The charts that matter: oil surges, but the dollar stays flat

With the oil price up and the dollar going nowhere, John Stepek looks at how that affects the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

The 1,000th issue of MoneyWeek came out yesterday. Thanks for all of your great ideas about where to invest £1,000 – we’ve reviewed some of the very best in the latest issue (page 36 if you’ve got your copy in front of you).

It’s a great issue and an achievement we’re all very proud of. If you’re a subscriber, I hope you enjoy it (always open to feedback at editor@moneyweek.com). And if you’re not - well sign up now and get your first six issues absolutely free).

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Podcasts and interviews

Merryn and I took a trip down memory lane for our 1,000th issue podcast – that’s nearly 20 years’ worth of MoneyWeek! We discuss some of your best ideas on how to invest £1,000 for a decade, wonder whether the pendulum is now swinging towards active management from passive (heretical to some of you, I realise), and re-read the first issue and realise that all of the live issues are exactly the same today as they were back then. Have a listen here.

Also, if you’d like a glimpse into my study (and who wouldn’t?), I had a video interview with Graham Rowan for his Money & Me web TV show the other day, just as we were in the run-up to putting the 1,000th issue together. I really enjoyed our chat – we talked about inflation, the end of the American empire, gold (of course) and financial education. Have a watch here.

We have another Quiz of the Week for you – see what you can remember and what you missed of the economic and political events of the past seven days. (And if you enjoy quizzes we’ve got a much bigger one in issue 1,000 – sign up to get your first six issues free now).

Here are the links for this week’s editions of Money Morning.

- Monday:What are negative interest rates and could they happen here?

- Tuesday:Is that it? Did we see the bottom for the stockmarket in March?

- Wednesday: A warning from history about the return of inflation

- Thursday: This contrarian indicator suggests the market has further to rise

- (PS if you like contrarianism, I wrote an entire book about it – The Sceptical Investor)

- Friday: The new Cold War: China’s crackdown on Hong Kong

And now onto today’s charts of the week.

The charts that matter

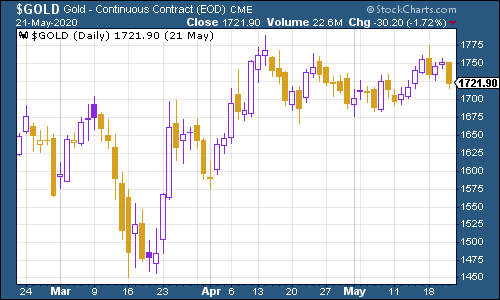

It was an interesting week for precious metals. Gold (measured in dollar terms) wasn’t hugely changed on the week, but its volatile sidekick silver started to take off at the end of last week, which suggests that the bull market might be gaining legs. For more on how to invest in gold, and gold miners, don’t miss Dominic’s recent cover story on the topic in MoneyWeek – if you’re not a subscriber, sign up here now.

(Gold: three months)

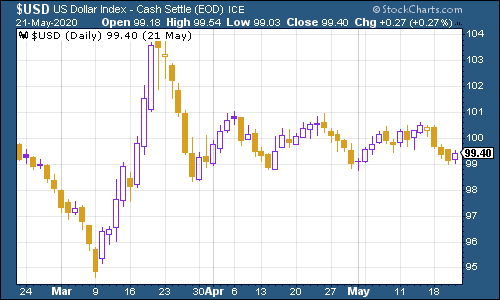

The US dollar index (a measure of the strength of the dollar against a basket of the currencies of its major trading partners) stayed below the 100 mark this week – the dollar is one of the most important prices in the world, so it is interesting to note that it has been trading in such a tight range over the last six weeks or so. At some point it will break lower or higher. That might dictate the next big move for markets.

