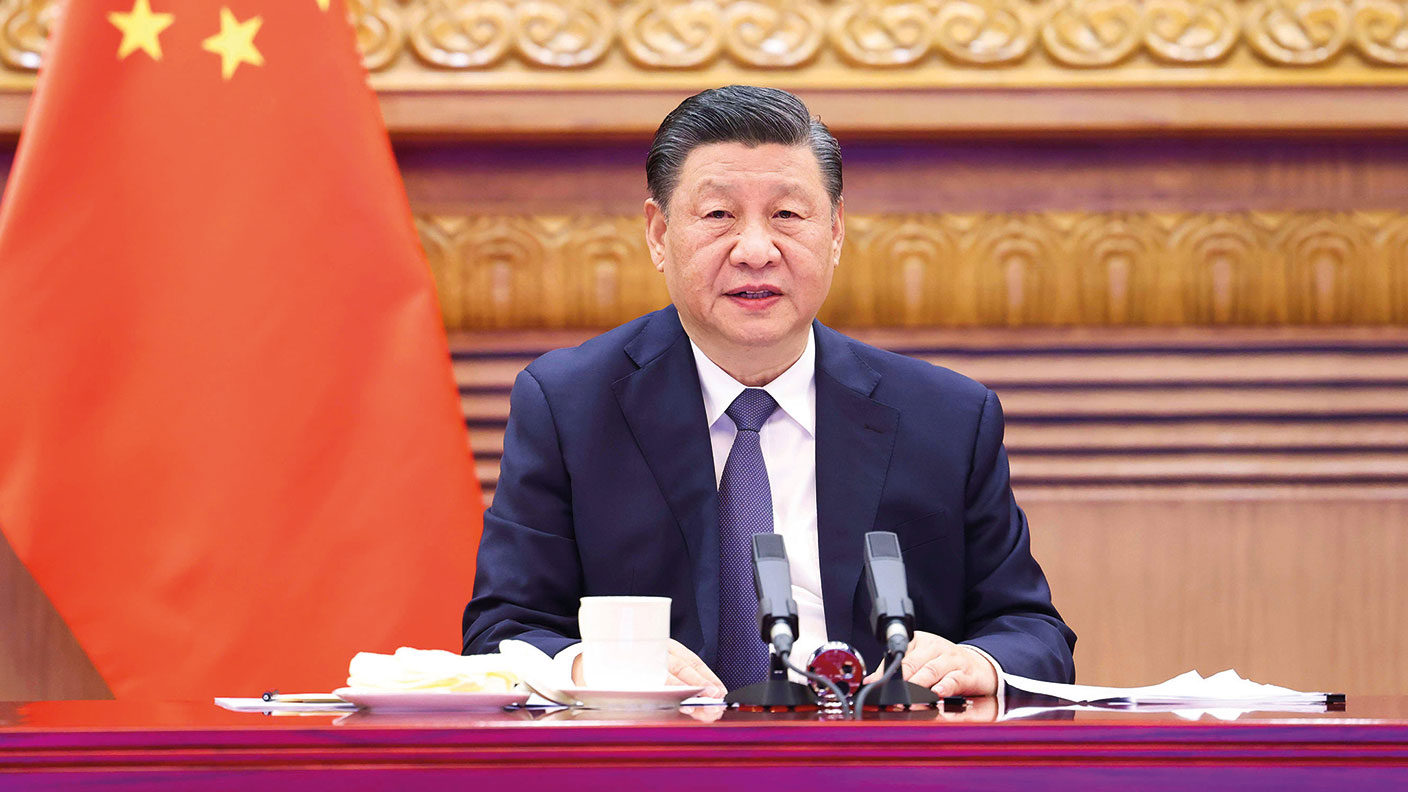

Xi Jinping’s zero-Covid dilemma

Xi Jinping’s zero-Covid strategy is toast, but strongmen don’t say so. Matthew Partridge reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Chinese leader Xi Jinping faces a moment of truth. The highly infectious Omicron variant of the virus that causes Covid-19 took hold in Shanghai, which prompted the government to lock up its residents for more than a month. That has left people struggling to find food and the elderly unable to get medical treatment. The fear is that Beijing will be next, which has led to the emptying of supermarket shelves and school closures. Xi is sticking to his guns on the zero-Covid strategy, deeming it to have been a success earlier in the pandemic, and relying on strict mass testing and quarantine to control the spread of the virus.

Lockdown fatigue takes hold

But given that the new variant is more infectious and has already spread more deeply into the population than in earlier outbreaks, lockdowns are starting to look even more obviously pointless than usual. That is generating a backlash among an “exhausted” population, says Chris Buckley in The New York Times. Residents under China’s past lockdowns complained about the “draconian restrictions”, but this time there are “more critics and bolder ones, including economists and business executives”. They are warning that, despite government attempts to stimulate the economy with infrastructure investments, the “chronic uncertainty” over “when it is possible to travel, spend, buy property or invest in business” is crippling consumer and company confidence and threatening a major economic crisis.

Some public officials are also starting to worry about the economic impact, and are privately complaining about Xi’s “ignorant” approach, says the Financial Times. This presents Xi with a dilemma, as his commitment to the zero-Covid strategy is based as much on political considerations as anything else. He has been a champion of the strategy and would appear weak if he backed away now, and would have to take the rap as Covid infections and deaths spiralled. He won’t want to risk that as the Party conference looms, where he aims to take an unprecedented third term as head of the party and state. At the same time, his “carefully cultivated image” as a “strong and competent leader” could also be “badly tarnished” if the government “blunders into an economic crisis” as a result of the Covid strategy.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Maoist mobilisations are hard to stop

That’s the trouble with “Maoist mass mobilisations”, says Eyck Freymann in The Wall Street Journal – China’s political system is good at starting them, bad at stopping them once they have begun. Mao’s Great Leap Forward proved this. Xi’s “bold embrace” of zero-Covid is beginning to look like a similar mistake. Xi will be aware of the historical parallels, so it’s possible he is aware that the result will be a turn away from the “open-facing, gradually marketising country” that China was before the pandemic. He may now explicitly seek to derive legitimacy less from GDP growth and more from his “common prosperity” strategy of preserving social order and redistributing wealth. If so, China is set to become a less dynamic and more static and ideological society – one in which “the party rules and the masses follow”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.