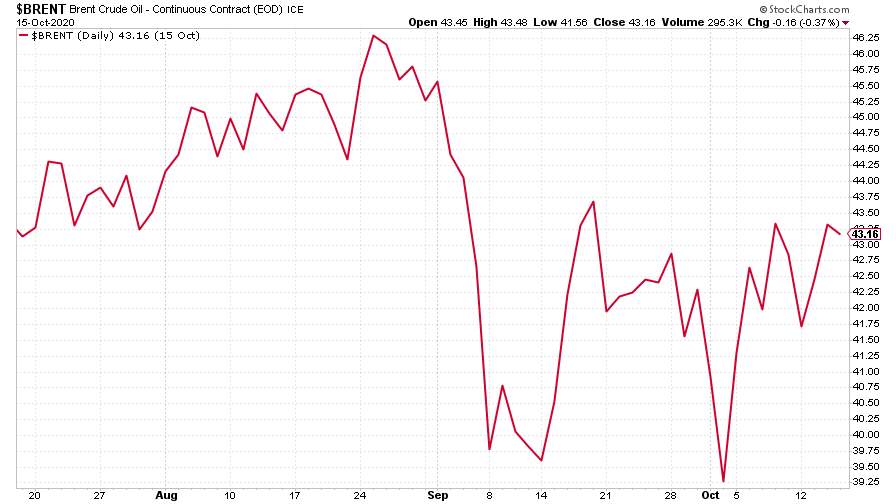

The oil price (as measured by Brent crude) was little changed on last week. On the stockmarket, the oil sector is now trading at some of its cheapest valuations ever seen.

(Brent crude oil: three months)

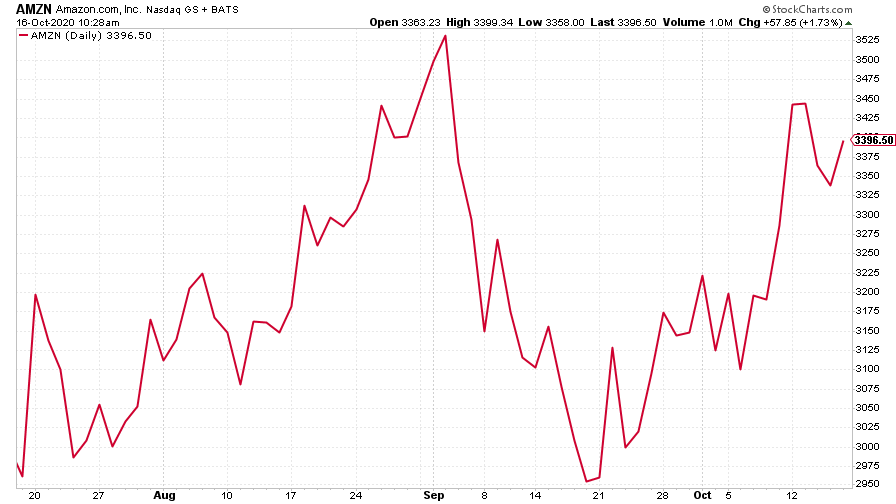

Amazon ticked higher this week as the Nasdaq continued to recover from its September slide.

(Amazon: three months)

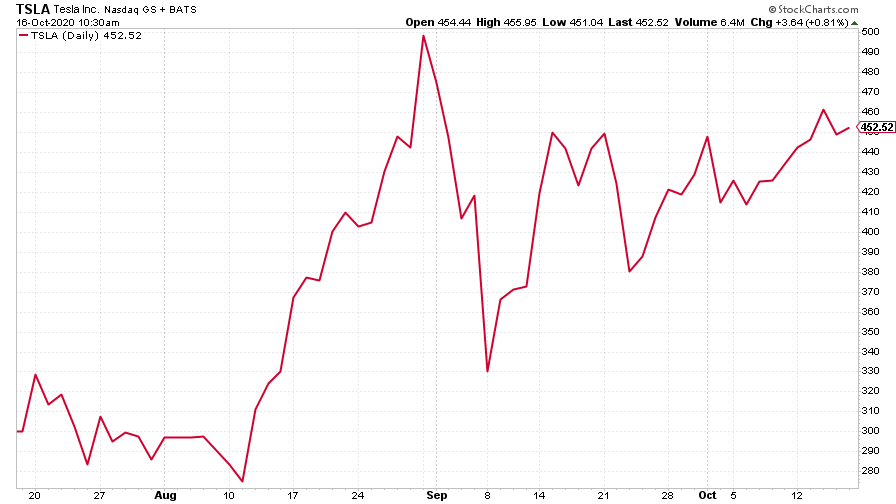

Electric car manufacturer Tesla also made gains.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?