(DXY: three months)

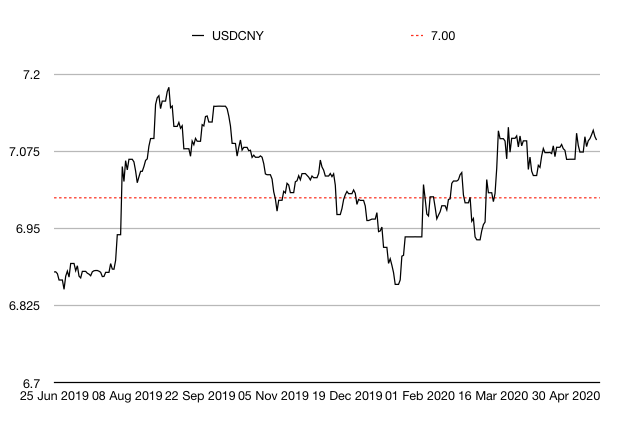

The Chinese yuan (or renminbi) remains above the $1/¥7 mark and it appears to be ticking higher. This is one to watch, particularly as relations between the US and China deteriorate.

(Chinese yuan to the US dollar: since 25 Jun 2019)

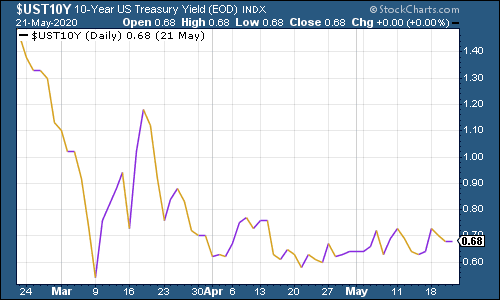

The yield on the ten-year US government bond edged a little higher (even as the Bank of England managed to sell some gilts (albeit of relatively short maturity) at an ever-so-slightly negative yield.

(Ten-year US Treasury yield: three months)

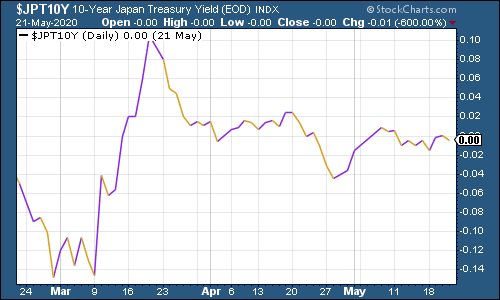

It was a similar story for the yield on the Japanese ten-year.

(Ten-year Japanese government bond yield: three months)

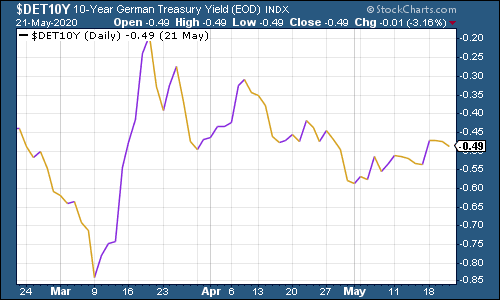

And the yield on the ten-year German Bund crept a bit higher as Germany and France appeared to agree on a bailout package for the eurozone. Again, it’s interesting to watch these highly important prices trade in such tight ranges.

(Ten-year Bund yield: three months)

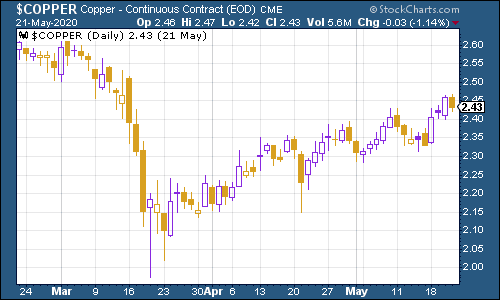

Copper continued to tick higher as hopes for the global economy re-opening continued to grow.

