Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

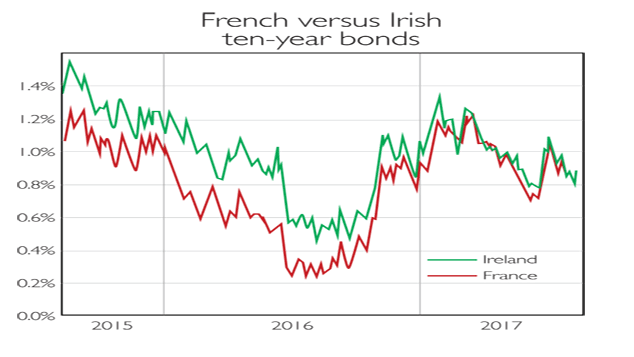

The crisis in the periphery of the eurozone is far from over. But unlike the Mediterranean countries, Ireland has recovered so strongly it grew by 5.2% last year that investors are now treating it as a core state, notes Kate Allen in the Financial Times.

The gap between the German ten-year bond yield and its Irish counterpart has fallen to decade lows. The difference with French yields has narrowed of late too. Indeed the Irish yield has edged below the French one at times, implying Irish paper trading at a higher price despite France traditionally being deemed the better credit risk.

Viewpoint

"[Many UK manufacturers] would very happily trade a stronger pound for continued membership of the single market We should get away from the idea that you can devalue your way to export success. In the mid-1970s the exchange rate of the Deutsche mark to sterling was just under six. Now, based on the current euro-sterling rate, the rate would be around DM2.1. Sterling has suffered a 63% devaluation in relation to the German currency Yet there is no doubt which country is the more successful exporter. If devaluation was the key to export success, Britain would be a world champion. The reasons for such success go much deeper."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

David Smith, The Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

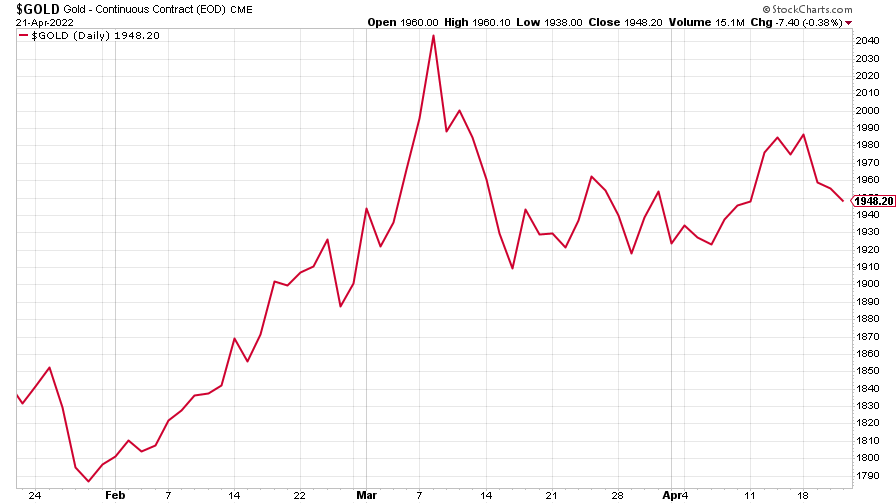

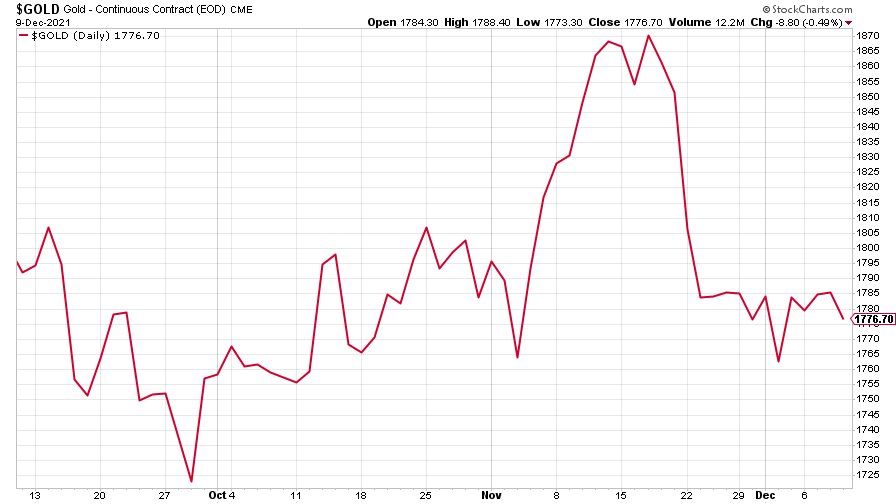

The charts that matter: bond yields and US dollar continue to climb

The charts that matter: bond yields and US dollar continue to climbCharts The US dollar and government bond yields around the world continued to climb. Here’s what happened to the charts that matter most to the global economy.

