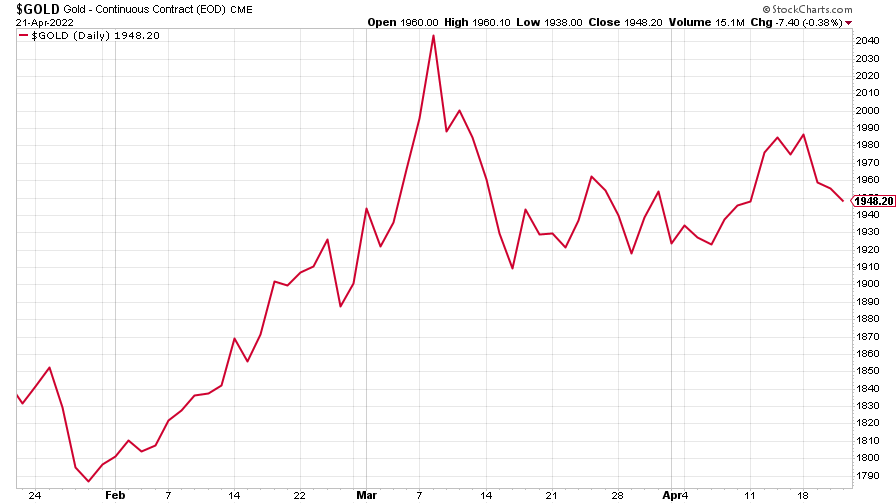

The charts that matter: gold hits a fresh eight-year high

As gold heads for new all-time highs, John Stepek looks at how that's affecting the other charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Quite an exciting week this week on a number of fronts. Most notably, gold hit a new eight-year against the US dollar and is on the home run to hit a new all-time high. Gold and inflation are among the many topics we’ll be covering in MoneyWeek over the summer issues, so if you’re not already a subscriber, get your first six issues free by signing up now (and you get our most recent ebook entirely free too).

No new MoneyWeek podcast for you this week, but I did have another enjoyable chat about Covid-19, lockdowns, V-shaped recoveries and lots of other topics with Conor Devine on his podcast Money and Plants – you can check it out here. And if you missed Merryn’s interview with Laura Foll last week, catch up here.

Also, my book – The Sceptical Investor, a guide to contrarian investing – is on sale right now. You can get 30% off if you buy it from the Harriman House website. Just enter the code HHSUMMER20 when you come to pay.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: How “support” and “resistance” can help you spot trading opportunities

- Tuesday: A first-half home run for investment trusts

- Merryn’s blog: Four excellent books to get your teeth into while you remain holed up

- Wednesday: An economics lesson from my barber

- Thursday: Can Rishi Sunak save the economy with stamp duty cuts and half-price meal deals?

- Friday: What gold, bonds and tech stocks have in common

I also had a chat with the team at challenger wealth manager Netwealth about how income investors can adapt to a world of miniscule interest rates and rather less generous dividend payouts – you can watch it here.

On to the charts of the week...

