Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

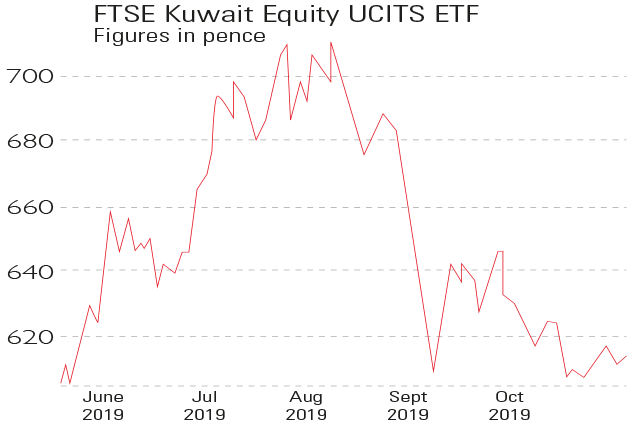

The KMEFIC FTSE Kuwait Equity UCITS ETF (LSE: KUWP) has made little progress since HANetf launched it in London earlier this year. But that could soon change. Kuwait is due to be promoted from a "frontier" market to an emerging one by index provider MSCI next June. That should entice almost $10bn of global investors' cash into the market, reckons HANetf.

The overall market capitalisation of the local index is only around $30bn. Meanwhile, Kuwait has the world's sixth-largest oil reserves, but is sensibly diversifying in an effort to become a regional commercial and financial hub. The ETF, which tracks the FTSE Kuwait All-Cap 15% Capped index comprising small, mid and large caps, has low exposure to oil.

Viewpoint

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"[Last week] talk of the Dow Jones... at 30,000 didn't seem so fanciful as when Barron's suggested it in January 2017, as the blue chips hit 20,000... the global economic backdrop has, for the first time in 18 months, begun to improve', writes Michael Pearce [of] Capital Economics. It's not just because of prospects of a trade deal. Recession risks have, well, receded. Growth may slow to a 1% annual rate in the current quarter, but odds of falling into an outright recession have slid... the risks from financial excesses still appear moderate, according to Goldman Sachs economist David Mericle. Commercial real-estate risks have eased, helped by slower price appreciation and better rents. Corporate debt is high, compared with GDP, but a better comparison is debt versus earnings and assets. Those metrics are not at alarming levels, even for high-yield issuers."

Randall Forsyth, Barron's

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

What would the greatest mathematician of the Middle Ages say about gold today?

What would the greatest mathematician of the Middle Ages say about gold today?Sponsored Italian mathematician Fibonacci is most famous for a curious sequence of numbers. Continuing his series on technical analysis, Dominic Frisby explains what these numbers are, and what they can tell us about gold’s next move.

-

How moving averages can reveal trades worth betting on – and ones to avoid

How moving averages can reveal trades worth betting on – and ones to avoidSponsored Dominic Frisby looks in more depth at how moving averages can help you catch turning points in markets and help you decide which trades are worth pursuing.

-

This chart pattern could be extraordinarily bullish for gold

This chart pattern could be extraordinarily bullish for goldCharts The mother of all patterns is developing in the gold charts, says Dominic Frisby. And if everything plays out well, gold could hit a price that investors could retire on.

-

Believe it or not, this market is a “buy”

Believe it or not, this market is a “buy”Charts With the world in the state it’s in and the market so volatile, buying stocks right now might go against all your instincts. But that’s just what you should be doing, says Dominic Frisby. Here, he explains why.

