Why a stronger euro is good news for investors

The fragile state of the eurozone has for a long time brought the threat of deflation. But the ECB’s latest moves have dampened those fears. John Stepek explains what’s going on, and why the euro is so important.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When a crisis rears its ugly head, eurozone politicians have had a long history of failing to act quickly enough. That may be changing.

And regardless of your political views, if you’re an investor, you need to pay attention because it could make you a lot of money...

Why the fate of the eurozone matters so much for investors

I’ll start by asking you to forgive me for repeating myself, but I want to discuss again why Europe and the eurozone are so important for investors to keep an eye on right now.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Since the global financial crisis, the biggest fear for markets has been deflation. That’s understandable. We are always fighting the last war in our minds, so that we don’t get caught out again. (The problem, of course, is that the next war is rarely the same as the last one, mainly because we spend so much time worrying about the last one. But we’ll get to that later.)

The basic problem during the 2008 crisis is that the global financial system turned into a black hole – the banks were bankrupt. So you pumped money in and it was just swallowed up. The US dealt with that first. It fixed its banks relatively quickly. The UK got there more slowly, but it got there. The eurozone didn’t.

Why? It helps to understand that fundamentally, a central bank is just an arm of the government. The US and the UK used their central banks and their power to print money to prop up their sovereign balance sheets, which in turn enabled their governments to stand behind their banks.

Europe struggled to do that because the European Central Bank (ECB) is answerable to lots of individual governments, and none of them were keen to throw their weight behind other countries’ banking systems. (As well as domestic politics, there was an element of hubris at an international political level, whereby this was deemed a crisis of the “Anglo-Saxon” model. Clearly no one had bothered to take a look at what all the German banks had been buying...)

Anyway. We then had the Greek debt crisis, which threatened to be another Lehman Brothers moment, just a couple of years after the original one. That took ages to sort out and it cast a deflationary shadow for much longer than that.

Ever since Mario Draghi’s “whatever it takes” speech, the eurozone has been clawing its way back from the brink, with Draghi patching together an ECB policy using toilet rolls and double-sided sellotape that roughly approximated a typical national central bank.

