Quiz of the week 2-8 May

Test your recollection of the events of the last seven days with MoneyWeek's quiz of the week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

1. Who said this earlier this week after they sold at a loss their entire portfolio of US airline stocks: “When we change our mind we don’t take half measures or anything of the sort.”?

a) Crispin Odey

b) Mark Barnett

c) Warren Buffett

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

d) Sir Chris Hohn

2. Which Indian city imposed a 70% tax on alcohol this week, to deter crowds from forming at shops, but also to support revenue?

a) Mumbai

b) Delhi

c) Bangalore

d) Chennai

3. Argentinian finance minister Martin Guzmán said this week the government could be ready to consider defaulting on $65bn of foreign debt, unless investors engaged in negotiations to alleviate its financial burden. How many times has Argentina defaulted before?

a) 3 times

b) 5 times

c) 11 times

d) 8 times

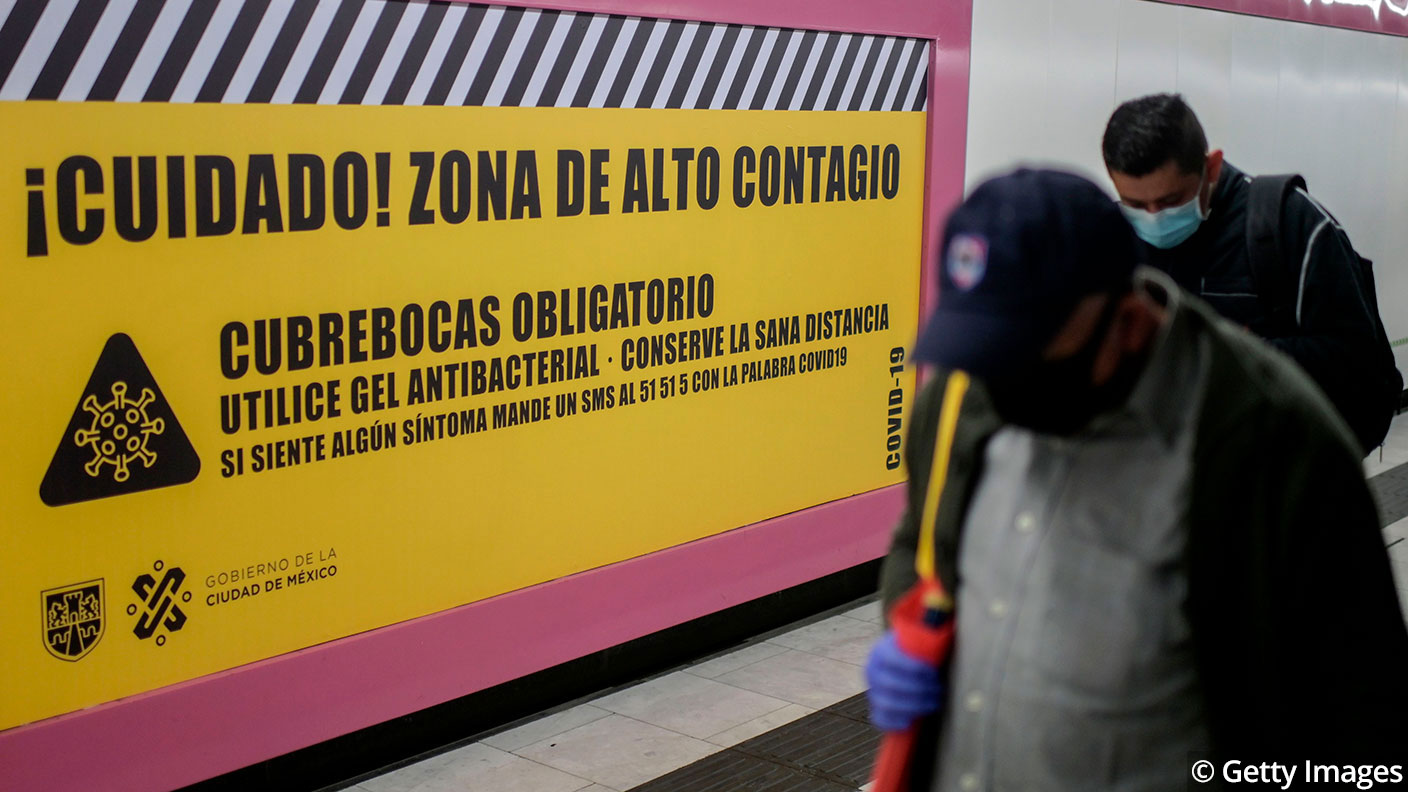

4. By how much did Mexico’s economy contract in the first quarter, quarter-on-quarter?

a) 1.7

b) 1.6

c) 1.4

d) 1.2

5. Which luxury American retailer filed for bankruptcy this week?

a) Nordstrom

b) Neiman Marcus

c) Barney’s

d) Bergdorf Goodman

6. Which neighbouring countries made moves this week to start reviving travel between them?

a) Australia and New Zealand

b) South Korea and China

c) Vietnam and Cambodia

d) China and Vietnam

7. As of Thursday 7 May, what was the price of a barrel of Brent crude oil?

a) $43.54

b) $22.08

c) $37.59

d) $31.59

8. Virgin Atlantic announced this week it is to cut over 3,000 jobs in the UK and end its operation at which London airport?

a) Heathrow Airport

b) Gatwick Airport

c) Stansted Airport

d) London Southend Airport

9. A further 3.2 million Americans sought unemployment benefits last week, bringing the total number of jobless claims to how many?

a) 32.3 million

b) 31 million

c) 29.9 million

d) 33.3 million

10. How much have British banks lent to firms hit by the coronavirus under the government’s main loan guarantee scheme for small and medium sized firms?

a) £4.1bn

b) £5.5bn

c) £4.9bn

d) £6.1bn

Answers

1. c) Warren Buffett. Buffett’s holding company, Berkshire Hathaway, sold its stakes in American Airlines, Delta, Southwest Airlines, and United Airlines. He added the future looked negative for investors as airlines are accumulating debt, diluting shareholder value by issuing equity, and could have overcapacity.

2. b) Delhi.

3. d) Eight times. Argentina has defaulted eight times before: in 1827, 1890, 1951, 1956, 1982, 1989, 2001, and 2014.

4. b) 1.6. Year on year, the drop was 2.4%. Andres Abadía from Pantheon Macroeconomics said the number was terrible, and confirmed the economy is under severe pressure. The data implies the economy shrank 5% in March, “the worst performance since the Mexican peso crisis in 1995”.

5. b) Neiman Marcus. Neiman Marcus Group Inc. filed for chapter 11 bankruptcy protection on Thursday in Texas, becoming the latest large retailer to seek a court restructuring during the pandemic that has severely knocked the US economy.

6. b) South Korea and China. This is Beijing’s first formal bilateral programme to ease border controls and help revive economic activity. Under a fast-track immigration arrangement, South Korean business personnel will be able to travel to seven provinces and three major cities in China after passing through health-screening and quarantine procedures.

7. d) $31.59. Brent crude rose $1.87, or 6.3% to trade at $31.59 per barrel, after dropping 4% on Wednesday. US West Texas Intermediate futures gained $2.40, or 10%, to trade at $26.39 per barrel, after declining more than 2% in the previous session.

8. b) Gatwick Airport. Rival British Airways also said it could not rule out closing its Gatwick operation as the coronavirus crisis deals heavy losses to airlines around the world.

9. d) 33.3 million. Though less than the 3.8 million a week ago and significantly lower than the 6.9 million for one week in March, the total still amounts to over 15% of the US workforce.

10. b) £5.5bn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.