(Copper: three months)

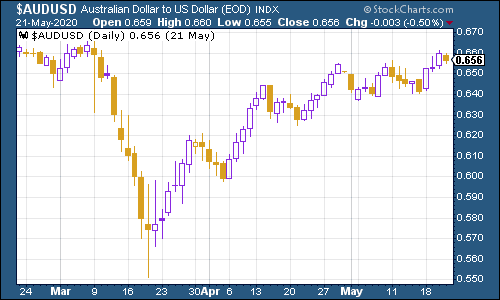

The Aussie dollar pushed higher this week, mostly on hopes for a solid economic recovery after the world re-opens.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin was yet another asset stuck in a tight range (by bitcoin standards, at least).

(Bitcoin: ten days)

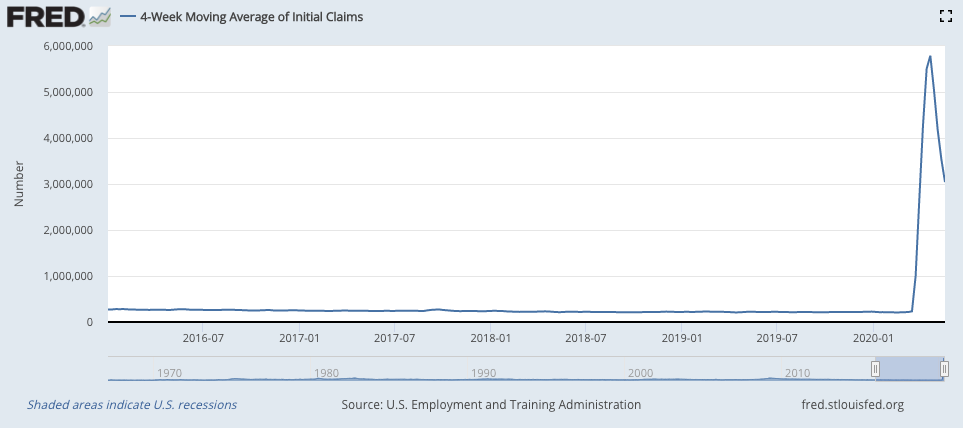

This week’s US weekly jobless claims figure of 2.4 million brought the total number of pandemic-related first-time applications for jobless benefits to nearly 39 million. Again, it was at least down a bit on last week’s 2.98 million. The four-week moving average now sits at 3.04 million, compared to last week’s 3.62 million.

(US jobless claims, four-week moving average: since January 2016)

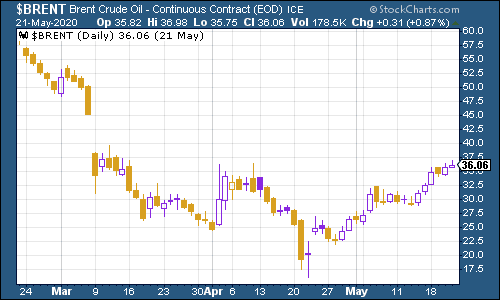

The oil price most definitely isn’t range-trading – it continued its recent strong winning run.

(Brent crude oil: three months)

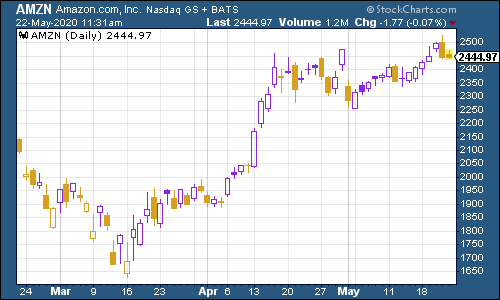

Amazon shares hit a fresh record high this week.

(Amazon: three months)

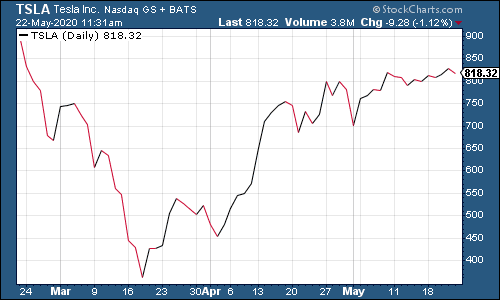

Electric car group Tesla was higher too.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.