Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Clothing retailer Next has released gloomy results, yet the firm's shares rallied strongly. Why? Ben Judge reports.

Clothes retailer Next (LSE: NXT) has long been a stockmarket favourite. Between 2008 and the end of 2015, investors saw its shares rise by more 500%. But now things are looking grim. Last week, Next reported its first annual fall in profit for eight years and warned that 2017 "looks set to be another tough year". Total sales fell by 0.3%, with a 2.9% decline in high-street sales not quite offset by a 4.2% rise in online sales via Next Directory, its mail-order business. Pre-tax underlying profit fell by 3.8% to £790m, and it expects profits for the coming financial year to be down as well, at between £680m and £780m.

The company's outlook statement was "about as bleak as it gets", says James Moore in The Independent. Next's "Brexit-backing chief executive" Simon Wolfson "bemoaned higher import prices", caused by sterling's post-referendum slide, and highlighted the fact that people were spending less on clothes and more on "experiences", such as eating out and going on holiday. To cap it all, he delivered a "supremely bleak analysis" of the prospects for the company's 538 high-street shops.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Despite the "vast majority" of the company's stores making a "healthy profit", it is legitimate to question their long-term viability and even "whether the possession of a retail portfolio is an asset or a liability", says Wolfson in the company's annual report.He concluded that even if retail sales continued to decline, "the portfolio could be managed down profitably" over the next ten years. This is clever stuff by Wolfson, says Moore. In "positing a worst-case scenario", he is softening investors up so that "when Next outperforms, he can take a bow".

While Wolfson may have brought his "usual forensics" to the problem of falling sales, even if you allow for his "trademark gloominess", he "hardly seems confident of a quick fix", says Alistair Osborne in The Times. Perhaps the problem is with the man himself. Wolfson has become "too cool for his own good". He spent too much energy focusing on "exciting new trends" while forgetting the boring stuff that makes up Next's "heartland product". "No one shops at Next for edgy fashion."

Still, Wolfson "has a track record of correctly forecasting the direction of the British consumer, so ignore him at your peril",says Andrea Felsted on Bloomberg Gadfly. The question is what his firm's woes might imply for other retailers. After all, "Next is highly cash generative" and still "has some levers it can pull to help its performance", in contrast to, say, Marks & Spencer. This helps explain why the shares rallied strongly despite Wolfson's downbeat comments. "Next offers some rare stability in a year that's set to be a wild ride for UK retailers."

Britain's ten most-hated shares

| Company | Sector | Short interest on 28 Mar | Short interest on 22 Feb |

| Carillion | Construction | 21.5 | 22.99 |

| Wm Morrision | Supermarkets | 17.45 | 15.86 |

| Ocado | Supermarkets | 16.72 | 17.95 |

| Mitie Group | Outsourcing | 15.23 | 14.82 |

| Tullow Oil | Oil and gas | 14.25 | 14.41 |

| Telit Communications | Telecoms equipment | 10.49 | 11.12 |

| Debenhams | General retailers | 10.07 | 8.78 |

| Sainsbury | Supermarkets | 8.69 | 8.64 |

| Marks & Spencer | General retailers | 8.13 | NEW ENTRY |

| Hansteen Holdings | Real Estate Investment Trusts | 7.54 | NEW ENTRY |

These are the ten most unpopular firms in the UK, based on the percentage of stock being shorted (the "short interest"). Short sellers aim to profit from falling prices, so it can be useful to see what they are betting against. The list can also be an indicator of stocks that might bounce strongly on unexpected good news when short sellers are forced out of their positions (a "short squeeze"). Hansteen Holdings, a FTSE 250-listed real-estate investment trust, is back in the top ten after news of the sale of German and Dutch properties sent the share price soaring to its highest since 2007.

City talk

Back in August 2014, an accounting scandal led to Tesco overstating profits by £326m. Anyone who bought Tesco shares between 29 August and19 September will get 24.5p per share in compensation under an £85m settlement with the Financial Conduct Authority. Tesco will also pay a £129m fine under a deferred prosecution agreement (DPA) with the Serious Fraud Office (SFO). But hold on, says Jim Armitage in the Evening Standard. Is this the right way to settle the scandal? "We should be uncomfortable" about deals that "rely on co-operation' from the accused, and don't result in the public seeing all the gory inside details of a case through a trial While it's welcome that DPAs get a result of sorts for the SFO, they should not be seen as a substitute for full-blown prosecutions."

Wolseley, the FTSE 100 building supplies firm, is to rename itself after its US arm, Ferguson, and will be traded under the ticker FERG from 31 July. Ferguson, which has been around for 64 years, contributes 84% of the group's trading profit, so the new name will raise Wolseley's profile in its biggest market. So how long will it be, asks Matthew Vincent in the FT, "before Ferguson plc accepts that it is essentially a US and Canadian firm and opts for a full US stockmarket listing"?