The charts that matter

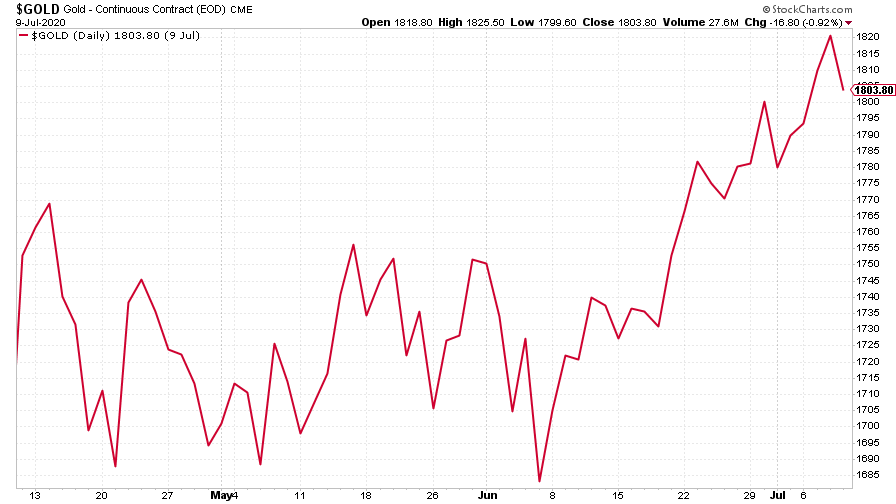

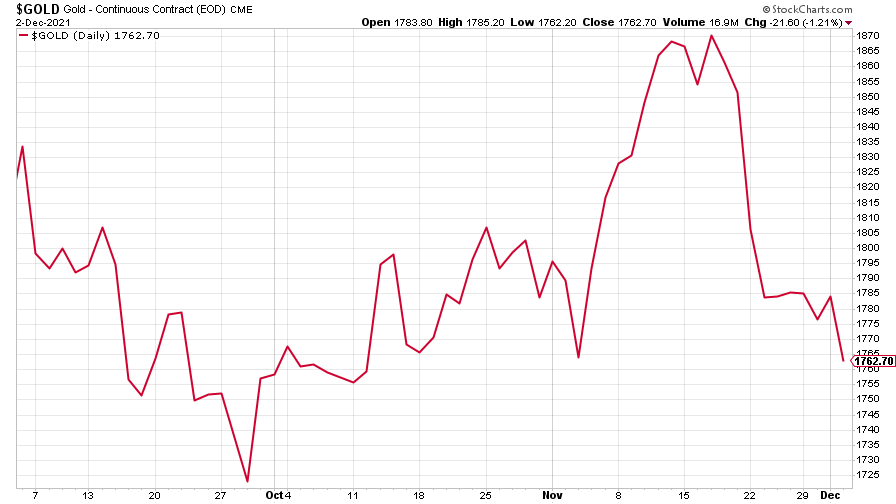

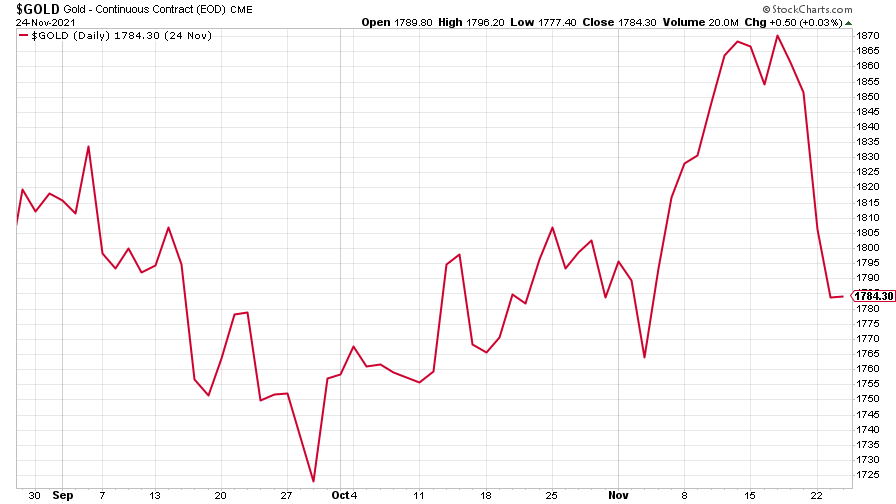

Gold had another good week, breaching the $1,800 an ounce mark for the first time in more than ten years. These things never move in a straight line but it does seem likely that gold is on its way to a new record US dollar high (the last one was set in 2011, at just above $1,900).

(Gold: three months)

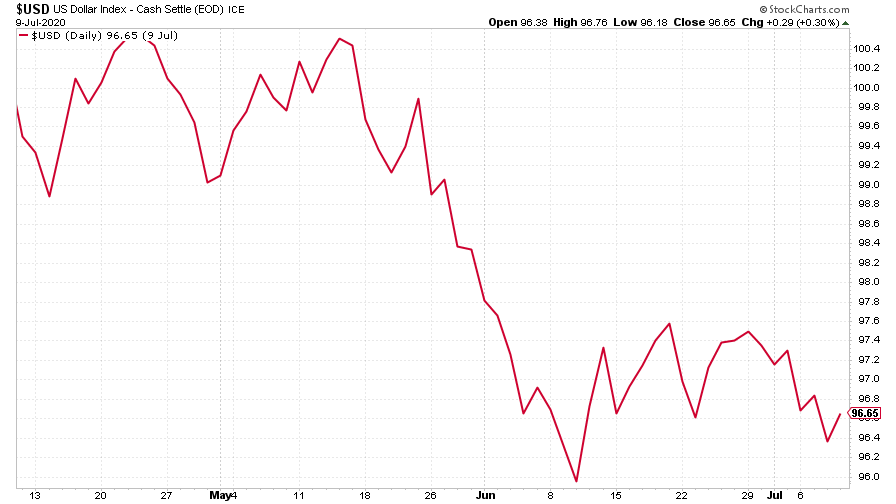

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell somewhat this week, which was one reason for gold’s gains.