-

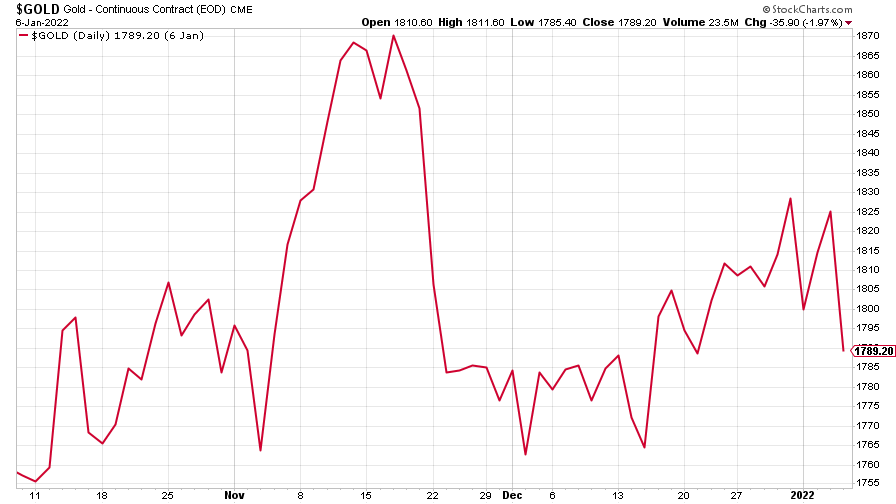

The charts that matter: markets start the year with a crash

The charts that matter: markets start the year with a crashCharts As markets start 2022 with a big selloff, here’s what happened to the charts that matter most to the global economy.

-

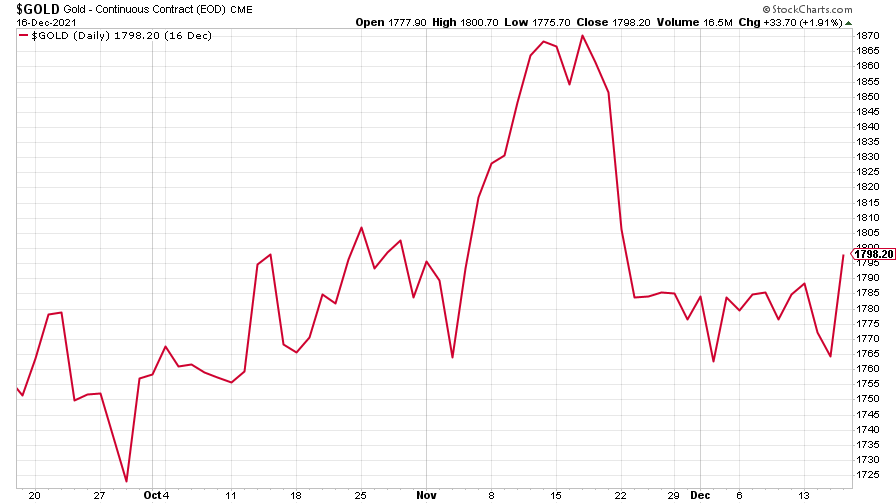

The charts that matter: Fed becomes more hawkish

The charts that matter: Fed becomes more hawkishCharts Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: a tough week for bitcoin

The charts that matter: a tough week for bitcoinCharts Cryptocurrency bitcoin slid by some 20% this week. Here’s what else happened to the charts that matter most to the global economy.

-

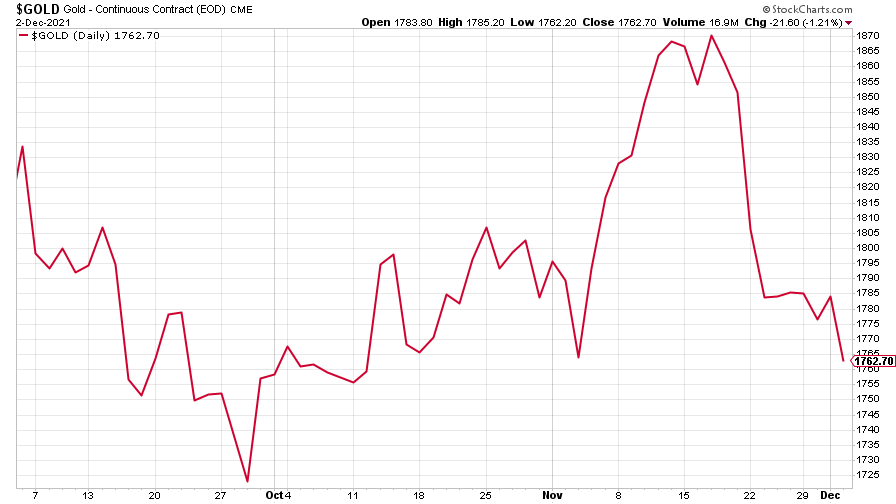

The charts that matter: omicron rattles markets

The charts that matter: omicron rattles marketsCharts Markets were rattled by the emergence of a new strain of Covid-19. Here’s how it has affected the charts that matter most to the global economy.

