Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Next (LSE: NXT) shares looked to shrug off a profit warning from the retailer this morning, with the group revealing that the exceptionally mild autumn has led to reduced demand for its winter clothing.

In a third-quarter trading update, Next says it now expects full-year 2014 profits to range between £750m and £790m, down from the £775m to £815m it had previously indicated. Sales for the three months to 25 October rose 5.4%, slower than the 10% growth expected.

Having already indicated in a trading statement last month that profits might suffer if the unusually warm weather continued, it is no surprise the shares did not suffer too much today. Midday they were off 40p or 0.6% to 6,395p.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While investors will be disappointed by the warning today, at least they were warned well in advance.

And while companies blaming the weather for poor performance is often on par with rail companies blaming cancellations on the wrong type of snow or such like, it is difficult to be too critical of Next. It has a very good record of giving advance warning of any serious concerns it may have that might impact its results.

Analysts cut Next forecasts

Analysts are now expected to shave their earnings forecast for its year ending January 2015 by around two to 3%. Charles Stanley, for instance, has cut its own earnings per share (EPS) estimate 2% to the mid point of the new guidance, 414p.

At 6,395p, the share price implies a forward 2015 multiple of 15.4. That is a slight premium to the general sector and looks justified considering Next's track record of delivering and pretty decent prospects going forward. The prospective yield is a reasonable 2.3, covered a healthy 2.8 times.

Commenting on the results, Charles Stanley analyst Sam Hart says, "We expect trading conditions in the UK general retail sector to remain challenging over the medium term, with the consumer environment likely to stay relatively subdued and the competitive landscape intense."

But Hart believes Next's strong ranges and the high quality of its online proposition means the company can continue to make good progress. "We forecast further healthy progression in pre-tax profits over the medium term."

He adds: "Strong free cash flow generation raises the prospect of further share buybacks and/or special dividends going forward. The vagaries of the British weather will inevitably continue to influence short-term trading performance, but good medium to longer term prospects for the company remain unchanged."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kam is a former deputy editor at Hemscott Invest and online editor, City A.M and he was also previously the Digital Editor at IFA Magazine. Kam is currently a senior journalist at The Global Treasurer and contributes to MoneyWeek. Kam shares expertise on the FTSE 100, investing and global stocks.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Defeat into victory: the key to Next CEO Simon Wolfson's success

Defeat into victory: the key to Next CEO Simon Wolfson's successOpinion Next CEO Simon Wolfson claims he owes his success to a book on military strategy in World War II. What lessons does it hold, and how did he apply them to Next?

-

Next’s results stand out against a tough retail backdrop

Next’s results stand out against a tough retail backdropAnalysis FTSE 100 retailer Next is dealing well with the tough conditions on the high street, with rising profits and a plan that's working. Rupert Hargreaves looks at the numbers.

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

Next shares soar as sales smash expectations – is the stock a buy?

Next shares soar as sales smash expectations – is the stock a buy?News High street and online retailer Next has reported a big rise in sales and profits. John Stepek looks at its performance and asks if it's worth buying Next shares.

-

Little cheer on the high street

Little cheer on the high streetFeatures Profit warnings from Debenhams and Mothercare are more evidence that traditional retailers are fighting a losing battle against nimbler online competitors, says Ben Judge.

-

Next: Out of fashion

Features Clothing retailer Next has released gloomy results, yet the firm’s shares rallied strongly. Why? Ben Judge reports.

-

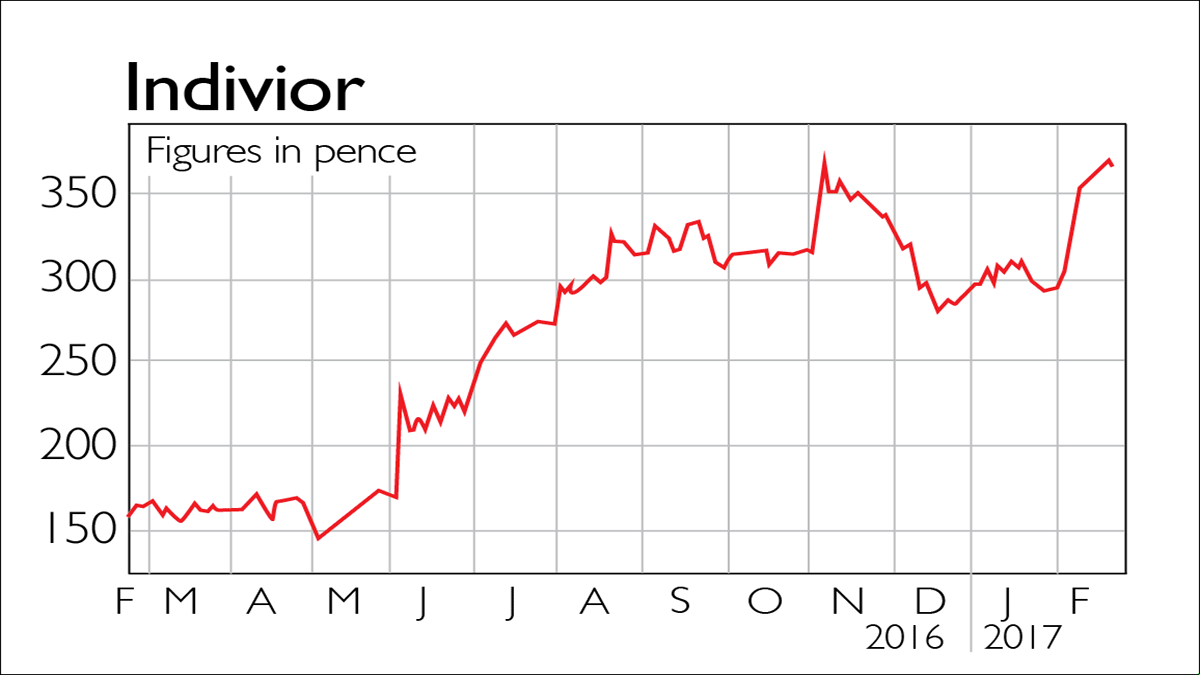

If you’d invested in: Indivior and Next

If you’d invested in: Indivior and NextFeatures Drugmaker Indivior is on the up, while retailer Next, once a favourite with investors, has lost its way.

-

Next faces its toughest year since 2008

Features The clothing retailer has long been a favourite of long-term investors, but now Next is facing tough times.