Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"If this is a rainy-day fund, they're saving for a millennial flood," Georgetown University's finance professor Lee Pinkowitz told The Wall Street Journal.

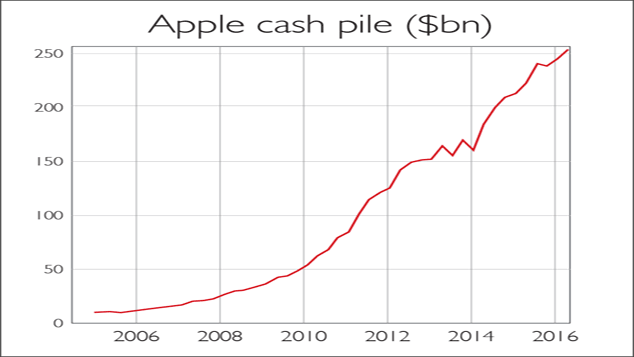

Apple's cash pile has swelled to $250bn, a sum bigger than the market value of Wal-Mart or Procter & Gamble. It also eclipses the foreign currency reserves of Britain and Canada combined.

Apple's lucrative products help explain why the cash pile has burgeoned; so does the group's historic tendency to avoid big acquisitions as well as dividends or buybacks. Ninety per cent of the money is held overseas to avoid high US corporate taxes.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"French productivity, measured by GDP per hour worked, is higher than in Britain to an almost embarrassing extent. Figures published by the Office for National Statistics this month showed that productivity in France is 29.4% higher I have always argued that this is because Britain is a higher-employment, lower-investment economy than France, where restrictive labour laws discourage employment and, where it is an alternative, encourage firms to invest. While a machine gets on with it, a French worker responds with a Gallic shrug. But that French worker has significantly more capital equipment than their British equivalent."

David Smith, The Sunday Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

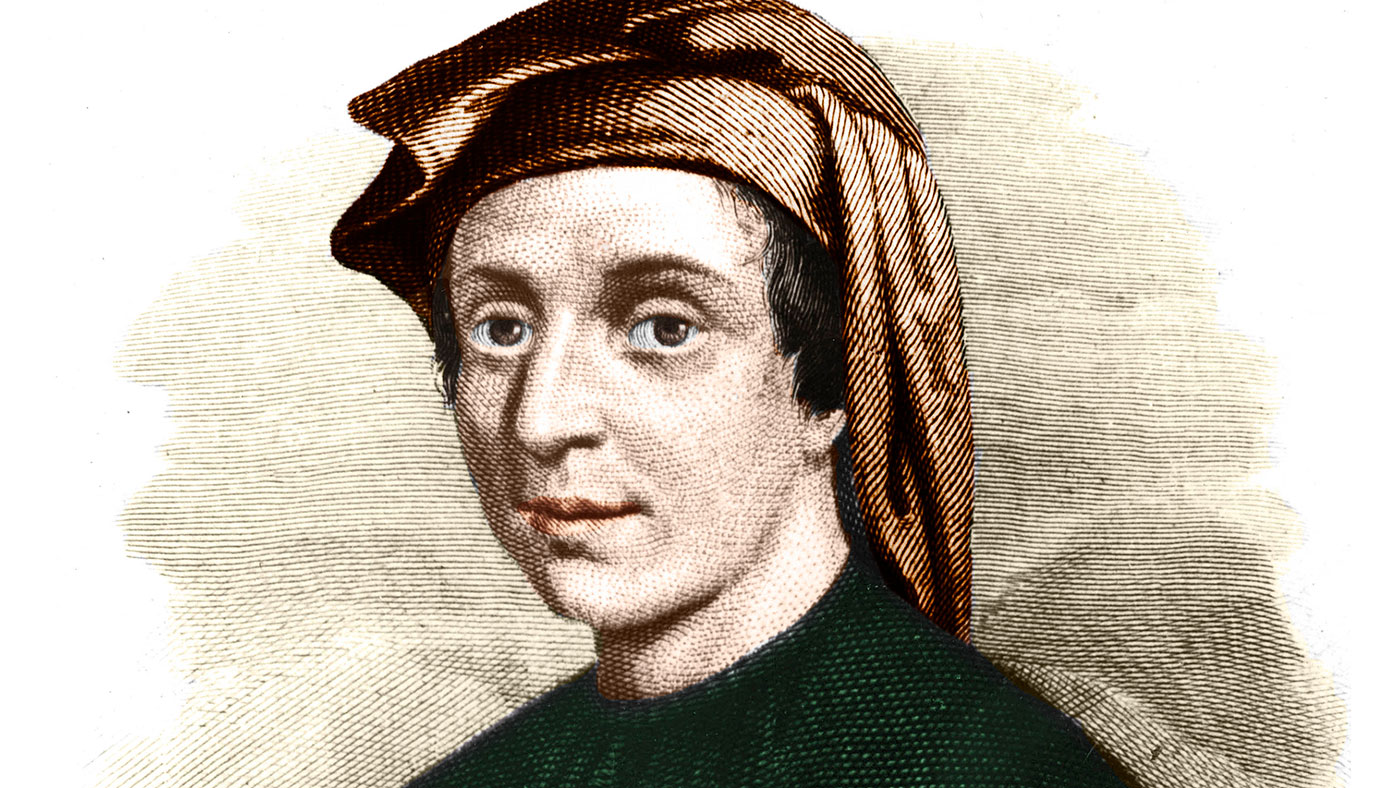

What would the greatest mathematician of the Middle Ages say about gold today?

