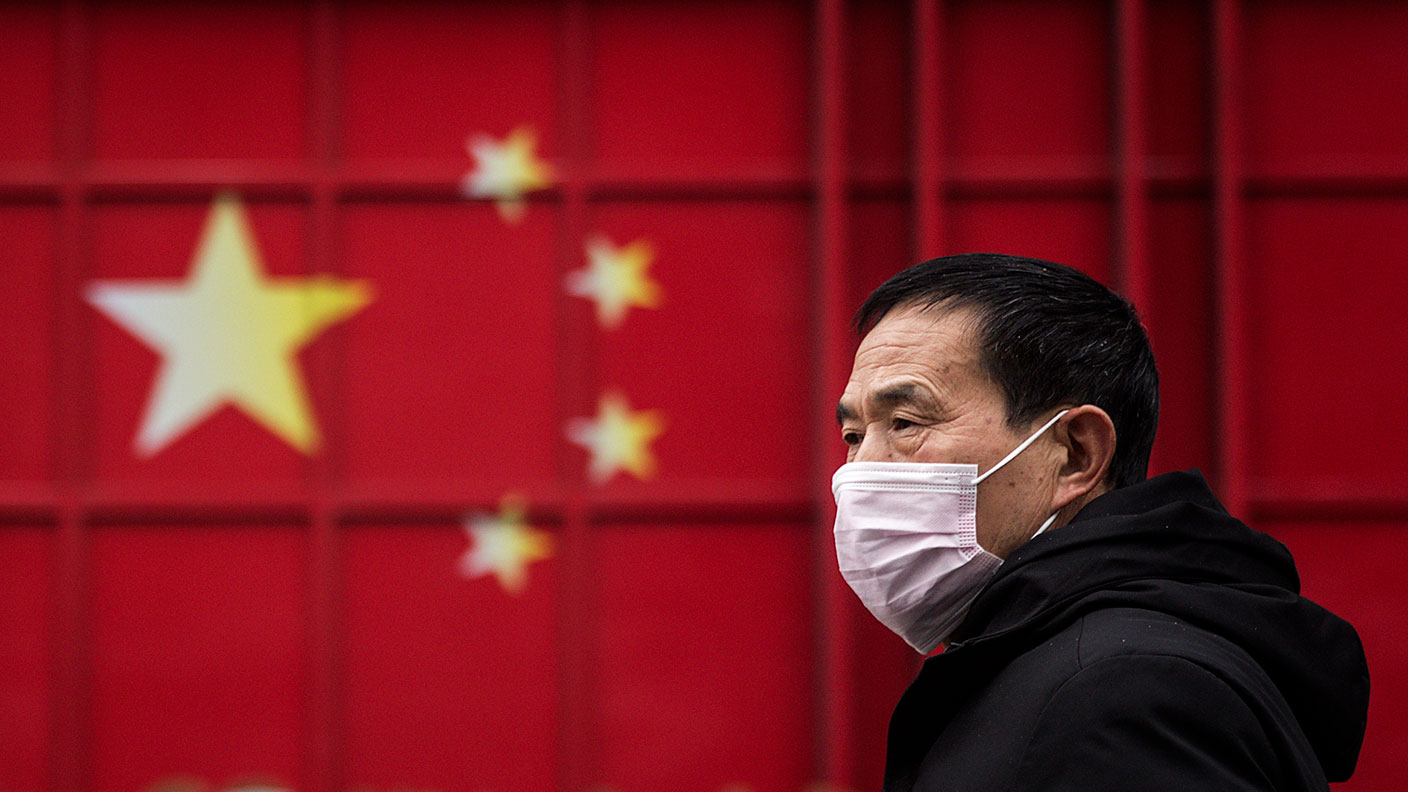

How China's “zero-Covid” policy could affect the global economy

As part of t its “zero Covid” policy, China is imposing stringent lockdowns as the number of cases rises sharply. Saloni Sardana looks at how this could affect the global economic recovery.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Almost two years after Covid restrictions were introduced, England is on course to lift them later this week. But restrictions in China are being reintroduced to combat the country’s worst outbreak in two years.

China has imposed a one-week lockdown in the city of Shenzhen, due to rising Covid cases. The city, sometimes described as China’s Silicon Valley, is home to the world’s fourth-largest port, Yantian International Container Terminals.

