Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only

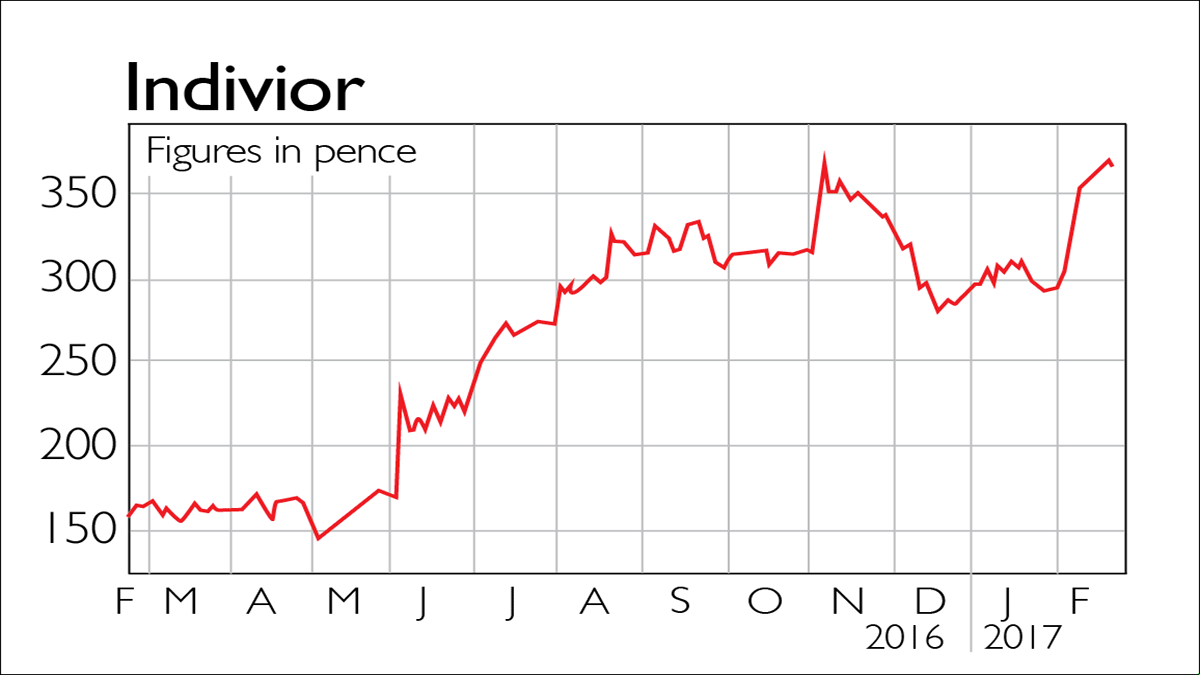

Indivior (LSE: INDV) is a pharmaceutical company that specialises in producing Suboxone, a prescription drug for the treatment of patients who are dependent on opioids. The firm operates in 40 countries worldwide. It was set up in 1994 as the pharmaceuticals division of consumer goods giant Reckitt Benckiser, but was spun off in December 2014 and listed as Indivior on the London Stock Exchange.In its first year as a public company, it made an operating profit of $346m on revenue of $1bn. Over the last year, the shares have risen by more than 130%.

