The charts that matter: your chance to contribute to our 1,000th issue

A look at how the charts that matter most to the global economy have changed this week, and what that means – plus a call for your ideas for the one-thousandth issue of MoneyWeek magazine.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

The first issue of MoneyWeek came out in November 2000. We’re now less than a fortnight away from publishing our 1,000th issue.

Even though 19-and-a-half years is not an especially long time in the great scheme of things, there are many things that we take for granted today that would have seemed unthinkable back then.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Imagine if you’d told us back then that in 2020, the US would be a bigger oil producer than Saudi Arabia. Or that every major central bank in the world would be printing money to buy government bonds – and would have been doing so for more than a decade.

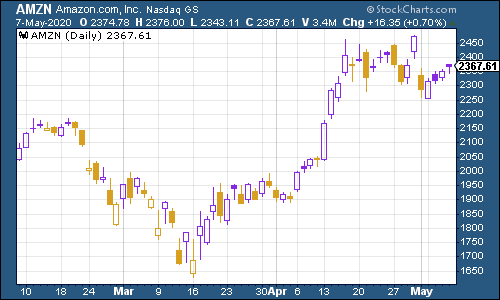

Or imagine telling us, in November 2000, with the dotcom bubble bursting and the point of maximum pessimism nearing, that in 2020, Amazon.com would be one of the world’s most valuable – and most feared – companies.

Much as we pride ourselves on being contrarians, I don’t know how we’d have reacted to those predictions (I suspect the one that would have surprised us least would have been the one about central banks printing money – we’ve rarely been ones to underestimate the odds of a central banker spiking the punch bowl).

But I’ll tell you something else – none of it would have surprised us quite as much as the idea that we’d be producing our 1,000th issue entirely remotely, because we’d all be staying in our houses due to a global pandemic.

Anyway – I want to make sure that you get hold of our 1,000th issue (the print edition will surely be a future collectors’ item after all), so I’d suggest you subscribe right now (you get your first six issues free, plus a free copy of my latest ebook, The Little Book of Big Crashes).

And we’re also looking for your views. If you were handed £1,000 right now that you had to lock up in an investment for the next ten years, what would you buy? You can choose whatever you want: a share, bonds, a fund, a bar of gold, cash (but tell us which currency) – just remember that, once you’ve invested, you can’t get it back until 2030.

Email your ideas to editor@moneyweek.com. We’ll be printing the best in the 1,000th issue – and there may even be a prize for the ones we find most interesting/entertaining/plausible/well-argued… so get your thinking cap on!

Podcasts, Money Morning and our new Quiz of the Week

On the podcast front, Merryn had a chat with Andrew Milligan, who has just retired as chief investment strategist of Aberdeen Standard Investments. Andrew is less upbeat than Merryn (which as you can imagine, really is an unusual state of affairs!) but he does have a very positive message for private investors. Have a listen here.

Oh and I made a guest appearance on the podcast Money & Plants, which is hosted by Conor Devine, a businessman and author who writes about both economics and health. You can have a listen to that here – we talk about house prices and Warren Buffett (I start in around 33 mins).

Conor also kindly gave me the chance to plug my book on contrarian investing, The Sceptical Investor. I highly recommend it, obviously – in paperback, ebook or on Audible.

Elsewhere on the website, don’t miss our new Quiz of the Week feature. See what you can remember and what you missed of the economic and political events of the past seven days.

And here are the links for this week’s editions of Money Morning plus other stories you might have missed on the website this week.

- Monday: Why hasn’t Warren Buffett bought anything yet?

- Merryn’s blog: “Cluster busting”: why Japan has been so successful in fighting Covid-19

- Tuesday:What could bring an end to this tech-led stockmarket rally?

- Merryn’s blog: Turn the Covid-19 bailout into a sovereign wealth fund

- Tuesday extra: Germany throws a spanner in the eurozone’s works

- Wednesday: Covid-19 could destroy our love affair with the city – here’s how to profit

- Thursday: The great dividend massacre continues – now BT has cut its payout

- Friday: The coronavirus isn’t changing any trends – it’s accelerating existing ones

The charts that matter

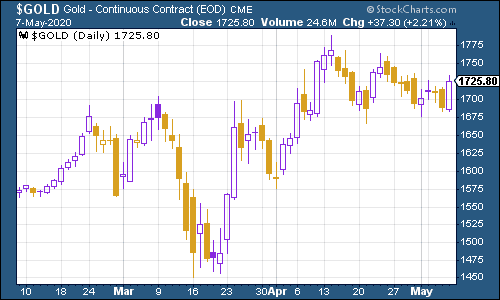

Gold (measured in dollar terms) had a better week as investors started to feel more edgy, both about life beyond lockdown, and about the potential for current actions by central banks and governments to cause inflation to pick up in the longer term. By the way, Dominic did a great cover story on MoneyWeek this week about gold, in which he discusses the best ways to invest in gold, and also his favourite gold mining tips. It really is worth subscribing, for this story alone.