“Yantian is thought to handle about 90% of China’s vast electronics exports, making it a key cog in global trade,” says The Times. So what is going on and what do China’s new restrictions mean for supply chains and the economy?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Why are cases rising and how severe are new measures?

Authorities have thrust around 17 million of Shenzhen’s residents into lockdown, as the number of Covid cases soars. They have also imposed a travel ban in the Jilin province, home to more than 24 million residents. Jillin residents have been barred from leaving their homes, and nobody can leave the province without police permission.

The stricter measures come after cases in China almost doubled on Monday to nearly 3,400, prompting measures that could threaten half of China’s GDP, says Bloomberg.

China’s surge in cases is thought to be related to a sharp rise in neighbouring Hong Kong; Shenzhen tightened its management of cross-border shipping after Hong Kong reported almost 27,000 cases and 250 deaths on Monday. China is still pursuing a “zero-covid policy”, hence the drastic lockdown.

What is China’s “zero Covid” policy?

China has maintained a “zero-Covid” policy since the virus was first detected in Wuhan in 2019. Its approach involved imposing hard citywide lockdowns, mass testing and travel restrictions early on after any outbreak of cases. This is the equivalent of UK prime minister Boris Johnson issuing a stay-at-home order and shutting pubs every time cases spike.

But the emergence of the omicron variant has put China’s zero-Covid efforts into doubt. Barry Norris, manager of the Argonaut Return Fund, has previously told MoneyWeek how the world economy is at threat due to this strategy because of the resulting continuous lockdowns and their effects on supply chains.

Which large companies have been affected?

Chinese lockdowns are wreaking havoc on a number of international companies who have halted operations in the country. Apple supplier Foxconn said it had suspended operations in the city until further notice. It told the BBC that it would reallocate work among backup plants in an effort to minimise any disruption.

Car manufacturers are also feeling the pinch. Toyota has shut its factory in Changchun and has not said when it might resume operations. Volkswagen followed suit, shutting its operations in Changchun, although the company hopes to resume later this week.

What does this mean for the global economy?

The main economic concern is that it will further damage supply chains at a time when they were still fragile from the effects of previous lockdowns in the last two years.

Russia’s invasion of Ukraine last month is also exacerbating supply chain issues. Both countries are agricultural powerhouses, so Western sanctions and the destruction of Ukraine’s agricultural infrastructure threaten to send the price of key commodities soaring. Prolonged lockdowns in China may make this worse.

With many people in the UK bracing themselves for inflation of around 7% this year; and US inflation already at a 40-year high of almost 8%, central banks might feel under pressure to raise interest rates more swiftly and sharply than previously expected, even although the rising costs are arguably disinflationary in the longer run (because they squeeze consumer spending).

China set itself a GDP growth target of 5.5% this year. This was already considered somewhat ambitious and it’s now very much in doubt, says Bloomberg: “With tighter virus controls in places like Guangdong and Shanghai disrupting manufacturing, an ongoing contraction in the country’s huge property market showing no signs of easing and an oil price hike pushing up business and consumer costs”.

How have markets reacted?

China’s outbreak has rattled markets – the Shanghai Composite stockmarket index fell 5%, while Hong Kong’s Hang Seng index, which hosts many Chinese tech giants, lost more than 6% on Tuesday. And with China the world’s top importer of crude oil in 2020, benchmark crude oil prices fell below $100 a barrel on Tuesday.

But some analysts think any disruptions will be short-lived and China and the wider world will be able to weather the storm. Yeang Cheng Ling, senior investment strategist at DBS Bank, said: "Such lockdowns have happened before, and (cities) have re-opened within a short period of time once the number of Covid cases were within control”.

While the recent restrictions imposed by China are the most severe since 2020, they still are still less stringent than those imposed at the start of the pandemic. And while Zhang Wenhong, a Chinese infectious disease expert, has dubbed the recent outbreaks as the "the most difficult period in the last two years of battling Covid" he says the outbreaks are still at an early stage.

So, for now, disruption may be short-lived. But UBS analyst Grace Chen said if the lockdowns spread to other cities such as Shanghai, this would spell more trouble for production and supply chains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.