(DXY: three months)

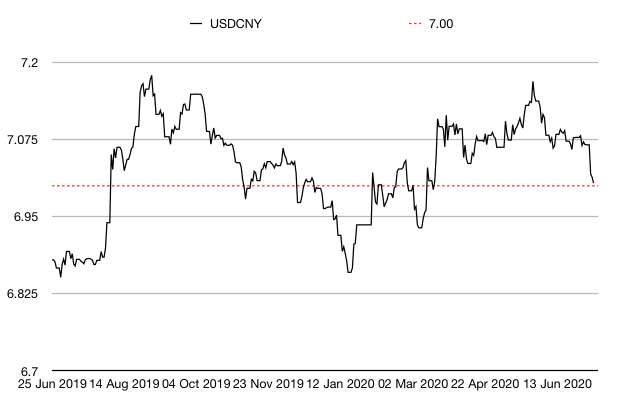

The Chinese yuan (or renminbi) grew significantly stronger against the dollar (when the black line on the chart below falls, the yuan is getting stronger) to the point where the number of yuan to the dollar dropped below the €1/¥7 mark which used to be viewed as a “line in the sand” and a warning sign for devaluation by the Chinese government. It helped that the US dollar was generally weaker, and also that China’s stock market surged with the blessing of official media outlets.

All else being equal, a stronger yuan is bullish – it means there’s less risk of a deflationary surge.

(Chinese yuan to the US dollar: since 25 Jun 2019)

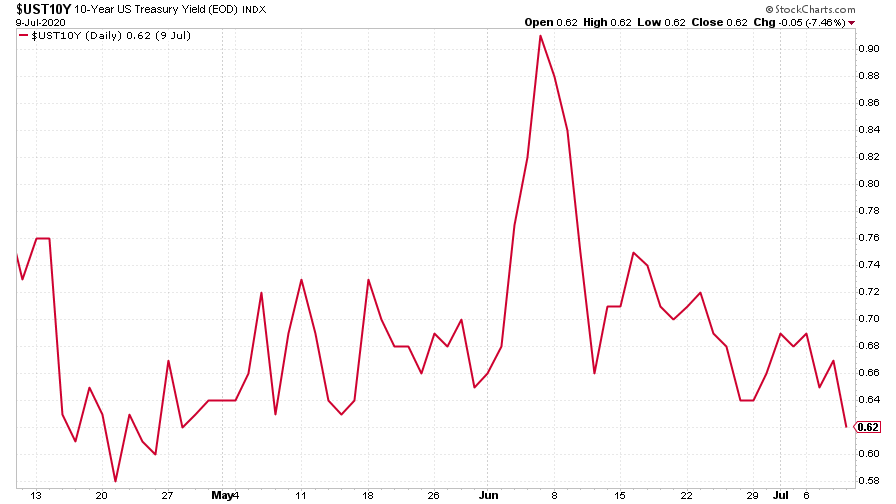

The yield on the ten-year US government bond trickled lower this week. It’s interesting that yields simply refuse to rise in the face of other measures that suggest at least some in the market are a bit wary about inflation (rising gold, for example). The best explanation I think is that markets are betting that government bonds in general are now pretty much entirely central bank-controlled. If the central bank wants yields to stay low, they just stay low.

(Ten-year US Treasury yield: three months)