(Gold: three months)

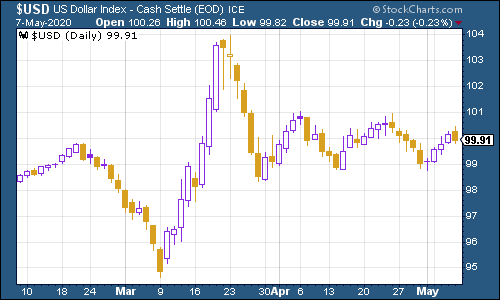

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – remains in a range although it ticked higher this week.

(DXY: three months)

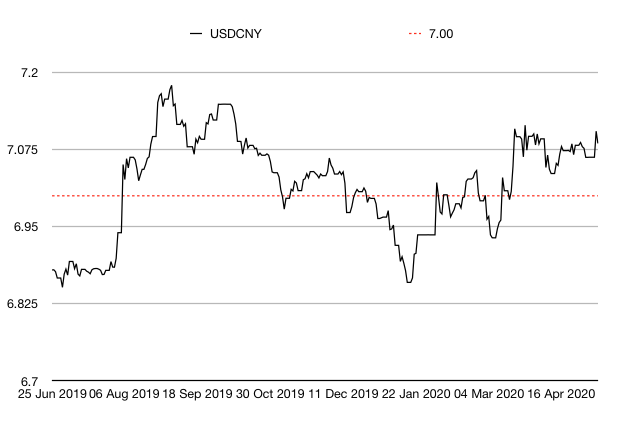

The Chinese yuan (or renminbi) remains above the $1/¥7 mark. This is one to watch as the rest of the crisis unfolds. If the yuan shows signs of sliding against the dollar, then that’s a warning sign that we’re heading for deflation, which in turn will be a red flag for the Federal Reserve, America’s central bank, that it really needs to weaken the US dollar.

(Chinese yuan to the US dollar: since 25 Jun 2019)

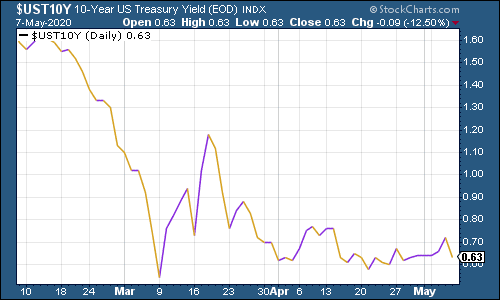

The yield on the ten-year US government bond was little changed this week.

(Ten-year US Treasury yield: three months)

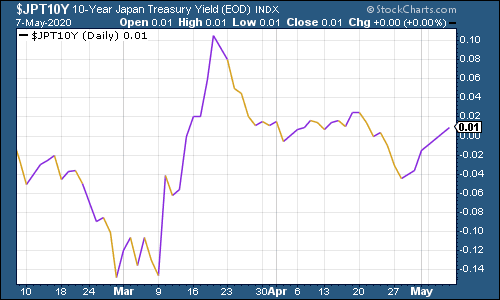

The yield on the Japanese ten-year edged higher and is now back in positive territory (just).

(Ten-year Japanese government bond yield: three months)

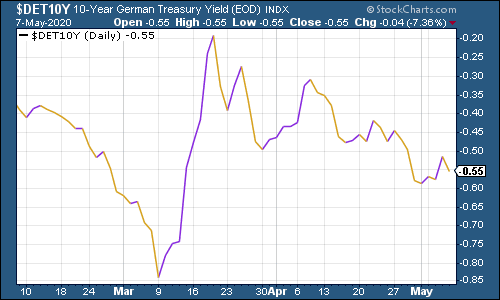

The yield on the ten-year German Bund edged a little higher this week. Markets are not currently especially worried about the German constitutional court’s mild challenge to the European Central Bank / European Court of Justice, and that probably makes sense. But make no mistake, in the longer run it’s another inch towards a proper discussion about the future of the eurozone, and one that might not be easy to fudge away. You can read more about that here.