What would the greatest mathematician of the Middle Ages say about gold today?Sponsored Italian mathematician Fibonacci is most famous for a curious sequence of numbers. Continuing his series on technical analysis, Dominic Frisby explains what these numbers are, and what they can tell us about gold’s next move.

-

How moving averages can reveal trades worth betting on – and ones to avoid

How moving averages can reveal trades worth betting on – and ones to avoidSponsored Dominic Frisby looks in more depth at how moving averages can help you catch turning points in markets and help you decide which trades are worth pursuing.

-

This chart pattern could be extraordinarily bullish for gold

This chart pattern could be extraordinarily bullish for goldCharts The mother of all patterns is developing in the gold charts, says Dominic Frisby. And if everything plays out well, gold could hit a price that investors could retire on.

-

Believe it or not, this market is a “buy”

Believe it or not, this market is a “buy”Charts With the world in the state it’s in and the market so volatile, buying stocks right now might go against all your instincts. But that’s just what you should be doing, says Dominic Frisby. Here, he explains why.

-

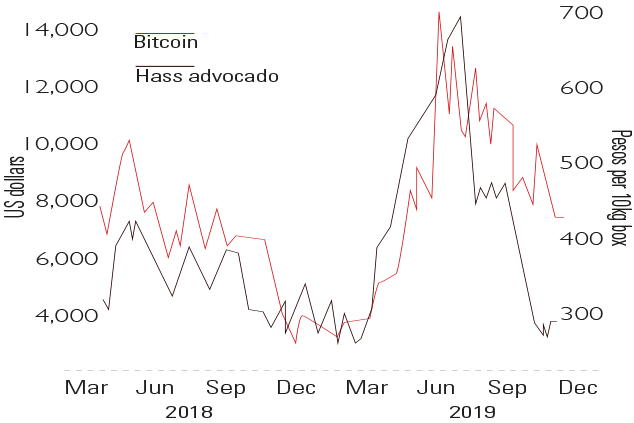

Chart of the week: avocados and bitcoin are in sync

Chart of the week: avocados and bitcoin are in syncCharts An amusing new spurious correlation has been spotted between the price of bitcoin and Mexican Hass avocados. In reality, of course, they have nothing to do with each other beyond “superficial price action”.

-

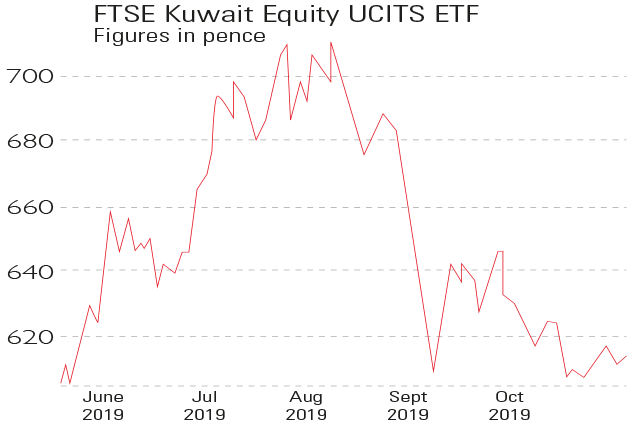

Chart of the week: Kuwait's stockmarket is ready for take-off

Chart of the week: Kuwait's stockmarket is ready for take-offCharts Kuwait's stockmarket is due to be promoted from “frontier” status to an emerging market by index provider MSCI next June. That should entice almost $10bn of global investors’ cash into the country.

-

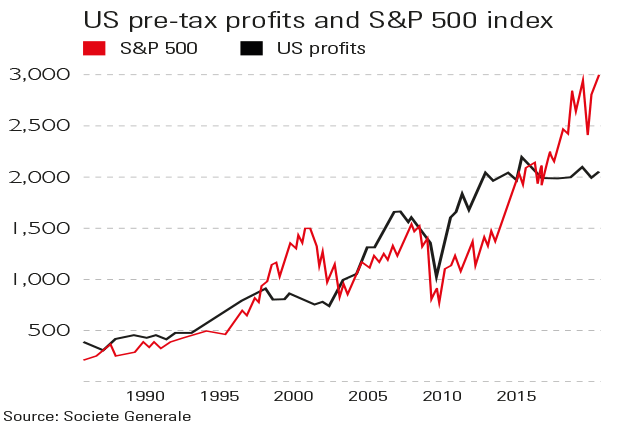

Chart of the week: US stocks outrun profits

Chart of the week: US stocks outrun profitsCharts The US stockmarket has become totally detached from underlying profits of its constituent companies over the past three years.

-

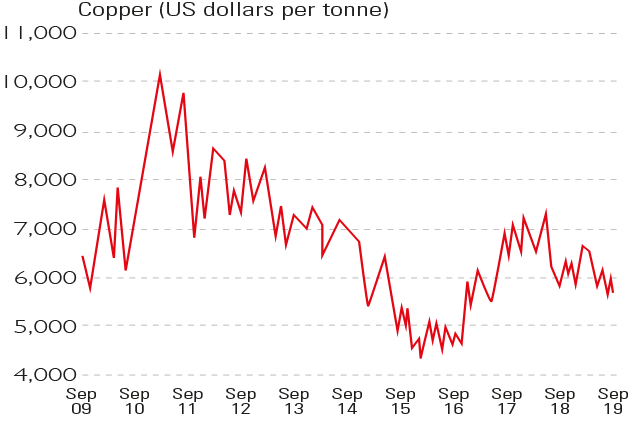

Chart of the week: Dr Copper diagnoses an ailing economy

Chart of the week: Dr Copper diagnoses an ailing economyCharts The price of copper has slipped by a fifth this year and is now at a near-two-year low of around $5,600 a tonne.