Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

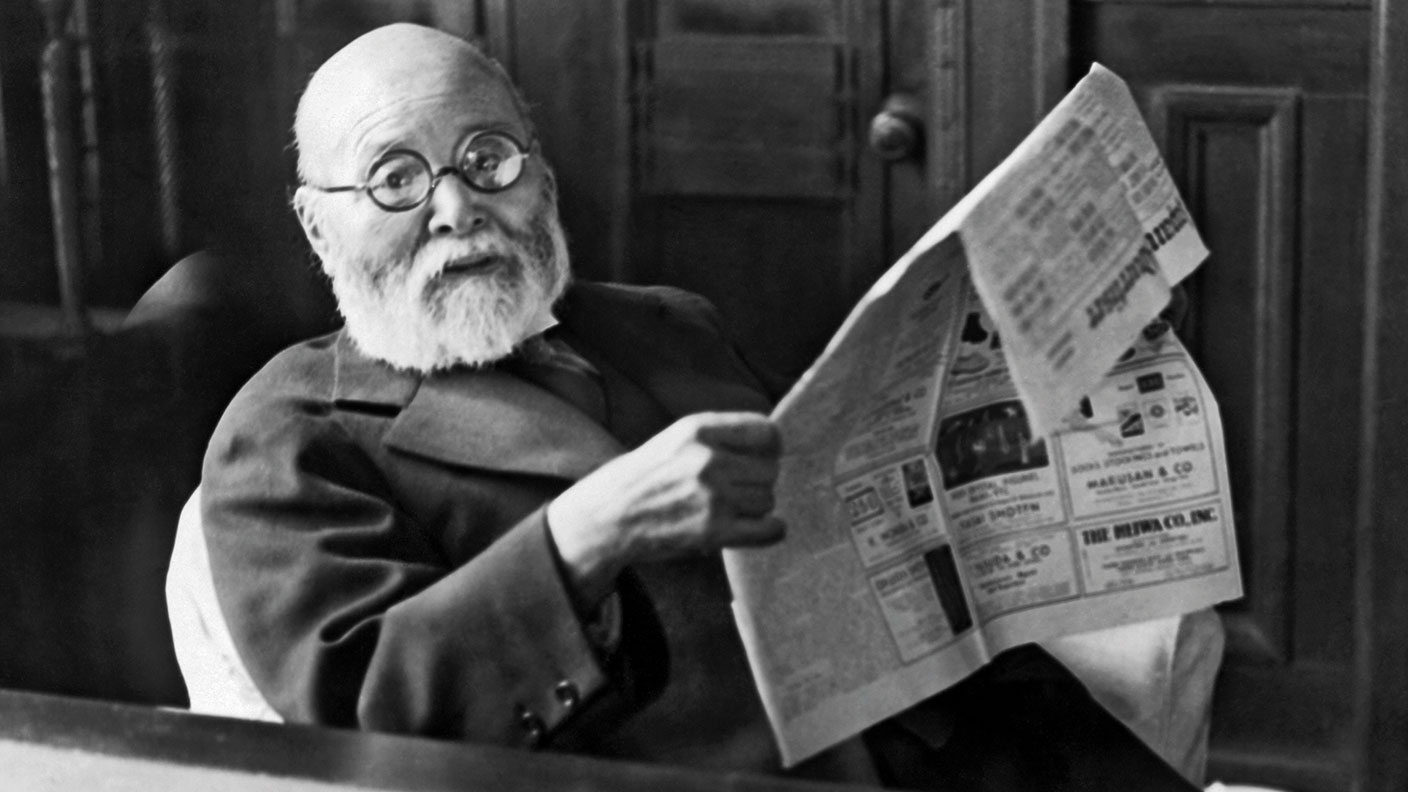

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some.”

John Maynard Keynes, The Economic Consequences of the Peace (1919).

Keynes was right, in this case at least. Inflation is the most insidious of taxes, stealthily sucking away the purchasing power of savers and depositors and those on fixed incomes. Despite a decade of ever more outrageous monetary experimentation – first quantitative easing, then zero interest rates, then negative interest rates – apologists for our central banks might ask, “So where’s the inflation, then?” To which the appropriate response might well be: “It’s on its way”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I was struck, for example, by the unanimity of opinion among panellists – among them the economist James Ferguson, the Financial Times columnist Gillian Tett and Conservative MEP Daniel Hannan – at MoneyWeek’s investor summit in November that modern monetary theory (MMT) was almost certain to be deployed amongst Western monetary authorities.

MMT holds that any government that issues its own money can essentially afford limitless purchases of goods, services and financial assets without needing to raise taxes or issue debt. MMT also posits that governments cannot be forced to default on debt denominated in their own currency. If this all sounds a little too good to be true, that’s probably because it is.

A disastrous precedent

My favourite rejoinder to the “free-lunch” logic of MMT is the following letter published by the Financial Times in November 2014: “Sir, Adair Turner suggests some form of monetary financing is the only way to break Japan’s deflation and deal with the debt overhang (‘Print money to fund the deficit – that is the fastest way to raise rates’, Comment, November 11). This was precisely how Korekiyo Takahashi, Japanese finance minister from 1931 to 1936, broke the deflation of the 1930s. The policy was discredited because of the hyperinflation that followed.”

What amazes me about the monetary debate is that nobody ever seems to ask why an arbitrary 2% inflation target, say, is somehow desirable in the first place? What about an inflation target of zero? Sound money beats debauched money every day of the year. We had sound money – and no inflation, in fact mild deflation – throughout the entire Victorian era, with no apparent economic ill effect.

But time moves on. The US Federal Reserve is now reportedly considering quietly abandoning its 2% inflation target – on the upside. The Fed would, it appears, quite like to let inflation have its head for a while.

MMT: a dangerous idea

Be careful what you wish for. Keynes himself once described himself and his peers as having “involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time – perhaps for a long time”. That was written in an essay entitled “The Great Slump of 1930”. That slump would go on to last for a decade and it would take World War II to lift us out of it.

I’m with the American fund manager Harris Kupperman, who wrote in December that “[We’ve] finally reached the limits of monetary policy. Does the ECB taking rates ten basis points more negative do anything but accelerate the bankruptcy of the eurozone banking system? Does it increase consumption or capital expenditures?”

“Of course not. If anything, it just starves the system of capital by taking everyone’s return on capital investment down towards zero and below. Who invests when expected returns are negative? What the world needs is a big reset of the system where leveraged firms default, solvent firms pick up the pieces and get to earn excess returns due to their past fiscal sobriety. Since we live in a democracy, that won’t happen, instead we will have extreme fiscal stimulus in order to kick the can further down the road.”

In other words, Kupperman expects MMT, too. If we are right, the inflationary genie may finally be about to emerge from the bottle. To which just one question is required. Got gold?

• Tim Price is manager of the VT Price Value Portfolio (pricevaluepartners.com) and author of Investing Through the Looking Glass: a rational guide to irrational financial markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.