(Ten-year Bund yield: three months)

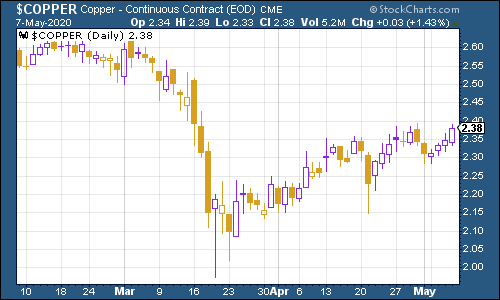

Copper just keeps ticking higher – that’s a healthy sign for the global economy (one of very few right now).

(Copper: three months)

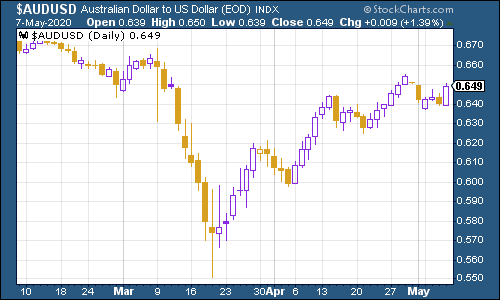

The Aussie dollar gave back some of its recent rally as the US dollar strengthened a little.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin had another solid run this week, and seems to be heading for the $10,000 mark ahead of the pending “halvening” (for more on bitcoin’s prospects, see our current issue, out yesterday).

(Bitcoin: ten days)

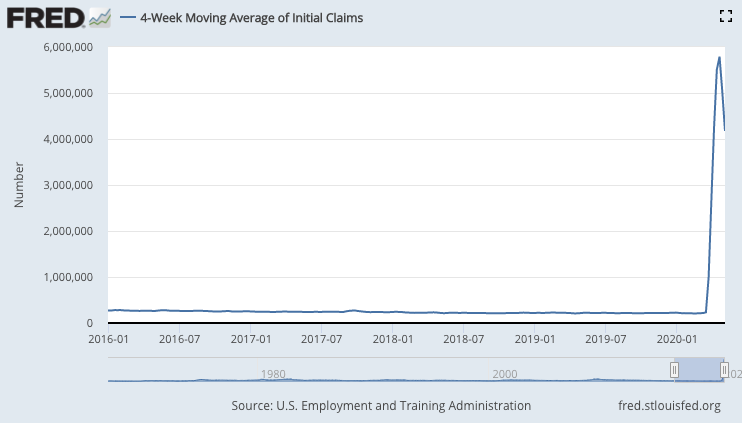

This week’s US weekly jobless claims figure of 3.17 million was lower than last week’s (3.85 million), but again the figure was a bit worse than expected. There have now been 33.5 million new claims in seven weeks. The four-week moving average meanwhile now sits at 4.17 million, compared to last week’s 5.03 million – although as the chart shows that’s far far worse than anything seen in the modern era.

The monthly US nonfarm payrolls data, meanwhile, just confirmed the misery. In April, 20.5 million jobs were lost (compared to a loss of 701,000 the month before, which was still extraordinary) and the unemployment rate rose from 4.4% to 14.7%. Markets were unfazed because they’d been expecting it. But those are still horrible figures.

(US jobless claims, four-week moving average: since January 2016)

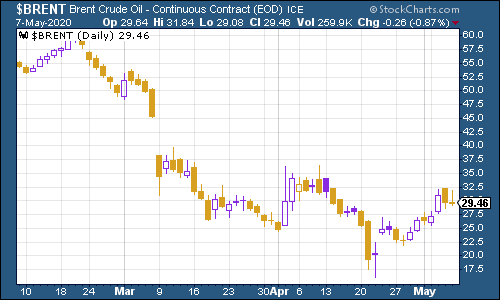

The oil price continued to rally as signs arrived that the supply glut is not quite as bad as some had feared, while Saudi Arabia started to raise prices for some customers.

(Brent crude oil: three months)

Amazon shares continued higher. It might be spending more money to cover its corona costs, but that’s only going to help to cement its position after the crisis is passed.

(Amazon: three months)

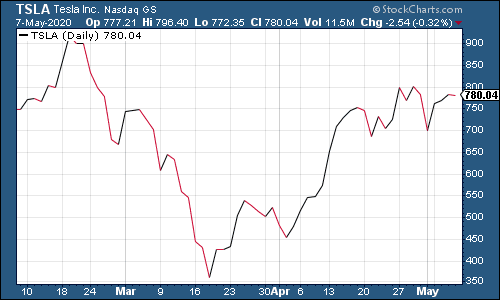

Electric car group Tesla recovered from CEO Elon Musk’s late night tweeting session from last week, to end the week a little higher.

(Tesla: three months)

Have a good weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.