-

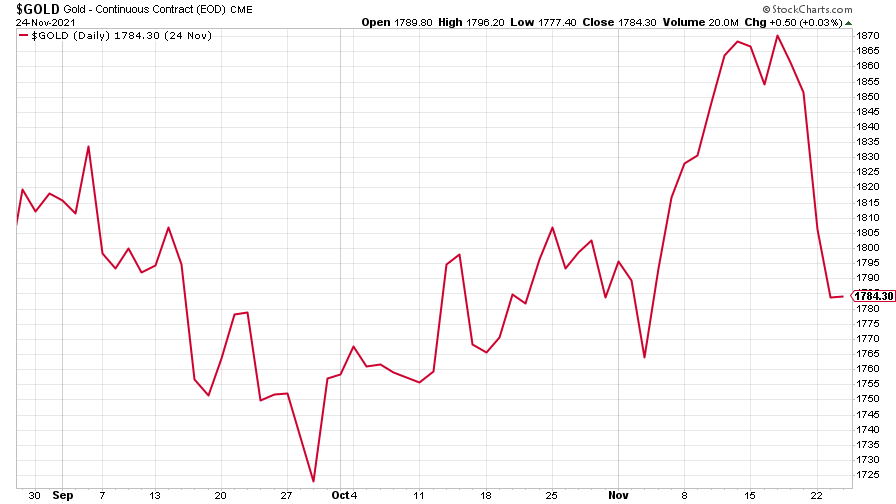

The charts that matter: the US dollar keeps on strengthening

The charts that matter: the US dollar keeps on strengtheningCharts The US dollar saw further rises this week as gold and cryptocurrencies sold off. Here’s how that has affected the charts that matter most to the global economy.

-

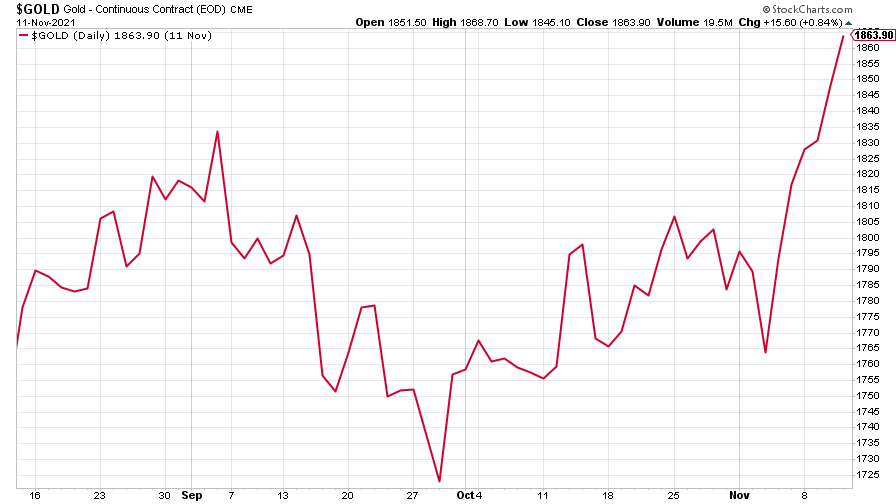

The charts that matter: gold hangs on to gains while the dollar continues higher

The charts that matter: gold hangs on to gains while the dollar continues higherCharts The gold price continued to hang on to last week’s gains, even as the US dollar powered higher this week. Here’s how that has affected the charts that matter most to the global economy.

-

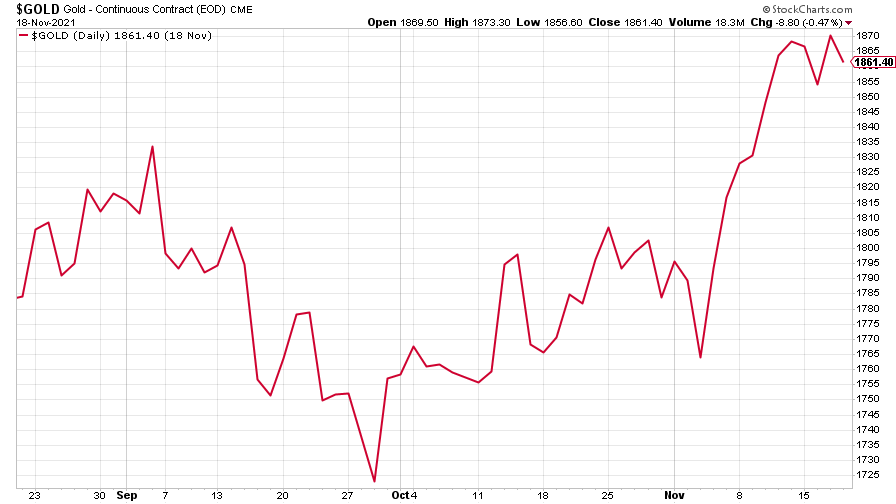

The charts that matter: inflation fears give gold a much needed boost

The charts that matter: inflation fears give gold a much needed boostCharts US inflation hit its highest in 30 years this week, driving gold and bitcoin to new highs. Here’s how that has affected the charts that matter most to the global economy.