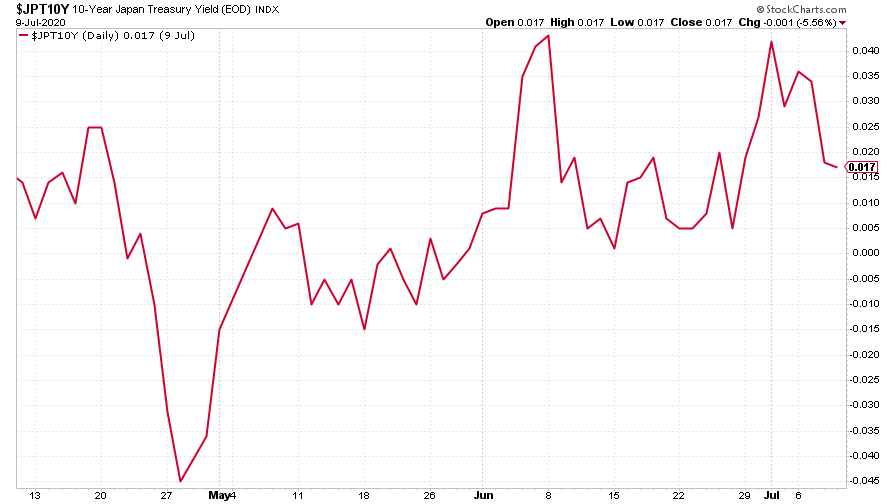

The same goes for the yield on the Japanese ten-year (Japan of course is where yield curve control first started to happen in the post-2009 world).

(Ten-year Japanese government bond yield: three months)

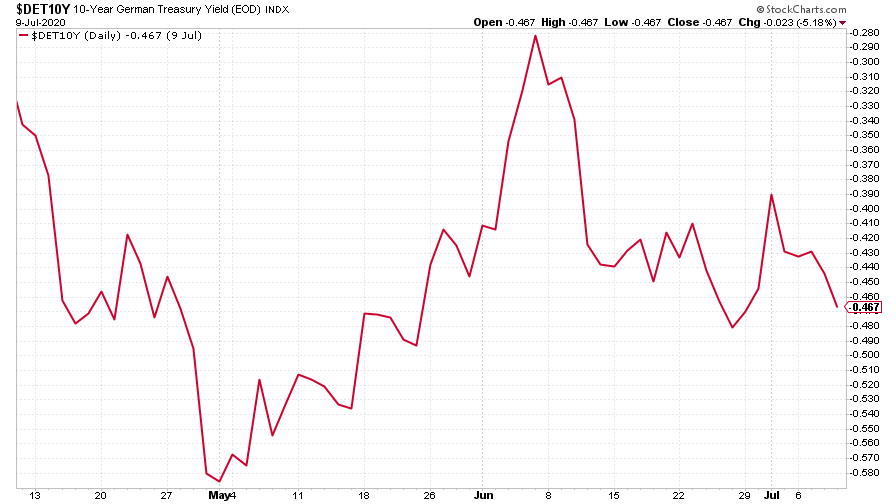

The yield on the ten-year German Bund slipped further into negative territory.

(Ten-year Bund yield: three months)

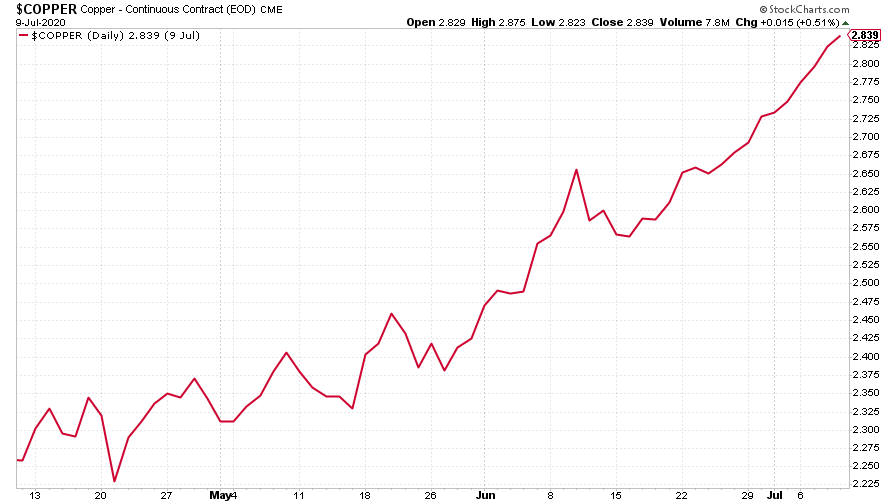

Copper is still the V-shaped recovery believer’s best friend. It has shot up like a rocket in a virtually straight line since hitting rock bottom at the end of March. In fact, if you’d gone long copper on the day that Britain locked down, you’d have done very well for yourself, with only a brief, nerve-racking correction in late April to cope with. It was very much helped by the generally bullish tone on China this week.