-

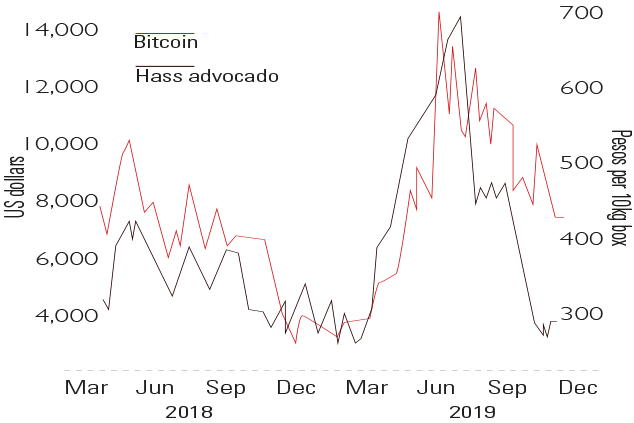

Chart of the week: avocados and bitcoin are in sync

Chart of the week: avocados and bitcoin are in syncCharts An amusing new spurious correlation has been spotted between the price of bitcoin and Mexican Hass avocados. In reality, of course, they have nothing to do with each other beyond “superficial price action”.

-

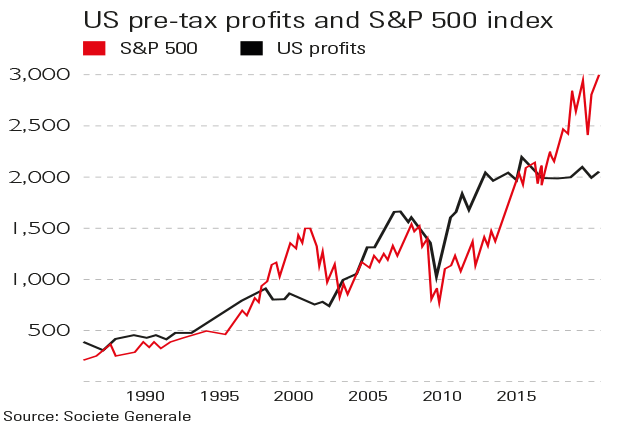

Chart of the week: US stocks outrun profits

Chart of the week: US stocks outrun profitsCharts The US stockmarket has become totally detached from underlying profits of its constituent companies over the past three years.

-

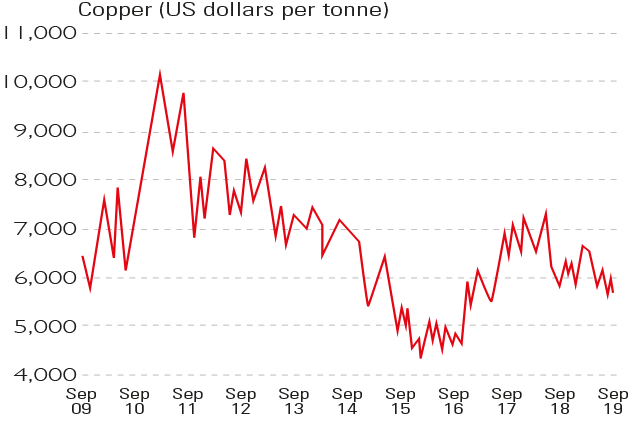

Chart of the week: Dr Copper diagnoses an ailing economy

Chart of the week: Dr Copper diagnoses an ailing economyCharts The price of copper has slipped by a fifth this year and is now at a near-two-year low of around $5,600 a tonne.

-

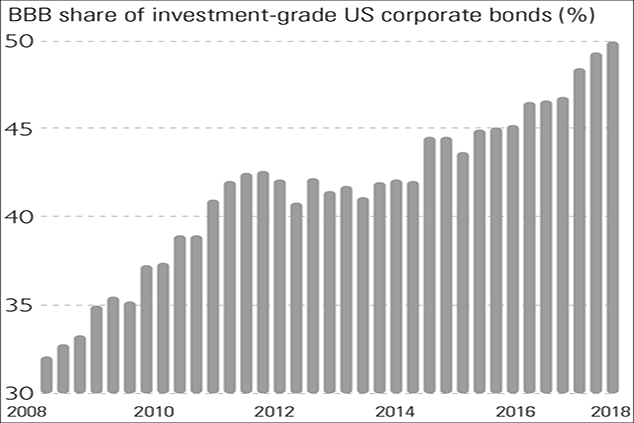

Chart of the week: America’s corporate debt binge

Chart of the week: America’s corporate debt bingeCharts US households have spent much of the past decade deleveraging. Companies haven’t as this chart shows.