Be glad you didn't

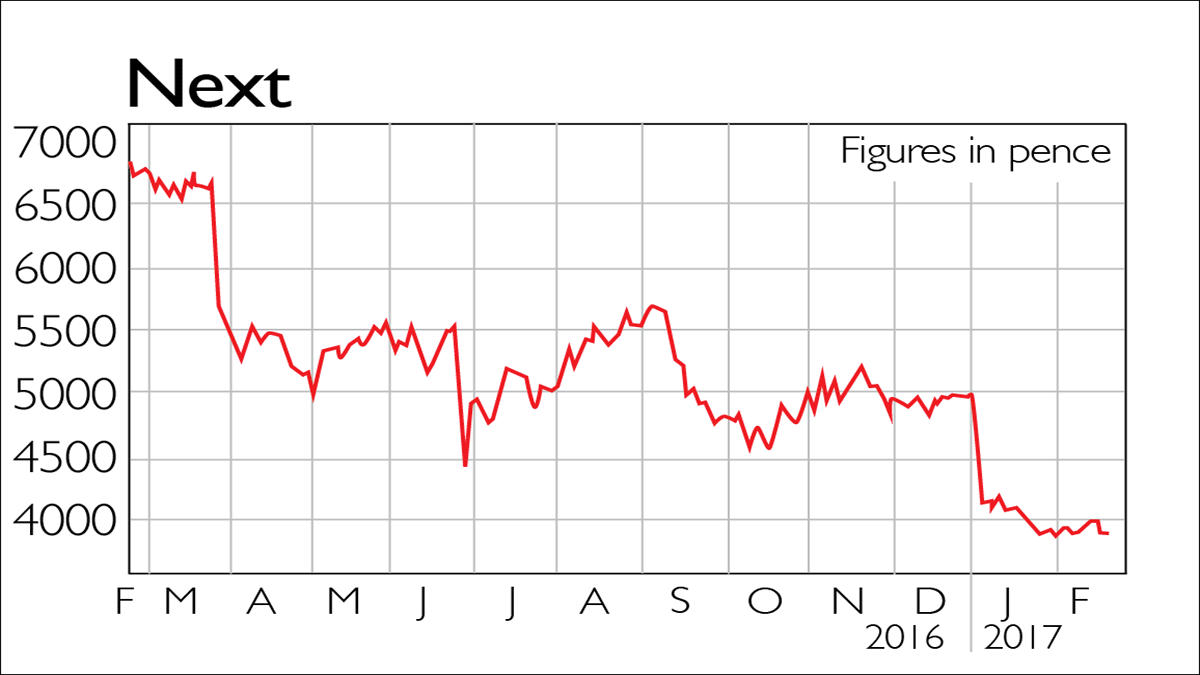

Fashion retailer Next (LSE: NXT) was once a favourite with investors. Between 2008 and late 2015, its shares rose by almost ten times. But since then, the company has lost its way as retail trends change. Last year proved difficult as customers deserted the chain, leading to multiple profit warnings. There's no relief in sight: last month, the firm warned that 2017 will be even tougher. The share price has slumped by over 40% in the past year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Defeat into victory: the key to Next CEO Simon Wolfson's success

Defeat into victory: the key to Next CEO Simon Wolfson's successOpinion Next CEO Simon Wolfson claims he owes his success to a book on military strategy in World War II. What lessons does it hold, and how did he apply them to Next?

-

Next’s results stand out against a tough retail backdrop

Next’s results stand out against a tough retail backdropAnalysis FTSE 100 retailer Next is dealing well with the tough conditions on the high street, with rising profits and a plan that's working. Rupert Hargreaves looks at the numbers.

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

Next shares soar as sales smash expectations – is the stock a buy?

Next shares soar as sales smash expectations – is the stock a buy?News High street and online retailer Next has reported a big rise in sales and profits. John Stepek looks at its performance and asks if it's worth buying Next shares.

-

Little cheer on the high street

Little cheer on the high streetFeatures Profit warnings from Debenhams and Mothercare are more evidence that traditional retailers are fighting a losing battle against nimbler online competitors, says Ben Judge.

-

Indivior’s miracle drug wears off

Indivior’s miracle drug wears offFeatures Indivior’s opioid addiction treatment has been exposed to generic competition. Can the drugmaker fight back? Alice Gråhns reports.

-

Next: Out of fashion

Features Clothing retailer Next has released gloomy results, yet the firm’s shares rallied strongly. Why? Ben Judge reports.

-

Next faces its toughest year since 2008

Features The clothing retailer has long been a favourite of long-term investors, but now Next is facing tough times.