(Copper: three months)

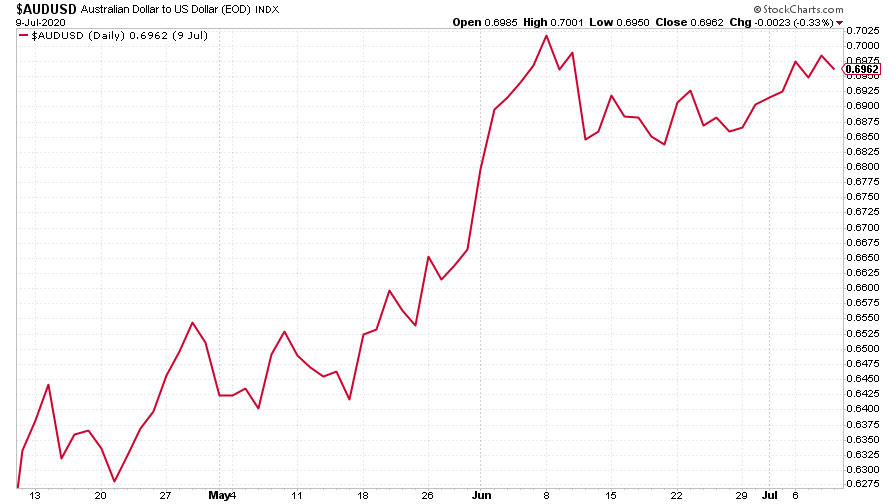

The China and commodities-sensitive Aussie dollar also crept a bit higher, helping the weaker dollar.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin continues to trade in an exceptionally tight range (certainly by its historic standards).

(Bitcoin: three months)

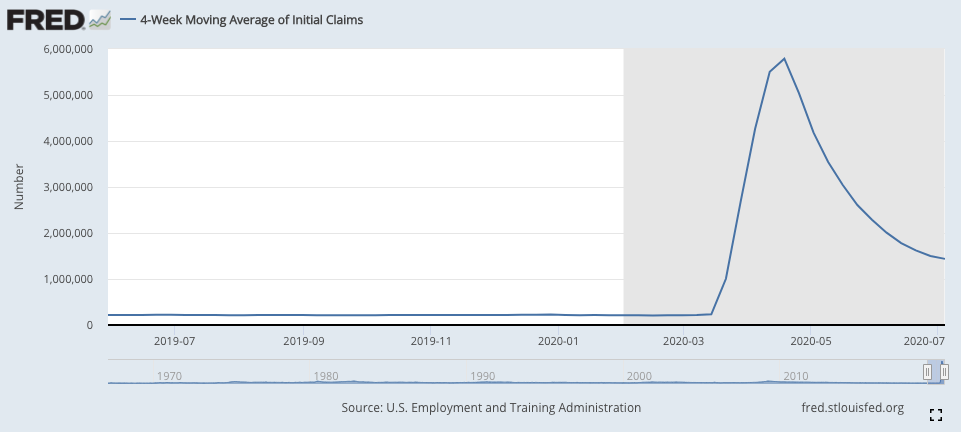

This week’s US weekly jobless claims figure was better than last week and better than economists had expected. The number of new claims fell to 1.31 million (down from 1.41 million last week, which was itself revised a little lower from 1.43 million). Economists had expected a figure of closer to 1.4 million. The four-week moving average now sits at 1.44 million, compared to last week’s 1.5 million.

(US jobless claims, four-week moving average: since June 2019)