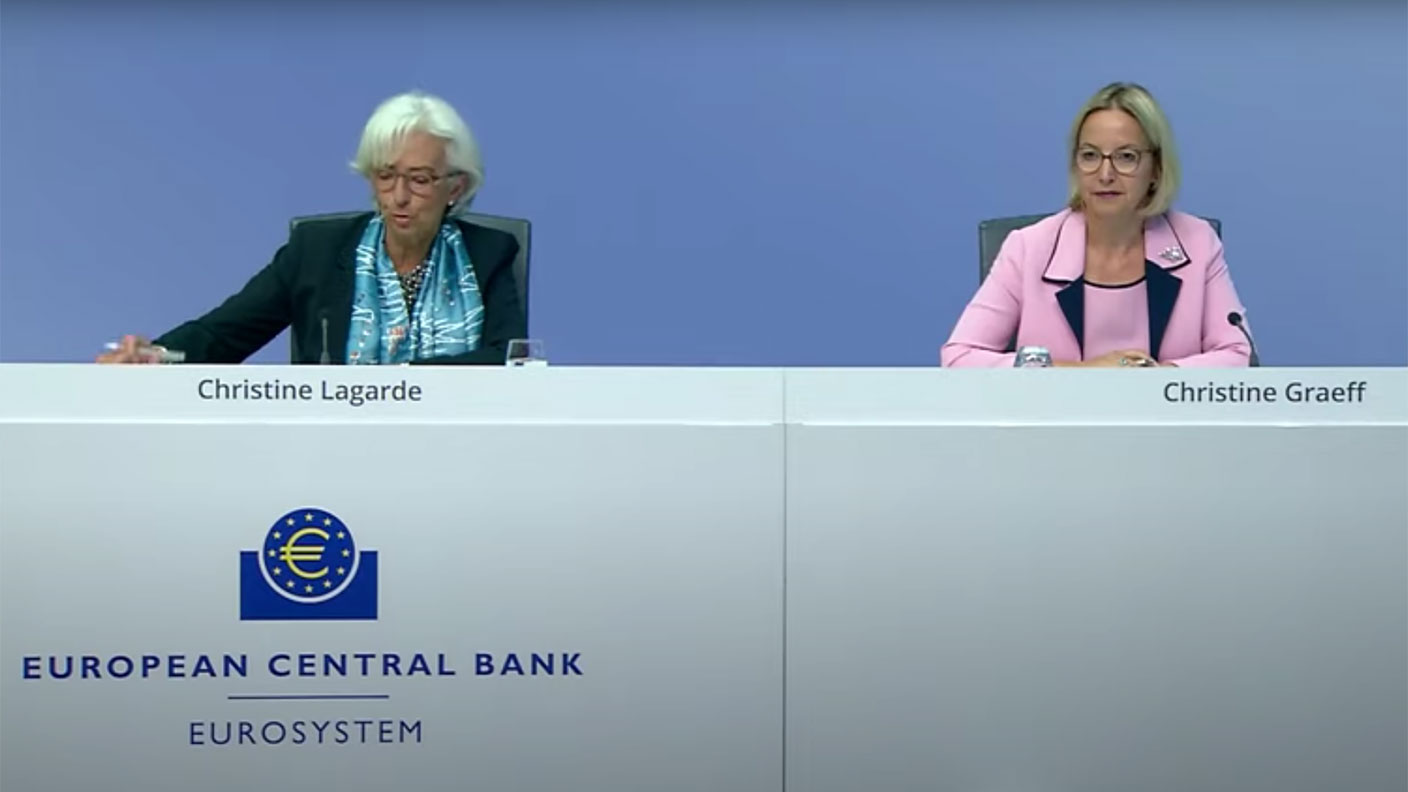

But there was always the risk that all of that would fall apart once Draghi stepped down. And it did look as though everyone was heading for another confrontation after Christine Lagarde took over.

Perhaps ironically, it’s only during the coronavirus crisis that convincing moves to underwrite the eurozone for the longer term (I won’t say permanently – nothing is permanent) and prevent the breakup of the euro have been made.

And this is why I keep talking about it. The eurozone’s situation has been a persistent threat hanging over the “big picture”. If you were worried about deflation you just needed to point to the eurozone and its ongoing stagnation. As long as that potential breakup is hanging over markets, there’s always a desire to price in a risk of it happening.

Most of the scariest moments of the last decade or so when it comes to deflation can largely be traced to concerns over the eurozone going pear-shaped again. 2016 and the Brexit vote was an obvious one – that was when we saw the first incredible peak in negative-yielding debt. More recently, when Draghi was coming to the end of his term and populism was kicking off in Italy and various other parts of the eurozone, we also saw creeping concern with bond yields sliding hard again.

So plugging that hole matters a lot to markets. And increasingly it looks as though they might achieve it.

Why money printing is leading to a stronger euro

Yesterday, the ECB increased the scope of its Pandemic Emergency Purchase Programme by €600bn, which was more than expected.

But perhaps more importantly, Germany has also announced a big stimulus (worth €130bn) for its businesses and consumers, aimed at – as finance minister Olaf Scholz put it – bringing Germany out of the crisis “with a ka-boom”. It includes a one-off bonus for households of €300 per child.

Why does this matter? Because it means Germany is serious about splashing the cash. Germany has always had a lot more fiscal rectitude than any other European country, for a wide variety of reasons. But this marks a departure from that, and indicates that Germany is also serious in its support for a pan-European Union support fund.

This, by the way, is why people keep going on about a “Hamiltonian” moment for the eurozone. I honestly don’t know much about Alexander Hamilton – there are way too many gaps in my knowledge of UK history for me to worry about starting on the US – but he was America’s first treasury secretary, and he played a key role in having the US states collectivise their debt. The idea is that we’re seeing something similar in the eurozone now.

But whether it goes that far or not doesn’t matter too much for markets. The fact is that the eurozone is moving in a market-friendly direction, and that’s what investors should be aware of.

To be clear, none of what I’m saying here is meant to be an indication of whether I think it's a good idea or not. All I’m pointing out is this: until now, a breakup of the euro has been a scenario that has continued to concern investors. That is now changing.

How do we know that? Because the euro is getting stronger against the dollar. You’d normally expect money printing to do the opposite, but in this particular case, it’s seen as shoring up the case for the euro staying together. In effect, the “breakup discount” is diminishing as a result of the money printing.

In turn, that’s also good for risk appetite. A stronger dollar effectively means tighter global monetary policy. If markets are to continue to rise – if we’re to get the melt-up that we’re all secretly hoping for – then the US dollar needs to get weaker.

Now, don’t get me wrong. Markets have come a long way in a short while and maybe they need a correction or a breather. But unless you’re a short-term trader (and if you are, I can’t help you much), then it doesn’t matter.

What’s more important is that this is another big step away from the deflationary scenario and towards the inflationary one.

That will bring its own problems of course. In fact, I’ll be writing about those for the next issue of MoneyWeek, coming up next Friday. If you’re not already a subscriber, snap up that six free issues deal now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Hints of private credit crisis rattle investors

Hints of private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.