Elon Musk, 45-year-old billionaire electric car evangelist, Tesla founder and space pioneer, has found time to come up with another project. Musk is hoping to develop what he calls "neural lace" technology that will implant "tiny brain electrodes that may one day upload and download thoughts", according to The Wall Street Journal. As well as perhaps treating brain diseases, it's thought Musk, who has said that artificial intelligence is humanity's "biggest existential threat", wants to "help humanity avoid subjugation" by intelligent machines.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Defeat into victory: the key to Next CEO Simon Wolfson's success

Defeat into victory: the key to Next CEO Simon Wolfson's successOpinion Next CEO Simon Wolfson claims he owes his success to a book on military strategy in World War II. What lessons does it hold, and how did he apply them to Next?

-

Next’s results stand out against a tough retail backdrop

Next’s results stand out against a tough retail backdropAnalysis FTSE 100 retailer Next is dealing well with the tough conditions on the high street, with rising profits and a plan that's working. Rupert Hargreaves looks at the numbers.

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

Next shares soar as sales smash expectations – is the stock a buy?

Next shares soar as sales smash expectations – is the stock a buy?News High street and online retailer Next has reported a big rise in sales and profits. John Stepek looks at its performance and asks if it's worth buying Next shares.

-

Little cheer on the high street

Little cheer on the high streetFeatures Profit warnings from Debenhams and Mothercare are more evidence that traditional retailers are fighting a losing battle against nimbler online competitors, says Ben Judge.

-

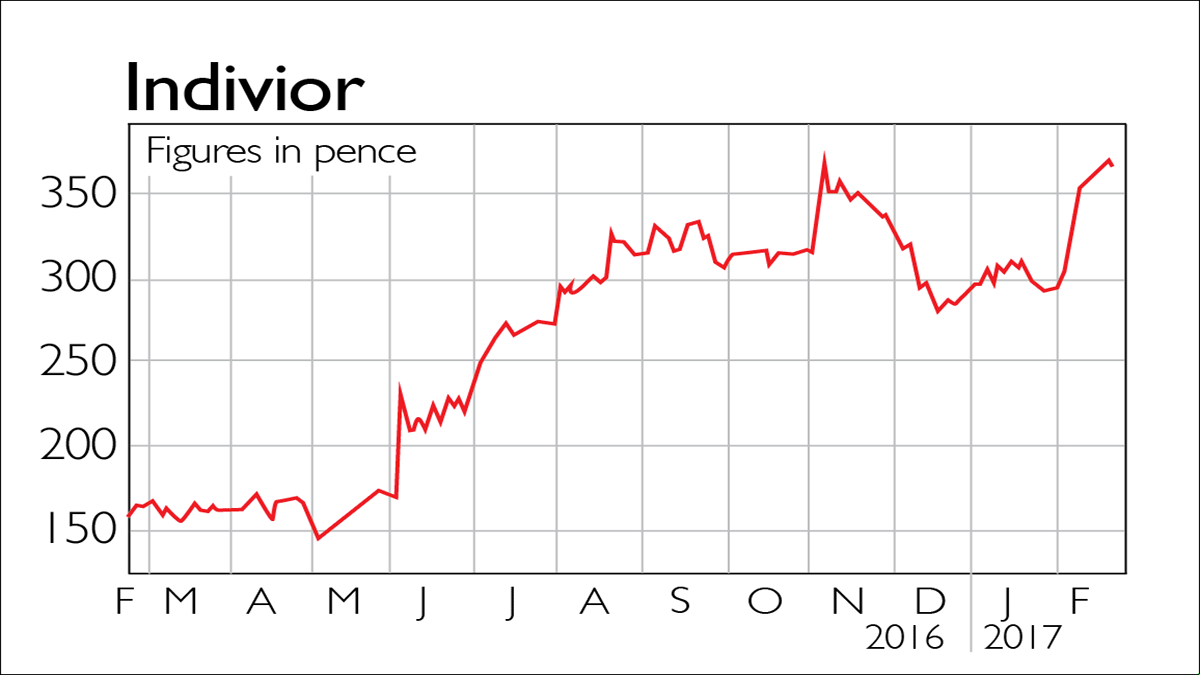

If you’d invested in: Indivior and Next

If you’d invested in: Indivior and NextFeatures Drugmaker Indivior is on the up, while retailer Next, once a favourite with investors, has lost its way.

-

Next faces its toughest year since 2008

Features The clothing retailer has long been a favourite of long-term investors, but now Next is facing tough times.

-

Shares in focus: Next is a rare star in the retail sector

Shares in focus: Next is a rare star in the retail sectorFeatures Fashion retailer Next has been an exception to the rule of the declining high street. Phil Oakley investigates to see if the shares are still worth buying.