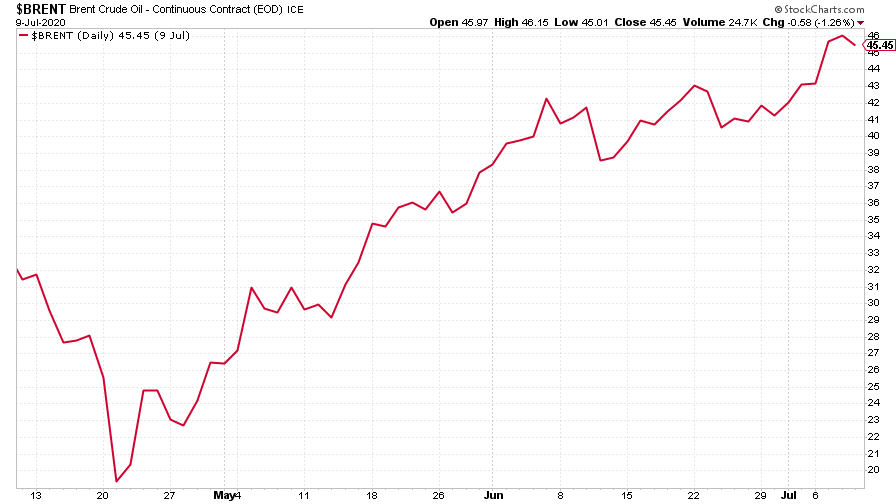

The oil price continues to edge higher despite a general lack of bullishness about the sector.

(Brent crude oil: three months)

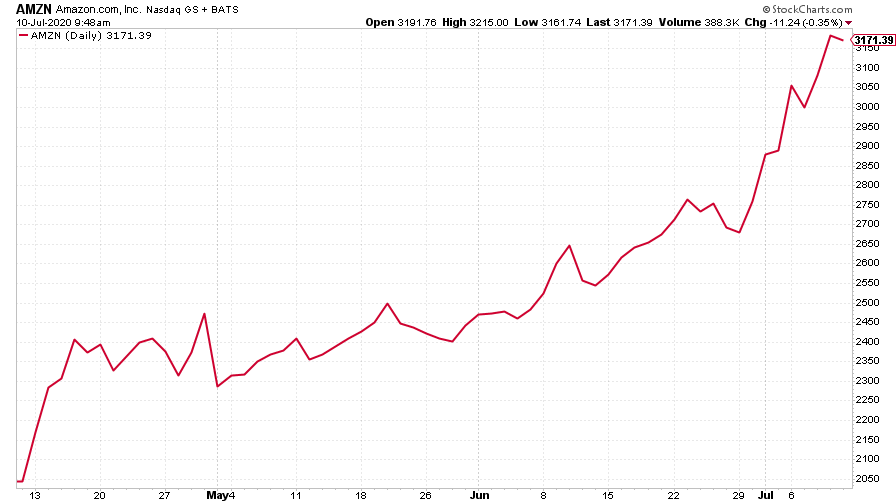

And it was another incredible week for tech stocks. Amazon hit a fresh record high...

(Amazon: three months)

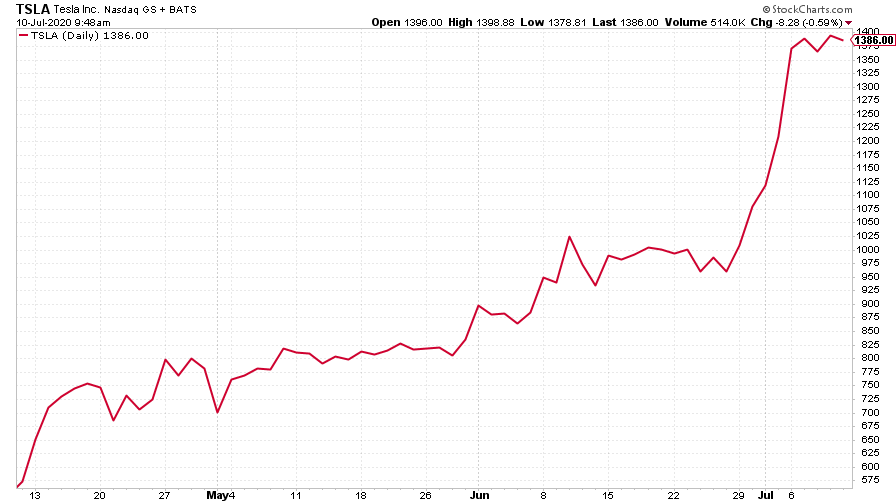

… as did electric car group Tesla. What’s going on? I tried to break it down in yesterday’s Money Morning.

