Shares in focus: Next is a rare star in the retail sector

Fashion retailer Next has been an exception to the rule of the declining high street. Phil Oakley investigates to see if the shares are still worth buying.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Clothes merchant Next has done well, but the shares are fully valued, says Phil Oakley.

Given the doom and gloom that has engulfed Britain's retailers over the last decade, you could be forgiven for thinking that the sector is a definite no-go area for investors. In a broad sense this is probably true. But like lots of things in life there are exceptions to the general rule.

When it comes to retailing, clothing chain Next has been a star performer. It has got a lot of the basics right and has profited handsomely from the mistakes made by some of its rivals.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Up until recently its performance and share price have defied those with a more cautious outlook, including me. Next's share price hasmore than tripled since 2010, while shareholders have also been showered with hefty dividend increases and one-off payouts.

So far, 2014 has been another good year for Next shareholders, with the share price still up nicely. However, a couple of weeks ago the company issued its first profit warning since the late 1990s.

So, has the Next juggernaut finally run out of steam or are its shares still a decent long-term investment?

Warm autumn cools growth

There's a lot to like about Next. The company is one of the most honest and open I've come across when it comes to sharing information with existing and prospective investors. This makes it a lot easier to understand than some of its peers. So what's going on at the moment?

First, it seems that the weather is affecting the way in which many of us buy our clothes. Companies often use the weather as a convenient excuse to cover up more serious problems elsewhere, but I don't think this is the case with Next.

The good summer weather probably meant it sold more than it thought it would, while a warm October has hurt the sales of its autumn and winter ranges.

That said, even on its most pessimistic outlook, Next still expects pre-tax profits to grow by 8% this year. With fewer shares in issue, this should translate into earnings per share (EPS) growth of 10% and a decent dividend increase of around 16%.

A lot of retailers would give their right arm for this kind of performance. The problem for Next and its investors is that it has become a victim of its own success, having delivered year after year of stunning sales and profits growth.

Common sense suggests that this cannot continue forever. Nevertheless, it still seems that there are plenty of things going on that can keep sales and profits heading upwards in the years ahead.

A very well-run business

Next has continued to be very good at improving the quality and design of its clothes. It has also benefited from adopting a bold approach of spotting new trends early. This approach can backfire for a clothing retailer if they back the wrong trend, but so far it's a strategy that seems to be paying off.

Another positive development is the continued roll-out of larger out-of-town stores. While other retailers have struggled here, Next seems to be doing well.

This has allowed Next to sell more home products such as sofas and dining room and bedroom furniture. These now make up more than a quarter of its selling space and diversify the business from its reliance on clothing.

Yet, it is the success of the Next Directory catalogue-shopping service that unquestionably makes Next stand out as a cut above the rest. While the business has already done very well, it has the potential to keep growing in the UK and overseas.

Customer service has been key here and Next continues to try to improve. Soon shoppers will be able to order something by midnight and have it delivered to a Next store the following day. The push into selling non-Next designer labels should also help woo new customers while keeping existing ones happy.

Should you buy the shares?

The focus on serving customers well has translated into an excellent financial performance over the years. This has also been helped by strictly sticking to rules such as never discounting products before Christmas in an effort to avoid trashing profit margins. As a consequence, Next has been making lots of money and generating plenty of free cash flow.

This surplus cash has found its way into shareholders' pockets as dividends, and has also been used to buy back lots of shares. Since 2010, Next has bought back a fifth of the shares outstanding.

Unlike many other companies, it has taken a lot of care not to pay too much for them and made sure that it has been getting a good return on the money spent. Given the backdrop of growing profits, this has turbo-charged returns to shareholders.

Sadly, this is unlikely to be the case in the future. That's because the stockmarket has put a relatively high price on Next shares. They are no longer that cheap on over 16 times expected earnings per share and an earnings yield (EBIT/EV) of 7.8%.

Determining the right price to pay for shares is rarely easy. However, Next gives investors a helping hand by saying how much it would be prepared to pay to buy them back.

It looks to get an equivalent rate of return of at least 8% by comparing a buyback with new investment in the business. To get this return it has stated that it won't pay more than 6,425p at the moment. This looks like good advice.