(Tesla: three months)

Just before you go – if you’re feeling bereft of dividend income, then make sure you register to watch this webinar! At the end of this month, Merryn will be interviewing James Dow, co-manager of Baillie Gifford’s Scottish American Investment Company, all about the best places to go hunting for sustainable income in the post-coronavirus world. Register to watch the interview here – it’s completely free.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

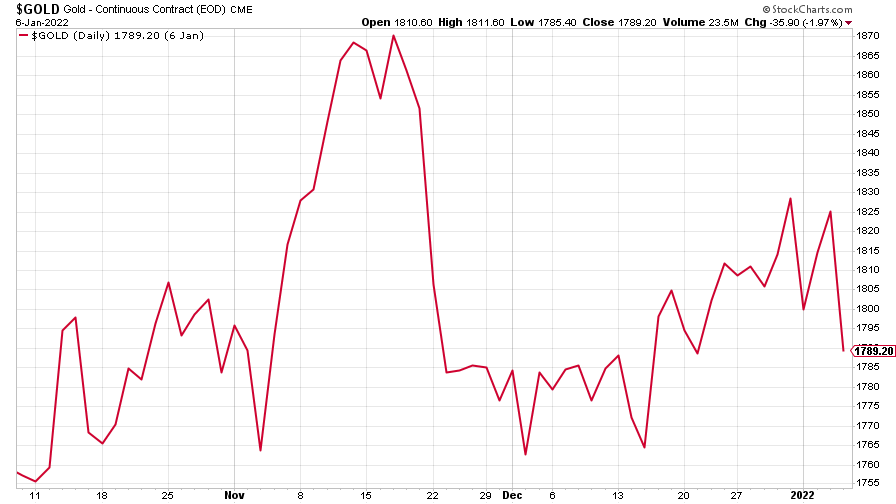

The charts that matter: bond yields and US dollar continue to climb

The charts that matter: bond yields and US dollar continue to climbCharts The US dollar and government bond yields around the world continued to climb. Here’s what happened to the charts that matter most to the global economy.

-

The charts that matter: markets start the year with a crash

The charts that matter: markets start the year with a crashCharts As markets start 2022 with a big selloff, here’s what happened to the charts that matter most to the global economy.

-

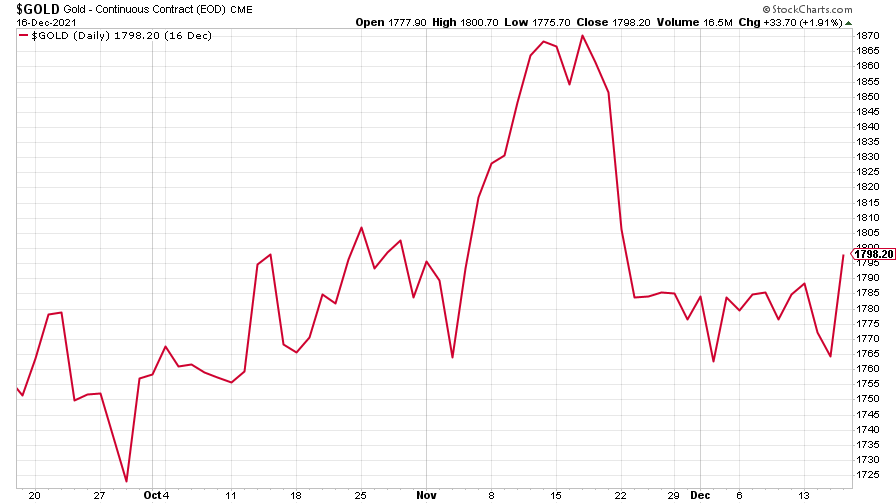

The charts that matter: Fed becomes more hawkish

The charts that matter: Fed becomes more hawkishCharts Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

-

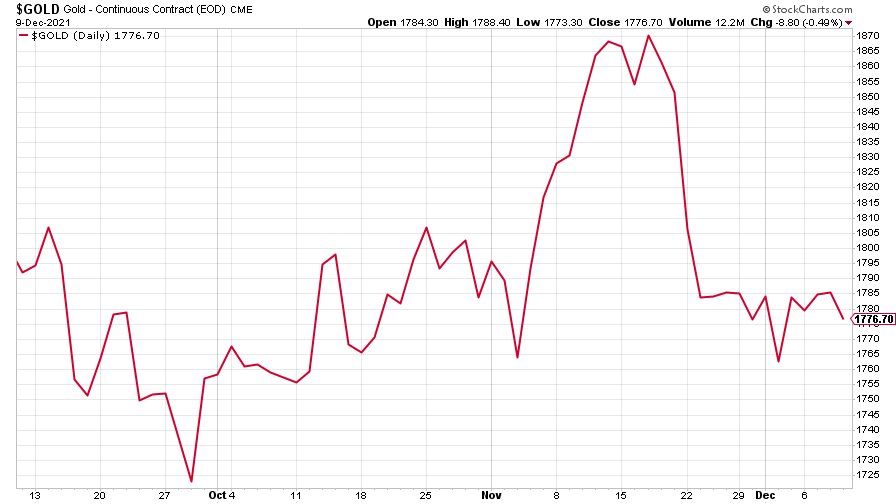

The charts that matter: a tough week for bitcoin

The charts that matter: a tough week for bitcoinCharts Cryptocurrency bitcoin slid by some 20% this week. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: omicron rattles markets