Verdict: hold

Next (LSE: NXT)

Buy: 13

Hold: 19

Sell: 1

Target Price: 6,800p

Directors' shareholdings

S Wolfson (CEO): 1,515,136

D Keens (CFO): 234,330

J Barton (Chair): 14,000

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Defeat into victory: the key to Next CEO Simon Wolfson's success

Defeat into victory: the key to Next CEO Simon Wolfson's successOpinion Next CEO Simon Wolfson claims he owes his success to a book on military strategy in World War II. What lessons does it hold, and how did he apply them to Next?

-

Next’s results stand out against a tough retail backdrop

Next’s results stand out against a tough retail backdropAnalysis FTSE 100 retailer Next is dealing well with the tough conditions on the high street, with rising profits and a plan that's working. Rupert Hargreaves looks at the numbers.

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

Next shares soar as sales smash expectations – is the stock a buy?

Next shares soar as sales smash expectations – is the stock a buy?News High street and online retailer Next has reported a big rise in sales and profits. John Stepek looks at its performance and asks if it's worth buying Next shares.

-

Little cheer on the high street

Little cheer on the high streetFeatures Profit warnings from Debenhams and Mothercare are more evidence that traditional retailers are fighting a losing battle against nimbler online competitors, says Ben Judge.

-

Next: Out of fashion

Features Clothing retailer Next has released gloomy results, yet the firm’s shares rallied strongly. Why? Ben Judge reports.

-

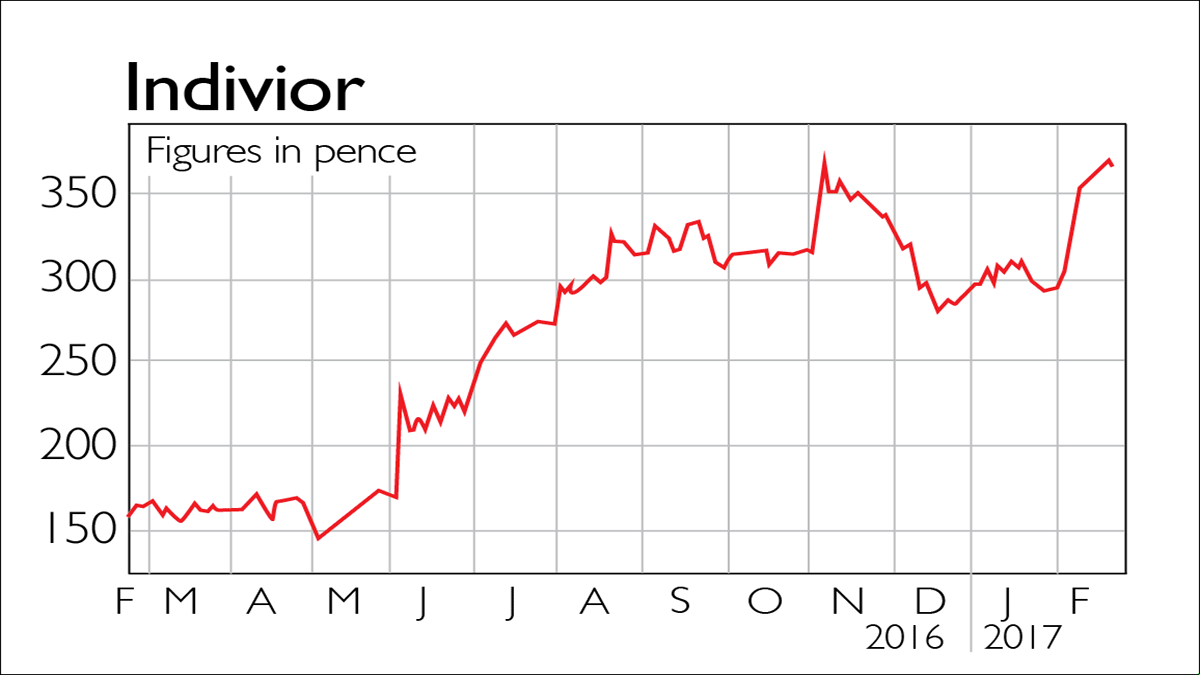

If you’d invested in: Indivior and Next

If you’d invested in: Indivior and NextFeatures Drugmaker Indivior is on the up, while retailer Next, once a favourite with investors, has lost its way.

-

Next faces its toughest year since 2008

Features The clothing retailer has long been a favourite of long-term investors, but now Next is facing tough times.