The charts that matter: omicron rattles marketsCharts Markets were rattled by the emergence of a new strain of Covid-19. Here’s how it has affected the charts that matter most to the global economy.

-

The charts that matter: the US dollar keeps on strengthening

The charts that matter: the US dollar keeps on strengtheningCharts The US dollar saw further rises this week as gold and cryptocurrencies sold off. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: gold hangs on to gains while the dollar continues higher

The charts that matter: gold hangs on to gains while the dollar continues higherCharts The gold price continued to hang on to last week’s gains, even as the US dollar powered higher this week. Here’s how that has affected the charts that matter most to the global economy.

-

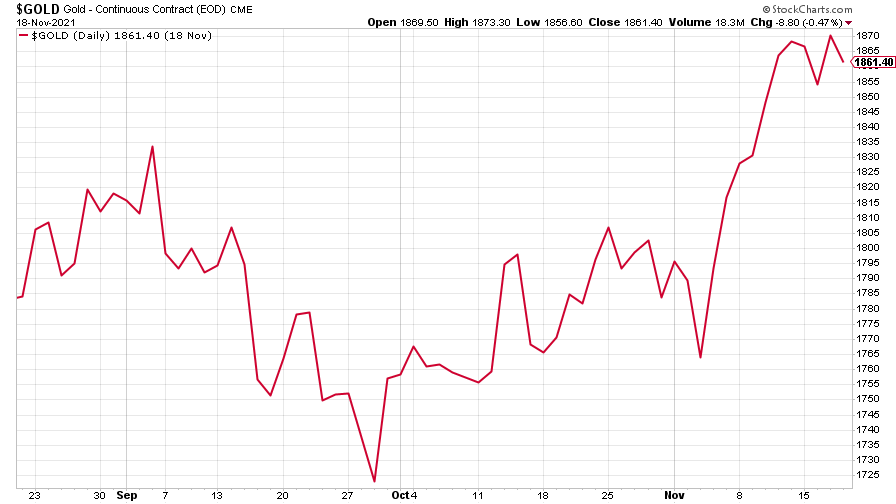

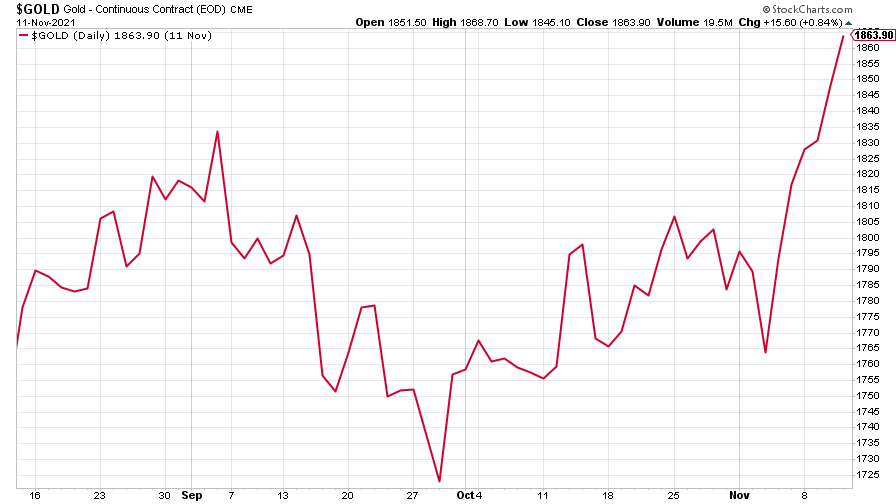

The charts that matter: inflation fears give gold a much needed boost

The charts that matter: inflation fears give gold a much needed boostCharts US inflation hit its highest in 30 years this week, driving gold and bitcoin to new highs. Here’s how that has affected the charts that matter most to the global economy.